The ETH ETF Trade Idea

Breaking down the best ETH beta, and how you can play the trade

PS. I started writing this article on 24th May, when ETH was $3632.22, and ONDO was $1.08. It took me a couple of days to write it, and certain assets have been repriced. The trade thus has a less favourable r/r, but the upside is still there to be captured, IMO.

Before we start, a word from today’s sponsor:

Demex, The Only DEX You Need

Demex is an all-in-one DeFi Hub and perpetuals exchange, that supports the hottest and most exotic assets for you to lend, borrow, trade, and more!

The Demex Points Program is live! Spin the Wheel of Fortune and try your luck for the legendary box packed with the most points.

Try it out with my referral code here!

Congratulations, my fellow Cryptonians. In a move that surprised everyone, the SEC has approved of a rule change to allow creation of ether ETFs - despite Gary Gensler having a notoriously hard stance against ETH in the public light.

I will not go into why this happened - I will leave that to the political pundits on Twitter. Our main concern is that it HAS happened, and that it signals a significant shift in the US government’s stance towards crypto.

This is also further enabled by the approval of FIT21 (“FIT21 provides the regulatory clarity and robust consumer protections necessary for the digital asset ecosystem to thrive in the United States”) - a new era of regulatory compliance is on the horizon for businesses.

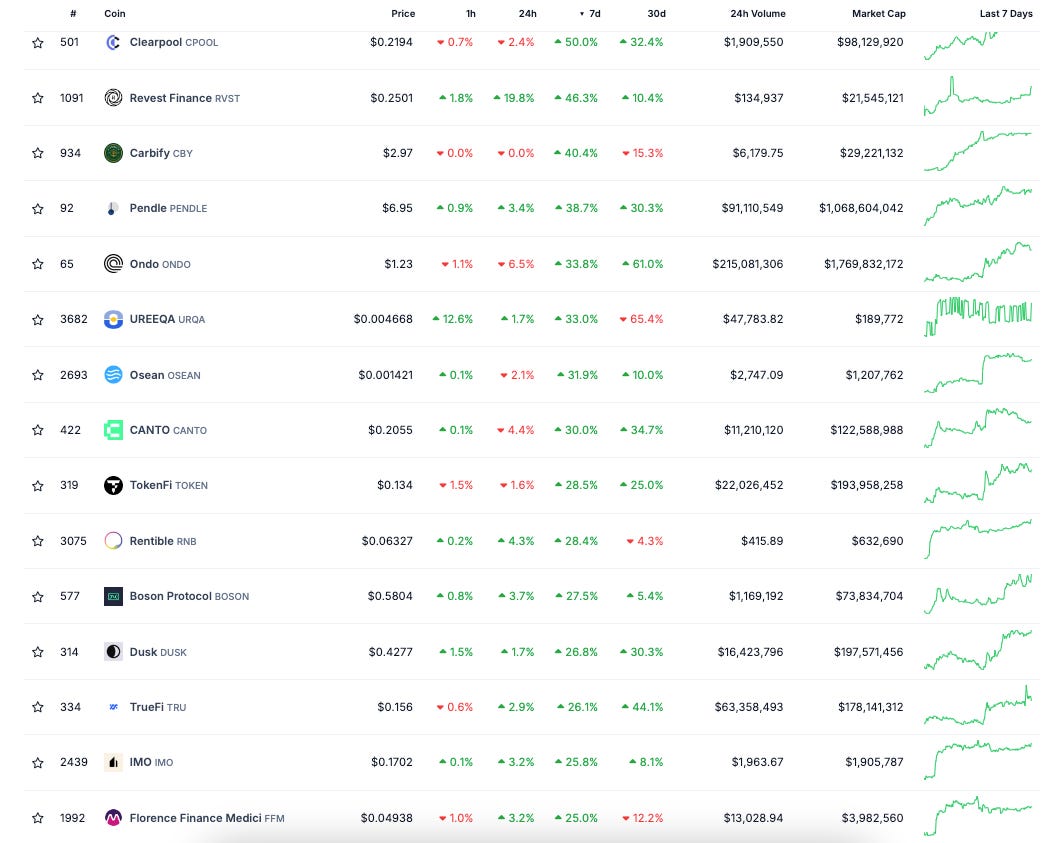

The US government new dovish stance towards crypto is extremely bullish, and you can see how the market has digested this information - RWA and Ethereum sectors are the prominent outperformers MTD.

