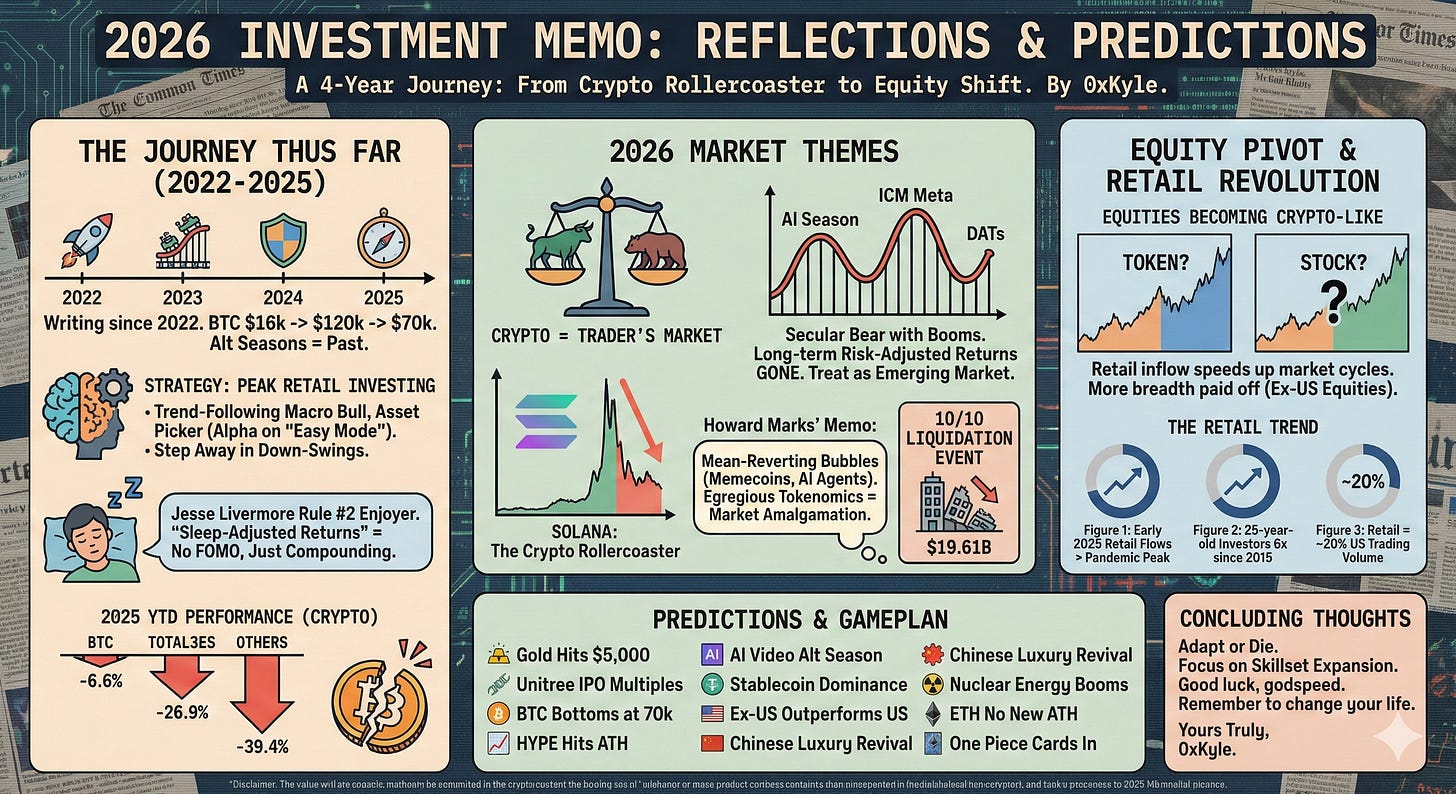

It’s that time of the year again. As 2025 comes to a close, I’d like to take this time to reflect on my journey thus far. I’ve been writing these memos since 2022, so this is the 4th yearly memo I’ll have published. It seems not too long ago that I first started this substack - time sure flies.

In the 4 years that I’ve been writing this, the crypto market has changed greatly. Bitcoin went from $16,000 at the bottom, to $120,000 at the top; Alt seasons are a thing of the past, and the industry went from being scorned post-FTX, to adopted by institutions worldwide ;

In the midst of all this, my strategy to making money has largely stayed the same. I don’t try to do anything sophisticated - at its core, my strategy can be broken down into two parts - the first, trend-following of a larger macro bull market; and the second, generating alpha by being an asset picker, and sizing it correctly. My strategy represents “peak retail investing” because I try to step away when the bull market starts to dissipate, and only believe in generating alpha in “easy mode”, and turning it off during “hard mode”. In other words, I am a Jesse Livermore Rule #2 enjoyer (except the shorting part, I don’t do that).

