DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

0xKyle: Good morning, everybody. Today is a long-term look at $SOL and its position for next cycle. The crypto market is dry, catalysts can’t play out – everything that has high FDV / inflation rate is following traditional laws of supply / demand right now. Hope you enjoy!

Introduction

Overview:

Solana is a Layer 1 blockchain built for mass adoption. It utilizes the Proof of Stake consensus mechanism and improves on it with the Proof-of-History mechanism. The Solana network is slated to be able to support up to 3,000 transactions per second, but realistically it can perform around 273 swaps / second on an AMM – whilst BNB can only manage 194.6 TPS, and Avalanche a maximum of 175.68 TPS, and ETH at 25 TPS

Tokenomics

Price: $19.37 | Circ Supply: 412.61M | Total Supply: 558.10M

Market Cap: 7.99B | FDV: 10.81B

Solana’s circulating supply consists of SOL that is currently circulating across exchanges, DEXes, user wallets, and also includes both staked SOL (delegated) and unstaked SOL.

Non-circulating supply normally consists of either:

SOL that is locked in a stake account – meaning, the account is frozen until a specific date

SOL that is owned by Solana Labs or Solana foundation

Inflation by rewards

SOL’s annual inflation rate is currently 6.017%, and will decrease by 15% every 180 epochs, with each epoch varying from ~2.5 – 3.5 calendar days. This inflation rate is delegated to stakers who ensure network security by validating the network

Venture Unlocks

As seen in the chart above, the initial seed allocations have been fully vested and distributed to market participants.

Validator Supply Unlocks

Solana utilizes a proof-of-stake unlocking system – as such, at any time validators that hold a large stake of SOL can choose to unstake and sell off. The unstaking process takes up to three days – or more accurately, when the current epoch ends – with each epoch lasting around 2.5 days

Currently, total SOL staked is 86.4% of the total supply – i.e 476,650,635.7 SOL is staked.

Catalysts:

The idea behind this trade lies more on the fundamentals of $SOL being undervalued compared to its price. It is thus not a “catalyst” trade in the conventional sense – rather, an investment that relies on the belief that $SOL is undervalued compared to its actual value. Of course, calculating actual value of internet tokens is not easy – especially not for Layer 1 tokens. While attempts have been made to try to value Layer 1s – such as using total gas paid as profit / earnings, or basic TVL/Mcap comparisons, I did not include them in this report because I feel like they do not place a huge weightage as to how people value $SOL; this is unlike Rollbit which is heavily dependent on their revenue dashboard.

Fundamentals:

Overall, the long-term thesis of $SOL is that it’s facing similar headwinds as $ETH did in 2019 – no one believed in it, and everyone was extremely bearish on whatever was built on it. Instead, when taking an objective look at it, we can see that Solana as an ecosystem actually has more than decent developer activity, strong community members, and undeniable interest from other participants to build on it. These are all important factors to not only keep the chain alive, but to help it flourish and move forward.

$SOL has decent fundamentals on both the tokenomics, product and technical side that it justifies being a good long-term bet for the future. Similar to how ETH was in 2019, $SOL will discover a similar trajectory as a “Lindy” L1 chain.

The fall of FTX alongside with the crash in token price ‘washed out’ all the bad actors

$SOL was particularly chosen over its competitors because out of all the “ETH Killers”, it is the one with the most mind-share, likeability and brand presence.

$SOL also faces similar circumstances as $ETH did back in 2019 – similar headwinds and negative press. I believe it pays to be bullish at bottoms.

Some recent $SOL News that have shown increasing development despite falling prices:

Hyperledger’s Solang opens Solana EVM, allowing ETH Devs to port over easily

Solana Pay being integrated with Shopify as a payment method

Visa introducing settlement of USDC on Solana

Visa report publishing Solana’s transaction finality

Product

The developer base of $SOL remained extremely strong during the FTX blowup, which indicates signs of strength and conviction in arguably what plays the largest role in growing Layer 1s. In essence, more dev activity = more products = more user which ultimately leads to long-term growth.

As seen in the figure below, Solana is the L1 with the 3rd largest development activity on the chain – while it’s far behind Cosmos and Ethereum, it’s leaps and bounds above Avalanche and Aptos.

More importantly, Solana Foundation have raised over $600 million in seed funding over the past two years – and with this money, they have launched some of the best hacker houses in the scene – such as Grizzlython, and Solana Hackerhouse 2023. These hacker houses does well in spreading the brand name of Solana, and onboarding future developers for the chain.

Technicals

The Solana Fractal

A story in two parts :

I kid. While a fractal may just be basic pattern recognition that doesn’t hold much value, I believe that the first principle that underpins a fractal lies in the idea of the product itself – that something is running parallel to what we’ve seen before. Like how you can draw a fractal of the Dot Com bubble versus the 2021 Crypto bubble – the underlying psychology and logic is the fact that the circumstances are alike.

