The Decade Long Thesis For Digital Assets, v2.0

New money, digital transition and degeneracy.

NOTE: This thesis represents my stand on the topic currently, but is subject to upgrades/downgrades as time passes.

I actually wrote a similar post about this a while back (the link is above). To summarise, the 5 reasons why I wrote you should be long crypto are:

Self-Sovereignty and Decentralization

Decentralized Information (Web 2.0 -> Web 3.0)

The Network State

Raw Potential

Gambling

Fast forward a few months and now you have me writing yet another article on the same topic. What changed? Well - for one, I've realised that the reasons I put forth in my earlier article are far too unpalatable. That is to say - the average person reading this wouldn’t care at all. For real though - who do you know around you that talks about “The Sovereign Individual” in real life? (Probably McKenna. No hate, I love the guy’s tweets about the topic.)

The point is, I dug deeper and found that there are more reasons why I think that we should be bullish on digital assets - and these reasons are far more “all-encompassing”.

You see, the thing about “real-life adoption” of technology is that no one cares about any of that ideological / technological fluff. Sure, elements of it are there, but it’s not the main reason why anyone adopts it.

Do you think people use Instagram because “it leveraged Internet technology to provide instant communication between points across the globe”? No! Despite being groundbreaking technology at the time, the main reason why ANYONE uses ANYTHING NEW always has to do with reasons far simpler - in this case, Instagram allowed people to check out what other people were doing in their lives.

And so, the same case can be made for my previous article. I harped on and on about all these ideological reasons, but these will not be the main reasons I believe people adopt digital assets. It is far simpler and far less complicated. There are 3 main reasons that I have come up with (for now).

Without further ado, let’s dive into “Why you should be long digital assets”, version 2!

Digital Assets As A “New Currency”

The first reason has to do with money. Now - what is money? To put it simply, money is anything that people decide is a worthy medium of exchange.

The function of money is to act as a common denomination for the exchange of goods and services in a physical place - that is to say that if I were to get a dollar in the USA, I will be able to trade that dollar for either a good (e.g a potato), or a service (e.g a haircut).

But who decides on what makes money, well, money? The people! If three people decided that they’d start using bottlecaps as money between themselves - that 1 bottle cap = a potato in their land, then that becomes “money” to them. Look at the fallout franchise! Everyone collectively believed bottlecaps were worth trading for - and so, it became money!

Now, whether bottlecaps are a “good form of money” is another question entirely - there are 6 characteristics that make money “good” - durability, portability, divisibility, uniformity, limited supply, and acceptability. But that’s not the point here.

The point is - money becomes money when the collective unconscious believes that this asset is of value. And what better concept represents that than - you guessed it - crypto assets.

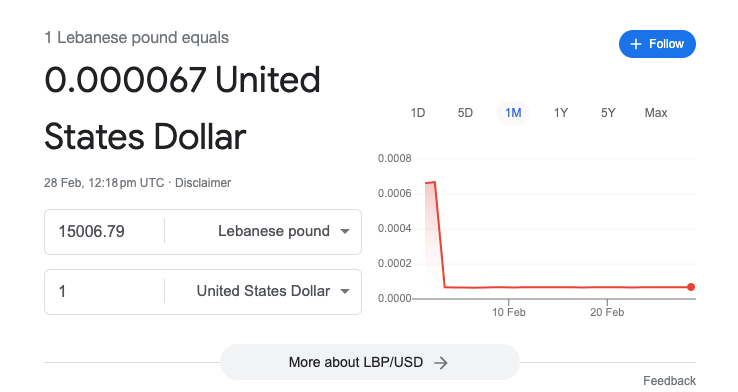

People have been harping about this for ages - crypto has “no intrinsic value”. But that’s exactly it! In my eyes, crypto is more akin to “Forex” - i.e your currencies. I mean, take a look at this:

Imagine having 6 decimal places - I only get that when I’m trading shitcoins. Now let’s look at this:

So - Kyle, what are you trying to get at? That Bitcoin will be “the new USD”? No! I don’t believe that one is trying to take over the other. I believe that - in certain countries in the world where their currency is becoming worthless, they might choose to transact in crypto assets instead.

But why don’t they just convert to USD instead? Good question - in my opinion, crypto assets are far more accessible - after all, to buy Bitcoin, all you have to do is download an exchange, and buy it. Whereas to get USD, you’d have to go to a local foreign exchange, and exchange your money. There’s also the issue of economic policies - whether the country in question wants to let the people exchange for USD.

I’m not saying this happens immediately though. In countries with high inflation, people are looking for investment opportunities to keep the value of their money - and the first haven is normally in physical assets, like cars or houses. Now I’m not sophisticated enough to debate whether cars/houses make good “money”, and I want to keep this article short.

