The term "Internet Capital Markets" mean many things. In today's context, Internet Capital Markets refer to the alchemical outcomes that comes purely from the benefits of blockchain technology: fin-tech that transcends geographical boundaries. The ability to borrow against magic internet money, tokenization of t-bills and private credit, stablecoins - in today's TradFi x Digital Asset world, they see all of this as "Internet Capital Markets".

However, they also mean something else to many of us on-chain traders that have lived and breathed this asset class for the past few years. Internet Capital Markets don't just refer to "on-chain T-bills" - they refer to NFTs, De-Fi, ICOs ; the many different speculative vehicles we have come up with in the past 10 years, and their subsequent token that would be traded - ever since the first smart contract was deployed in 2015 on Ethereum.

And in this article, I want to dissect that very side of the Internet Capital Markets. The side that focuses on the coins, the narratives, the 10x'es, 100x'es, airdrops - the mechanisms that underpinned the original thesis of internet capital markets.

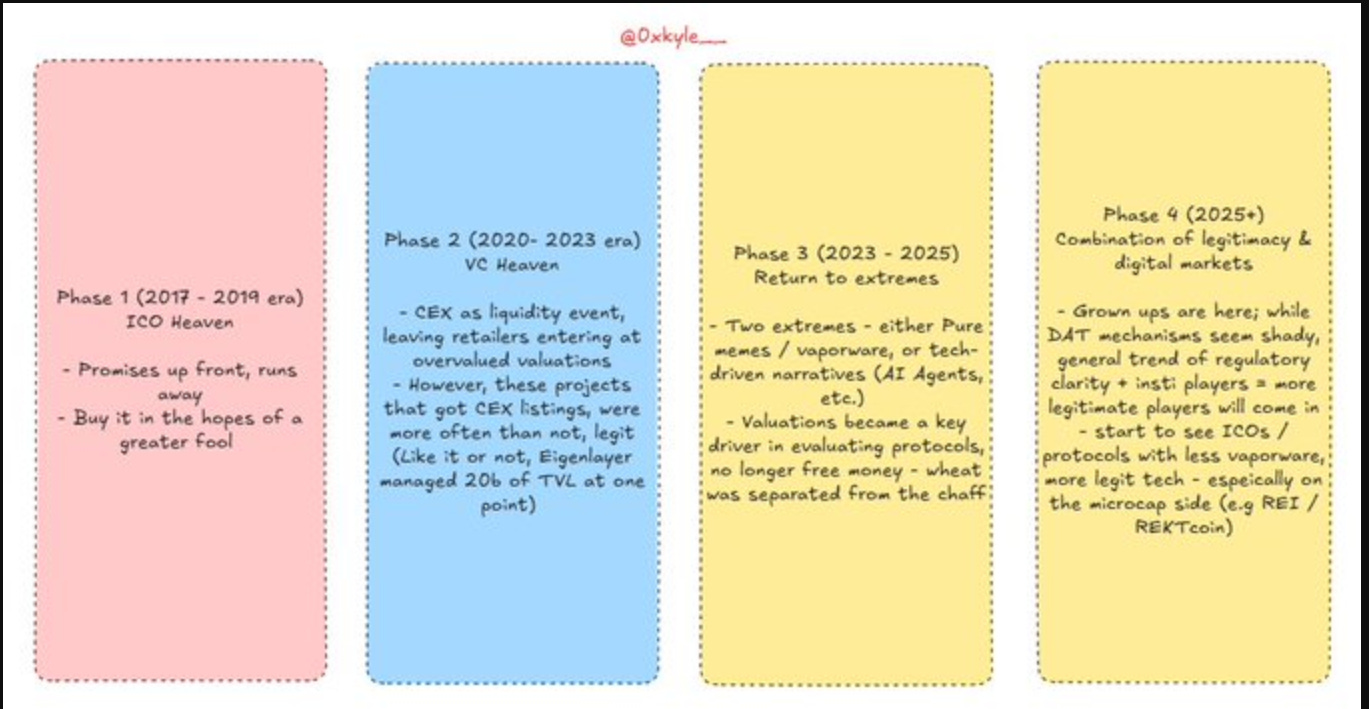

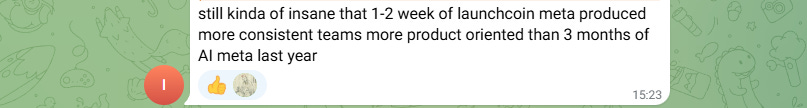

I am of the belief that we are about to enter, what OG crypto players would call: "a new meta." To dissect this, we must first observe these capital formation mechanisms, and the differences that come with it:

Over the past few cycles, we've seen the market change its financing mechanisms. From ICOs, to CEX Alts, back to memes, etc. I've broken it down in the graphic above, but very simply:

Original ICOs (2017 era)

A mechanism where you would invest based on a promise, and sell in the hopes of a greater fool. Very rarely was the tech real, and even if it was real, it was generally unusable or not value accretive.