I believe that with the ETH ETF and the recent dovish stance towards crypto, these two sectors in particular are poised to continue outperforming in the coming weeks & months.

Introduction

Overview

This thesis can be broken down into two - first, the outperformance of Ethereum as an asset class and its relevant alts, and then the outperformance of the RWA sector as a beta to the overall “bullish crypto government stance”.

These two sectors are tightly connected because:

With the SEC approving the ETH ETF, it signifies a more dovish stance towards crypto, thus meaning that RWA assets driven by institutions will also see more flows (as we’ve already seen in ONDO’s relations with Blackrock)

The “ETH thesis” from institutions has always been tokenization, stablecoins, real-world settlement - that major institutions will go around talking about RWA assets on Ethereum; that has always been the major narrative for ETH, after all.

And so, the TLDR is:

Long ETH and its best beta

Long RWAs - with ONDO being my favourite

It is also possible to consider other RWAs to long, but the reason why I’m not is because ONDO itself is an altcoin to ETH, and going down the risk-curve simply means you’re more exposed to market beta in the event of a downside move. I prefer to keep things simple.

Cross-Examination Of The ETH ETF

Now to breakdown the ETH ETF trade. I think this is extremely interesting because unlike the BTC ETF in which we had a lot of time to “prepare” for - the ETH ETF caught many market participants offside. It’s why we saw a 25% candle in a day when the odds of an ETH ETF approval were vastly changed overnight.

The thing is, the market rarely allows you the same trade twice - the thesis of this trade hinges on the idea that “the ETH ETF hasn’t been priced in”. To measure this, we’ll first have to look at how the BTC ETF performed:

Key Dates for BTC ETF

June 15, 2023: Pivotal week for BTC, when Blackrock showed their hand and filed a spot Bitcoin ETF

October 23, 2023: Perhaps what truly cemented the probability of a BTC ETF was SEC not appealing the court ruling for Grayscale, meaning that they were considering it seriously → market thus has confirmation

Jan 10, 2023: Official launch of the Bitcoin ETF

Here’s some things to note

The Blackrock ETF announcement essentially kickstarted the closing of the discount

Only when the ETF launched did the discount fully close (obvious statement to make, but thinking about it, it’s like “free money” and now that we’ve had “proof” that an ETF can / will be launched, the discount might close even BEFORE the ETF launches)

OI spiked up after June 15, shot down somewhere in August, but started an uptrend in October that peaked in February

I look at CME OI because it’s the best vehicle to see institutional positioning

Now, let’s look at ETH in comparison.

Key Dates for ETH ETF

20 May, 2024: Bloomberg analysts up odds of ETH ETF approval from 25% → 75%

23 May, 2024: SEC approves exchange applications to list spot ether ETFs

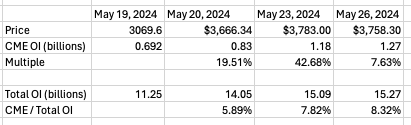

So here’s the stuff that’s interesting to note:

The ETHE discount is has closed from -24% to -1.28% in the span of 2 days, compared to the few months GBTC took to close

You can see that CME OI growth hasn’t been as strong as the BTC ETF growth

Lastly, most of the ETH move was priced in upon the revision of probability, but not on the event itself - i.e the market has front run the announcement of the ETF, which is ironic considering how for BTC, every announcement saw a sharp spike in price ; like I said, the same trade won’t work twice

And so with the context in mind, let’s break this down:

Thesis & Risks

I’m going to start with the risks of the trade, just because I think that it’s much more important to weigh the downsides of a trade than the upsides - manage your downside, and let the upside take care of itself

Risks:

Main Risk: The market has topped / close to top for ETH / Time-based capitulation

The argument for this would be how quickly the discount has closed and how the price of ETH behaved into the announcement itself. You can make the argument that these people know how the trade goes - that it’s basically a free upOnly trade, yet CME OI and total OI has basically stagnated.

If anything, the fact that ETH OI is just 4bn shy of the BTC OI on January 10th could signal that “all longers have already longed, who is left to buy?”

