First things first - some disclaimers:

I hold CARDS.

THIS ARTICLE WAS STARTED WHEN CARDS WAS ON ITS FIRST DRAWDOWN AT 0.1547. I AM POSTING THIS AT ATH LMFAOOOOO. But on a serious note, I didn’t try to time the price, my priorities is to just get this piece out. Make your own decisions, just take this piece for information

This is not financial advice. Investments in any products, services, tokens or projects involve the risk of loss. Past performance is not guarantee of future results.

This does not reflect the opinions of my employers. Views expressed are my own, and this content is provided for informational purposes only and should not be relied upon in any manner as professional advice.

And some credits:

Thanks @c0xswain and +EV Capital for the first intro to CARDS

Thanks @David from DACM for sharing notes

Thanks @notthreadguy for the amazing podcast

And of course, thanks collector crypt for launching this and thoum for building a great business

Collector Crypt Thesis

Anyone who thinks CARDS is "just a crypto RWA" is doing a great disservice to the business. While it's not wrong, it is a gross oversimplification of the business that I believe Collector Crypt (hereby abbreviated as CC) has built. In particular, I believe that CC has a variety of different strengths (moats) that can be categorized into the following:

Token Moat

Deep Distribution + Logistics Strength

Founder Alignment

Sourcing Moats

Resilient Business Model

The importance of all of these factors cannot be understated. Over the past few days we have obviously seen the explosive growth of TCGs as a narrative, and thus I expect the usual crypto outcome of "everyone moving to where the gold is" akin to a mini gold rush, as many people rush to try and replicate their success. But what people are failing to realize is that this isn't a product that can be easily duplicated.

In fact, I am of the opinion that unlike AI Agents who benefit from the typical Software-As-A-Service type of scale (and hence ease of replication), replicating a TCG RWA is 1,000x more difficult than it seems. This is because of the huge logistical and deep real-world connections one has to have in order to build a scalable business, much unlike most of crypto's "purely digital businesses" where code can be forked and features can be copied overnight.

In my opinion, the combination of a strong business model operating in a high growth vertical creates a compounding advantage that becomes increasingly difficult for competitors to replicate over time. CC represents something far more defensible than the typical crypto project, and CC has something others don't - time advantage: they spent years building the unsexy but critical infrastructure that actually makes a TCG business work: purchasing networks, authentication processes, logistics systems, and most importantly, the trust and reputation that comes from successfully handling $75M in transactions.

Market Opportunity

Before we begin, let's size out the market opportunity of TCGs today. I will have to proclaim that I'm not an expert on this - my experience in TCGs only goes so far as playing Duel Masters when I was a kid (fantastic game, btw).

