GM. As we head into 2024, my core portfolio is now fully allocated. This memo serves as an illustration of how I think 2024 plays out. The investing world is a nuanced one, and I have tried, to the best of my ability, to capture that nuance in this article. But I am not perfect, and so I will open with a disclaimer that this is not financial advice, and only serves as an insight into how I think about 2024 - nothing more, nothing less.

If You Fail To Plan, You Plan To Fail

Crypto Twitter has been injecting its users with an amazingly high dosage of hopium in the past few months. We’ve seen Bitcoin finally break out of a near 500D range between 15k and 32k, and at this point, everyone is shouting: “NEXT CYCLE! NEXT CYCLE!”

But as 0x_Kun, one of my favourite Tweeters on the accursed website, likes to say:

Have a plan. Follow the plan. Because - when it goes to shit (and it will), you will know what to do. And so, the crux of this article is to delve into my 2024 plan. At the end of the day, you don’t want to make life-changing money without changing your life. No matter how much we like our coins and think that they’re going to “revolutionize the world” - cash is king.

This article is broken down into two main chunks:

How I see 2024 playing out

What narratives I think will do well

Part 1: The Great Bull Case Of 2024

Let’s first start by setting the facts straight. I always like to go from a top-down approach when thinking about my investments - first macro, then micro. And so, here are the data points that I believe matter the most:

Bitcoin ETF

Rate cuts

Bitcoin halving

There are lots of other smaller factors too - it being a Presidential Election year, China stimulus, etc. But I believe that those 3 afore-mentioned events are the most important, and thus have the greatest impact on my portfolio. If you were to worry about every minor event, you’d never make a trade.

I then like to map out a list of possible scenarios and attribute probabilities to each one. The market is just a series of ups and downs - with some downs, being much larger than the ups. As such, I believe that it’s first prudent to determine how I think the cycle will play out on a longer-term basis.

Scenario Breakdown

Before we get into the scenarios, let me explain some underlying assumptions I have about the key events I’ve listed.