Being ok with “average, or slightly above average” returns has allowed me to enjoy year on year compounding while not sacrificing leisure time. It is another reason why I believe it’s the optimum strategy for a lazy retailer like myself, akin to “sleep-adjusted returns”.

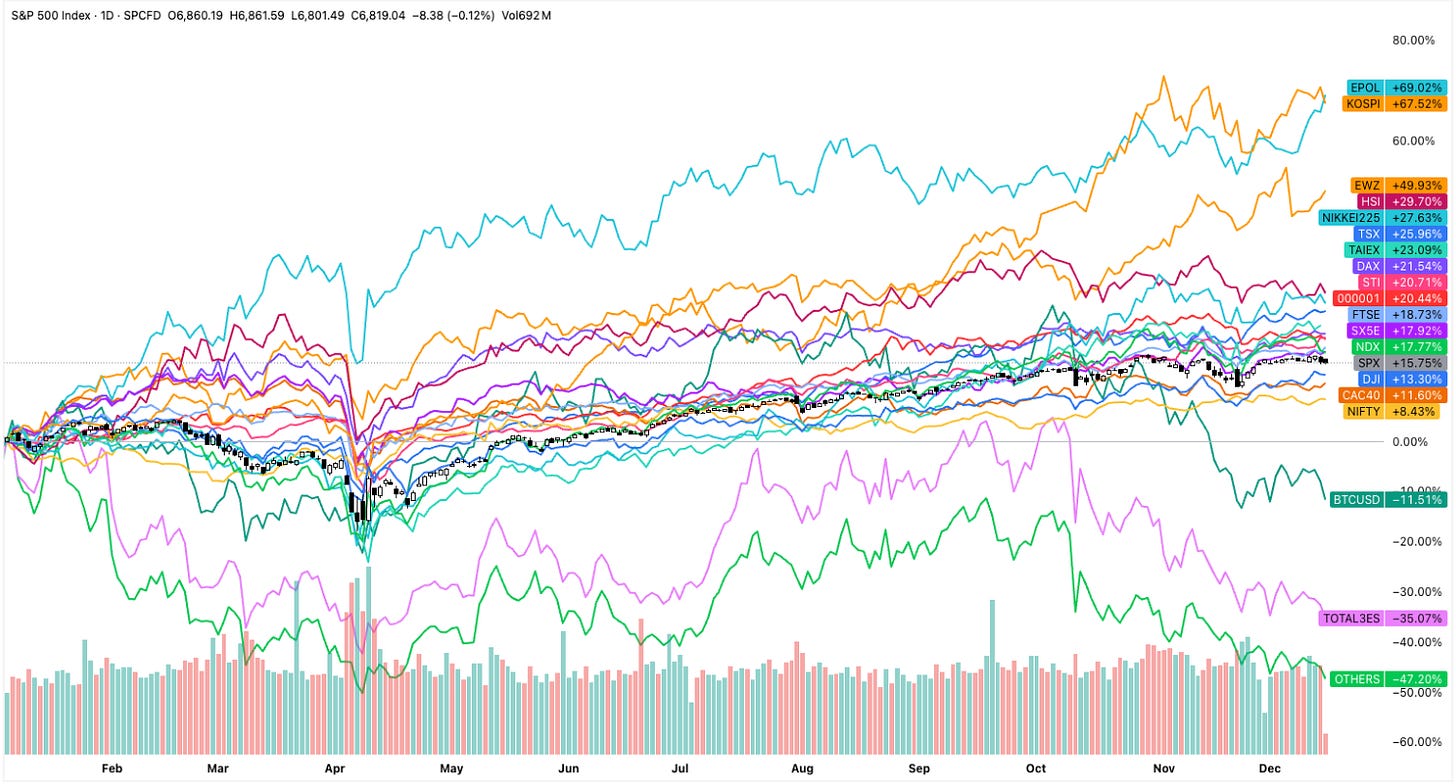

This strategy has had added benefits too - and been immensely helpful in navigating the crypto market this year. Why? Well, the average return for this year is in the dumps - BTC’s YTD is -6.6%, and TOTAL3ES sits at -26.9%, OTHERS at -39.4%. The average YTD return for a top 500 altcoin, is almost definitely negative. Thus, learning to step away in down-swings has allowed me to save a good chunk of my P&L that would have otherwise been donated away.

