P.S. I’m heading to New York City (NYC) for a year in January 2024, and am looking for a crypto internship as an analyst for that duration! Open to anything from working at protocols & startups to venture / liquid funds. If you know anyone interested / you’re looking for one yourself, please feel free email me at 0x.kyle3@gmail.com, or DM me on Twitter! <3

Executive Summary 📝

Well, Uptober played out, just not the way everyone expected.

We had a strong start where BTC pushed to 28.5, but it was swiftly rejected, following choppiness

We then retested 26.7k, and we had our glorious fake ETF news day where priced pushed to 30k before getting rejected

The overarching takeaway was how offside positioning was for such an event - thus people started believing that “BTC will start appreciating and the ETF news will be a sell-the-news” event

Whatever the case, a few things remain clear:

Heikin Ashi signals turned green on 15th October

10D crossing the 100D SMA signalling a momentum shift upwards

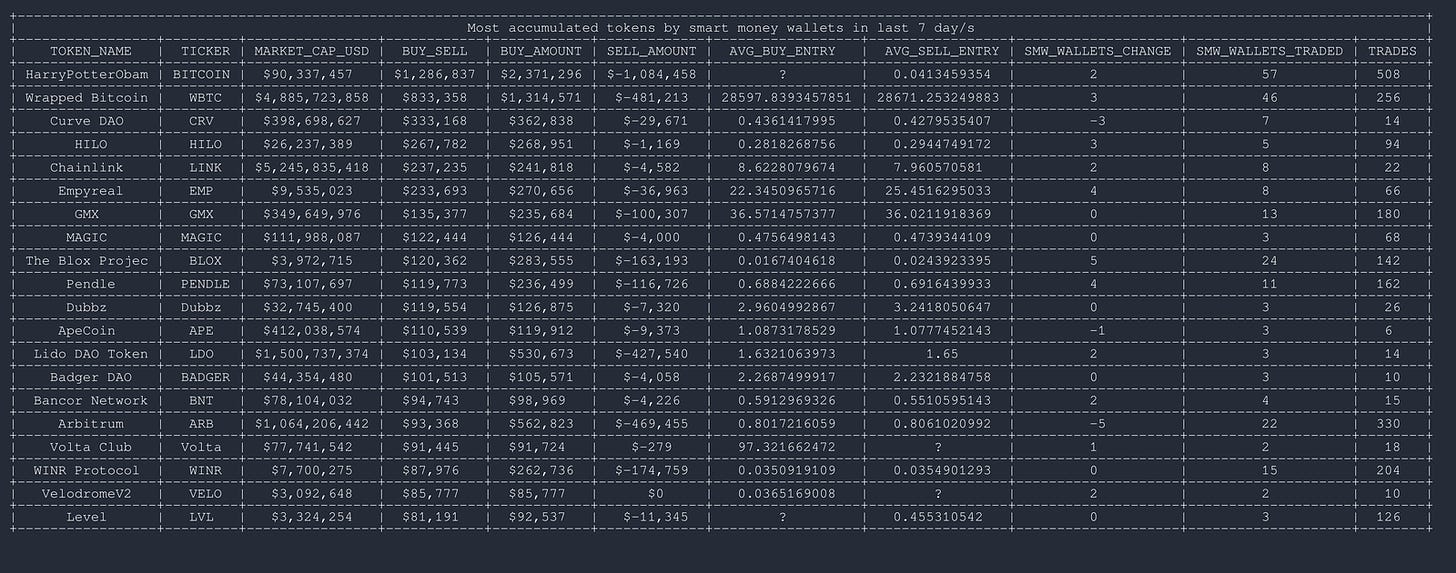

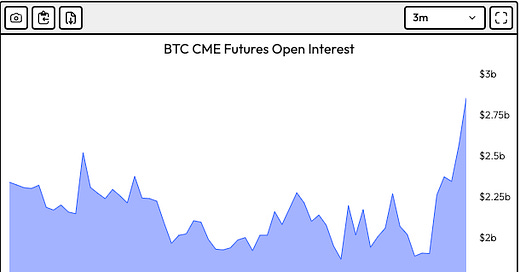

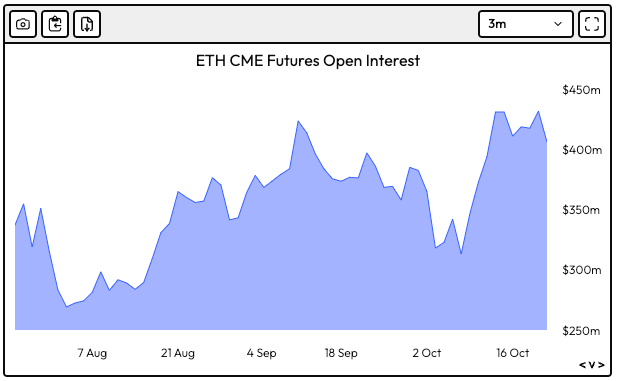

The other prevailing narrative is that this move is CME flows driven - with CME futures OI exploding in the past week.

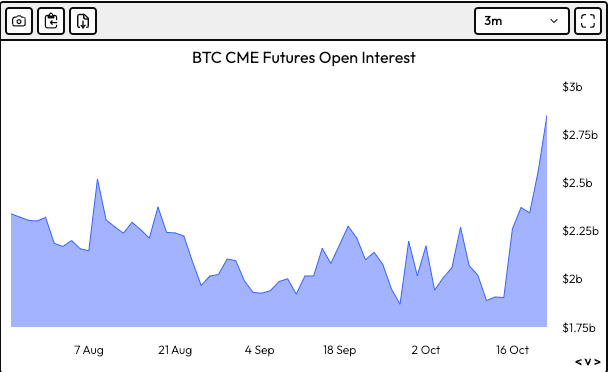

Ethereum CME Futures OI however, remains relatively peaceful.