BTC Halving Is A Non-Event

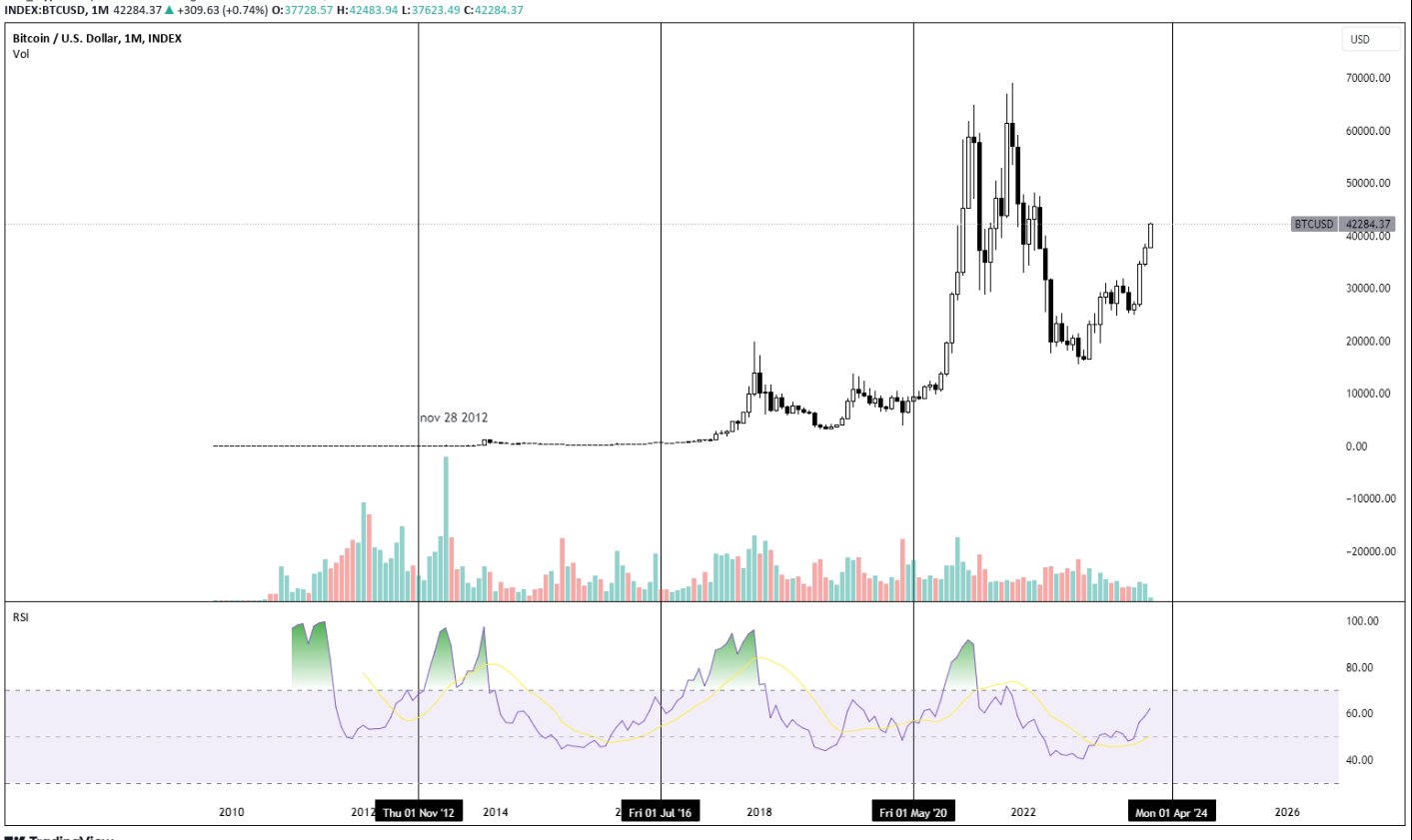

In all these scenarios, I believe that the Bitcoin Halving is a non-event that doesn’t necessarily imply numba go up immediately. Looking at the chart above, you can see that Bitcoin’s halving always preceded a bull market, yes - but it never is the direct catalyst. There is always a lag between the halving and up-only mode.

I’m basically saying that numba CAN go down after halving.

Rate Cuts Are Bearish

Secondly, I believe rate cuts are bearish. Like the halving, they are events that precede a bull market - but when they happen, they’re almost always bearish events.

With that out of the way, we can analyze the 4 scenarios I’ve hand-drawn.

This Time Is Different…?

All the scenarios differ in one thing - how early or late we see a local top.

Scenario 1 - Best Case, But Least Probable

Scenario 1 is a up-only event for the entirety of 2024 to 2025. Not much elaboration needed for this case.

Scenario 2 - “Sell The News” ETF - Also Improbable

ETF creates a local top, and we go down - until uponly sometime after the bearish event. Now, if you’re a paid subscriber, you’ll know that I talked about the ETF being “sell the news” because BTC was rallying into the event. This was at a time when no one thought it was “sell the news” - everyone was simply buying to front-run the announcement.

My position has since changed - with everyone now talking about how the ETF is “sell the news”, I think it becomes an event with incredible whiplashes on either side, but otherwise something akin to a non-event.

Scenario 3 - Rate Cuts ARE Bearish. MOST PROBABLE.

Crypto hasn’t really lived for that long compared to the traditional financial markets. When looking at how Bitcoin has performed against a high-rate regime, we only have one data point to look at - 2019.

Perhaps this is what GCR meant when he told us to “study 2019” - as it’s eerily similar to what we’re facing right now. I believe that this is the most probable event - we see a local top due to rate cuts somewhere in 2024, and a few months of downonly - into the biggest bull run we’ve ever seen.

ETF, halving, rate cuts are mostly longer-term events that set the stage for a greater bull run. The market is rarely so nice to give everyone what they want - a simple uponly in 2024. I believe that this scenario encapsulates that factor, and as such - it is the most probable way of how I see 2024 play out.

