DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

The Almighty Bulla Case

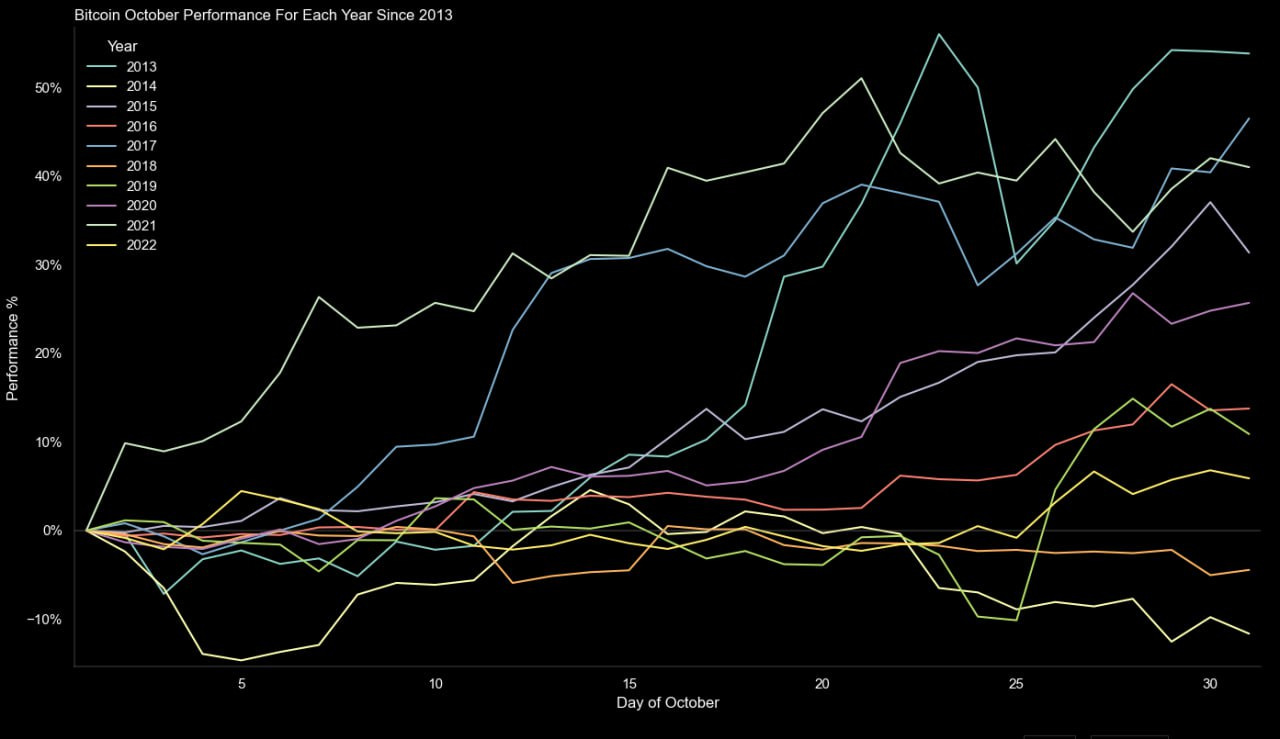

Seasonality

Bitcoin usually performs well in the month of October, with only 2 years where the monthly return was negative.

Rates Hike Being Frontrun

With everyone planning to long “once rates decrease”, it would make sense that the traditional market sees a continued rally until the event passes (i.e sell the news). If correct, hopefully we see a correlation b/w tradfi and crypto. But I think this data point holds less weightage.

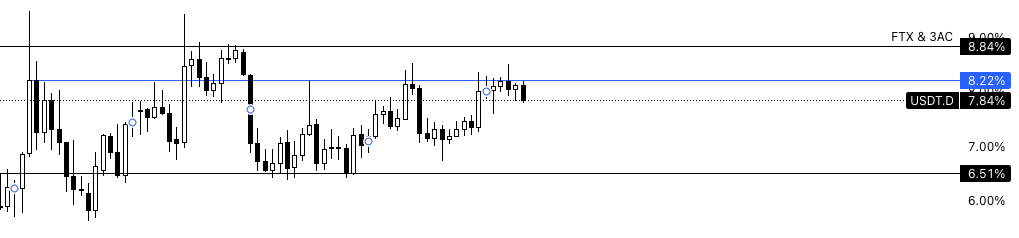

Stablecoin Dominance Decreasing

Stablecoin dominance has slowly been decreasing as bullas liquidate their stables in the name of Lord Satoshi.

BTC Monthly Breakout

The Bitcoin monthly chart closed below 27.2k on September, yet has already blasted through it on the 2nd day of October. Heikin-Ashi signals also pointing green.

Dirty Bera Case

Fundamentals haven’t changed

Ethereum ETF, Bitcoin ETF still haven’t actually come. It’s once again a game of hot potato, with over 12bn in OI being added in the last 24 hours. We’re pumping into nothing.

Mt. Gox Overhang

This has been a recycled narrative but yes, turns out there’s still gajillions in BTC being held at the sake of the government / FTX / entities. As the same with SOL pumping despite knowing Alameda holds millions of their tokens, this is a non-event in my eyes.

Overall

Vibes feel different. Different in a good way. I’m long, my active management portfolio is like this currently:

With plans to accumulate:

$UNIBOT

$MOG

$SPX

$BITCOIN

$RVST

I plan to go from 60-40 stables-eth previously, to 40-60 ETH-alts.

Narratives

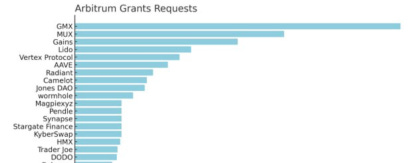

ARBTOBER

Need I explain more? Arbitrum is giving free money to protocols, so bid those protocols.

REAL WORLD ASSETS

MKR has been doing well in the whole “high-rates MKR gud product”, and now RWA is catching a bid. Strays that are getting caught in the crossfire include $CANTO, $FXS, and very possibly $BTRFLY.

EVENTS

One thing I’m keeping an eye out for is how price reacts to conference sell-offs / events. Two big events coming up are: RDNT’s mainnet, and LINK’s post-conference sell-off. If LINK doesn’t sell off / gets bid post a small nuke, that will be a huge sign to go omega long.

ON CHAIN

On-chain coins will be what I’ll be participating in mostly. With a good $BTC bid, a rising tide lifts all boats but I’ve always found on-chain to have more assymetric upside than normal alt perps. It’s easy to make the on-chain market pump, and when we dump they stay slightly more resilient due to how inefficient it is. Some names I’m keeping an eye out for are:

$RLB / $UNIBOT

$PRIME

$BITCOIN / $MOG / $SPX

$RVST

$RDNT / $GRAIL / $GMX

$CANTO

That’s it from me. Hopefully I don’t regret this post, and the market doesn’t just mean-revert. But I mean it when I say the vibes do feel slightly different - sellers are exhausted, and people yearn for some uponly price action.

We’re in the market of taking risk, so take risk I shall. Such is the name of the game, after all.

Cheers!