Duel Masters was my childhood game. In my opinion, it had the potential to be one of the best TCG card games rivalling Magic - sadly they got canned by their parent company. That being said, I think their world building was phenomenal, and the picture above is one of my favourite cards - Alcadeias, Lord of Spirits.

In the story, the Angel Commands are fighting against the Demon Commands, and he’s the boss of them all. Very binary storyline, I know - but what I love best is his line - “We have watched and we have waited. Now we act.”

It’s such an epic line and describes how aptly we crypto traders have felt over the past 2 years. Here’s a timeline for those with goldfish memory:

June 2022 - 3AC collapsed.

Nov 2022 - FTX Collapsed

Jan 2023 - Echo bubble

Mar 2023 - Smaller echo bubble

Oct 2023 - ETF starts getting taken seriously

Jan 2024 - ETF gets approved

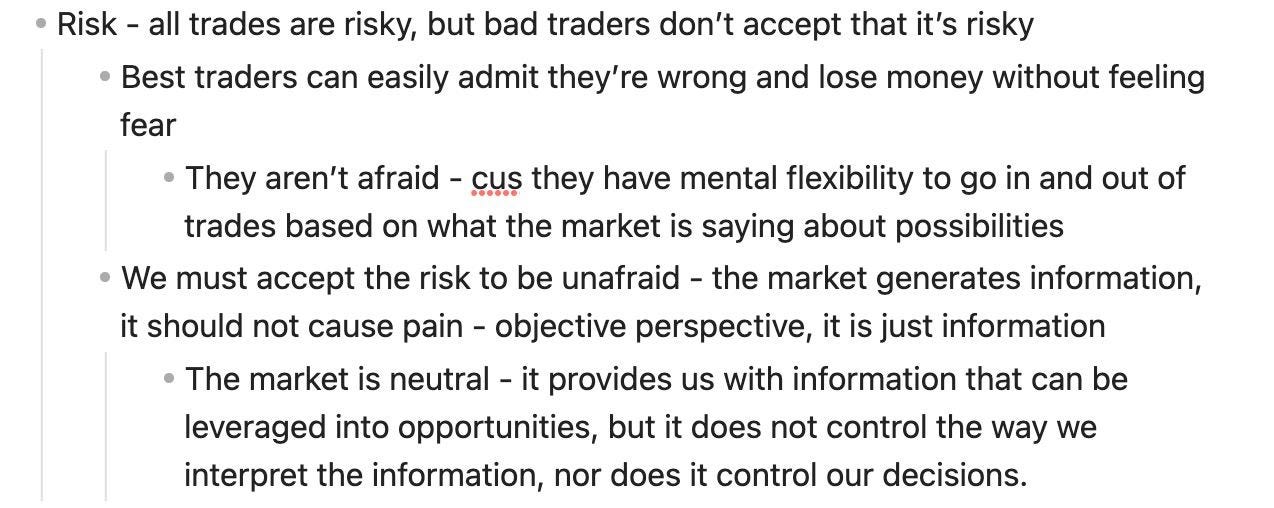

And if you’ve stayed here for the past 2 years, you know the bear market wasn’t easy. Conditioned to the chop, we have been ingrained with the idea to take profit on every pump, to follow the thesis closely, to cut trades as soon as it shows signs of weakness.

We have to be ruthless in our trades, because if you didn’t manage your money properly in the bear, the market would manage it for you. It was some of the hardest conditions to make money, because everyone was so full of dread - news pumps were sold into, charts were designed to go downOnly, and on-chain participants were not as eager to jump into the latest ponzi as they used to be.

What We Have To Remember Going Into The Bull

Market regimes are like tides - they change, and you need a different strategy to swim in each. You can’t use the bear market strategy in a bull market - you’ll end up leaving a lot of money on the table, and not fully extracting the value of the bear market.

Bear markets focus on revenue driven narratives and products with real demand-drivers IRL. Some of the best performers were coins like MKR and Rollbit - two products with great fundamentals. They’re also one of the worst performers in the bull so far.

Why? What changed? Well, bull markets focus on growth and dreams. Bulls tap into the future we can have, not the future we are living in right now. It’s why Decentralized AI is so great, because everyone imagines that in a couple years, this will 10x our lives.

And so, with that being said, I made a list of things to remember in the bull market with respect to how we trade:

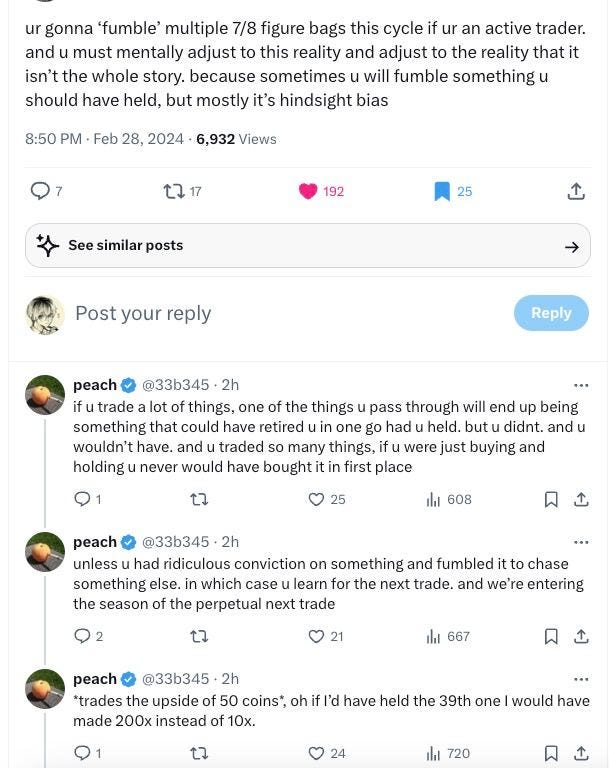

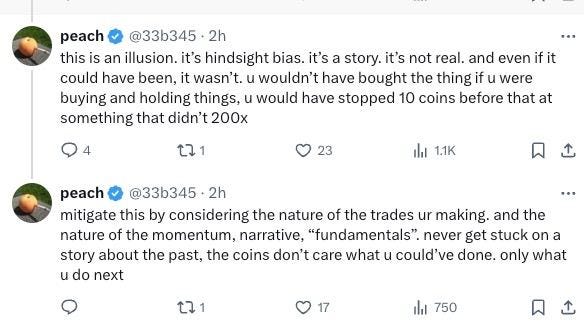

Let trades ride. You have to buffer a certain multiplier on your TP zones and let winners ride if the market favors em. Rules are good, but know when to break them.

Stop over-rotating to chase the pump. The worst part about the bull is seeing everything but your coin pump - and so you sell, to buy the coin that pumped 50%, just for it to retrace and your old coin to pump. No - over-rotating is the worst strategy. Patience is the name of the game.

Don’t get liquidated. Don’t overleverage. I know you want to make massive returns, but survival is always key in any market condition. Survive and you’ll see another bull.

Don’t midcurve things. If everyone is doing something, don’t midcurve it - jump in with them. In the bull it pays to be in the bandwagon, playing musical chairs until the music stops. BTC NFTs heating up? Jump in - it’s probably not a fad.

Try everything. It’s +EV to try new protocols in the bulla, and try new things.

Ape first, research later. Don’t 100% agree with this but I do agree that the timeframe you have to get into a good trade grows shorter - sometimes it pays to ape in small size for a good entry before researching, especially if it’s something illiquid (e.g NFTs)

Find yourself a good group of crypto friends to share your wins with. Don’t share your wins outside with your normie friends / family. And whatever you do, don’t flaunt your wealth.

To really find the best trades, look at what popped off previously but has low attention now. High chance it gets another round (e.g GameFi right now, or Celestia).

High conviction bets. Sizing is everything - I would rather be 20% in 5 coins that 1% in 100 coins.

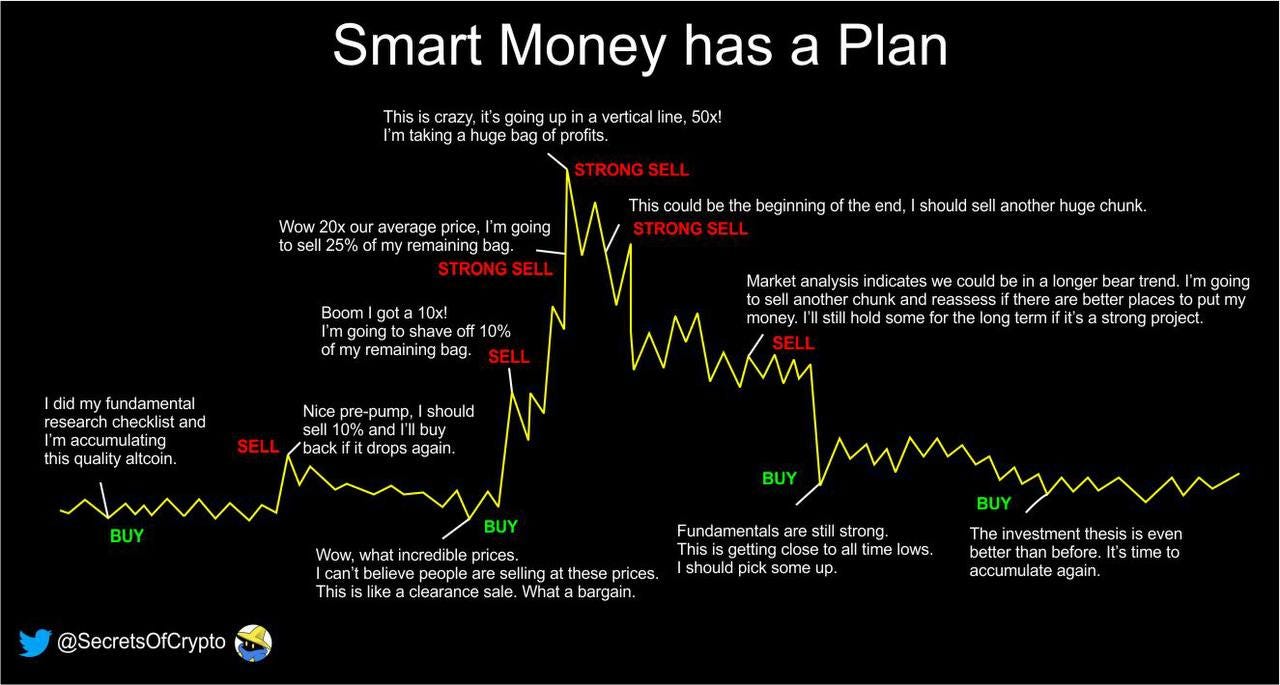

Have scenarios for tops - and react accordingly. Plan out what a top signal / when a thesis on your coin is completed, and then sell when it hits. Don’t set price targets - they always move as price goes up. Instead, think - how many % completed is my thesis, or what do top signals for this coin look like?

And here are some good picture reads I’ve collated:

Anyways, hope you guys enjoyed this one. I’ll see you guys on the other side.

<3, Kyle