$RLB - CT's Most Controversial Casino

A in-depth review of Rollbit, The Crypto Casino

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

Introduction

Overview

Rollbit is a casino that offers casino games, sports bets, a NFT marketplace (including NFT loans), and most importantly, a crypto futures exchange where you can leverage up to a 1000x in predicting whether the price will go “up” or “down”. It also has a spot crypto portfolio option, allowing users to buy select spot tokens. Their newest feature, Degen EXchange, features on-chain coins such as OX (Su’s New Exchange), HarryPotterObamaSonic10Inu and Unibot.

Launched in 2020, Rollbit has a native token $RLB. It had no ICO – the entire supply was distributed via an airdrop to users, and people who bought their NFTs (Rollbots).

Tokenomics

Price: $0.147184

Max Supply: 5,000,000,000

Total Supply: 3,296,951,622

Circulating Supply: 3,296,951,622

Market Cap: $485,237,627 (#66 on Coingecko)

FDV: $735,888,304

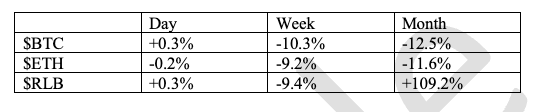

Rollbit’s Relative Performance:

Catalysts:

Buy & Burn

Rollbit’s largest catalyst is it’s buy and burn mechanism – it uses a portion of its daily revenue to buy and burn $RLB. More specifically, it uses profits from 3 different revenue streams to purchase $RLB, namely:

30% from the 1000x Crypto Futures Vertical

20% from the Sportsbook Vertical

10% from the Casino Vertical

Above is a picture of the breakdown of Rollbit’s annualized burn. In 1 year, they buy back 13% of the market cap – and in all honesty, that’s a negligible amount. If you’re an investor, you’re assuming market cap goes up – in which case, the annualized burn goes down. For all intents and purposes, the “buy back and burn” is an effective ponzinomic catalyst, but in actuality has negligible implications in the shorter term, especially less so if you believe price will go up.

Narratives

Rollbit has enjoyed quite a bit of narrative this year – partnerships with key influencers such as Hsaka, Gainzy, Alex Wice, etc. have meant that it has enjoyed its fair share of riding the CT on-chain narrative wave as one of the strongest “gambling coins”. In fact, the “on-chain index” consisting of “$OX, $UNIBOT, $BITCOIN, $RLB” has been touted as one that has outperformed majors – which, depending when you bought, obviously has.

I do think Rollbit will continue to experience a dominant mind-share in the hearts and minds of the crypto people, so long as it continues to remain the dominant player in its field (in crypto). There is none quite like Rollbit (in crypto) for the time being – an amalgamation of perps, casino games and sports betting is quite unique.

The reason why I’m putting (in crypto) is because Stake is quite obviously Rollbit’s biggest Web2 competitor – I do think that Rollbit still dominates in the crypto scene because:

Its perps exchange is unique and has garnered the love of CT

It has partnered with many crypto-natives, which is a major reason why it is so prominent in CT

It also has a token, versus Stake who doesn’t have a token. It is the only way crypto people can express their bullishness on the future of gambling (right now)

Metrics

Rollbit is #66 on Coingecko, which essentially makes it a higher marketcap than GMX and dYdX – aptly done, seeing as its Fees/Mcap are much higher than GMX and dYdX

The next course of action I can imagine is comparing Rollbit to an exchange, and using that exchanges’ token as proxy to measure it. Assuming correct data (which, honestly is hard to get, so it’s a pretty stretched assumption. I’ve posted the links to the data in resources down below), Rollbit has better Fees/TVL than Binance and OKX. This means that for every dollar deposited, Rollbit is making more off fees.

This isn’t surprising, seeing as how Rollbit is a casino facilitating the separation of money from the gambler and the house, whereas Binance features more of an “exchange” for traders.

Of course, the one thing I should compare Rollbit to are other casinos, but the data for casinos are extremely opaque and hard to find.

Technicals

Rollbit has a great chart, with clear signs of a longer term uptrend. Previous ATHs at around ~0.13 remain technical areas of support for the coin.

On-Chain Analysis

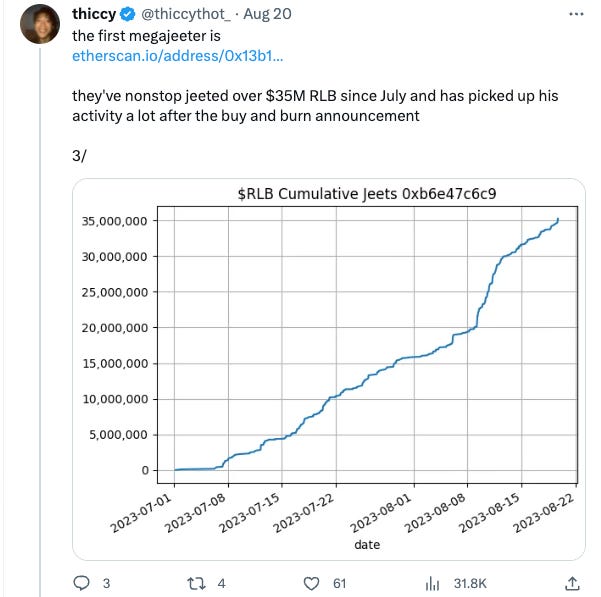

Jeeters

There have been on-chain analytics that show $RLB whales consistently selling their tokens. The last I checked, they were still selling it – constant sell pressure often is a bearish case, but also may create bottoms for people to buy into.

