0xKyle's Market Color #15

Solana Breakpoint, OpenAI's Conference, Kabosu's Birthday, and more!

P.S. I’m heading to New York City (NYC) for a year in January 2024, and am looking for a crypto internship as an analyst for that duration! Open to anything from working at protocols & startups to venture / liquid funds. If you know anyone interested / you’re looking for one yourself, please feel free email me at 0x.kyle3@gmail.com, or DM me on Twitter! <3

Executive Summary 📝

Following last week’s push to $35.2k on BTC, we’ve now settled in a range between 33 and 34k. Bullishness is expected to continue so long as Bitcoin remains above $32,000 establishing that it indeed has broken out of the range it’s been in for the past 500 days.

Yes, it’s been 500 days since 3AC collapsed. How time flies! BTC.D continues to grind ever so steadily higher, a good sign of an imminent bull market. ETH/BTC, continues its decline, but as I said in my High Conviction Bets newsletter, the ETH/BTC trade is one in which it’ll rebound… eventually.

Market Narratives

While BTC stalls, alts have been having the time of their lives, with the game of musical chairs being very much alive. Let’s get started:

$STX. This token does well on BTC expansionary moves to the upside - and worth picking up, if you believe BTC goes to 40k. It’s very simply, just higher beta BTC.

Solana Breakpoint - $SOL, $RNDR.

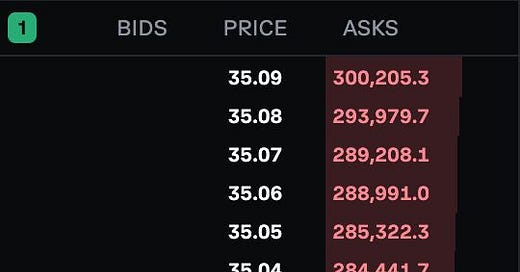

Worth noting that this was a picture circulating around CT - huge buy-wall into Breakpoint. Since SOL is currently at 35.8, I’m going to assume it’s not there - but unconfirmed, so DYOR

OpenAI’s conference - 6 Nov. AI coins have absolutely killed it with multiple coins on-chain seeing 400% moves.

Kabosu’s Birthday (2 Nov), Elon’s Doge-1 Launch

$TIA launch and tradeable on major exchanges, may be a “new token” narrative

ApeFest 2023 - Nov 3-5

NearCon - Nov 7-10

Many of last week’s narratives are also still playing. Keep yourself updated by keeping tabs on all of the narratives I’ve mentioned last week & this week - if alts start breaking down, you can measure outperformance and strength in who dumps the least.

On-Chain

RLB has attained ATHs again. Glorious.

Unibot hack causes token to dump to the low 30s.

Many of the same narratives are rotating around on-chain as well. You have AI - imgnAI, TAO, BOTTO, OLAS, AQTIS, NERF - the list goes on and on.

ImgnAI’s “huge announcement” was a partnership with NVIDIA that many X users claim is a “nothingburger”.

You can read more about on-chain AI tokens in this thread.

Meme coins suffered in the Unibot hack, with some dumping more than >50% - but bounced back strongly. JOE, in particular, saw huge inflows into the dump by the hacker. New memecoins this week are BCAT, TISM, MILK, DAVID, etc. The list really goes on.

“High quality memes” remain to be the trifecta - SPX, JOE, BITCOIN. Of course, PEPE also saw great returns in the past 3 weeks oweing to a burn of 6.9T PEPE tokens ($6mm USD) and the onboarding of new advisors. Tweet here.

SPX’s (the meme, not the index) performance has been disappointing as of late. The price of memecoins almost always has a linear correlation with the amount of attention it gets. Underperformance in the memecoin can either be a buying opportunity if buyers believe in the community, or a sign of weakness that the meme is dying out.

Solana De-Fi has strongly outperformed in the past few weeks, oweing to the performance of their token. Protocols like MNDE, NEON, all getting attention, alongsided their resident meme token - BONK.

We’ve also had outperformance by tokens that fit into none of these narratives

RVST broke out of its range to the upside of 11 cents, as people ride the RWA / 2.0 narrative.

Conclusion

Well, that’s it for this week folks. I hope you enjoyed my newsletter, and I apologise for being a bit late this week. Finals are coming and on top of studying, I’ve been applying to a ton of places in NYC. If you know anyone hiring, don’t hesistate to reach out!

I’ll see you guys next week. Until then, live your best life sers.

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.