On-Chain Microcaps

A brief introduction into OCMs, and some of my favourites right now

(Full Disclaimers below. Not financial advice. All content reflects my personal views only - not those of my employer, and is for general information only; They do not constitute endorsement, advice, or guarantees, may include ads or undisclosed positions, and you should consult qualified professionals because all investments carry risk of loss.)

Alts are dead, long live alts.

Any participant in the digital asset market of the past few months has been greeted with an overwhelming amount of down-only in asset prices (namely, alts) - all while BTC hovers around ATHs.

The alt-coin landscape in crypto is grim. Gone are the days in which crypto participants expect multiples in their gains - these days, most “pumps” are at most 50% moves; which, while respectable, in reality hide the fact that you’d have to hold through a -50% drawdown first - ending up with a -25% from when you first entered.

The cost of capital for investing in alts has thus never been higher. Many alts face systemic problems, and I have narrowed it down to 3 basic criteria that altcoins have to show in order to be considered “a worthy investment”. Sadly, probably <20 altcoins have all 3. They are:

Product Market Fit: A business that is revenue generating, shows growth, and is ideally something high growth

Alignment with token holders: Buybacks are the current way to show this - but buybacks, unless done with huge size, is ultimately “useless” - the crux here is but the message that is being sent ;

No supply overhang: Many altcoins face immense unlocks - and combined with reason (1), most altcoins with a lack of product face an issue where there is virtually no buyers for their tokens - see: ETH L2s as an example.