I enter 2026 largely keeping to the same strategy - and here I will explore what I believe to be the overarching themes for 2026.

Crypto Will Be A Traders Market For The Foreseeable Future

Crypto is in a secular bear market with booms in between: January 2025 (AI Season), May 2025 (ICM Meta), July - Oct 2025 (DATs). 2025 has been a gradual realisation and subsequent grappling with the simple fact that crypto’s long-term risk-adjusted returns do not exist anymore, and that this industry is more akin to an “Emerging Market” due to structural disconnects between capital formation and shareholder value.

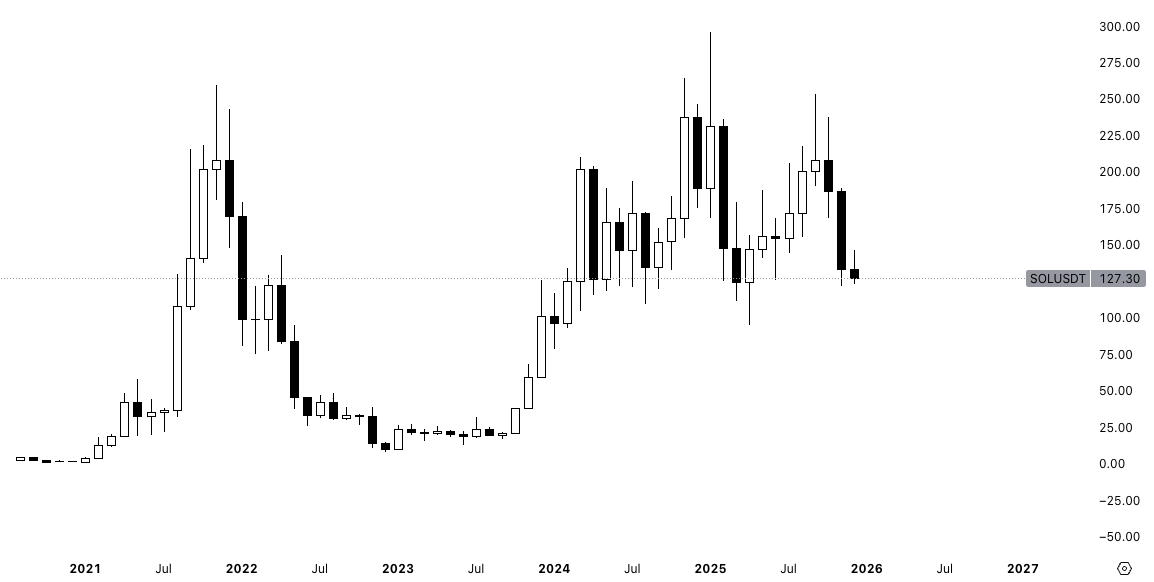

The chart of Solana, a top 10 market cap coin, depicts all the problems with investing in crypto assets. Firstly, these assets aren’t long-term compounders. They don’t grow year on year, unlike the Mag 7. The chart is more akin to a “rollercoaster ride”. And while they have demonstrated monumental gains (from $8 in the depths of post-FTX crash to $296 just a couple months ago), the fact that Solana has drawn down 50% from those highs only drives home the point that these assets have to be traded around, and not held.

I still remain firm in the view that crypto will continue to remain the only market to offer such magnificent returns in a short (ish) span of time. But in the same vein, it will also come crashing down. I am highly skeptical about 99% of these assets reaching prior ATHs ever again.

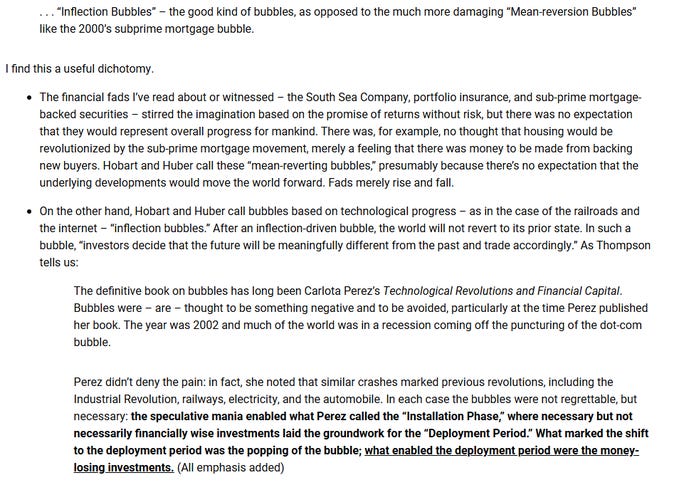

I quite like this mental model provided by Howard Marks in his latest memo. Crypto has a lot of these “mean-reverting” bubbles that have no expectations in the underlying developments. Memecoins are a classic example of these - assets that exist purely to drive returns. What value does Fartcoin or SPX6900 bring to the world? And every other narrative in crypto is a wrapper around a memecoin, trying to pretend it has value - see AI Agents.