On-Chain Analysis

Projects that move to $SOL are bullish indicators of how the chain, is in fact, not “dead”:

Render Token has just announced a migration to Solana in the RNP-002 proposal;

Projects building on $SOL:

Drift Protocol – On chain perps platform

Chicago Board Options Exchange – It joined the Pyth Network, which is built on Solana

Parcl – Real estate derivatives platform on Solana

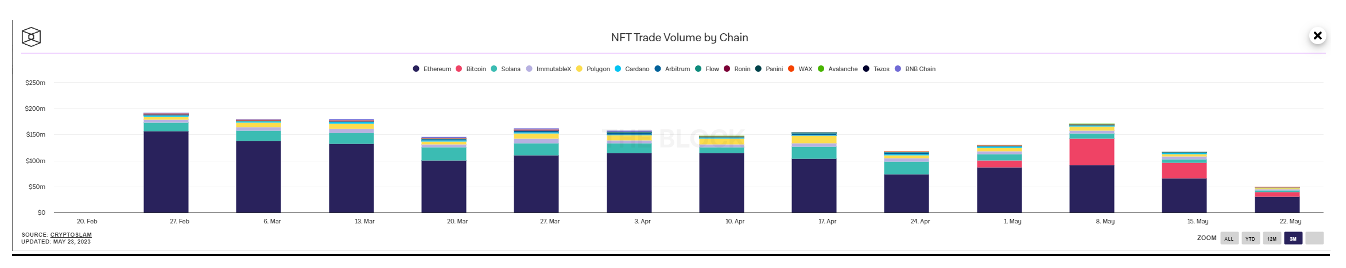

On average, Solana ranges between 5-20% of daily NFT volume, and is the leading contender next to Ethereum for being a chain for NFTs. I believe that this is an undervalued point – NFT traders are well-known to bring in huge amount of retail interest, and I believe that we may see SOL become a secondary NFT chain, thus raising mindshare of the token. There have already been a number of notable collections that have come from Solana, namely: MadLads, Solana Monkeys, ABC, and many more. It’s worth noting that even though y00ts and DeGods moved to Ethereum, they did launch on SOL, and were able to gain significant traction before moving – thus showing that there is potential for NFT trading activity on Solana.

Social Media / Community:

The Solana community is extremely active on Twitter, with their community being second to the “ETH Maxis”.

Multiple key opinion leaders have emerged to say that they believe SOL will be huge because of various reasons, such as:

Ansem: Biggest SOL Shiller

Heartereum: “Don’t fight cults”

Picklecrypto: ETH 2019 vibes

AviFelman on 100x: Solana is currently controlled by people who deeply believe in it, there is zero fast money -> Any hint of new activity could probably skyrocket SOL

Thesis

I think that Solana does have the potential to do great things. If I had to pick out of all the Layer 1s, I would choose Solana. But to me, its greatest strength could also end up being its greatest weakness. The way I see it, 2024 is the cycle of the institutions. Solana is well positioned with partnerships with big traditional names like Visa, etc. This makes it a good contender for being the Layer 1 with the highest beta to any ETH ETF.

Bull Case:

Solana has the largest mindshare next to Ethereum – it will benefit from any form of ETH ETF

Traditional institutions may look into alternative Layer 1s to invest in – and see that Solana has huge potential to outperform

Solana continues partnering with big brand names, and continues to be the Layer 1 with the most legitimacy

Lindy Effect compounds on this – being such a large, battle tested chain, it forms a virtuous cycle where people just can’t stop finding good things to say about it, making it a self fulfilling prophecy

Bear Case:

If Solana becomes known as the chain with “high settlement speeds” for stablecoin / general purpose payment transactions, it inadvertently will attract the ire of any news that deals with stablecoins / payment allegations.

And seeing as to how stablecoins are quite literally in the snipers scope of the SEC, if this plays out, it’ll be very bad.

Depending on how ETF plays out – perhaps tradfi institutions will only be allowed to invest in ETH ETFs, meaning no trickle down effects to any non-ETF Layer 1s.

Risks

Alameda Risk

On 13 September, FTX was ruled to be allowed to sell their digital assets, with Solana making up to $1.062 billion of that.

However, the Solana foundation released a post showing that the SOL tokens held by FTX would be linearly unlocked till 2027.

According to the terms of the crypto conversion to fiat by FTX, there will be a cap of $50 million for the first week and $100 million in subsequent weeks, which limits the selling pressure.

Assuming that the creditors can sell all the SOL tokens, they’d need around 10 to 12 weeks to unload their total holdings, which will distribute the selling pressure over time.

The 30-day average daily volume on spot exchanges is $338 million, per CoinGecko data. On a weekly scale, it is around $2.5 billion, giving FTX’s selling pressure a small percentage of 4%.

Many of the VC firms that first invested in SOL have been impacted in the fall out of FTX, and are hence forced sellers of $SOL.

These include, but are not limited to: Alameda, Jump, Multicoin – while Jump might not be directly impacted, their recent controversy with Luna and their actions to pull back from trading digital assets, I will not be surprised if they start selling their tokens as well.

This is a huge risk – Alameda owns over 8.26% of total SOL, and Multicoin and Jump having a combined stake of over 21.8 million SOL tokens, which represents another 4% of total SOL.

Generally, it seems that this news always immediately forces a knee-jerk short reaction in the markets, but on closer examination may not be true.

Execution

Solana seems prone to insane FUD – buying those events could be good entry points

Also just observing CT, trying to position when the market stops talking about it entirely / everyone’s attentions are focused on something else

Manage risk wisely – make sure you size properly

Stop losses can be placed on invalidation of thesis

Invalidation

Any changes to the FTX / Solana saga may require re-examination of short-term downsides – but long term upside remains the same

If Solana stops building / fails to reach meaningful traction in the coming months with traditional companies – i.e they just stop making progress at all – that’s super bearish

Because of how “fundamental focused” this thesis is, any changes to the fundamentals listed above will

Resources

https://cointelegraph.com/news/blockchains-like-solana-brag-about-tps-but-it-s-misleading

https://coinalyze.net/solana/usd/binance/solusd_perp/price-chart-live/

https://twitter.com/knowerofmarkets/status/1658502466931941385

https://messari.io/report/state-of-solana-q1-2023?referrer=asset:solana

https://twitter.com/Pickle_cRypto/status/1660182765793431553

https://twitter.com/heartereum/status/1659971498180849672?s=20

Longish view on ETH?

Is it literally dying on the vine to SOL or we need to be patient for an eth etf?