Growth

Rollbit’s cumulative net volume is on an uptrend, with more deposits than withdrawals. Also, deposit volume over time is slowly increasing, signifying more users depositing assets. New users are also on an uptrend, with an average of 171 new users daily. Overall, RLB’s on-chain metrics seem to show a platform that’s steadily growing users

Team / Community

From an outsider’s look, there is nothing notable about the community to comment on – unlike memecoins who generally have a strong social media presence, with tweet reply-guys in certain communities such as $MOG always posting memes and such.

On July 31st 2023, FatManTerra announced a call with a US government agency about Rollbit. This prompted key figures of the Rollbit community to attack him – and a counterargument thread exposing FatMan was posted by the co-founder

Partnerships: Rollbit’s propulsion to fame can be said to have been heavily influenced by the onboarding of key influencers such as Gainzy, Hsaka, Alex Wice, and many others. Gainzy, in particular, is a prominent crypto-gambling personality with a large Twitter following that brought the attention of Rollbit to the masses.

Thesis

I like Rollbit as a project, I really do. But as an investment, here’s the simplified breakdown of what I see to be the biggest headwinds (and tailwinds)

Bear Case

It’s hard to make the case that Rollbit hasn’t topped (locally). At 21 cents, we had a Hsaka partnership, an Alex Wice partnership, and virtually everyone on CT talking about it. On August 9, the day the Buy & Burn catalyst was announced, $RLB dropped 10% - following that, it increased by 38%, topping out at 21 cents. However, sentiment during that time was at peak bullishness.

Current market conditions aren’t facilitative for another on-chain bull-run for a while. With Bitcoin at 26k, crypto is facing an extremely low volatility and risk-off regime.

From a business perspective, limiting itself to just crypto natives seems to be shooting itself in the foot when it could be aiming for the stars instead.

Bull Case

The fact of the matter is that Rollbit has incredible growth, and incredible value as a casino. It’s metrics blow dYdX out of the park, and if you compare Fees / TVL Ratio (see above), RLB has better metrics than even Binance – for every dollar in TVL, Rollbit makes slightly more in fees – making it a more “profitable” endeavour.

Growth still seems to be on an up-trend, and people are playing Rollbit – by no means is it a dead app.

If anything, now might be a great time to buy – if you forecast future growth and profitablility.

Quite frankly, the bear case I’ve built just attacks from the angle of “why Rollbit won’t go up in the short term”, but doesn’t give substance for Rollbit to go to zero; the issue here is that for Rollbit to hit all-time highs again, you might have to wait a while (which is fine for an investment, not a trade)

Overall, I believe possible key areas that signal a strong buy on RLB would be anywhere below $0.10 (severely undervalued), and possibly the area between $0.13 - $0.14 (a 30% correction from ATHs).

In the short term, I don’t think we print new godly candles breaking through ATHs, but in the long term I think a market cap of 1 billion may not be that far-fetched (a 2x from here). I know many people who are holding $RLB for a “next cycle coin”, which, if projecting current growth and taking into account future possibility of expansion, is a decent idea.

Risks

In order of what I imagine to be the greatest risks:

Growth Risk

Rollbit is crypto-focused, but with majority of CT already knowing about it, it begets the question: Who is left to buy? Rollbit should consider pivoting and attracting retail customers as well – and that has to start by allowing people to deposit with fiat, not just crypto. Especially because its main competitors in the casino space were retail focused before pivoting to crypto – crypto can be seen as the smaller subset of the bigger picture.

Regulatory Risk

While Rollbit is fully licensed and authorised by the Government of Curacao, there has been past instances where their regulatory legitimacy was called into question. On the FatManTerra saga, there was also a tweet where Fatman supposedly was in talks with a “US government agency” on Rollbit’s operations.

I’m sadly not knowledgeable enough about legal rules to understand the worst-case scenario – I’m not sure as to how much jurisdiction a US government agency can have on a Curacao license, but it’s definitely something to keep in mind and to keep a look out for.

Transparency Risk

There are concerns that Rollbit’s volumes have not been accurate, and that they are faking volumes. While this may be possible with wash trading, their buy back and burn accounts are public – we can corroborate their daily revenue with how much they’ve burnt on-chain, which should lay rest to any concerns for the time being.

Execution

Setting limit bids at key buying areas I’ve mentioned

Also just observing CT and Rollbit, trying to position when the market stops talking about it entirely / everyone’s attentions are focused on something else

Manage risk wisely – make sure you size properly

Stop losses can be placed on invalidation of thesis

Invalidation

If another casino that’s bigger than Rollbit launches a token (e.g Stake), this doesn’t directly invalidate Rollbit’s growth, but it’ll probably still be better to bet on the larger casino – it’s like betting between Bitcoin and Litecoin – bigger is better

Regulatory risk – if government agencies start gunning for casinos, this would signal short term bearishness that could impede Rollbits’ growth

New bearish information coming to light – e.g fake data / shady origins / etc.

Loss of partnerships from key figures – could signal either something bigger happening, but also loss of faith from key CT infleuncers would probably lead to a falling domino effect

Growth stagnates / even goes negative, as revenue drops – Rollbit stops becoming a profitable project and even loses users ; would signal something in the market changing, and the fundamentals of the project losing ground.

Good read!

why is it so down right now?