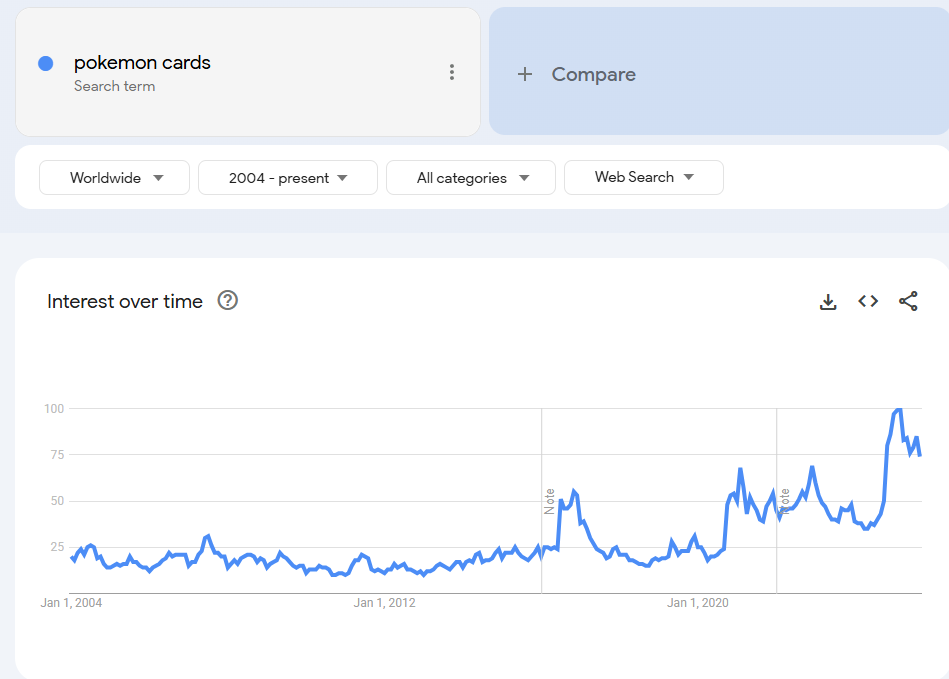

But that doesn't mean that I am unable to see the scope of the market opportunity here - it is massive. For starters, I will only be focusing on Pokemon cards for now, because that is what CARDS currently offers - and also, because of the simple fact that Pokemon cards are the cornerstone of the entire TCG industry. Pokemon cards have seen the largest long-term increase in value amongst all card categories: up 3,261% over 20 years.

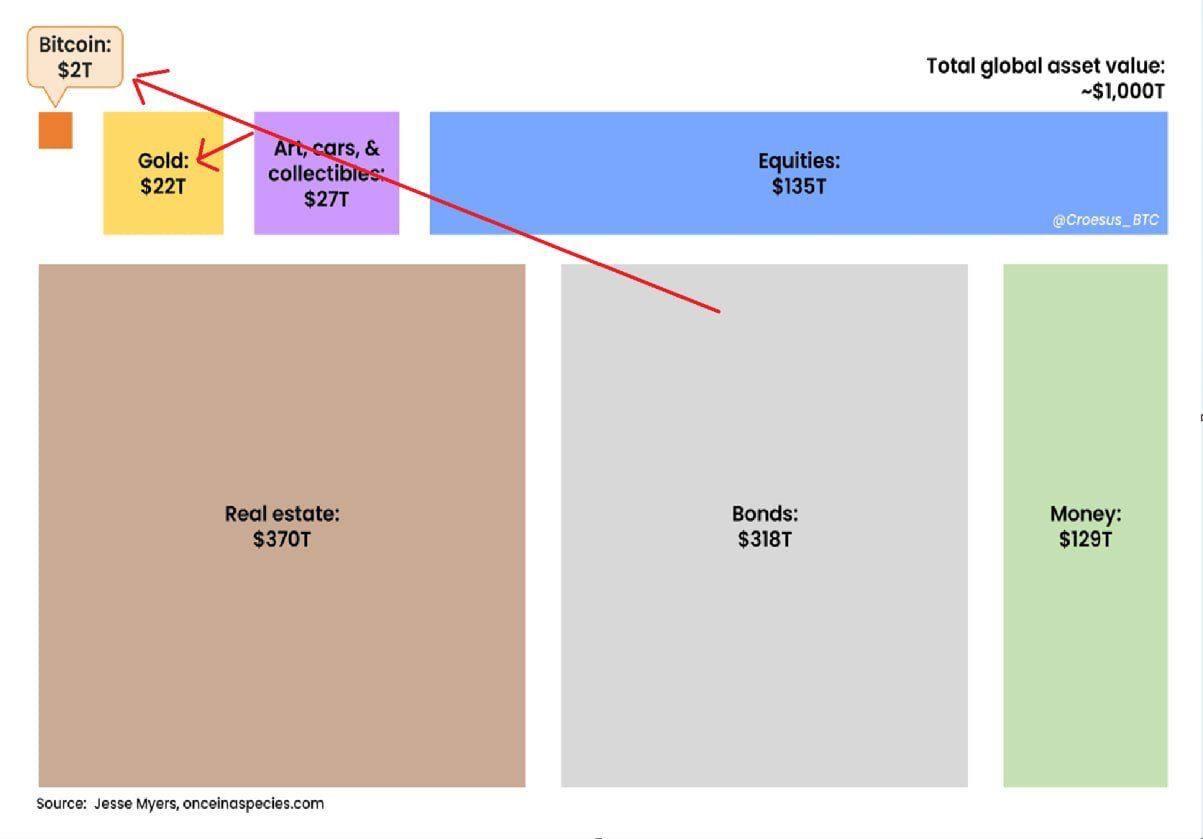

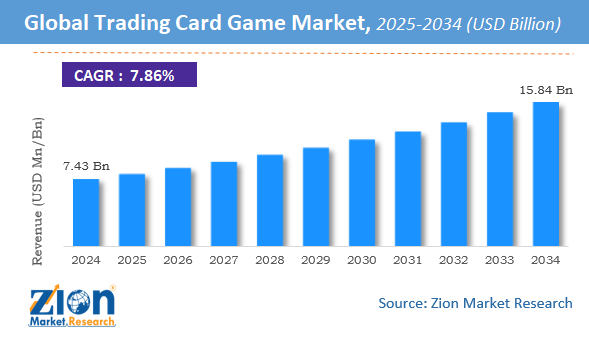

And on a broader scale, the arts, cars & collectibles market is larger than Gold's market cap. Of the $27T, $7.43 billion alone is attributed towards TCGs as of 2024 - and this is projected to grow even further with a CAGR of 7.86% YoY.