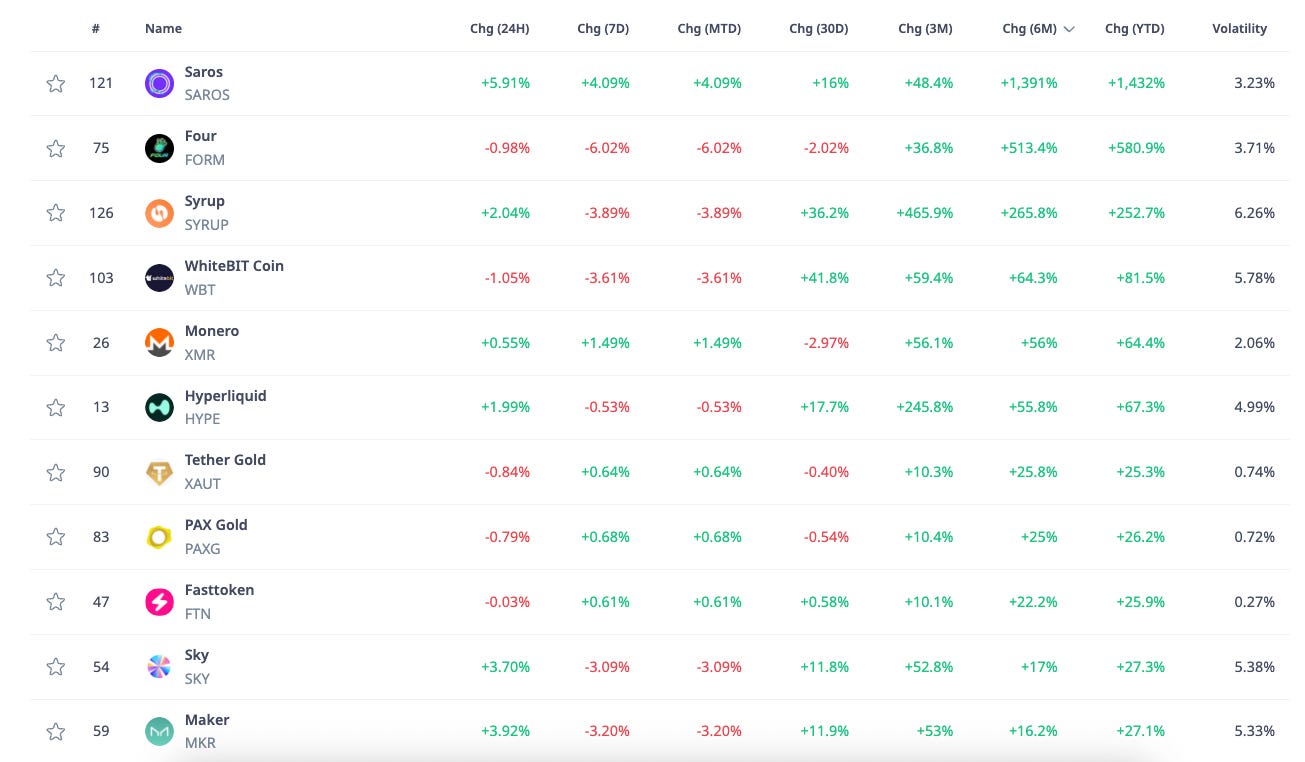

The reality is, many tokens don’t even hit 2/3 of this. And what you get is a sea of tokens that look like this:

Add to the fact that investing in alts is often extremely path dependent, and that path can often take you through a boat load of volatility. Imagine buying a token at what you think is a fair price, just for it to -50%, before going back to break-even again. Case in point - Hyperliquid’s HYPE:

To add salt on the wound, Hyperliquid’s considered one of the best tokens out there right now that fulfill all 3 points (hence its ability to break prior ATHs) - in many other tokens, the path dependency ends after the -40% move down, where you wait for the next 20% altcoin pump before exiting your position:

It’s why everyone is saying that it’s a “traders market” right now - which is very much true. Liquid investing is some of the hardest its been since I’ve joined the space - any thesis that you pitch, can go -50% first (even if it’s a tier 1 asset) ; and the total number of coins that satisfy all 3 criterias can be counted on one hand.

Why On-Chain Microcaps

I’ll spare you guys the “Internet Capital Markets” pitch - the angle I’m going for is a little different. I believe On-Chain Microcaps (hereby being abbrieviated as OCM) is one of the few investable sectors left from a liquid investors POV.

It’s important to note that while I mention Microcaps, the range of this is usually anything sub-500m in market cap (but exceptions can be made). More often than not, I look for sub-100m tokens - but the crux is that they’re on-chain. This makes all the difference, as projects no longer need to give a significant % of their supply to CEXes - thus reducing supply overhang.

So - why OCM? Well:

Ability to generate multiples instead of percentages

This is just simple math. It’s way easier for a 10m market cap coin to 3x, than a 3bn market cap coin. I’m sure many people are scoffing at this, saying “yea, but I’m not going to ape a 10m shitter” - well, here’s SPX6900 - once a sub-300m market cap coin that has 180m in liquidity, that 3.5x’ed in the last 120 days.

While this is quite obviously selection bias, the fact is that there IS more potential for upside in this area - if you look at >500m market-cap tokens that have generate multiples in the past 6 months, only 3 of them have >100% returns ; 1 of which is a fund favourite, and, was originally on-chain before it got listed on CEXes everywhere (SYRUP).

No Token Inflation

Generally these tokens are launched through launchpads, which means they’re fully diluted upon launch. This is great, because they avoid any unnecessary supply overhang that can cause investors to retreat out of fear.

Alignment with tokenholders

The Internet Capital Markets narrative spawned a bunch of tokens that were all weirdly aligned with tokenholders. While small, many of them flaunted “buyback programmes” despite being sub 50m in market cap - a great start, compared to the large CEX alts that have not done much so far. While alignment isn’t supported by all OCM tokens, I have noticed that on-chain coins seem to have a higher propensity to engage some sort of buyback, compared to CEX alts.

However, there are many drawbacks that come with the OCM thesis as well:

Not scalable for large sizes

Ironically, the reason why it can generate multiples, is the same reason why funds can’t invest in it - they’re just too small to allocate size that would move the needle for a fund. Much of these OCM tokens have liquidity pools with <1m in liquidity - buying 6 figures would likely give you double digit slippages.

However, I argue that it’s still an extremely scalable strategy up to 9 figures. It is possible to allocate 7 figures into, say, a 50m MC coin - if that 3x’es, that’s still a nice gain.