On top of that, many of these tokens dug their own graves and paved the way for their own charts to look like “rollercoaster rides”, by having 1) egregious tokenomics that lead to massive supply dumping on a monthly basis, 2) having little to no value accrual to the token, 3) not even making revenue in the first place for people to consider it as a legitimate product they’d invest in.

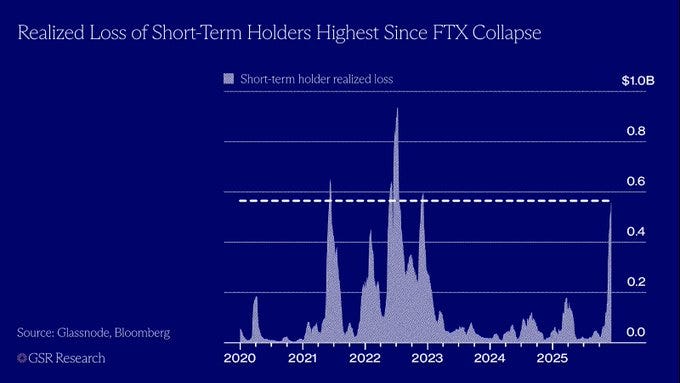

The resulting current state of market is just an amalgamation of all of these structural issues that came crashing down on 10/10, which took the spot to be the top crypto liquidation event of all time at $19.61B (2021 April’s liquidation of $9.94B sits 2nd). As a result, what we’re seeing now is basically the “end of the cycle”, where prices face downward move after downward move.

As a result, I have started to pivot away from the crypto markets and investing in equities. And I believe that most of what 2026 will have to offer lies in becoming a generalist more than a specialist, being flexible rather than tied down to a specific sector of the market. Looking at the returns of different indices in 2025, it proves my point - this has been the year of ex-US equities, and it paid to have more breadth.

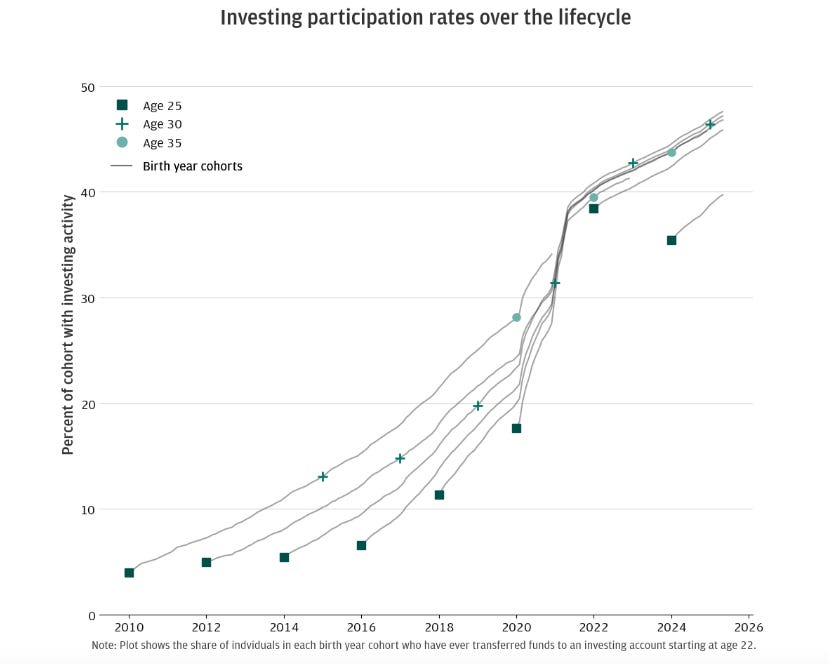

Retail Investing Is A Long Term Trend And Is Causing Traditional Market Structure To Shift

