My Most Used Frameworks In Crypto Trading

How I use this to gain an edge in trading

DISCLAIMER: The information provided in this newsletter is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading involves a high level of risk, and it is important to do your own research and consult with a qualified financial advisor before making any investment decisions. The strategies and frameworks discussed here are based on personal experiences and opinions and may not be suitable for all individuals. Past performance is not indicative of future results, and there are no guarantees of profit. Please trade responsibly and only with funds you can afford to lose.

NOTE: The words “Trading” and “Investing” are used interchangeably in this article for ease of writing.

Why Do We Need Frameworks?

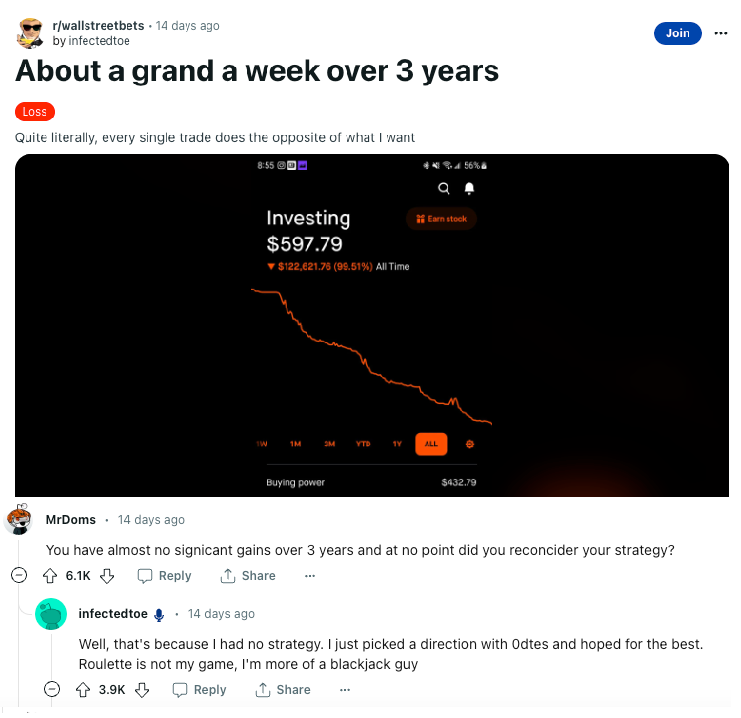

Frameworks are quintessential for any trader in evaluating potential positions that they’re about to take. If all you’re doing is looking at an asset and flipping a coin to decide whether to long/short, you’re just gambling.

And it’s important to understand that just like snowflakes, no two traders are alike. Each trader has a unique trading style suited to him or her. It’s all about finding the edge you’re most comfortable with, and honing it to perfection.

Some of you familiar with my tweets and style may know that I don’t fancy anything on the lower time frames and I lean towards a more fundamental style of trading, while using technicals to guide entries.

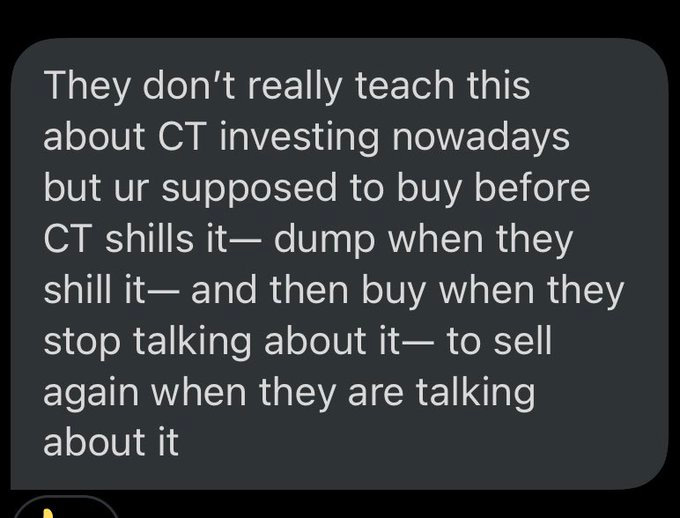

I also generally like to use psychological frameworks in how I invest, making sure that I stay on top of how people are feeling with regard to a certain ticker.

I don’t do any of the technical based trading so prevalent on CT, like “longing the bounce on the 10D SMA” or whatnot. And that’s ok.

This theory is applicable not just in trading, but throughout life, really. In gaming terms, it’s like having your character have a certain affinity to a role (e.g mage) and choosing to main warrior instead. That makes no sense! Always stick to what feels the best to you, because you will naturally be better at it.