Easily ruggable

The downside of permissionless markets is that many of these coins may end up with teams that just give up after a brief period. I will argue that this is not so different from CEX alts though - there are many large CEX alts with teams that have “checked out”. Either way, one has to have a good due diligence process in order to separate the wheat from the chaff.

No PMF

Many of these coins are small and likely new, and thus don’t show strong PMF. This is not great for the longevity of the tokens, but I’d argue that there are still gems out there waiting to be found.

Because of these reasons, I have found on-chain to be the only place in the crypto-space worth looking into. Now, this article’s getting quite long, but don’t worry - the next part is what you guys have been waiting for:

OCM Watchlist

For the brevity of this piece, I will not be diving deep into these tokens. I might do deep dives into individual ones later down the line, but for now, I’ll keep it short and sweet. These are just some of the OCMs that I’m looking at right now.

REI

Launched during the AI season in Q4 2024, REI has been one of the quiet outperformers - from 5m at the absolute bottom, to ~95m right now. It’s building an AI model, and seems to be literally the only comeback story of the AI Agents arc - hence making it worth a check.

Shuffle

OG 0xkyle readers remember that I pitched Shuffle a long time ago. Well - it didn’t do spectacularly well, but recently, their launch into the US market is, imo, a huge unlock that is super under-the-radar. They’re currently top 5 casinos in the world, and this could basically put them neck to neck with Stake.

Anyways, for separate readings on Shuffle, you can check this pitch on BidClub by Mitchell.

Launchcoin

While it has been a disappointing month for Launchcoin, I do think that this is the launchpad that has a differentiating factor going for it. My take on launchpads is that it’s a race to 0 - permissionless markets just means that each time we get a mini bull season, people will start bundling coins and “crime szn” will start again - and thus, each mini cycle ends faster and faster.

Launchcoin actually changes this with barriers to entry. For reference, just think about “irl launchpads” - i.e stock market IPOs. Imagine a world where anyone could IPO - you’d probably get a lot of crime, because humans are driven by greed (in fact, if you study bubbles of the past, many of them were just “vaporware IPOs” - exactly the problem we face in crypto).

Launchcoin at least attempts to change this - and while the updates have been quite minimal, IF they succeed, it’s worth a bet.

