0xKyle's Market Color #27

Healthy Correction, New Narratives, Geopolitical tensions?

This weeks newsletter is brought to you by: Solv Protocol!

Solv Protocol introduces SolvBTC, the world's first-ever yield-bearing Bitcoin. Similar to how Ethena provides high quality yields to stablecoin users, SolvBTC will provide high quality yields to BTC holders. SolvBTC uses a multi-strategy framework to obtain BTC native yields for BTC holders. Some of the strategies used include:

Market Making Strategies

Delta Neutral Funding Rate Strategies

Cross-Exchange Arbitrage

Solv is backed by Binance Labs, NOMURA Group, Mirana, Blockchain Capital and more, and has achieved a TVL of more than $250 million, providing high quality yields to more than 35,000 users.

Come participate in Solv's Point System today! You can try it out here!

Executive Summary 📝

It’s an interesting phenomenon to observe the PA of alts vs BTC this week. For the most part, BTC.D has been steadily grinding higher while alts are dying like flies against BTC. This can simply be explained with the fact that BTC has direct ETF inflows, but perhaps what we should be concerned about is broader market strength.

The question everyone wants to know is - wen bottom? I believe that BTC might continue ranging for a while, but the bottom is in the midst of resolving - this weekend, most good alts pumped 10+% off the lows.

CPI is this week, and you can expect the usual short-term de-risking into CPI which might dampen volatility, but all in all, I’d set bids at key levels from here expecting alt szn Chapter 3 soon. With most alts already down 20-30% from the highs, this puts us into a healthy consolidation as we go into the halving.

However, on the macro side we might see a “black swan event”. A few days ago, traders were spooked at increasing tensions between Israel and Iran. I’m no geo-political expert, but as far as I’m concerned, war is always short term bearish and spooks the markets.

This could be the black swan of 2024, with the same results as Covid - i.e you buy the war FUD, and then we rip into the halving + post war bullishness. There’s been a ton of threads about how BTC has reacted to this - that it seems like we’re having a “flight to BTC” just like how people flee to Gold in times of uncertainty. Is BTC finally taking the narrative of digital Gold? Time will tell.

All in all - cautiously bullish is my take, and removing emotions from the process by just setting bids at key levels - if I think it still goes down more, I size less for the higher bids and more for the lower bids.

Market Narratives 🎙️

If you’ve read my latest High Conviction Bets (link below), you’ll know that I mentioned the importance of rotating into key narratives this cycle (so far), instead of holding a “undervalued” token and praying it goes up. I’m bringing this up because we might be seeing the emergence of a new narrative - ETH might be finally taking the stage.

This year, many, many people have called the ETHBTC bottom - just for it to go even lower. However, with Eigenlayer coming up in Q2, there’s good chance that ETH will do well - especially given recent performance of ENA (Ethena airdrop).

We also have Pendle taking the stage, and as such we might be seeing signs of life in the ETH maxis.

ETH Narrative

ENA - Ethena’s token

PENDLE - strong coin, one of the most used yield farming protocols this cycle it seems

ALTLAYER - Eigen beta

POND - Eigen beta

The usual LSDs - LDO / RPL / FXS /

If you’re feeling adventurous - L2s like OP / ARB / STRK / SKL / MATIC

Ordinals are also taking the stage once again, and with that comes the rise of BRC-20 tokens. ORDI rose 30% in the weekend, and so:

ORDI

SATS

might look like decent tokens to ape. I will however, say that on-chain has much more opportunity than CEXes when it comes to apeing Ordinal related tokens - read more below!

Other outperforms I’m eyeing to pick up more of:

WIF

SOL

Lastly, there are tokens that are already so dead, yet have performed incredibly well previously - for example:

GALA

TIA

INJ

LINK

The issue with these tokens is that being early is as much of a curse as being wrong - the trade could be right, but you could be a few months too early. These are difficult tokens to trade, and as such I usually rely on certain EMA crossovers to tell me when momentum is building.