Of course, these are all just numbers - what I like to look at are anecdotal trends and underlying ideologies that drive these numbers, because I believe they reveal the true staying power of this market opportunity. And based on what I'm seeing, I believe that these trends are here to stay:

The Millenial & Gen-Z wealth transfer

The first and most obvious trend is generational. The kids who grew up with Pokemon cards in the late 90s and early 2000s are now in their prime earning years. These kids now have nostalgia backed by disposable income, and this shows up in the data - nearly 1 in 5 adults reported purchasing Pokémon cards for themselves.

So when a 30-year-old software engineer sees a PSA 10 Charizard, they're not just seeing a piece of cardboard; they're seeing their childhood, and they now have the financial means to own it.

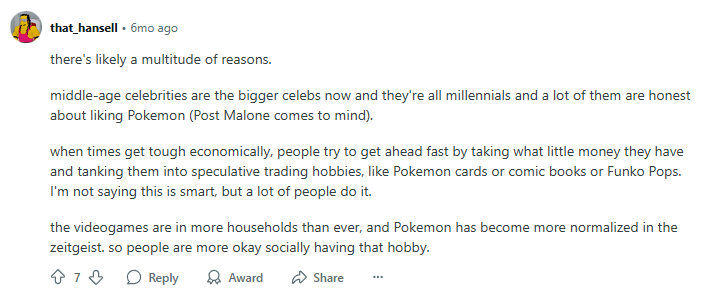

To add on, a simple Google search of "why are pokemon cards so popular now" on Reddit would give you similar answers:

The Labubu-fication of society

This is an interesting one. I believe that Labubus are just a deeper manifestation of how economic inequality and mainstream gambling culture have converged to create a new collectibles paradigm. When traditional wealth building feels impossible, people gravitate towards alternative forms of both spending and wealth creation that still retain that crucial "fun factor."

You can kind of see this in everything - sports betting, gachas, blind boxes, 0DTE options, pack openings - these are all forms of "sophisticated gambling," each on a different level of the spectrum. Deep down, the mechanics are similar - they all deliver some sort of dopamine hit, on top of having that allure of making financial gains.

TCGs build on top of this by also giving you a tangible collectible every time - and there's always that luck factor where a $4 Pokemon pack could contain a $500 card. So - for a generation priced out of traditional asset accumulation, TCGs offer the psychological satisfaction of "investing" while scratching the same itch that drives sports betting apps and crypto day trading; I believe that is incredibly powerful.

Overall, the growth & size of this market is up and to the right. The final nail in the coffin for me is the simple fact that this is a trend that came back after 2021. As an outsider, it was quite obvious to me that 2021/2 was quite an amazing bubble for Pokemon cards, with celebrities like Logan Paul paying $5.2 million for a Pikachu graded PSA 10 in 2022. Obviously, NFTs were also doing extremely well - but one of these survived while the other didn't.

That to me, is a clear sign that this is an industry that shouldn't be faded. The ability for TCGs to not only survive but thereafter grow stronger after a major speculative bubble tells you everything you need to know about the latent demand for these things. NFT floor prices went to literally zero, yet Pokemon cards were able to find their footing and continue climbing!

Tokenization Product-Market-Fit For Collectibles

Now that the market opportunity has been cleared, let me talk about what problem the tokenization of RWAs solves in general. Like many things in crypto, in 2021 we believed that we had a solution searching for a problem. But little did we know, we already had a problem to solve, it would only take us 4 years to realize it.

I wrote a tweet about it here; but the gist of it is that we didn't realize the golden egg we were sitting on until TradFi came and pointed it out to us! Now, the whole world is going crazy: Robinhood is integrating perpetual futures, every bank is trying to build a stablecoin (today, Stripe announced Tempo, a payments-focused blockchain), and Larry Fink himself said that "every stock, every bond, every asset can be tokenized," and that would "revolutionize investing."