Most of the time, it was a game of hot potato. Some examples - Bitconnect, Dentacoin, and many more.

2. VC Heaven

The bubble that came in 2021 also brought alongside institutional capital, that would, in hindsight, be extremely damaging for the space. Incredibly high valuations, poor incentive designs (who works when they get 100m upfront?)

However, with this wave also came more legitimate products - and so you can't truly say that the low float, high FDV meta was all bad ; while these coins were incredibly overvalued, they also brought some of the most important protocols you know and love today.

Ethena is an example - I love them, but it is no secret that the simple mechanisms "giving too much, too early" has damaged their ability of "token go up" at the beginning - but they are undisputably one of the best products in crypto. There are many more of these "double-edged swords";

This was the era that also brought Solana, Uniswap, and many more. While there might be dissent around how the businesses are being run today, the fact of the matter is - this was not all bad, and cannot be known as such.

Was there a way to avoid it? Maybe. But at the end of the day, its the growing pains of the industry - despite the fact that 4 years later, we are still reeling from the after-effects.

3. A bit of both - return to the extremes

Post FTX, the crypto space faced this sort of existential dilemma - and you could clearly see it. Many people ended up subscribing to the belief that "everything's a scam", and that most of crypto is just a way to get rich. It is a belief I used to subscribe to as well, but it's important to understand the nuances of it.

Just because its casino in nature, doesn't mean that it's all a casino - ultimately, stablecoins and tokenization are currently proving to have massive use-cases outside of just launching tons of memes, and being the USD pair for long-tail assets.

In this era, the nature of projects that entered were divided. We had pure memes (dogwifhat, pepe), and more legitimate narratives - e.g AI agents. While valuations have come down significantly, and you may walk away thinking "was it all a meme?" - just because they are seen as memes doesn't mean they will always remain as memes.

Again, this is the slow process of maturation in this space. There are some projects that have crossed the threshold of meme to something legit - see REI for this.

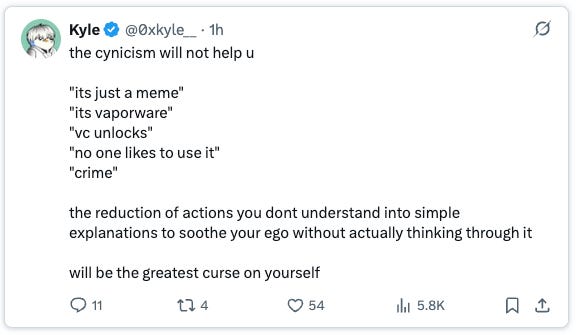

Lastly, having this mindset of everything is a meme, will prove to be incredibly damaging in the next few years, because:

4. Combination of legitimacy & digital markets

We are entering the era of the adults. Institutions are here, and they are truly excited. But perhaps because we stay too close to the sausage factory - we know how the sausage is made. This has led to many mind-boggling outcomes ; for example, crypto people being bearish Circle IPO because, again, they knew the bear thesis too well.

Knowing too much is a curse. And that's why this cynical mindset of how "everything is a meme" will prove to be incredibly damaging, because writing it off just like that will keep you from believing.

Take Ethereum as another example. This was the worst performing asset for 2 years - in which many, many large holders capitulated. It was called many names - and it got to the point where we all unironically believed that decentralization had failed, Ethereum wouldn't see the light of day again, etc.

And then look at it now. Do you think Tom Lee knows (or cares) about the cringe videos of the Ethereum Foundation leadership singing and dancing on stage? Do you think all these institutions like BlackRock, who launched a tokenized fund on Ethereum, cares about the "soy-boy mentality" of the EF?

No. And that's what you have to internalize. It seems that most of crypto has forgotten how to dream, whereas Trad-Fi is learning how to dream again. And with that will inevitably come many more opportunities, as digital assets become mainstream and attract more and more high quality builders.

And this is what I mean by Internet Capital Markets. We are entering an era of unrivaled potential in the past 5 years - the perfect blend of regulation, technical prowess, and capital. And some of this will inevitably come on-chain. I am not even joking when I say that I believe some of the most valuable companies in the next few years will launch a token on-chain.

In fact, it's already reality. Hyperliquid is the pinnacle of what Internet Capital Markets represents. They had no VC funding, and (as far as I know) they don't have equity - it's purely an on-chain token, that wasn't originally listed on exchanges.

Let me repeat that again.

Hyperliquid is a $40 billion dollar business, that had no pitch decks, nor cap-table baggage. A raw, on-chain juggernaut that came in, dominated the market, and now on its way to making $1 billion dollars in annualized revenue - scaling from zero to one. It is the purest distillation of Internet Capital Markets in action.