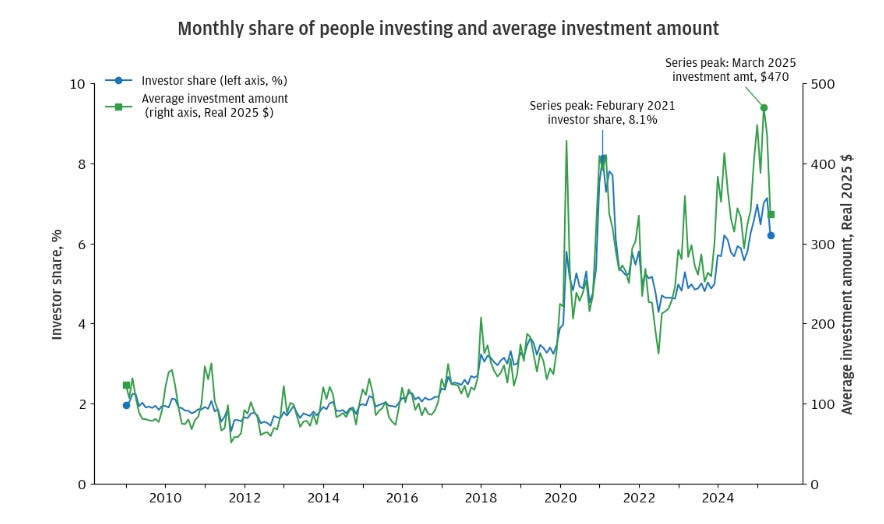

I believe that this trend of retail investing will only continue to grow because investing has become so democratized that retailers from all over the world are starting to do it. Lower barriers to entry to this “sport” mean that the investable asset class is starting to “go global”. The world is now accessible to capital flows from, well, everywhere. A retailer in the US speculating on Korean stocks that have its fundamentals rooted in the AI narrative. A Grab driver in Singapore investing in Polish stocks. Etcetera.

This is another bearish point for crypto, because for the longest time crypto was thought to be the “Internet Layer” that anyone in the world could invest in. But now that investing has become so accessible, why would retailers choose to invest in low-value, speculative digital assets when they could buy literally anything else?

I digress. Retail investing growing is a pretty obvious thesis, and at this point, it’s hard to argue against the data. But what I want to point out is the scale of things. Anecdotally, it feels like many people do agree that retail is investing at scale, but fail to grasp the consequence of more retailers entering the market.

As a result of retail inflow, equity markets in general are becoming more crypto-like. The one thing I’ve always loved about crypto is how it managed to speedrun market cycles in a much shorter span of time. We got to experience the entire stage of investing in the span of months, even weeks - from accumulation to distribution. And now I’m seeing similar signs in the stock market. Can you guess which one is a token and which one is a stock in the image below?

That’s right - they’re both stocks. And while not all stocks exhibit said properties, it cannot be denied that there are more and more aspects of the equity markets that are becoming more “crypto-esque”.

The world of equities is broad. This is just one small trend-shift I’m noticing.

If You’re In Crypto, Pivot To Equities

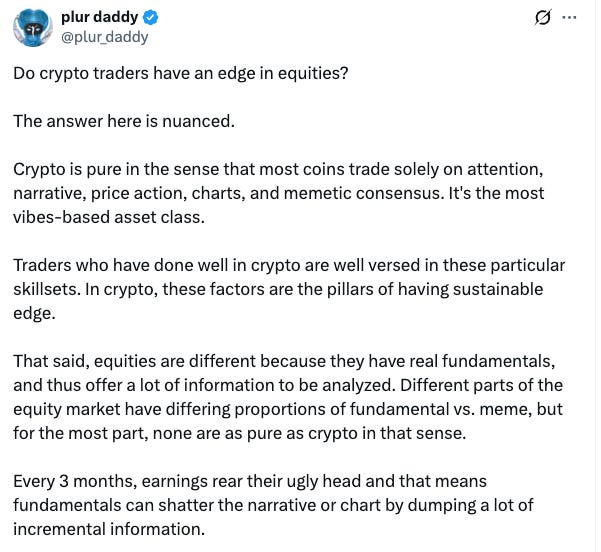

As a result of low volatiliy crypto markets, many have pivoted to equities - and there has been a lot of chatter on the timeline about whether said crypto traders have an edge in equities. My take is: I don’t think anyone has an edge in equities just because they were “from crypto”. However, there are certain skillsets that could make prove beneficial (e.g handling volatility), but ultimately, you’d still have to adapt.

I am in the same boat. I don’t proclaim to be good at stocks. In fact, quite the opposite. I am having massive imposter syndrome writing this on a Substack which I know for a fact, is read by hedgefund managers with dozens of years more experience than myself in traditional markets.