Scenario 4 - Halving Is Bearish, Improbable

I don’t really need to elaborate anymore - this is similar to Scenario 2, just an earlier top.

Scenario 5 - DownOnly; Also Not Likely

This will probably catch the entire market offside - and really, I added it in for fun. I don’t think this will happen.

Scenario 6 - Local Top, But Rally Afterwards

I didn’t include this in the drawing because it would be too complex - but scenario 6 is basically the event in which any one of my previous 5 scenarios happen, but we don’t top with the same severity as I expect - and instead rally quickly afterwards. This would mean shorters and sidelined capital get caught offside, as people wait for “better entries”.

Conclusion?

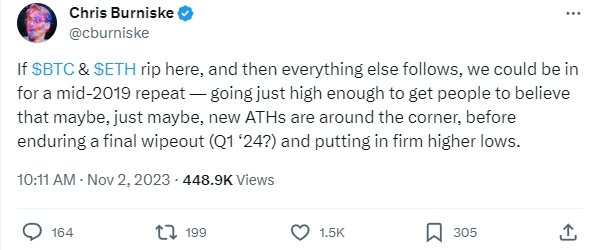

TLDR: I believe that we see something similar to 2019 - where at some point, we’ll see a flush right when people are calling for new ATHs. This tweet pretty much summarises what I think will happen:

So - how will I be playing this?

As I have learnt in 2023 - my biggest risk in this industry is being underallocated despite knowing that sometime, somehow - we will see ridiculously uponly mode again.

Being a retailer, I am not bogged by the constraints of LPs to constantly optimize for returns. I am free to manage my liquidity however I feel like.

Thus, my strategy will be very left curve - derisking my portfolio by a certain percentage before rate cuts to buy back lower, while leaving the rest of my positions untouched.

It’s a simple strategy - and I like to optimize for simplicity, not returns. I believe that more complicated steps = a greater chance of error / slipping up. This strategy will not net me the most gains, but it will be extremely easy to manage = better QoL.

Theoretically, though - if I were running a book, I guess I would hedge through opening shorts on majors (if net long alts) / decrease the amount in which I’m net long. Other ways could be diversification into more defensive assets (which I know nothing about), or buying far out-of-the-money options (which I also know nothing about).

Like I said - retailers keep it simple. 😎

To wrap it all up - I foresee that rate cuts will be that first sell-off before uponly mode. “This time is different” may be a meme, but it is true that on a micro level, there are differences in how we should approach markets - but the overall picture will still look the same.

No man ever steps in the same river twice, for it's not the same river and he's not the same man. - Heraclitus

Part 2: The Narratives To Play

Here’s the part you’ve been waiting for. What narratives will pop off the most in 2024?

Again - let’s take a top-down approach when thinking about this. The one question to figure out is: who’s buying?

I believe that 2024 will be very institutionally dominated - with the Bitcoin ETF and increasing attention on crypto, this is a no-brainer. And narratives are simply “hype-trains” in which everyone jumps on the same bandwagon and tries to get off before everyone else.

As such, the best-performing narratives will be those that have the most buyers - and since I think these buyers will be denominated mostly in institutions, I believe that the best-performing narratives will have certain sets of criteria to be met, i.e

Regulated

Products that have shown PMF - not vaporware

Etc.

This is not to say that all narratives have to meet these criteria. In the past month, we’ve had CT-bred narratives like RWA, DeSci, etc. These will obviously keep on coming in a bull market, but I like to focus on what I think will be consistent outperformers, for the sake of brevity.

And so, without further ado - here we go:

ETF Beneficiaries

ETF flows into Bitcoin means that its beta will probably see extremely good outperformance in the short term. We’ve already seen this happen with STX, ORDI, TRAC, etc.

Just like how CT has Telegram / Twitter alerts for “WHALE BUYS 10000 BTC!” - imagine the same but tradfi version. “SOVEREIGN WEALTH FUND BUYS BTC”. GG.