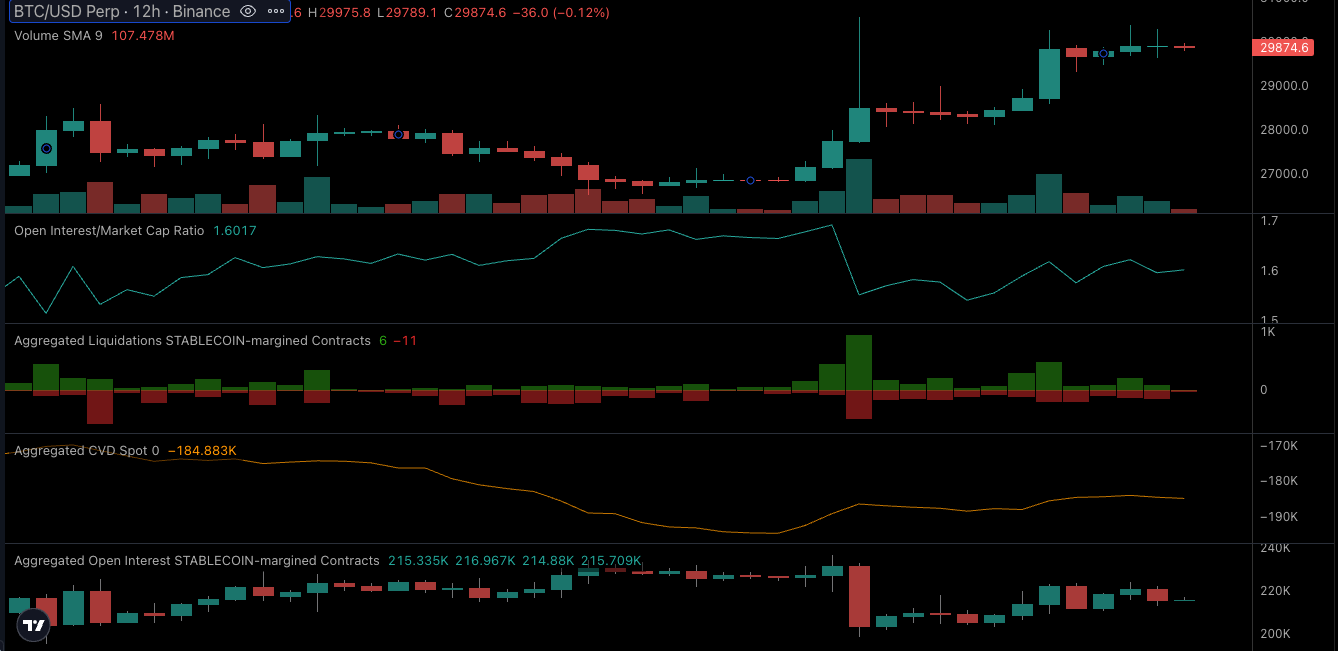

Focusing your attention on the wick to 30k on the fake news day, we can see OI experiencing a sharp drop as shorts got blown out.

What happens next is that OI goes up, but price goes up more than expected - suggesting external buy flows or thin books

Move isn’t really spot driven as well, as Aggregated CVD Spot remains quite the same as it was a week ago.

Overall, it is a plausible theory. It would make sense that more BTC-friendly tradfi companies front-run other trad-fi companies, although I imagine that if someone already had the clearance to buy, why buy now when they had the whole year to do so?

As I said, people who already wanted to buy BTC would have already bought it, the BTC ETF doesn’t change things. But perhaps I’m missing a subset of wealthy institutions who could indeed do so, or have forgotten about Bitcoin and only recently realised that it is the future of France.

Whatever the case, I’m all for it. I have no good read on where Bitcoin goes - although there is more reason to be bullish than bearish. With over 477 days since the collapse of 3AC, we’re well deserving of some action. (Not financial advice)

Market Narratives

With it being BTC led rally, your best choice of alt for BTC remains to be STX. With the release of sBTC and the hacker house, traders may look for a sell-the-news event, in which case a better entry may be given.

It’s worth noting that BCH also did numbers. In fact, the numbers are -

BTC 1W: +11.3% | STX 1W: +21.9% | BCH 1W: +13.3%

Solana and Link are these weeks’ overarching narratives. Link, seemingly broken out of its 525 day long range, along with SOL, are these weeks outperforming alts on the Bitcoin rally. As they say, bid strong tokens on a pullback.

