PS: I’ll be extremely busy in these few weeks finding a place to stay in NYC, so there probably won’t be any market colour updates. Instead, I hope you enjoy this Node Monke thesis that I’ve been working on for a while.

Lastly, If you’re in NYC and wanna grab a cup of coffee, pls lmk! <3

If you follow me on Twitter / are a paid sub, you’ll know that one of my most recent high-conviction bets is the Node Monkes – a 10k PFP collection on Bitcoin that has garnered attention from top artists like Jack Butcher and Beeple (God forbid, he was the top signal).

While I admit I did oversize on this bet a lil, I have good reason to believe that Node Monkes will be one of the best-performing NFTs in this cycle. If you can’t already tell, I’m extremely bullish on the monkes.

You may be skeptical about this trade because it’s an illiquid NFT rather than a liquid shitcoin, but my counter is that as a profit maximalist, I will take any asymmetric bets that I see.

But before I shill you <my bags>, we must, as first principles maximalists, dive deep into what makes a good JPEG in the first place.

On NFTs:

I don’t proclaim to be a great NFT trader, but I do have my roots in the NFT game – with my first transaction on ETH being a Loot derivative that I paid 0.4 ETH for. Much of my early experience in crypto was in NFTs, so it’s not like I know absolutely nothing about it.

NFTs are more illiquid shitcoins, nothing more, and nothing less. With that analogy in mind, it is possible to build a framework around “what makes a good NFT”. And so, in no particular order, here’s what I believe to be the most important factors in making a good JPEG:

Does the collection have a strong narrative in the first place?

Yes, narratives exist even for NFTs. If you were here last cycle, you would remember that we had multiple narratives – for example, pixel art was the main narrative at one point (Kaijus, Cyberkong, etc..) then you had gaming NFTs (Wolf game), PFPs (Azuki, CloneX, BAYC) and many others.

Even recently we just had a SOL NFT run as the overarching narrative for SOL NFTs. As such, for NFTs to even catch a bid, there must be some sort of collective belief in the ecosystem. You don’t see AVAX or Tezos NFTs doing well precisely because there is no narrative.

Who are the buyers and sellers?

This is where “Community” comes in. For an NFT project to succeed, you can’t have people looking to flip. Just like how for a good token project to succeed, you can’t have buyers who are looking to sell on a 1.5x. No – these people must be in for the long haul. Simply put: more buyers than sellers.

But with this, you can go one level deeper – how do you tell if an NFT project has a good community? While there are no quantitative numbers I can pull, there are a myriad of factors that go into this:

Art. Is the art good?

No matter the NFT, the art must be decent, and cannot be a copycat of other existing art styles. Just like how betas of shitcoins always underperform, NFTs that copy a big projects art style (e.g Ordinal Punks, BTC Degods, etc.) are extremely undesirable.

This is even more true for PFP projects, where the PFP is “social proof of wealth”. Flexing a copy of a big project is like getting caught red-handed renting that Lamborghini for Instagram Pics instead of owning it.

Are there whales buying? Are people buying to hold rather than buying to sell?

People love to follow smart money – and nothing is more indicative of smart money in a NFT project than absurd sales. Golden BAYC selling for 500k? Alien crypto punk for a million? These sales collectively bring a sort of “prestige” to holders of the collection, knowing that rich people think that their JPEGs are valuable.

These high value sales aren’t limited to grails though. Above floor sales for normal PFPs are one of the best indicators in gauging the sentiment of buyers. When a PFP project consistently has people buying above the floor, it shows that buyers are willing to pay a premium for a NFT that they actually enjoy owning.

Mindshare? Are people loving the project on social media?

NFTs are an attention game – and for PFP projects, there’s nothing better than seeing many people rocking your collection. Remember how everyone at one point had an Azuki, or Cryptopunk, or Bored Ape? PFPs thrive heavily on attention, and you always want to see a good amount of people rocking your PFP for it to garner any significant long-term traction

Can the NFT project survive capitulation?