But it’s not completely disregardable. Because I believe that the markets will behave more erratically due to an increase in retail participation, I subsequently think that the experienced crypto trader who spends most of their lives trading against retail, will be able to find some sort of edge. Take narrative trading, for example. I’d say that if you were sharp enough, you could catch many of the themes that drove returns this year - Hyperscalers / Space / Memory / FinTech / etc.

And alas, what alternative do I have? I don’t expect crypto to be as lucrative as it once was, and so, I can either pidgeonhole myself into catching those 1 - 2 trades that generate multiples in a year (if they do happen), or I can expand my existing skillset. TLDR: Adapt, or die.

Anyways, by my standards, I’d say I’m doing well so far. Above are the YTD returns for my portfolios. And at the expense of sounding stupid, I would actually like to elaborate on why I believe I, as a crypto trader have been doing well.

Identifying strong themes juice a lot of returns

Back to my point above - this is something I actually believe “crypto traders” are good at - identifiying core narratives and positioning themselves around it. More examples are: Hyperscalers (IREN / HUT), Space (ASTS / RKLB / PL), Financialization (HOOD / SOFI), Memory (SNDK / SK HYNIX), Robotics (TER), Nuclear (OKLO), Quantum (IONQ / QBTS), Metals (SILVER / GOLD), etc.

I’m still trying to get better at pre-identifying themes, but a lot of it is just second-ordered thinking. Stock selection comes later, but with AI, much of the informational edge has been flattened. Again, it helps that with more and more retail investing coming in, narrative trading will once again become a huge theme in the markets.

Learning what to trade

I do recognise that I have no edge trading “news” or earnings. But truth be told, there is a lot of edge to be captured if you play at the right tables in this game. For 10 years, crypto was one such table - overlooked by everyone else, giving outsized returns. Now, with the dominance of retail, we’re starting to see the same type of table appear in equities - the small-ish cap (sub 10 billion) space. I’ve been getting my hands dirty here, and boy is it fun. You’re seeing similar return profiles - e.g DAVE (35x since 2023), RKLB (12x since Sep 2024), etc.

The process of finding one such stock is being refined - I’m very much in the early stages when it comes to my workflow. But so far, I think it’s the table that I’m most suited to be playing at.

Handling volatility

The most commonly cited trait of crypto traders does help a bunch here. Unlike our coins, these things do have fundamentals - and if you can hold a “pre revenue” coin through a 40% drawdown, you sure as well can do the same for a stock that actually does something.

My Biggest Weakness Thus Far

But the irony is that crypto teaches us to “not hold” - and that’s where it becomes a double edged sword. With TRUMP, LUNA, and all the events that the typical crypto trader has been through, I’ve found that my biggest weakness is selling at the first sign of trouble. Akin to PTSD, the moment I feel like it’s toppish, I instantly start selling - expecting some sort of market wide drawdown like we saw earlier in February this year.

It’s still something I’m trying to unlearn.

Some Predictions

Not to be taken too seriously, but just stuff I think have a good chance of happening.

Gold hits $5,000

I believe Gold is in a structural bull market of its own. In the past few weeks, the shiny metals (Gold, Silver, Platinum) have done fantastically well, and I see no reason for this to stop.

Unitree IPO does multiples on opening (2-4x)

Robotics seems to me to be deeply underrated despite being one of the most life-changing applications of AI. Many in the AI space are constantly hyping up new models, new applications, but I’ve seen very little love for robotics despite it being so adjacent. Sure, the Figure Robot launch was highly covered, but when I compare it to the hype around general SF AI Tech? It’s not even close. I do believe Rewkang is on to something with his robots thesis.

BTC bottoms at 70k

It is quite possible to me that BTC will bottom soon - whether it makes a new ATH is another question entirely. The downside risk is minimal based on how it’s been trading, but I have no understanding of where the upside will come from.

HYPE hits a new ATH, while all other alts continue to grind / chop

FWIW, my holdings right now are a sub-10m microcap, and Shuffle. I no longer hold HYPE, but I am looking to get an entry to it in the near future. That being said, Hyperliquid is one of the few products that have exhibited properties of being a great altcoin:

It doesn’t have high inflation

It has some sort of value accrual / alignment

It has a product that has continued to grow QoQ & isn’t just a flash in the pan

When 99% of the altcoin complex is uninvestable, I expect inflows into one of the most pristine assets that have come out of this past cycle.

There will be an on-chain / alt season - and it will be AI Video related

This may seem counter intuitive to my prediction above, but like I said - I believe crypto is still the best space for “mean-reverting bubbles” that happen in the short span of time - i.e an alt season of 1-2 months, like what we saw with ICM in May. I believe there will always be pops, you just have to get out before everything collapses (again).