SOL 1W: +33% | LINK 1W: +29%

I recently wrote a deep dive report on the fundamental thesis of Solana, titled: Solana, as the next Ethereum. Feel free to read it!

Other notable mentions are Aptos and INJ, up 23.5% and 17.9% in the past week alone. These seem to be favourites among the “inner circles” of CT

RNDR going into breakpoint on 30th October (along with SOL) is an event that many people are watching. For the past year we’ve had sell the news on conferences. Is this time any different? (I suspect not).

Apecoin saw some chatter as people built a thesis on “$1 being a nice round number support”. It’s perfect for a coin with “Ape” in it.

Blur also was up +10.1% in the past week, after bleeding 99% the entire year. Good job, NFTs!

Other notable mentions:

CANTO, MKR, FXS all have the “RWA” narrative, with MKR being the strongest large mcap, and CANTO being the degen smaller cap with higher returns.

Polygon’s release of their new token, POL, sparked interest in MATIC. Seeing as how it’s possibly an entirely new token (unconfirmed, based on that tweet only) - if true, would end badly for MATIC once released.

Unlike MATIC, Merit Circle has done the opposite - allowing redemptions of MC into their new token, BEAM. This has flown under the radar for many people - except me, who figured no one cared, until the token went up 30%. You can read the proposal here.

A gentle reminder that Arbitrum grant program and also perhaps more under-mentioned is the Optimism grant program!

The world might have forgotten about them, but dYdX v4 is coming… any time now…

Since I’m talking about dYdX, might as well remind everyone that we were also waiting for SYNChain, until a VC market sold SYN, causing everyone to leave with disappointment.