But before you this is a Hyperliquid shill piece, let me take a step back. I don't believe that it ends with just Hyperliquid. I believe that over the next few years, we will see many more just like it.

Isn't that thrilling? We're about to enter an era of abundance - don't let your own cynicism crush the dreams that you once dreamt. But perhaps what irks me the most is that this is so painfully obvious to anyone that sees this - but we are all too busy trying to chase a 50% gain on some random shitcoin because that is what we have been trained to do for the past 4 years. It's time to dream bigger - and the playbook's already here.

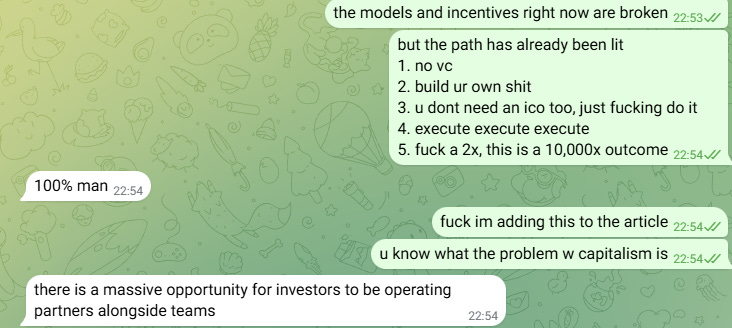

In a serendipitous conversation I had with @connorking_ (someone whom I'm very lucky to be able to call a good friend), we discussed this:

THERE IS A MASSIVE OPPORTUNITY. FOR INVESTORS. TO BE OPERATING PARTNERS. ALONGSIDE TEAMS.

There is no need for the chains that tie us down today. For too long people have been bound by the structures of the past - but in the age of the Internet Capital Markets, owning 5-10% of your own coin, and making it into a 100m / 1bn dollar product, will net an outcome much larger than what people expect.

Yes, financing will still be necessary. Yes, it's not wrong to ICO. But again - look at Hyperliquid for the path to tread if you're confident in your product. And look at how rich the founders are now. Again - no VCs, just owning a large chunk of your own product, and listing it on the Internet Capital Markets - and the market, the arbitrer of truth, will reward you if it deems it so.

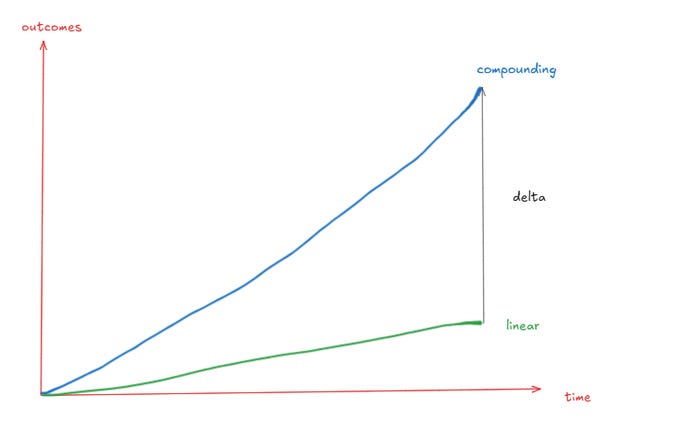

You know what the problem with capitalism is? Its that most participants of capitalistic markets think too short term. Capitalism drives innovation in the right direction, but it doesn't drive it far enough. People settle for a quick buck, when they would have netted a much larger outcome if they stayed on for a couple more years. This is quite literally, the mathematical power of compounding.

Sure you can make 10m from raising a product and abandoning it, or you could make 300m from just working on that product for a few more years.

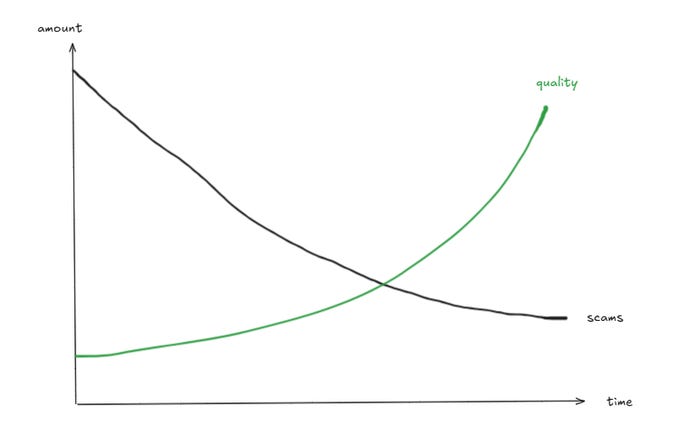

And lastly, I want to talk about the speculative nature of the markets. Of course, the market is a voting machine in the short term. We will undoubtedly still see prices for many "valueless" assets go up. And we may see prices of "good" assets far eclipse its fundamental value. And we will probably still see similar outcomes as before - teams dumping, etc.