Stablecoin adoption gets massive implementation, and CRCL goes above $200

While there’s a lot of talk on stablecoins and work in progress, we’ve yet to see the boots on the ground moment by all of these major banks and players. Tempo is still under construction, the big banks are all gearing up to enable it (but not here yet) - I believe 2026 will be a continuation of a clear stablecoin dominance. The problem I’m wrestling with is the simple fact that Trump and the rest of the world is in a rate-cutting cycle, which is bad for stablecoin companies, but perhaps good for money velocity.

Ex-US indices continue outperforming US indices

Pretty self explanatory.

Continuing below are a continued lists of predictions that I

Chinese luxury consumer stocks make a revival (Popmart, Laopu Gold, etc.)

The AI bubble slows down and takes a back seat, with more returns being seen in other sectors

Nuclear energy continues doing well

ETH doesn’t go back to ATHs

Pokemon cards are out, One Piece cards are in (especially given it’s the Pokemon 30th anniversary)

The only DATs to survive will be MSTR and BMNR

We see a lot more crypto M&A of tokens

Crypto looks to find a way to turn stocks into tokens after spending 2025 realising the other way around (tokens into stocks through DATs) don’t work

Crypto gambling takes off (Disclaimer: I have Shuffle bags)

The crypto bear market continues into 2026

2025 Gameplan Review

And to close it off, we’ll review my previous years’ memo, to see how they played out.

My Macro Scenario

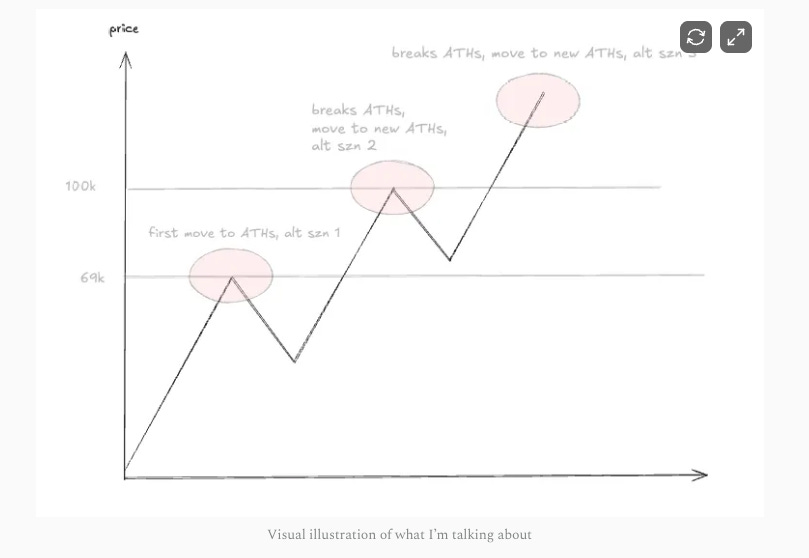

I drew that picture & wrote the following:

Conclusion:

BTC up, and up more than 2024

Alts - play offense, know when to switch to defence, but less defensive than 2024.

Well, I’d say it came partially came true but overall, a pretty bad prediction because it didn’t account for the path dependency - we made new ATHs in September, but look where we are now. This sort of passes.

AI

Yes, this is still here. But as the tweet above shows - we’ve gone through a few waves already. If you read my thesis on AI tokens (link here), I believe the next wave is coming soon.

To be fair, this seemed like a more short term prediction than anything. I’d say what I said came true - before they all went -99%. My picks of ALCH / DIGIMON / AI16Z all did fantastically well, again, before they went -99%. This passes.

DeFi

Top Picks: AAVE / ENA / Morpho / Euler / USUAL

Side Picks: Stablecoins / Payment related tokens

Meh. Some of these names did not make a new ATH ever since January 25 - so this was a pretty bad basket to play. AAVE briefly made a new ATH, but it was pretty short lived. ENA & Euler basically topped on a YTD basis in January 25. USUAL collapsed; the only winner here is Morpho. This fails.

L1 Trade

I’m going to get so much hate for this, but I believe the L1 trade comes back in size. Hype is a no brainer, but Sui has been massively hated at $1, then at $2, and now at $4. The L1 trade in itself is something I believe the market has been missing though - it stands out as one of the areas that no one is looking at, yet massive opportunity lies (as seen in how Hype has 10x’ed).