And I believe that this time is not different. We have once again become so jaded by false starts that we are missing the simple fact that the NFT thesis from 4 years ago has found product market fit. How? Here's an analogy:

You want to buy a rare collectible. Today, if you wanted to purchase it, you would have to find a seller, arrange a viewing, wait for shipping, pray that nothing gets damaged or stolen - a whole boatload of hassles. This whole process takes weeks and costs hundreds in fees.

Now, imagine that collectible as a tokenized asset. You can buy it instantly from anywhere in the world with a few clicks. Authentication is cryptographically verified and immutable. Settlement happens in seconds, not weeks. The physical item stays safely stored in a vault - until you decide to redeem it. When you're ready to sell, you can list it on a global marketplace and receive payment immediately upon transfer.

The convenience tokenization unlocks is pretty much unparalleled - it trades with the speed & efficiency of a digital asset, while maintaining the underlying traits of a physical one. You basically get all the benefits of ownership with none of the traditional friction.

And of course, this is not a new idea. This is why tokens were made in the first place. But today, we finally have (god forbid I say it): Product-Market Fit. It's taken years, but I truly believe that we are on the cusp of change - that the tokenization wave is truly upon us.

Why CARDS will win

Now that the context has been set, let me deep dive into Collector Crypt (CC), and why I believe it will be the clear winner of this trend. For those who don't know, CC is a Solana-based platform designed for trading physical and digital collectible cards through an innovative on-chain marketplace. They specifically deal with Pokemon cards (for now), and most crucially, they have a Gacha that allows consumers to open packs online - more on this later.

As for logistics, this is how it works (as displayed on their website):

First, you send your cards to their secured vaults, including PSA, PWCC and ALT, where they are stored and insured

Cards are authenticated, scanned, and linked to your profile or wallet

Lastly, you can buy, sell, and transfer cards securely at a fraction of competitors' prices

And over the past week, their token has gone absolutely parabolic:

However, I am of the opinion that CARDS still represents the best in the biz, and that the underlying business has so much room to grow. This is a strong company, with an incredible team, building in a high growth vertical… Most importantly, this is one of the rare cases where I feel like having a token makes sense. That is the first of their strengths:

1. Token Moat

$CARDS represents the token of CC, and I believe that having a token is justifiable in this case because:

It is a high growth business in a high-growth vertical that has a lot of thematic crossover with the crypto industry

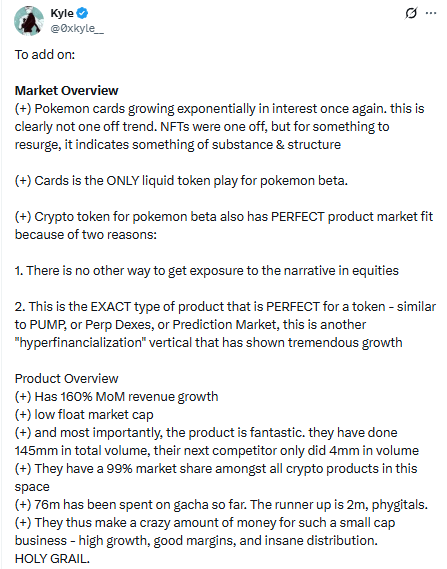

It offers liquid exposure, is N of 1, in a vertical everyone is dying to get exposed to

Pokemon cards, Crypto Traders, and Sneakerheads often have more in common than they do apart. Interestingly, the Venn diagram of people who understand the value of a PSA 10 Charizard and people who buy digital tokens is basically a circle:

Crypto traders are highly speculative, and when you combine it with TCGs, it seems intuitive that a token would unlock this latent demand that liquidity otherwise could not find exposure to. Not everyone wants to buy underlying pokemon cards, but having a token that could, in some sense, represent the TCG Market? That would be incredible.