So here are two of my frameworks that I apply - and if they don’t suit you, that’s ok. I just hope that this article helps someone who’s still struggling, and is looking for some guidance.

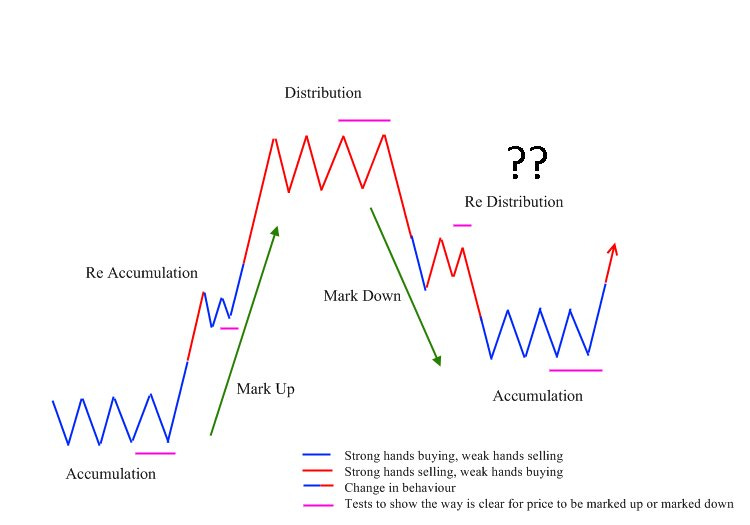

1. Accumulation And Distribution

This strategy was influenced heavily by Beetcoin - all credits go to him.

The idea is simple:

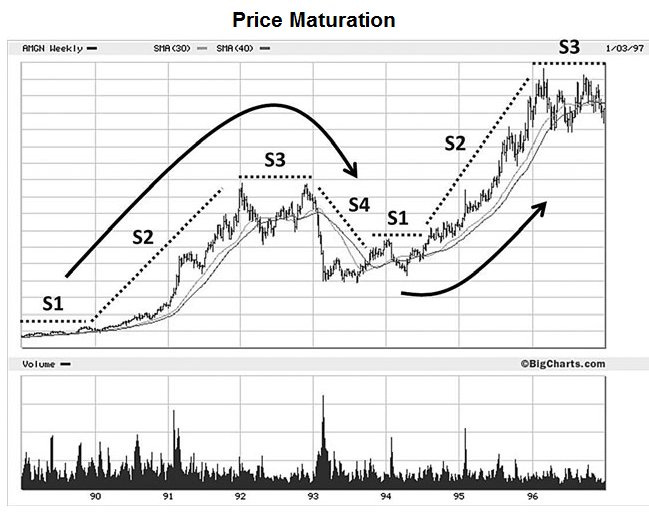

S1 accumulation range (no media/max opportunity)

S2 directional trend (where you should trade)

S3 huge volatility (media going crazy/min opportunity)

S4 final mark down/crash

You’ll make most of your money in S2, and you want to spend the least amount of time in S1 and S4. And most importantly, survive to experience a lot of S2’s in your career. Trading is a marathon, not a sprint. Too many people let the idea of “getting rich quick” get to their heads - be patient and it’ll come to you.

This strategy has helped me countless times in identifying where I think we are in market structure. Generally, I suck at buying S1 - I rely most on getting in early at S2, and selling at S4 (because I suck at timing tops too). But as Delta aptly puts it:

Here’s a classic example of the structure being in play. And when you rationalize it, you realise that speculative investments (i.e everything in crypto) relies on many “mini bubbles” - where reflexivity brings the coin much higher than it rationally should go, and gravity brings it back down. The structure thus makes sense.