To be honest, I find this argument to be pretty strong. I believe that the market is heavily front-running this trade - the expansion of Open Interest past ATHs despite the ETF just launching is unlike the BTC trade, wheree we really only saw such high OIs in the market upon the launch of the ETF itself.

The market is taking the “approval of ETF” to equal “the launch of ETH ETF”, which are two vastly different things. This take makes sense when you look at how price reacted on the announcement of the approval itself, and how the discount was closed so quickly.

I actually agree with this take, and that’s why I started the article with, I quote: “these two sectors in particular are poised to continue outperforming in the coming weeks & months.”

I believe that we will start seeing some time-based capitulation when people realise that these effects aren’t instant, and that is when you start bidding. I myself have set bids at certain price levels - filling my bids slowly and surely. Here’s a quote to illustrate how I’m trading this:

Idiosyncratic Regulatory Risk

I’m in less of a position to comment on this just because I have no idea how reg risks work. But, from what I’ve read on TWITTER (DOT) COM, people are saying how only 19b-4s have been approved, and not the S-1s.

This, in essence, means that it “can be challenged in the next 10 days” (?) ← I don’t know if this is true! BUT if it is, it definitely presents a huge risk to the trade if the entire thing was a sham of some sort, LOL.

Or maybe, there’s some other “hidden in between the lines” kind of risk that comes with this approval - idk. But, definitely something to keep in mind.

OK I LIKE THE TRADE. WAT LONG????

I know it’s been a long article so far, but we’re getting to the good part. The story so far is: ETH gud, but maybe market front run too hard. But still, ultimately bullish long term catalyst. So, what do you buy?

When choosing a beta to ETH, many participants will suffer from analysis paralysis - after all, you have Liquid Staking Derivatives (LSDs), L2s, ZK-Rollups, and De-Fi protocols, memes, and many more to choose from.