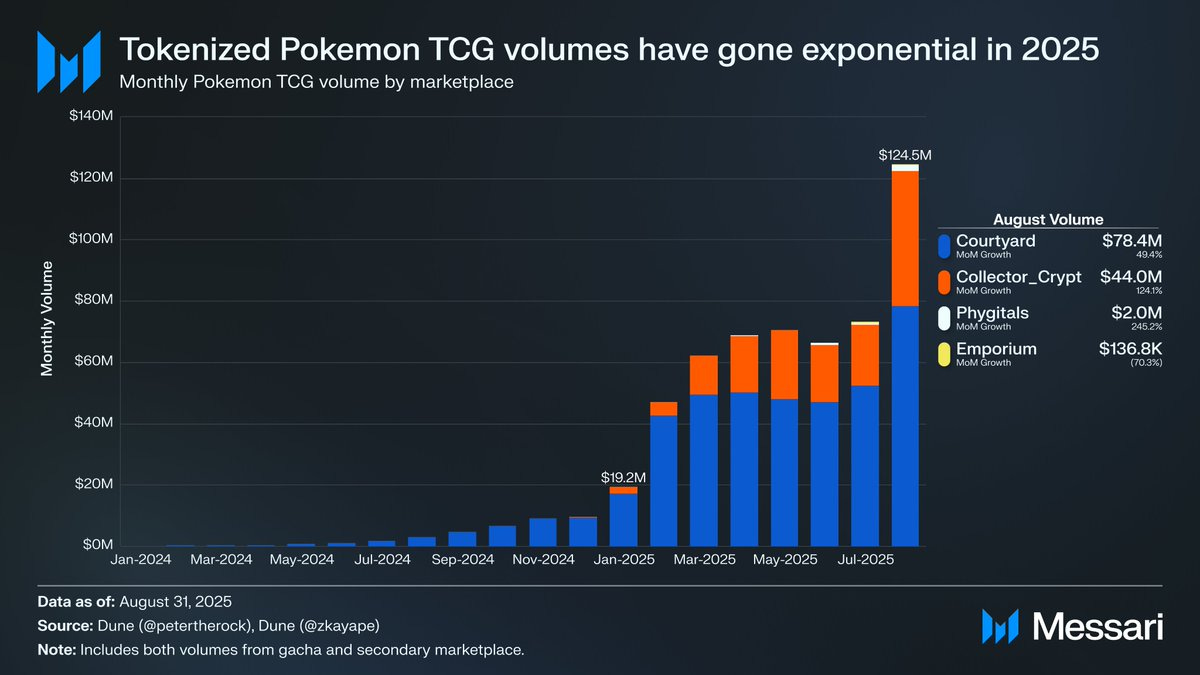

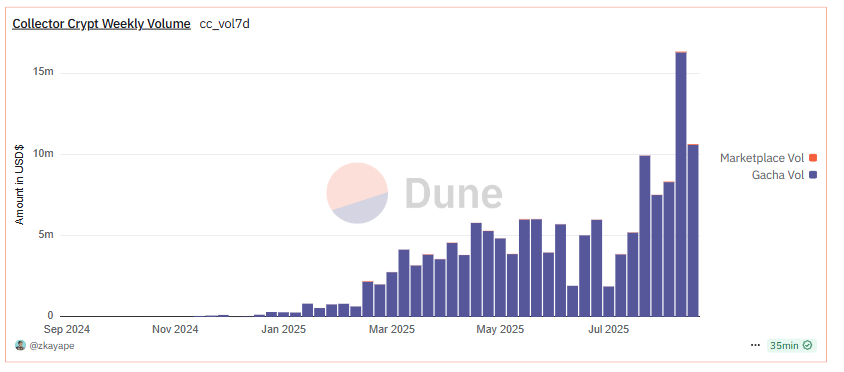

The data on tokenized TCG volumes already reflects this - they have gone exponential in 2025.

In some aspects, that's what CARDS is. It offers liquid exposure to a vertical that everyone else is dying to get into. And not just any vertical - one that is part of the "hyperfinancialization" thesis. The best products in crypto always have to do with some angle of hyperfinancialization - whether it be DeFi, Perp DEX, or Prediction Markets. Now, we have the Pokemon market - one of the hottest alternative asset classes in the world.

The other aspect is the fact that it is a high-growth business that has great fundamentals; Other tokens just don't offer the same type of upside - you may be speculating on the general theme, but without the same fundamentals, all they do is act as betas with no type of alpha capture of their own. Currently, CARDS is really the ONLY liquid bet that individuals can bet on - Courtyard doesn't have a token, and Phygitals does not do enough volume to justify betting on it even if they had one.

Thus, when you take two and two together, you get a golden egg - a token with good, growing fundamentals, building in a space with a large and growing TAM.

2. Deep Distribution + Logistics Strength

This is the part many people fail to understand. Above, I mentioned that CC would be a very hard business to replicate, and it's precisely because of their incredible distribution and logistics.

Firstly, they are literally one of eBay's largest card buyers, purchasing $500,000 worth of cards every single week. They've built the world's first end-to-end eBay scraping auction tool that monitors thousands of auctions daily, uses proprietary pricing algorithms, and places bids on hundreds to thousands of cards simultaneously. No one else in the world has this capability.