I FEEL (extremely unprofessional) that, in essence, when crypto actually becomes more readily accessible to people all around the world - people will start turning to crypto assets for them to keep their purchasing power. Whether it be in BTC, or in stablecoins (the more obvious choice) - the outcome is the same; digital assets provide an alternative way out for these people.

Digital World Needs Digital Assets

The second reason has more to do with where we’re going as a civilisation. Now, humanity has survived by creating more and more innovations to improve the speed at which we do things. The dawn of Internet technology increased our progress exponentially. After that, we have had E-commerce, Cloud Computing, The Sharing Economy, etc.

In my mind, I call these “ponzis”. Not because they literally are, but because I believe that humanity always needs a new “ponzi” to illustrate progress. I believe that we always need something “new and shiny” to focus their attention on - the latest, of course, being AI technology.

Now, most of the time the ponzis of course have a positive real-world impact, in the sense that it makes things more convenient, etc. And in THIS context, I feel that crypto has successfully cemented itself as a self-fulfilling ponzi prophecy. Crypto has grown large enough that people cannot just ignore it anymore - and as much as people like to say “it has no real use case”, the ponzi has grown so big that it will literally find a use case for itself.

So - use 1: The new ponzi will self-fulfil and find a solution for itself, just like with “The Gig Economy” (remember how everyone thought the Purge would happen when Uber was launched because they believed that trusting strangers was too dangerous?)

Use 2: I also believe that crypto has a use case in our increasingly digital world - more specifically, in finance. Combined with reason #1 (i.e crypto assets as a form of money), we now need the financial rails to support these crypto assets - hence, De-Fi.

And like - think about it for a second. We have had entire aspects of our lives changed by technology. Food? Ubereats. Gigs? Fiverr. Education? Google. Entertainment? Youtube.

It just seems so painfully obvious that finance will be revolutionized, in time. I don’t know how many of you have actually tried taking a loan on Aave or Compound - but it’s incredibly easy. Glossing over the fact that it has to be overcollateralized, what’s great here is the ease and convenience that crypto (or De-Fi) has introduced in the system. Compare that to taking a loan in the real world.

And that’s what ponzis (or technological revolutions, whichever one you want to call it) are all about, right? Convenience, and shortening the distance between you, and your goal.

And then, you also have NFTs - what better way to flex wealth on a social media platform than digital goods that showcase your wealth? I mean, what’s the difference between flexing a Bored Ape, and a “photo of your Lambo"? In both cases, you don’t even know whether the guy owns it - one just has a more culturally direct connotation with being rich.

In time, I really believe that crypto assets will be so ubiquitous, that they will permeate our cultures and our lives. And that is when people no longer have to google “how much does X NFT cost?” - they will just know that if you own it, you’re rich. Sorta like a lambo.

The Theory Of Degeneracy

WHEW. Are you still here? If you are, I’m proud of you. If you’re not - well at least you tried. My last and final point is the same point I covered in my first article - that crypto assets are a “digital casino” with much better odds than an actual one.

The difference here is that in my first article, I didn’t believe in this that much - I even put the word (EXTRA) beside it, and called it an “extremely unfulfilling outcome".

Fast forward 7 months, however, this has become a HUGE reason I’m bullish on crypto assets. I’m once again going to quote GCR here.

People always say that “crypto is volatile, it’s dangerous to trade” and that “there’s no intrinsic value, stay away”. But do they realise that in 2000s, people were literally getting paid to long random Internet companies the moment they IPO’ed? It was literally real-life shit-coining.

Speculation is the name of the game, and greed is a natural trait of every human on Earth.

Why would you want a stable market? What money is there to be made in a market without volatility? In a highly efficient market where “everything is priced in”, there would be no way of making money at all!

Why do you think we’ve come up with so many highly complicated financial instruments? We really went from ‘this share represents ownership in a company’ to ‘bet on the direction of the stock’.

The truth is - the stock market has always been a tool for speculation. It was never meant to be some sort of “safe haven vehicle that produces yield comfortably” - it’s just that over the years, it has been heavily restricted by the powers that be.

But now, it’s changing. Combined with the depression of a new generation entering the workforce who realise that they have no money to afford a house, all while facing low wages and high inflation, you have:

A generation of young people eager to take risks while they still can to make an obscene amount of wealth, or die trying.

This isn’t bad, by the way. You can’t say that “crypto is zero-sum” - every market is zero-sum! For every winner in the stock market, there is someone on the opposite side of the trade. Crypto just offers an easier alternative that is more accessible and has a lower house edge.

And so, as people realise that they don’t want to spend the rest of their lives slaving away at a job, they will, like everyone else in their 20s, google “Easiest ways to make money".

The crypto market is always open.

I literally wait for your next article drop. Great writing. Great info. 💯

Great thesis, thank you