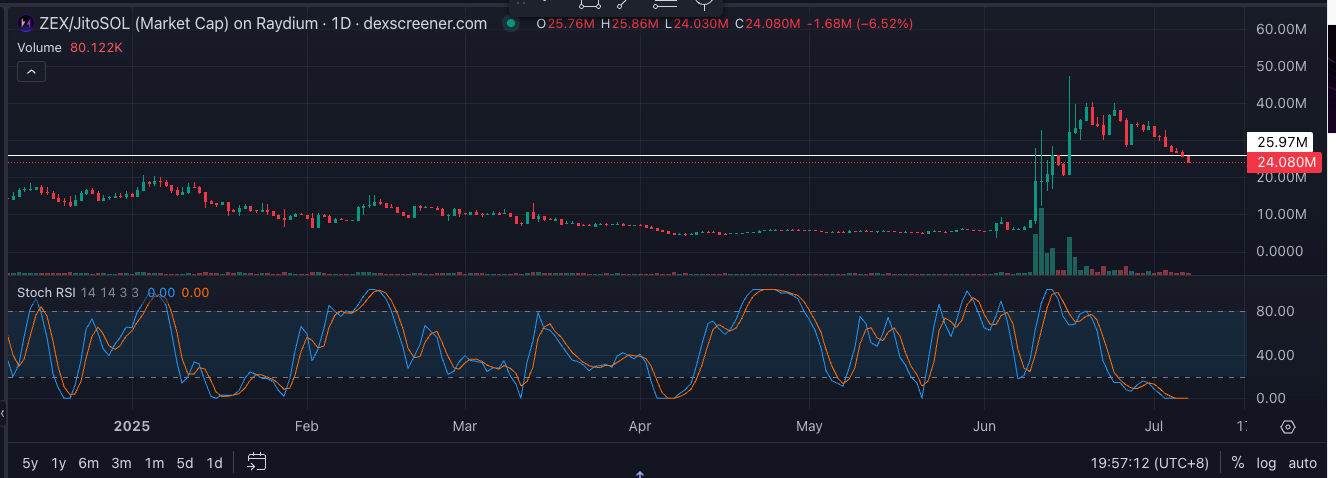

ZEX

ZEX (rebranded to Bullet) is building a perp DEX on Solana. While you might think this is the 100th Perp Dex iteration, I truly believe there is space for perps on Solana - mainly because “trenchers” are quite a legit addressable market that would be perfect to trade perps. Add to that the fact that the current product offerings for perps on Solana aren’t the best, ZEX could be quite an interesting play.

Others

Some other names I find interesting:

CLANKER

PCULE

DUPE

REKT

FLIPR

TIBBIR

GP

Well, that about sums it all up. While I’m not 100% convinced on any of them, it’s alot more interesting to me than looking at the same few tokens on my watchlist. OCM definitely presents a different opportunity set that I believe is way more interesting than traditional altcoins right now.

Also - one last thing: investing in OCM is alot different than traditional altcoin investing. I might do an article as to how I invest in OCM tokens in the future, but it’s pretty dangerous to go 100% size on any of these singular tokens, as the rug risk really is way higher than traditional CEX tokens. Sizing is key in the on-chain market.

Till next time,

Kyle

Disclaimer

This content, which contain opinions and/or information related to any products, services, tokens, or projects, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or to be regarded as an endorsement of any products, services, tokens, or projects. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. Investments in any products, services, tokens, or projects involve the risk of loss. Past performance is no guarantee of future results. You should always consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

Views expressed are my own

The commentary in any of my posts (including but not limited to those on my blog (https://0xkyle.substack.com/), and social media (https://x.com/0xkyle__)) reflect the personal opinions, viewpoints, and analyses of myself only, and should not be regarded as the views of my employer DeFiance Capital or its respective affiliates. Commentary on any projects, protocols, companies or other subject matter discussed in my posts should not be taken or interpreted as an indication that DeFiance Capital holds any interest in the subject matter discussed. Neither DeFiance Capital nor myself will be liable for any actions arising from assumptions made with respect to myself or DeFiance Capital based on my posts.

Views expressed are not investment advice, endorsements or recommendations

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by me. I may invest in any of the projects, protocols, companies or other subject matter discussed without obligations to inform or disclose such investments to you, the reader. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular product, service, token, project, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any product, service, token, or project mentioned. Nor should it be construed as an offer to provide investment advisory services by myself. Any mention of a particular product, service, token, or project and related performance data is not a recommendation to buy or sell that product, service, token, or project.

Statistics are only informative

Any charts provided here or on any of my personal platforms are for informational purposes only and should not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data. While taken from sources believed to be reliable, I have not independently verified such information and make no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, posts may include third-party advertisements; I make no representations of having reviewed such advertisements and do not endorse any advertising content contained therein. All content speaks only as of the date indicated. The information provided here (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information.

Advertisements

I may receive payment from various entities for advertisements on my blog or social media from time to time. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith by me. In addition, any mention of a particular product, service, token, or project and related performance data is not a recommendation to buy or sell that product, service, token, or project.

I DO NOT WARRANT, ENDORSE, GUARANTEE, OR ASSUME RESPONSIBILITY FOR ANY PRODUCT OR SERVICE ADVERTISED OR OFFERED BY A THIRD-PARTY WEBSITE, AND I WILL NOT BE A PARTY TO OR IN ANY WAY MONITOR ANY TRANSACTION BETWEEN YOU AND THIRD-PARTY PROVIDERS OF PRODUCTS OR SERVICES. I SHALL NOT BE LIABLE FOR ANY DAMAGES OR COSTS OF ANY TYPE ARISING OUT OF OR IN ANY WAY CONNECTED WITH YOUR USE OF THE SERVICES OF ANY BROKERAGE COMPANY.

As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.