And beyond that, they've become the largest buyers at most auction houses they participate in. I'm not an auction expert, but I would assume that when a customer consistently shows up to your door offering to give you so much business, they get to build relationships and reputation that cannot be replicated.

I'm being serious when I say that I really doubt anyone could replicate this easily. They have the ability and talent to source cards, go through logistics and infrastructure to get the cards on-chain efficiently - this isn't just code. This is operational efficiency at its peak; getting inventory vaulted, authenticated, scanned and minted in the shortest amount of time possible is a moat that cannot be easily surpassed.

On the verification level, they have experts verifying it, and professionals that authenticate them. Above all, they have good support systems in place to make sure nothing falls through the cracks - on the podcast, Tuom Holmberg (CEO) mentioned that they give a 100% refund if they sold you a card and it wasn't real. I mean, in an industry full of scams, this integrity is seriously a breath of fresh air.

This expertise can't be built overnight - it really comes from within. And that takes us to our next strength:

3. Founder Alignment

The reason why CC is able to do all of this, is simply because Tuom Holmberg (CEO) has been in the game for decades. From the podcasts, my image of him is a highly principled person that is deeply passionate about TCG - having played Magic The Gathering for most of his life.

While he was previously a Biotech Executive, he decided to pivot entirely into TCGs - something that he was clearly passionate about his entire life. Take note, all of this was just taken from listening to podcasts done with Tuom, so I could be wrong - but I truly think that this is a man who loves his business, and will do everything he can to succeed at it.

This is best illustrated in how he spent all the money that he raised on buying cards - not to his pockets or inflated salaries. The man still drives a 2021 used Toyota Prius while building a business that's done $75M in revenue. His tokens are locked for 12+ months, and despite numerous under-the-table offers, he's maintaining his integrity and long-term vision.

This level of founder-market fit is incredibly rare, impossible to fake, and extremely difficult to compete against. When your competitor genuinely loves the business and reinvests every dollar into making it better, you're not just competing against a company - you're competing against his life's work.

4. Sourcing Moats

This is another great moat for CC. They have an unparalleled ability to source grail cards unlike other platforms - most users have continually mentioned how Collector has the most “value for money” gacha rewards compared to competitors in the market - such as Phygitals and Grailed. This is especially important for gacha mechanics which rely on the Pareto Principle - 20% of the rewards drive 80% of the volume; i.e the ability for the company to source the best cards, and put them up for rewards, drives a lot of the volume to the protocol.

This scalability gets increasingly important for power users who truly play to win. Power users don’t like to use platforms who have either ungraded cards, or have bad inventories - CC has (so far) been incredible for power users to use, and this, like exchanges or perp dexes, are the “whales” that drive a lot of the volume to the platform.

5. Resilient Business Model

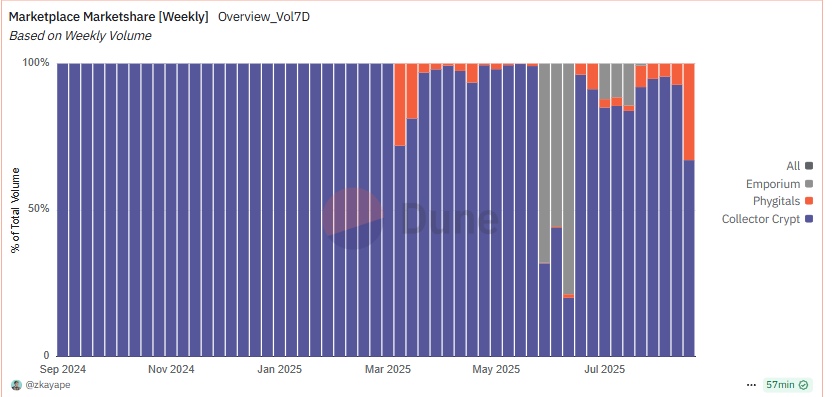

And of course, all of this culminates in the fact that Collector Crypt dominates marketplace market share.

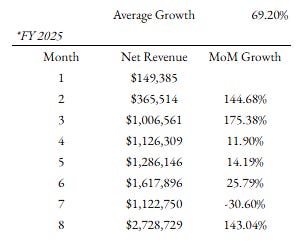

Their only real competitor - Courtyard, raised $43M while they raised <$3M. Yet, they have gotten to 2/3rds of Courtyard's revenue - and ONLY with Pokemon cards.

