0xKyle's Market Color #16

Rate cuts are bearish, ETH's failure to break 2.1k - Is the top in?

P.S. Exam week isn’t really over yet but most of the difficult assignments are done! So I’m back. 😎 Also, I've found a job in NYC (admittedly non-crypto related) - so if you want to meet (Jan 2024 onwards) do feel free to reach out! Will definitely be looking forward to meeting some chads.

Executive Summary 📝

This week witnessed a breakout from the $36k range as Bitcoin gradually trended upwards. Admittedly, the monthly outlook strongly favours the bulls. From a technical analysis (TA) perspective, the next crucial resistances appear to be in the vicinity of $43k to $45k, but overall, the prevailing trend is upward.

On the flip side, Bitcoin's counterpart, Ethereum, is facing challenges. Despite Ethereum's surge to $2k following the Blackrock ETH ETF filing, it's widely acknowledged that the upward trajectory of ETHBTC is not a matter of if but when.

For ETHBros like myself, the consistent underperformance and lacklustre returns of ETH have been rather frustrating, to say the least. It failed to breach the 2.1k mark, a significant peak during the bear market, signalling the market's current sentiment towards ETH.

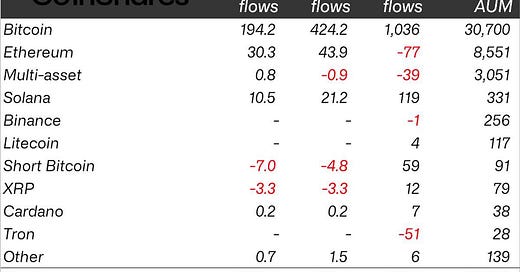

You can actually see Ethereum’s YTD flows are terrible, and its weekly / monthly flows compared to Bitcoin are suboptimal. It even has lesser YTD flows than Solana - GG.

Well, whatever. Today, I want to bring to your attention an opinion that I have - the opinion that “rate cuts are initially bearish”. Hear me out.

The chart below overlays the Fed Funds Rate on the S&P500 Index. Observing the instances when rates began to decrease, we note that the market experienced a downturn in 100% of these occurrences over the past 20 years.

While it's true that past performance doesn't guarantee future results, I find it more compelling to explore why this pattern persists. And I attribute it to the simple fact that the economy lags behind the stock market - the market is known to peak, and bottom before the economy.

In situations where a widely known and bullish event is anticipated, such as rate cuts, there's a tendency for a "buy the rumor, sell the news" dynamic. The market rallies in anticipation, but once the event materializes, a sell-off ensues as all the anticipated buyers have already entered the market.

We’re now seeing the same thing with Bitcoin, as institutional buyers “front run the ETF narrative”. DonAlt (the duck) astutely pointed out that if Bitcoin turbo increased in price before the ETF, it was likely a sell-the-news event - and I believe him to be right.

So - why bring this up? Well, it’s simply because I believe that the top is near. I’m not a big fan of calling tops or trying to predict the future (even though that’s literally the job of all traders) - but I think that the argument is logical - you have two bullish events - rate cuts, and an ETF.

I don’t doubt we can go higher, but I will just say that the higher we go, the less R:R there is for being long at that price - as GCR says - crank up risk when trend first reverses, and gradually protect capital as time passes.

The higher price goes, the less greedy you want to be.

Unfortunately, the price for being wrong on this thesis could be missing out on the upOnly event of the century - as such, I think the best way to position into this is to segregate your spot / trading portfolios. Just be spot long, and more risk averse on the trading side as we come into the event.

Market Narratives

Something I’ve noticed this past week to substantiate my anecdotal observation was also the simple fact that market narratives seemed to have tapered off. At the beginning, we had a good amount of narratives to trade - now, they’ve all seemed to be taking a break.

One can make the argument that they’re consolidating for another move higher (which - I can see happening), it’s just something to keep in mind.

$TIA - I midcurved the heck outta this, but basically it’s a low-float, high FDV coin that’s the future of France. The foundations of TIA are admittedly good - with the first unlock in October 2024, TIA is the shiny new coin that CT is pumping.

$FIL - Seems to me that people are going after the things with a Grayscale premium. This also includes $MANA, but $FIL seems to have more attention given Rewkang and Arthur Hayes (both shilling machines) love this.

$MATIC - Speculatooors speculating about the Matic announcement on the 14th. In a bull market, news conferences aren’t necessarily sell the news unlike the bera, if the news is big enough (just look at dydx)

Speaking of which - $dYdX has been performing phenomenally well. with the launch of v4, this coin may finally see some love

SYN - when talking about dYdX, its annoying little brother comes into mind. People seem to have forgotten about synchain - but maybe, just maybe, the curse of the “permanent-resistance below 50 cents” can be broken.

$FTT - Need I say more? FTT is the week’s outperformer, up 237% on news that FTX MAY get restarted. I’m not following this too closely, so I don’t know how viable this option is - but hey, speculators be speculatin’.

SOLUNAVAX - Good god, this is back. Sol has been outperforming for most of this month’s pump, and narrators have pivoted to pumping Avax and Luna as well. Jfc.

NTRN, a new Binance launchpad coin + “Cosmo eco coin” is getting a good pump into ATHs

After that, you have most of the recurring narratives - Link & INJ as outperformers, AI & China coins doing their own thing.

On-Chain

RLB attained new ATHs of 25 cents, and is now at 22 cents. This thing is just uponly man

Grok is the latest memecoin. Not sure what it does, and not looking into it. I simply have no edge in ze memes. Something about what Elon Musk posted about Grok and ChatGPT.

LSD tokens like Lybra did see a huge pump, but retraced somewhat as LSD majors couldn’t seem to catch a bid. Curse you, Lido!

PRIME seems to be doing well, chugging along nicely while the rest of CT is unaware of its existence. I paperhanded it at $3. Nice.

Gaming seems to be doing pretty well, with tokens having the following performance:

$ILV : +77%

$GALA : +34%

$IMX : +54%

$PYR : +53%

$MC / $BEAM : +55%

$PRIME : +52%

$SFUND : +56%

$UOS : +33%

BEAM is one coin I see whispers going around CT. I’ll look into this~

Sol Eco is doing relatively well this week, with names like SHDW, MNDE, FLUXB doing multiples. You also have the main NFTs - Madlads, SolanaMonkeBusiness, doing close to 2x. Solana ecosystem wallet Phantom also saw more than 100k downloads in the past week itself. All very bullish signs for SOLANA SUMMER.

RVST is another one that pumped straight up to 30 cents, but has retraced bigly to ~20 cents. Might be a good buying opportunity if you’re into it.

UNIBOT continues its lacklustre performance. It has bounced back from the hack, but it seems unable to break out from the 40s-50s range.

Remember - there’s like a ton of things that go on in the on-chain and perps market daily. This newsletter serves as a summary of what I deem to be the most important things. Hope you guys still like it though.

That’s it for this week~ I’ll see you guys in High Conviction Bets coming out mid week!

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.