Narrative Trading #1: Introduction - How To Find Alpha & Research

An introductory guide to narrative trading

Welcome to my short series on how to trade narratives. This is my attempt at condensing my past year of knowledge in the markets into quick tidbits for you to understand and internalize. I hope it helps!

What Is Narrative Trading?

Crypto (and the larger stock market in general) is primarily dominated by cycles - think BTC halving → bull run → bear market → bull run → etc. This isn’t a uniqueness specific to crypto but is instead a trait that can be seen across any market in general.

But in these cycles, there are “mini-cycles” in which certain “themes” of tokens pop off - with some recent ones being the DEX Narrative post-FTX or the L2 narrative. These “flavour of the month/week/day” run-ups are crypto-specific, because as far as I’m concerned I don’t see something similar happening in Trad-Fi markets.

No one really knows how they come about, nor is it necessary to. Narratives are a function of price - i.e price almost always moves before the narrative arrives. Most of the time, people will come up with “reasons” price moves in a certain direction, and that reason - be it true or not, will be the overarching theme. Think of the recent $GALA pump - why it happened is secondary to the front-running that happened afterwards with SAND and MANA, as people slowly internalized that we were having a “metaverse pump”.

How I like to think about it is by recognizing it as the “collective unconscious” that all traders share - a narrative is like the game of Agario, where each narrative starts off as a blob and slowly works towards becoming the biggest blob that occupies every trader’s mind. For example, the current biggest blob is the “Echo Bubble 2023” thesis. It’s always important to re-evaluate your “biggest blob biases” in order to determine whether you’re subconsciously long or short.