This ALL happened in the past 8 months - where they've had average monthly net revenue growth of 69% MoM - and anyone who thinks this is "airdrop farming" clearly forgot that we have been in a bear market in the past 8 months on-chain - practically zero people were talking about this.

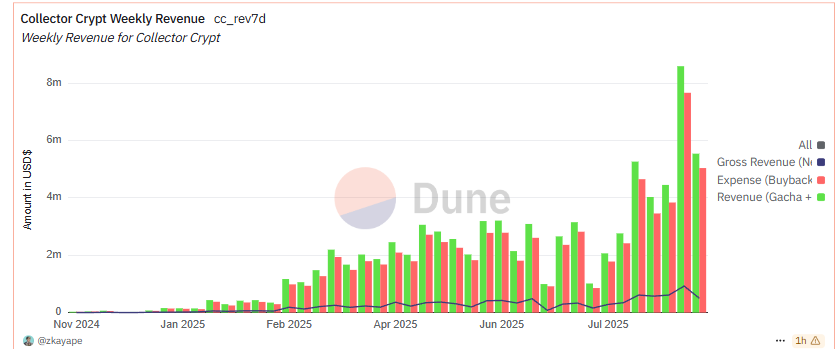

Growing whilst being profitable is basically the North Star of any company. $7-10M in profit on $75M in revenue while having growing volumes week on week - an actual, cash flow generating product.

And to top it off, the unit economics are beautiful. The gacha in particular, is an extremely intelligent product: For $50, you get an expected value of $53.5 - and the money they make is through buying back the cards you don't want at a discount of 15%.

This basically means that on average, customers are getting a fair deal while CC captures value through inventory recycling rather than house edge exploitation. CC has created a system where customers maintain positive expected value, but the platform still generates sustainable margins.

And once sports cards launch, this will represent another massive TAM expansion. The scalability is what really sets this apart from traditional businesses. Their infrastructure can handle exponentially more volume without proportional cost increases. They've already proven they can go from zero to $75M in revenue in under two years with a skeleton crew.

To sum it all up: This is a fantastic business.

Catalysts

The icing on the cake, after all of this, is continued horizontal expansion to other markets. The biggest catalyst I see for CC is expansion to other IPs - for example, NBA and Magic The Gathering (MTG). While this might seem “simple”, this unlocks net new demand which can double or triple their revenue.

This is because MTG is a pretty large part of the TCG market as well - making up to ~20% of TCGs (Pokemon makes up approximately ~65%) ;

The icing on the cake, after all of this, is continued horizontal expansion to other markets. The biggest catalyst I see for CC is expansion to other IPs - for example, NBA and Magic The Gathering (MTG). While this might seem “simple”, this unlocks net new demand which can double or triple their revenue.

This is because MTG is a pretty large part of the TCG market as well - making up to ~20% of TCGs. If CC successfully onboards MTG, it not only captures an entirely new audience of competitive players and collectors, but it also establishes itself as the default digital-physical bridge for trading card IPs. Each new IP brought in is not just incremental revenue; it compounds the network effects. For instance, MTG players discovering CC could spill over into Pokemon or NBA products, boosting liquidity across the board.

The NBA angle works differently but could be even more powerful. Sports IPs have broader mainstream penetration and a more casual collector base, which opens the door to mass adoption beyond core TCG players. If CC integrates with NBA cards, it can attract sports fans who don’t care about Pokemon or MTG but still want to engage in collectible markets digitally.

Thus, the real unlock here is diversification of audience. Relying too heavily on Pokemon (~65% market share) leaves CC exposed to shifts in a single IP’s popularity or licensing. By expanding into MTG, NBA, and other IPs, CC creates resilience in its revenue base and significantly expands its TAM. The more categories they can aggregate under one roof, the harder it becomes for competitors to dislodge them, since they’re no longer just “the Pokemon platform,” but the de facto platform for collectibles.

Now, let's talk risks.

Risks:

Inventory Risk

This is probably the largest constraint right now - cards sell out immediately on open. This is despite so much money going into buying inventory - they are literally running out of supply that can't handle the latent demand. This, in my opinion, is a good problem to have. I'd rather they face this, than face the problem of not having enough demand.

Counter: Of course, this is still a problem. I believe that Tuom Holmberg has some sort of solution to this though. This is where conviction comes in, I guess. I'm willing to underwrite this risk, that he will find a way through this.