Top Picks: SUI / Hype

Side Picks: Abstract

This absolutely fails. SUI pico topped at $4. As for Hype, well… while it did run up, its current price is close to where we were in January 2025. Also, it’s kind of a cop-out pick - it’s less of a L1 than a Perp Dex. In hindsight, I’m not sure what I was talking about.

NFT Tokens & Gaming Coins

Top Picks: Pengu / Anime (Azuki) / Spellborne / Treeverse

Side Picks: Prime / Off the grid (if token comes out) / Overworld

Well I’d say Pengu is the only winner here, even though it went -90% in January. It proceeded to rip 8x, and above all, Pengu has been the only NFT project that has garnered mainstream attention. The basket overall fails though.

Other Narratives

These are on my list, I don’t LOVE them, but they’re interesting

Data tokens - Kaito / Arkm

Memes - really only like PEPE. Everything else… looks cooked

DePIN - PEAQ / HNT

Ordinals

Dino Alts - XRP, etc.

Old DeFi - CRV / CVX

I didn’t really write a view on these, so they don’t matter.

Predictions

Prediction: DePIN gets implemented by a serious company in a serious manner, somehow. Maybe an acquisition.

I’m not sure if this came true. Maybe someone in the replies can help? Combing through my memories I don’t think it happened.

Prediction: Binance loses market share as the top exchange. Not to Hyperliquid, but either Bybit / OKX

This didn’t come true fully, but I will say that Binance’s reputation and market share has definitely taken a turn for the worse, especially after 10/10.

Prediction: Metaverse coins get new life as VR hits new strides

Nah.

Prediction: ICOs are great again

Oh this turned out fantastically well. Cobie’s ICO Platform got acquired by Coinbase for $375M, which goes to show how ICOs are the new in-thing again.

Prediction: ETH On-Chain szn never happens

I was right on this.

Prediction: Sui hits double digits ($10 min)

LOL. No.

Prediction: ETH yield gets approved in ETF, thus spawning more yield products for staking other tokens, and yield aggregators like what we had in 2021

Oh this turned out to be correct!

Prediction: A major artist uses NFTs & tokens in a way to keep tabs on his / her fandom and reward them

Nope, didn’t come true.

Prediction: Bitcoin hits 200k

I wish.

Prediction: More L1s see their CEOs / founders leave after seeing Aptos

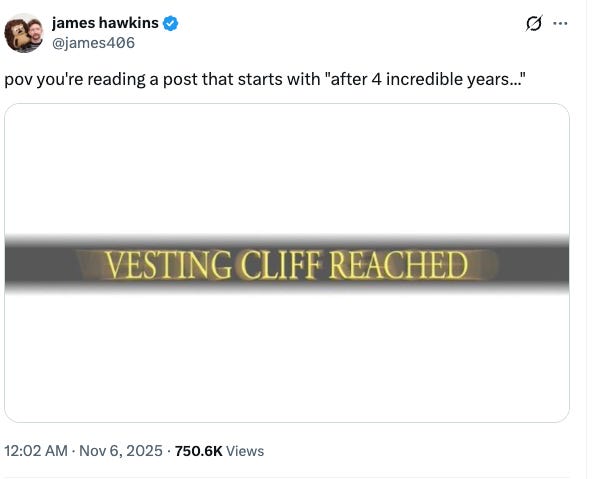

This sadly came true. Nowadays we’re seeing more and more exits, with the typical “vesting cliff reached” meme attached to them.

Prediction: Base loses the on-chain race as another L1 takes over. Solana retains.

I’d say Base is still the winner alongside Solana so far.

Concluding Thoughts

This about sums up how I will be positioned going into 2026. I expect that a lot of what I’ve said here will probably change greatly, as with my 2025 Gameplan.

Good luck, godspeed, and see you on the other side, ladies and gentleman. If you make life changing profits on the way, remember - change your life.

Yours Truly,

0xKyle

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

Super interesting on not holding crypto for the long term - definitely agree that we should be taking profit and buying the dips. Probably best for my sanity to reinvest profits into equities like S&P

The transition from crypto to equities actually makes alot of sense when you frame it as moving from one mean-reverting bubble environment to another that's starting to look similar. What caught my attention is the quantum mention alongside space and nuclear, these feel like classic second-order bets where the infrastructure narrative hasn't fully caught up to where hardware capabilities are heading. I ran into similr dynamics with small cap biotech a few years back, where retail piles in on headline risk but misses the actual value accrual points. One thing though, do you find position sizing harder in equities given they generally have better fundamentals than shitcoins? Like, when's the signal to cut vs hold through volatility?