On-Chain ⛓️

On-chain remains a mixed bag, but there’s been quite a lot of activity on certain chains - BLAST is no more after the multiple rugs — let’s take a look at $YIELD (of which I lost a lot of money)

Base chain remains relatively hot, with their NFTs seemingly doing well. With meme activity dying down across all chains, it might be a good time to start DCAing into the stronger memes:

boden on SOL, alongside the cats - popcat, sharkcat, man Ion’t even know - I’m so lost in memes lmao

MOCHI / TOSHI on Base previously - and you also have doginme, COIN, etc.

For Ordinals, you’re spoilt for choice for what to buy:

Node monkes

Puppets

$PUPS (memecoin token)

Runes

Bitcoin Virtual Machine ($BVM on Dexscreener)

On-chain remains relatively “trench” level which means I can’t spend that much time on it (due to the nature of working a Web2 job in the day, lol). Trends change in a day, and today’s top performing coin is tomorrows largest loser.

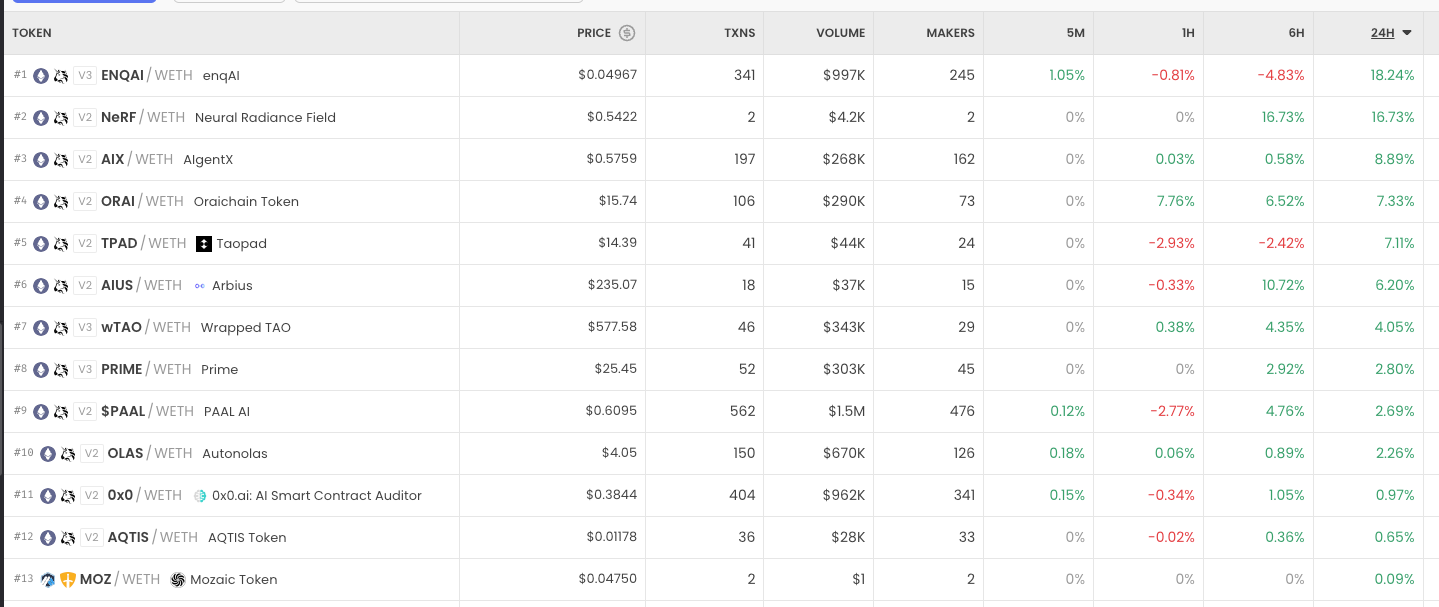

This week, the number of coins that have performed consistently throughout the week are extremely little - as such, I’m quite at a loss for words when trying to find tokens to cover. These tokens literally go up 80% in one day, and -50% the next. No “good project” that has concrete progress comes to mind - but AI had a recent resurgence on-chain as well.

Well, that’s all for this week! See you guys next week - and fingers crossed, we’ll see better prices! Remember - stay safe, and stay healthy!

<3, Kyle

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.