Something fishy is also going on in XRP land… the last time this happened - well, we all know what happened! A fringe theory is that this bullish news for XRP will end well for majors too.

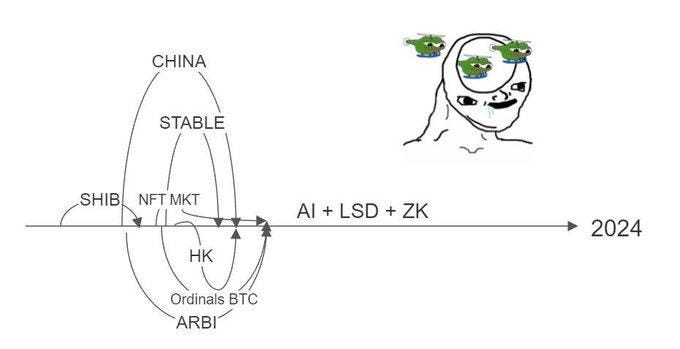

Lastly, I would like to remind everyone that the picture below was the main narratives we had this year. Always good to revisit - and maybe pick some cheap ones up (if they give good vibes)

Personally I think AI has the chance of being the fastest horse. The market also seems to have forgotten about LSDs - DegenSpartan, holder of 1 ETH, continues his holy crusade for LSDs

On-Chain

Whew, now that the perps market is covered, lets move on to on-chain.

RLB and Unibot continue to be chads. RLB in particular has interesting market activity, with many big buys recently.

Unibot, a silent market leader, has everyone thinking that Banana, Maestro, Rampage, etc. will all beat it. But I’ve been using Unibot and I really love it - market leaders don’t lose their moat easy. ‘

HILO v4 is coming up, and the increasing interest is reflected - in an increase in price

Empyreal, a project on Arbitrum, saw good inflows this week

ATOR, the Tor focused, insanely complicated project, still continues its grind upwards. To the moon!

PRIME, a coin with seemingly no catalyst, has seemed to always find buyers, and is now chadding along above the 3 dollar mark.

imgnAI with its webapp and v2 saw a up-only candle from the bottom

Pear v2 is coming up'

Revest finance has been the talk of the town, with their new hires and protocol pivot.

On the Memes side:

HPOS10inu, aka ticker $BITCOIN, has people memeing that it’s “the highest beta to BTC”. Can’t say that’s true, but it definitely has been the highlight of the memes this past week

JOE, an up and coming memecoin, is currently fighting for its life. You may have seen that

uglylovable yellow M&M looking thing in your replies on X - as a meme, it’s garnered the hearts of manySPX6900 continues its outperformance amongst the memes as well

Lockheed Martin Inu was the first interesting thing on my plate that I liked. I’m not much of a meme degen myself, but I found the name to be extremely funny

MOG also saw outperformance in the past week. I myself know a few extremely chad MOG holders, and while I may not share enthusiasm of the same level, I find their community to be one of the better ones amongst the meme coins.

Well, that about sums it up! I hope you enjoyed this, and I’ll see you guys soon! I’ve linked my reports on Solana and Rollbit below as well, if you want to read them.

Read the Solana report here.

Read the Rollbit report here.

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

Good overview. Thanks. Good luck in the job search. I'll make sure to share that section in the comments when I share this.

All these good vibes aren't backed by much though are they? We're not seeing an influx of new users nor are we seeing new products land. Possibly there's something in gaming but most web3 gaming seems to have a tenuous relationship to crypto. Bit like Rollbit has a somewhat a tenuous relationship to crypto. Their product doesn't have to be on chain. It is. For now.

The RLB thing seems more a marketing exercise than anything. A very good one no doubt but there's no use to the RLB token apart from being a substitute to buying shares in Rollbit. Only the link to RLB and Rollbit is pretty loose. What is the effect to Rollbit of RLB going to zero? Probably not much aside from marketing. Which is smart on their part.