Top Picks: COIN (Stock) / BTC / ETH

I think that Coinbase will be a huge beneficiary from the ETF narrative, seeing as how Coinbase has been picked by 9 out of the 12 ETF issuers. Unlike betas, which only see an increase in price due to people chasing outperformance, Coinbase is a direct recipient recipient of liquidity into the crypto ecosystem.

Imagine this: BlackRock, Franklin Templeton and WisdomTree come up to you and say that they want to use your platform to custody their products. Idk man - sounds pretty bullish.

Naturally, we’ll probably be seeing an Ethereum ETF as well - so you can expect ETH to pick up the slack when that happens.

Side Narratives: BRC-20 / LSTs

BRC-20s and LSTs are BTC and ETH betas - with BRC-20s also having the favour of being the “new shiny object” on the street. LSTs are the equivalent for ETH - not much need to elaborate.

The Lindy Effect

Antifragility is very real in crypto, and the longest-lasting protocols that have shown to have consistent output despite all that has happened will probably see emerging interest as fundamental thesisoooors build a report around it.

We’ve already seen this with VanEck’s paper on Solana, and we’re probably going to see more of it. Tradfi wants higher beta, but doesn’t want vaporware - this is the perfect niche sector to allocate into.

Top Picks: SOL

No big surprise there. I wrote a whole report on why I thought SOL was going to go astronomically high back when it was $20-ish; you can read it below. I believe that once FTX estate fully liquidates what’s left of their unstaked SOL, funds will see it as a high-quality asset to start accumulating.

Side Narratives: TIA / Aptos / Layer 2s

TIA is most definitely not lindy, but has the benefit of being the shiny new coin that has the closest “mind-reach” to SOL - mind-reach being defined as the first thing people think of when they ask: “What’s SOL beta?”

Aptos is interesting because they’re doing something. While MATIC might be known as the chain with the best BD team, it’s impressive how Aptos has secured partnerships with Windows, Alibaba and more this year.

Lastly, Layer 2s are a decent product with a great use-case - but with the emergence of 10 different Layer 2s in the past month itself, from Blast to… a Layer 2 for board games? I’m kind of bearish on this one just because it seems more of a “spray and pray” rather than a “wow these Layer 2s are building something amazing!”.

Cults (Communities) are very important in building a strong token, and I can say that Solana has an incredibly resilient community; whereas those that rely more on just betting on breadth rather than depth tend to do worse.

Regulation & Product-Market Fit

I believe that 2024 will also be the year of regulation. I believe that it is in no fund’s interest to invest in De-Fi, when the regulation around De-Fi isn’t yet clear. Instead, I think people will trend towards products that have passed the bar, yet have shown clear product-market fit.

There’s really only one vertical that falls into both categories: exchanges.

Top Picks: MMX / dYdX

Exchanges are one of the few products in crypto that actually solve a core issue. I believe that Perp DEXes / exchanges will see a resurgence, especially with how the SEC is now going after all the exchanges - first Binance, now ByBit.

This creates a sort of anti-fragility; the bearish event is over, and so investors feel safer without the uncertainty over their heads.

MMX and dYdX are two picks that I believe will benefit - in the past, any fud with a CEX would almost always mean a pump in dYdX (CEX vs DEX narrative). dYdX has shown to constantly ship out great updates - and with v4 now here, funds may be looking into it as a more “revenue-generating” play.

MMX is a bet on Saudi money as well - with the recent Pheonix Group IPO (a BTC mining company) being 33x oversubscribed, something tells me that they’re itching to invest in crypto.

You may think - why is De-Fi not on my list? Well, like I said - De-Fi is in murky waters right now. I’m leaning towards there being some sort of regulation against De-Fi in the near future.

Side Narratives: Other Perp DEXes

GMX, Hyperliquid, Level Finance, Synthetix - you name it.

Decentralized AI

Again, I wrote a full-length article on why you should be bullish DecAI. This is probably THE NARRATIVE of 2024 for me - you have a product that is revolutionizing the 21st century, and for the first time, retailers that actually agree with decentralization.