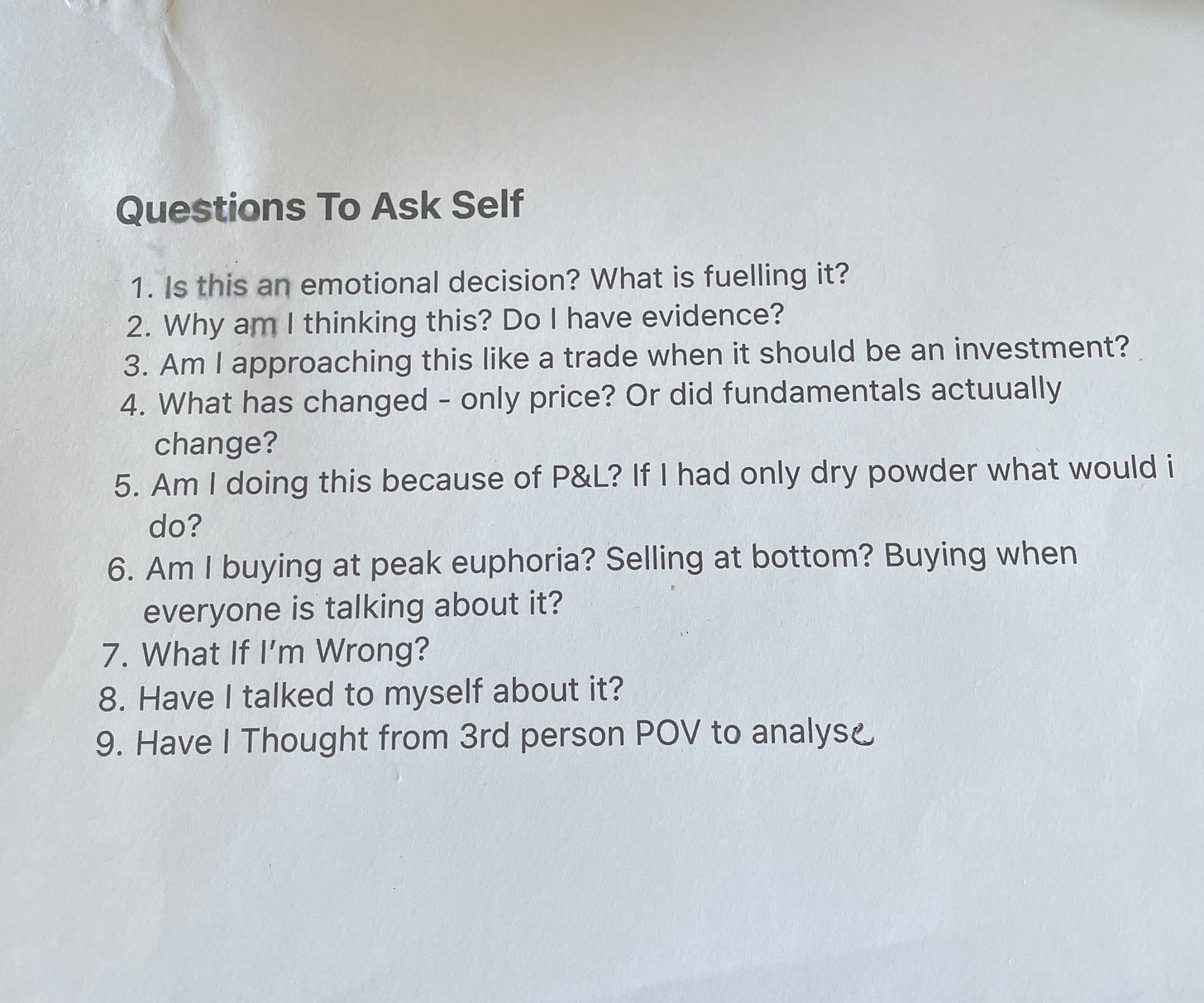

2. Questioning Everything

In front of me I keep a piece of paper I refer to every time I make a decision in the markets. I make sure to always thoroughly go through every question in this list before buying, or selling.

Life is led by emotion. When you feel hungry, you eat. When you feel tired, you sleep. A strong emotion is almost always proceeded with a strong action to negate that emotion. And this is even moreso in trading.

When an asset you own goes up, you feel euphoric - why sell? This asset is generating you happiness - selling is counter-intuitive! In fact, you would buy more of it in the hopes of making even more money.

Likewise, when it goes down, you immediately want to clear it from your inventory. It’s generating unnecessary anger - so you want to get rid of it immediately.

Acting on your emotions like this often creates the scenario known as “buying the top and selling the bottom”. In investing, it is thus necessary to trade counter-intuitively to how you would normally live - emotions must be taken out of the equation.

Making a list of questions you would ask yourself when buying / selling something and make sure you can answer every question when you make a decision.

Concluding Thoughts

I hope you took away a lesson or two from this. As always, I enjoy hearing your feedback. If you don’t already know, I launched a paid substack where I do deep dives - all for the cheap price of a Starbucks per month. If you enjoy reading, do consider supporting me =)

Here’s the latest paid article:

Solana... As The Next Ethereum?

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

hi Kyle, New subscriber here. Can I ask some ?s related to this article?

bes t,jeff