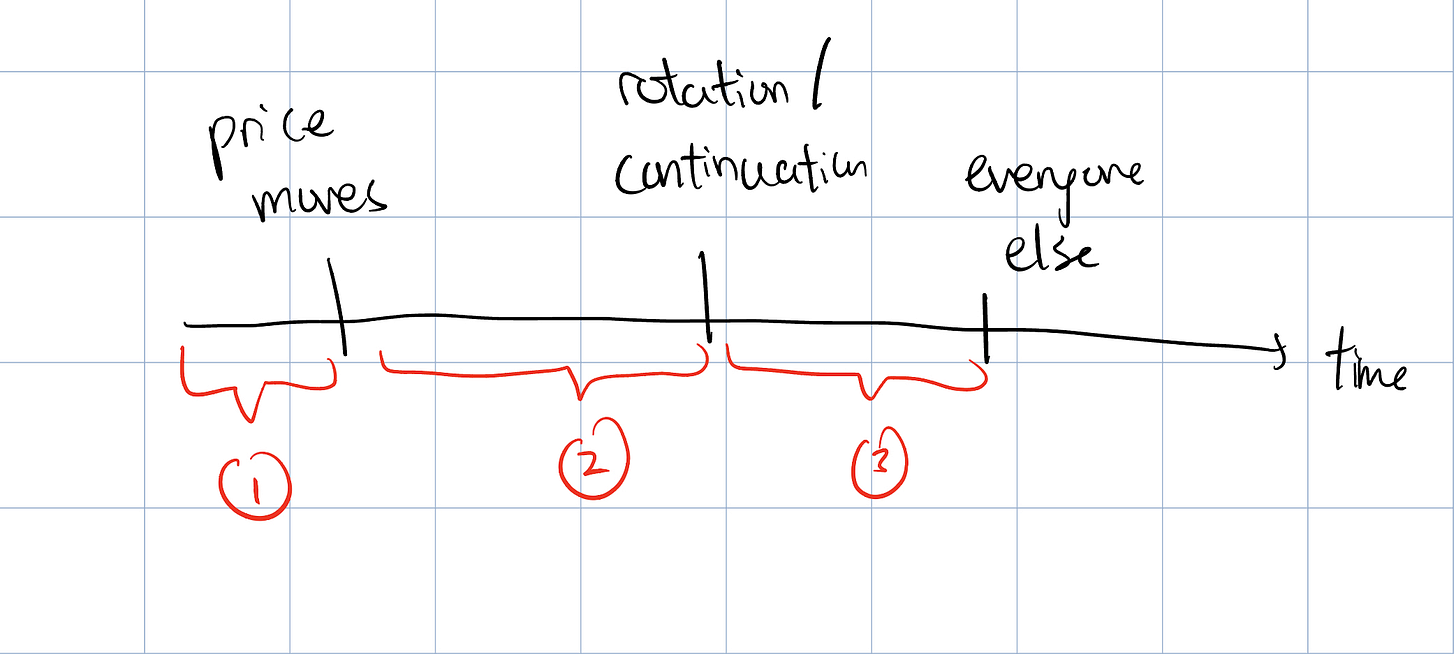

And so, we more or less know what a narrative is and how they propagate. Now, what are the stages a narrative trade normally takes? Well, how I think about it is that there are 3 major inflection points you can enter, namely:

The point before the narrative begins

The point at which the earliest people find the narrative and ape rotations/continuations

The point at which everyone finds out

However, entering a trade at each of the points comes with different drawbacks:

At Point (1), you have the highest reward, but slim probability

At Point (2), you have slightly less reward, but a higher probability of being right

At Point (3), you have the least reward, but pretty much confirmation that this narrative exists

Personally, I like to trade Point (2), as I feel like it offers the best balance between the three. Most narrative traders you see on CT are also trading Point (2) as well because it’s the strategy that doesn’t depend on luck as much as (1) does, while also still being more rewarding than (3).

Finding Alpha

The context has been set, and now it’s time for me to dive into how exactly you can find the narrative at the perfect moment - before it pumps, but after confirmation.

This is going to sound extremely simple, and you might not believe me - but in reality, I’ve found that many of the tools just aren’t that useful when compared holistically. I’m talking wallet-watching, on-chain tracking, etc.

These are time-consuming methods that, when viewed across a longer time horizon, probably don’t give you as much alpha as being in a Twitter group full of De-Fi degens. On a holistic basis, these strategies take much more effort for much less payout.

And so, the two main strategies I use are:

Twitter Lists

Discord Groups

Now, it’s not so much about the platform I use, but the type of connections I have. This is the key takeaway I want you guys to internalize - it’s all about the network. If you’re in a discord group full of traders who actively look at the markets, you can more or less observe the flow - the flow of where the general trend is going. But if you’re in a group where everyone sorts of just apes after price moves - you’re going to be in for a bad time.

Certain Twitter lists/influencers are also great for making such observations - take GCR, for example. All you had to do was read his tweets and watch the price go up to more or less buy into the narrative of an echo bubble - you really didn’t have to do anything else!

Certain other information aggregators are also extremely useful - say for example a narrative trading substack (ahem).

Conducting Research

The next step in trading is to conduct research on what you’re trading. Research is basically googling everything you don’t know about a project - from reading the documents to talking to the admins on Discord. All of this isn’t purposeless - in fact, it’s the opposite.

Research is extremely important in building your thesis (more on this next time). You can’t just blindly ape what your friend group tells you to - you have to know the project in order to build conviction, and conviction is what allows you to stay after shakeouts to capture the meat of the trade.

For example, HOOK experienced an extremely volatile week, and many traders I know got shaken out by the erratic price action. However, with research, you build knowledge as to how the protocol works and what makes it good - with that knowledge, you’re able to stay in your positions for longer periods of time, knowing that it has “intrinsic value”.

While you don’t have to know everything about a project, it’s important to at least know the basics - for example, that MATIC is a scalability solution and will benefit from a L2 / scalability narrative.

Concluding Thoughts

Honestly, there’s no ultra-secret method that narrative traders use to front-run the markets. A lot of this also comes with practice and trial-and-error. So just show up every day and grind it out.

Well, I hope you’ve enjoyed this piece. There will be more coming out in the later weeks, and I hope that at the end of this short series, I’ll have helped you become a better trader in some way.

Anyways, here’s some alpha for you:

Twitter Lists: Aylo has some pretty good public lists here.

Discord Servers - I have a few, but they’re all gated. I’d recommend you just lurk in a few notable ones (e.g The One by moonoverlord), talk to some people in there, and create your own.

good article, a good read (:

Fantastic article, thanks for sharing!