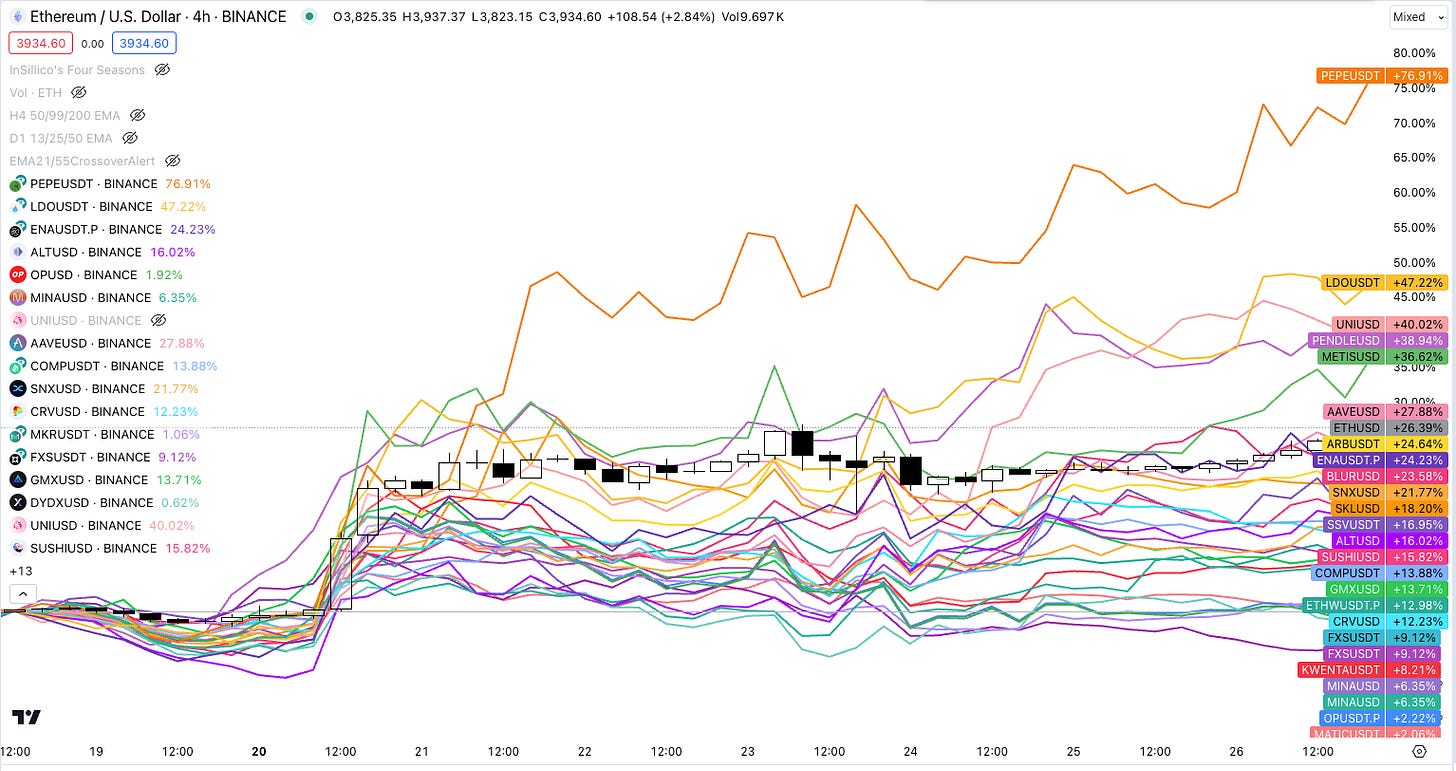

As such, when plotting the performance of all these coins, we can see that the outperformers are (in order of most outperformance to least outperformance):

PEPE, LDO, UNI, PENDLE, METIS, AAVE

This is on a lookback period of 1 week (i.e 18 May - 26 May). This is a crude method of gauging outperformance - a more scientific method would be actually calculating the beta of all these coins on a more “proper” lookback period - but it works for me.

I personally am choosing to long PEPE and PENDLE out of all the coins, just because they have been favourites of the market all year round. These coins don’t just outperform idiosyncratically - they have been some of the best performers YTD.

Thus, I believe PEPE + PENDLE offers the most upside. They have the added effect of being high attention coins that the market loves ; I would not fade the strength of the PEPENDLE combo.

Time For The RWA Side Of The Trade

I’ve spent too long talking about the ETH ETF trade and now I’m running out of brainjuice to write about the RWA side of the trade. The thesis is simple: RWAs has been something that the institutions have been pushing since their entrance into crypto, and ETH has been the main chain for that - with ONDO having collaborations with Blackrock being built on ETH.

As such, it’s a beta play to the general ETH narrative. For asset selection, my main picks are ONDO, with some people I know also shilling CANTO / DUSK. Personally, I’m going simple with this one - 1 ONDO = 1 CONDO.

Others

As a side note, I think a good pair trade to put on will be the ETH/SOL pair. Generally I get the feeling that SOL has topped out for the time-being, and long ETH / short SOL beta will be extremely attractive.

Concluding Thoughts

Whew! If you made it to the end, you deserve a cookie! I hope you enjoyed this trade idea. I’m starting to get back into the swing of things, so I’m hoping that I’ll be able to keep on pushing new trade ideas! Other than that, for the Americans, please have a very happy Memorial Day. I’m in NYC, so if you ever want to have a cup of coffee, feel free to reach out.

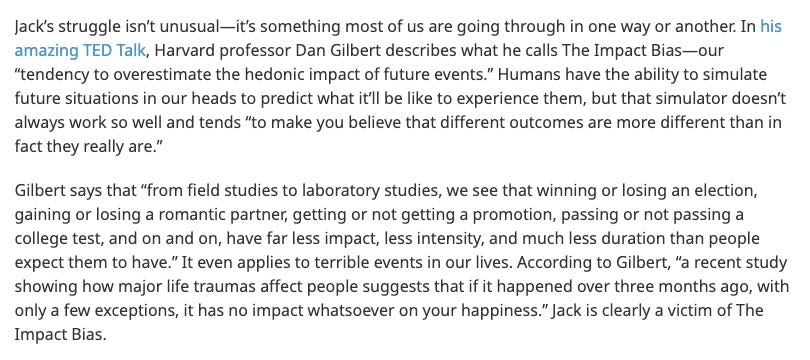

Also, here’s a good screenshot that I wanted to include, just to show how people might over-estimate this whole “spot ETF approval” thing and position themselves too early.

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

ETH looks good for continued moves higher into the end of the year

Hi Kyle, Do you think slow up and to the right grind price action for eth long term, I guess they call it super cycle or still in tenuous spot due to L1 competition..? Eth at 20-30k achievable for this cycle

? J