0xKyle's Weekly Market Narratives #5

Biggest traders on CT turning bearish. 6 Feb - 12 Feb, 2023

DISCLAIMER: The information contained in this newsletter is for informational purposes only and should not be considered financial or investment advice. Any opinions expressed in this newsletter are solely mine.

Welcome to the fifth week of weekly market narratives, the only substack in the entire crypto space that covers narratives in the markets. If you don’t know, I’m writing a short series teaching you how to trade narratives. Check out the first post here.

Executive Summary

$BTC 7D: -2.9% | $ETH 7D: -0.3%

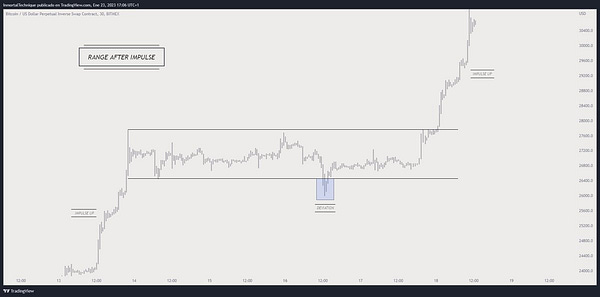

The markets rallied upon Jerome Powell’s statement during FOMC last week, yet bullish sentiment waned at the end of the week as big CT accounts such as CL207, Husslin, and even GCR gave slightly bearish indicators as to what was coming. Big CT accounts seem to believe that there are signs of exhaustion in the markets - a view I initially disagreed; after all, everyone started selling but the majors still remained relatively steady.

The counterpoint is that the flow of alts seem to be more and more degenerate as people chase the wildest pumps across the risk curve. This isn’t an indicator that should be taken lightly, for it points to late-longers chasing the pumps that they missed to begin with. It’s not so much a healthy appetite for risk than a “shit, I’m not going to make it because I feel like the big moves have already happened” which signals desperation, greed and a belief that the market would keep on going. What happens next, as we’re all familiar, is an exhaustion of the markets as people stop bidding on majors.

Max pain scenario might actually be a chop downwards with no clear signals that eradicates bulls and bears alike. As such, moving into this week I’ve derisked most of my alts with dying narratives and instead shifted towards spot long on majors. I’ll be looking to bid alts with strong upcoming catalysts, but will size down on them. I still don’t think it’s a good idea to short in an overarching uptrend, so I won’t be touching the red button for a while.

Tweet Of The Week:

Market Narratives

CT Darlings See Continued Strength

$CANTO 7D: +20.7% | $HOOK 7D: +21.4%

I don’t really think I have to elaborate much on these - you can read the breakdown in last week’s summary here. But what I do want to point out is that Canto seems to be running into a wall of exhaustion here, with price making lower highs and lower lows. I still like the token, but I’ve been derisking at ~0.60. I obviously don’t think it’s going to nuke to 0, but I think that it’s good to secure profits if you’ve already made it.

NFT Marketplace Tokens Finally Get Attention

$LOOKS 7D: +46.3% | $X2Y2: +36.4%

The upcoming $BLUR airdrop on the 14th of February has gotten NFT marketplaces running. I guess the key question to ask is: How much of it is priced in? This is a token that everyone knows is going to airdrop in 8 days - so how much higher can we go? Personally I think that barring any sort of incredible market downturn, a successful drop has a considerable chance to still see higher upside in NFT tokens.

Other NFT marketplaces tokens are: $NFTB / $JPEG / $NFTX / $SUDO (when launch) / $BLUR (when launch)

Arbitrum / ZK-Rollup Narrative Takes Off

With a sudden rise in protocols posting about “Monday” tweets (see what I’m talking about here), everyone’s talking about the long-awaited Arbitrum airdrop that could be coming on Monday. This also coincides with the recent ZK-Rollup narrative we’ve been seeing in the markets. Arbitrum coins have also been seeing strength, with tokens such as $MAGIC being up 100% in the past month alone.

Personally, I’m not too big a believer in the rumour mill, but I think it’s worth keeping a close eye on in case $ARBI actually drops. I’m looking for entries into $MATIC, as their zk-EVM is dropping sometime soon.

Tokens:

Arbitrum: $Y2K / $MAGIC / $GMX / $PLS

ZK-Rollup: $OP / $MATIC / $LRC / $MINA / $IMX

The App-Chain Thesis Rises Again…?

$SYN 7D: +43.5% | $dYdX 7D: +30.3%

I wrote about this a few months ago, so I’ll spare you the details. Basically, these two tokens are looking to launch an app chain, and finally, CT has hopped on the news. However, the problem with these sorts of plays is that you’re left holding these tokens for an indefinite amount of time until they launch their chain. But based on past results, it seems like they have a propensity for procrastinating, with both chains saying that they’d launch in December 2022 before delaying it.

AI Tokens Once Again

$imgnAI 30D: +5284.7%

With imgnAI up an incredulous amount from pre-sale, this kickstarted the second AI rally. Lot of people I know call for a sustained AI rally, which I don’t necessarily disagree with. Full disclosure though, I’m sidelined. But my advice would be to ride the AI wave as long as market structure holds, because this is the one narrative that has incredible weekly strength. AI is always at the top of everyone’s minds with the usage of ChatGPT being so ubiquitous these days.

AI Tokens: $AGIX / $FET / $SNS / See the whole list here.

Individual Tokens:

$INJ broke new highs this week, which saw a +43.6% increase in its price. Remember that this is a token that launched a $150m ecosystem fund, and so it might be worth spending some time to look into who’s building on it.

$STG’s proposal to burn 10% of their total supply saw their coin pump 13% on the week. Note that STG is one of those coins with a team prone to making pumpamental news.

$PSI - TridentDao’s coin, saw a successful launch with over $3m bootstrapped for their raise. I’m even seeing chatter that this is the “next DFK”, so let’s see.

LSD tokens such as FXS / LDO / RPL are seeing renewed chatter after the past week saw their prices devalue from ATHs. People are calling for a renewed rotation back to LSDs in light of the upcoming Shanghai Upgrade as well.

$MASK / $DOGE all saw a huge pump in the past week as Elon hinted on adding Twitter payment solutions. These coins tend to pump on Elon news, so it might be good to add them to your watch list in the future. After all, buying on Elon’s tweets was an extremely profitable strategy last year.

Items To KIV:

$CFX still lies on everyone’s minds as a “Chinese coin” proxy. It might be good to buy at some levels if we see renewed strength in the markets, with a bet that narratives will rotate back to the good ol “Asia bid”.

Don’t fade the doggy coins as we’re seeing good ol end of rotation doggo pump in $SHIB / $DOGE

I do think that certain bluechip NFTs might be good pickups while the entire market is focused on Checkmarks and Open Editions

In the case of a nuke, I would like to pick up strong tokens that performed well previously. I’m mostly looking at $SOL and $APTOS.

In the case of a choppy scenario, I would gladly take a step back from the markets to focus on my studies (it’s hard juggling my grades, my social life, my part time job, all whilst providing this alfa for free).

Useful Tweets

Some love for the bulls

Great content Kyle as usual!

If u knew that in the next days $BTC would go down around 21.9K before shooting back up and cutting through 25K like knife through butter up to 27.7K, what would your best bet be? Which one of those coins would u pick for max profit?

Best f***ing newsletter, love it! Keep em coming Chad