But the point is, this upcoming wave of digitalization will bring more legitimate, GOOD founders to the fray - and I believe this is the trend shift that will lead to many great on-chain products being built.

Something like the above. It'll never hit 0, but it doesn't have to. Look at Hyperliquid. Look at Ethena. Look at Aave. 1 billion in annualized revenue. 10 billion in stablecoin TVL. 60 billion in net deposits. Look at Pengu. Look at Rekt. 197 trillion in collective views, 2m toys sold worldwide. Drinks brand selling in 7-11s across the states. And all with a token issued on the blockchain.

Sure we might argue on whether they're overvalued or undervalued. But I'd much rather discuss that, than return to an age where we'd be forced to buy assets of businesses that were selling a promise, with nothing to show for it. I'd much rather own a piece of something real, than pretend to play a game of hot potato.

If you keep looking and believing every coin is "a meme", well, that's just not a very productive viewpoint. Someone of Jeff from Hyperliquid's calibre launching a token isn't far-fetched anymore. The next Steve Jobs could VERY WELL launch a token on-chain. Some of these assets WILL end up becoming on-chain powerhouses that run the future of finance. And we're ALL getting the chance to buy it. Reducing it to "just a meme" is a very good way of capturing a 1,000x outcome.

This is what I mean by the evolution of speculation. We have evolved, from trading worthless vaporware, to being able to own a stake in hard, durable, and most importantly, on-chain assets that will define the world.

It's time to believe. What can be, unburdened by what has been. Undo the shackles of the past, reduce the bear in you to ash. For the future is bright, my brethren. We cannot let the darkness of our past blind us to the optimism of the future.

And that, ladies and gentleman, is what the future looks like, to me. Internet. Capital. Markets.

------------

Editors note on long term outcomes:

Look at Japan. Japan is known for their renown quality, but this quality can't be built in a day. It's decades of inculcation into their culture, their products, their way of life. If they had just "optimized for money", they wouldn't have gotten far. But because they thought decades ahead, they can reap the rewards today. This is what long term thinking looks like. It has paid off in ways that can't be quantified - clean streets, cool vending machines - not all calculated under "GDP", but definitely serves in many ways to attract big spenders, who eventually bring revenue to the country.

DISCLAIMER:

This content, which contain opinions and/or information related to any products, services, tokens, or projects, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or to be regarded as an endorsement of any products, services, tokens, or projects. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. Investments in any products, services, tokens, or projects involve the risk of loss. Past performance is no guarantee of future results. You should always consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

Views expressed are my own

The commentary in any of my posts (including but not limited to those on my blog (

), and social media (

)) reflect the personal opinions, viewpoints, and analyses of myself only, and should not be regarded as the views of my employer DeFiance Capital or its respective affiliates. Commentary on any projects, protocols, companies or other subject matter discussed in my posts should not be taken or interpreted as an indication that DeFiance Capital holds any interest in the subject matter discussed. Neither DeFiance Capital nor myself will be liable for any actions arising from assumptions made with respect to myself or DeFiance Capital based on my posts.

Views expressed are not investment advice, endorsements or recommendations

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by me. I may invest in any of the projects, protocols, companies or other subject matter discussed without obligations to inform or disclose such investments to you, the reader. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular product, service, token, project, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any product, service, token, or project mentioned. Nor should it be construed as an offer to provide investment advisory services by myself. Any mention of a particular product, service, token, or project and related performance data is not a recommendation to buy or sell that product, service, token, or project.

Statistics are only informative

Any charts provided here or on any of my personal platforms are for informational purposes only and should not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data. While taken from sources believed to be reliable, I have not independently verified such information and make no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, posts may include third-party advertisements; I make no representations of having reviewed such advertisements and do not endorse any advertising content contained therein. All content speaks only as of the date indicated. The information provided here (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information.

Advertisements

I may receive payment from various entities for advertisements on my blog or social media from time to time. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith by me. In addition, any mention of a particular product, service, token, or project and related performance data is not a recommendation to buy or sell that product, service, token, or project.

I DO NOT WARRANT, ENDORSE, GUARANTEE, OR ASSUME RESPONSIBILITY FOR ANY PRODUCT OR SERVICE ADVERTISED OR OFFERED BY A THIRD-PARTY WEBSITE, AND I WILL NOT BE A PARTY TO OR IN ANY WAY MONITOR ANY TRANSACTION BETWEEN YOU AND THIRD-PARTY PROVIDERS OF PRODUCTS OR SERVICES. I SHALL NOT BE LIABLE FOR ANY DAMAGES OR COSTS OF ANY TYPE ARISING OUT OF OR IN ANY WAY CONNECTED WITH YOUR USE OF THE SERVICES OF ANY BROKERAGE COMPANY.

As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.