The Sam Altman saga has left a bitter taste in peoples’ mouths as they realise the perils of centralization - more and more people are saying we need to “open source” AI.

Call it open source or decentralization - whatever. Rebranding is bullish - just like how we rebranded from “cryptocurrencies” to “digital assets”. I wholeheartedly believe no one is bullish enough on decAI.

Top Picks: TAO / OLAS

Side Narratives: TAO Subnet Tokens / RNDR / AKASH / Other AI subsets

I don’t think RNDR will perform as well simply because dino coins have huge bagholders from past cycles that are just salivating at the idea that they can be rich again. But who knows - I may be wrong.

GameFi… v2

Last cycle we had huge interest in GameFi - and this cycle, we have those games finally releasing. Many CT natives absolutely hate Gamefi - play2earn, play-and-earn… who cares? They’re all high FDV tokens that belong in the trash.

This idea is why I think GameFi will see a “hated rally”. Many funds have PTSD from trying to get into Gamefi rounds at high FDVs - but this cycle, those games that have legitimately built something amazing will do the best.

Top Picks: Overworld / Treeverse / Prime / L3E7

Side Narratives: NFTs → BLUR

NFT bottom is probably in, and I believe that we’ll see renewed interest in gaming NFTs.

Other potential narratives

For the sake of not missing anything out, I’ll just list down narratives that have crossed my desk in the past few months that have shown decent potential:

dePIN / RWAs

deSci

Memes (BONK / DOGE / PEPE / HPOS10INU)

RUNE / CACAO

GambleFi

Airdrops (LayerZero / Starknet / ZKSync)

Concluding Thoughts

Congratulations if you’ve made it this far! This about sums up how I will be positioned going into 2024.

The one thing I haven’t talked about is how I think we this cycle ends - and lately, I’ve been giving more and more thought to the GCR idea that "the last pico-top were funds getting in, the next pico-top is when countries start buying.”

This sounded ridiculous at that time, but after learning how countries with high inflation are considering adopting Bitcoin into their portfolios (e.g Argentina) - I think this to be more and more likely.

But - that is an article for another time. I wish you all a very blessed December, and a wonderful new year going into 2024.

Good luck, Godspeed, and see you on the other side, ladies and gentleman.

Psst… here’s a special offer for making it to the end. Get 20% off for 1 year on my paid research! Otherwise, you can just subscribe for free and receive my weekly market updates!

<3, Kyle.

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

Thank you for sharing your perspective, I value thesis that are different than mine quite a lot in these days of the CT echo chamber, however I’m surprised by how US centric the perspective in this piece feels to me. Now being from the US myself, I am often guilty of this bias, but the line that particularly stuck out to me was something to the effect of ‘What new money is actually likely to come to market?’ I can think of several places in the world, whose governments don’t absolutely do everything possible to restrict their access to crypto, who haven’t participated in previous crypto cycles. Inflation in USD has been the most tame of nearly any currency these last few years. It has been particularly noticeable to everyone, crypto believer, or not. Imagine what that’s like when inflation is 20 or 30% year after year for your local currency, and access to USD or euro, is only on the black market with gouging exchange rates. Coinbase’s announcement this week that anyone can send money to anyone for free with a simple texted link might possibly have a larger impact on 2024’s crypto prices, then all three of the US-centric themes listed in your piece.

If these new entrants are truly new to crypto, I wouldn’t expect a lot of the developed country targeted coins, or obscure technical infrastructure/defi altcoins to gain much benefit, but I think anything in the top 30 market cap coins is fair game (especially stable, coins), plus potentially meme coins or culturally relevant coins/game tokens, might see some truly absurd gains.

It will be extremely interesting to see where increased adoption comes from in 2024. I very much enjoy your writing, look forward to reading anytime I see one pop-up!

I don't know how to thank you, Kyle for all that you share and bringing all of us along with you. You are a true Uber Mensch!