Valuation Risks

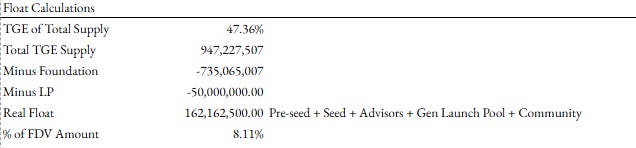

It's too high of a valuation, with $400M being pretty "fair value" as FDV goes.

Counter: $400M isn't a crazy valuation at all if they resolve inventory and expand into more markets (e.g Sports). Also, I believe that FDV isn't the metric to look at here, considering that only ~3.5% more supply will unlock in the next year. In this case, its "real" market cap is only 8.11% of FDV.

Conclusion

There is only one ticker, and it is $CARDS.

Thank you for your attention to this matter.

Resources

https://www.zionmarketresearch.com/report/trading-card-game-market

https://finance.yahoo.com/news/pok-mon-cards-3-261-140108492.html

https://www.twitch.tv/videos/2557371115

Disclaimer

This content, which contain opinions and/or information related to any products, services, tokens, or projects, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or to be regarded as an endorsement of any products, services, tokens, or projects. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. Investments in any products, services, tokens, or projects involve the risk of loss. Past performance is no guarantee of future results. You should always consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

Views expressed are my own

The commentary in any of my posts (including but not limited to those on my blog (https://0xkyle.substack.com/), and social media (https://x.com/0xkyle__)) reflect the personal opinions, viewpoints, and analyses of myself only, and should not be regarded as the views of my employer DeFiance Capital or its respective affiliates. Commentary on any projects, protocols, companies or other subject matter discussed in my posts should not be taken or interpreted as an indication that DeFiance Capital holds any interest in the subject matter discussed. Neither DeFiance Capital nor myself will be liable for any actions arising from assumptions made with respect to myself or DeFiance Capital based on my posts.

Views expressed are not investment advice, endorsements or recommendations

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by me. I may invest in any of the projects, protocols, companies or other subject matter discussed without obligations to inform or disclose such investments to you, the reader. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular product, service, token, project, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any product, service, token, or project mentioned. Nor should it be construed as an offer to provide investment advisory services by myself. Any mention of a particular product, service, token, or project and related performance data is not a recommendation to buy or sell that product, service, token, or project.

Statistics are only informative

Any charts provided here or on any of my personal platforms are for informational purposes only and should not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data. While taken from sources believed to be reliable, I have not independently verified such information and make no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, posts may include third-party advertisements; I make no representations of having reviewed such advertisements and do not endorse any advertising content contained therein. All content speaks only as of the date indicated. The information provided here (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information.

Advertisements

I may receive payment from various entities for advertisements on my blog or social media from time to time. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith by me. In addition, any mention of a particular product, service, token, or project and related performance data is not a recommendation to buy or sell that product, service, token, or project.

I DO NOT WARRANT, ENDORSE, GUARANTEE, OR ASSUME RESPONSIBILITY FOR ANY PRODUCT OR SERVICE ADVERTISED OR OFFERED BY A THIRD-PARTY WEBSITE, AND I WILL NOT BE A PARTY TO OR IN ANY WAY MONITOR ANY TRANSACTION BETWEEN YOU AND THIRD-PARTY PROVIDERS OF PRODUCTS OR SERVICES. I SHALL NOT BE LIABLE FOR ANY DAMAGES OR COSTS OF ANY TYPE ARISING OUT OF OR IN ANY WAY CONNECTED WITH YOUR USE OF THE SERVICES OF ANY BROKERAGE COMPANY.

As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

Благодарю за ваш труд!

Nice write-up. A few questions.

1- You have a dune dashboard that shows they are dominating "Marketplace Marketshare" but this doesn't seem to include Courtyard which is by far #1. I pulled up the Dune dashboard and it shows Courtyard so I'm not sure the dataset you're using. Writing this to see if I'm missing something (i.e., is Courtyard's marketplace a different concept than Collectors Crypto?)

2- Continuing on the point above- what specific advantages do CARDS have relative to Courtyard? Courtyard appears larger and better funded. Seems CARDS is more organic and has less of an existing fee base (whereas Courtyard would have to cannibalize its fees to be competitive) but Courtyard must be doing something right to be winning on volume.

3- Gamestop apparently is launching a similar competitor as well (Gamestop PowerPacks). Any thoughts on this?