Just like coins, all NFT projects will eventually face some sort of dip. The initial post-hype dip is the breaking point for legitimate NFT projects in determining whether they live or die. Many NFTs don’t survive the drop in attention as people scramble to exit, but if you have a strong holder base with people who genuinely enjoy collecting the JPEG, you will see continued bullish price action.

Other factors

You then have other smaller factors like:

Team: Are they anon? Do they have a shady past?

While no rule states anon devs are better than doxxed devs, I have observed that sometimes not knowing who made a collection has made it perform better. I believe this to be a more “tail risk” sort of factor – there’s more downside in knowing who the artist is – because if he turns out to be a serial rugger, you can bet the NFT is doomed to fail. But not knowing it doesn’t mean it won’t succeed – and unless the artist is famous, more often than not knowing some rando is behind the project just doesn’t have that much upside.

Operating under a pseudonym seems to be better, in this regard.

Catalysts

This is a double-edged sword. Depending on the project, it might be better to not have anything at all – for example, if people are collecting a PFP project based on “potential catalysts” instead of more “holder-ish” reasons like liking the art, you can bet that these will be additional sellers once the catalyst passes.

There are probably many other factors, but these are the ones that I believe to be more important. Now that we know what makes a good NFT project, let’s look at the bullish thesis for Node Monkes.

Send Nodes:

1. Overarching Narrative:

Like ETH Eco in 2021, the Cambrian explosion of BTC Eco in 2024 will be a no-brainer.

The first reaction I always get when I tell people this is: “Why not SOL? Why BTC?”. I believe that the chain itself has a sort of “vibe” to it. The best advertisement of a chain is simply: numba go up.

In 2021, we had so many on-chain coins and NFTs on ETH that went upOnly. Yet in the past few months, Solana didn’t have the same wealth effect – while you had certain collections that outperformed, you didn’t have the same insanity that we regularly see on ETH.

Hold on, I’m not saying SOL dies, or that you didn’t have some insane trades (you did, e.g Madlads, tensorians, WIF, etc..) But Solana shitcoins regularly topped out before hitting 1M mcap on Solana, NFT collections would get undercut every 1 SOL increase, etc.

You see this same thing on Arbitrum as well – low-gas chains seem to all suffer from the same problem. Sure, on-chain season will continue to exist on SOL, and there’s always money to be made.

But it doesn’t have the same asymmetry when compared to BTC. BTC just blows this argument out of the water - It has provenance. It’s the mother of all cryptocurrencies. It’s the OG coin. And Bitcoin holders have had nothing to do on the chain for the past decade – while ETH had their De-Fi boom just 3 years after being created.

I believe that the BTC narrative is much stronger in this regard. There’s just so much money on Bitcoin that I find it unfathomable that the BTC Eco won’t get bid. Go to the BTC Degods NFT collection, and you see people paying 1 BTC for a copycat JPEG. That’s crazy.

Additionally, the fact that it’s a pain in the ass to bridge, store, and figure out how BTC chain works is a great sign that many people will fade the trade until its too late. It reminds me of Canto back in 2023, where people just found it too difficult to bridge to – Canto NFTs went up 100x afterward.

I just think BTC Eco is an evergreen narrative with a much greater upside, and that the reigning collection on BTC will undoubtedly be worth hundreds of millions.

2. Amongst all the NFTs, Node Monkes stand out

First mover advantage & the proper timing

Node monkes are the first original PFP project on Bitcoin. It had insane hype on week 1, and despite the FUD, it created a strong community of holders who believed in it. Sub-communities have also formed around them which is another good sign of long-term holders and mindshare spreading

Launching in the bear would have been suicide for many NFT projects, as there was just not enough liquidity sloshing in NFTs. Launching too early on BTC wouldn’t be the best - but Node Monkes seemed to have the right timing in launching when there was enough infra, but not too late that it was over-saturated.

3. It has a low inscription count

Inscription numbers are important to Bitcoiners, with many people willing to pay a premium on the first hundred inscriptions. Node Monkes greatly benefits from this, being the first 10k PFP inscribed on BTC.

4. The art is great

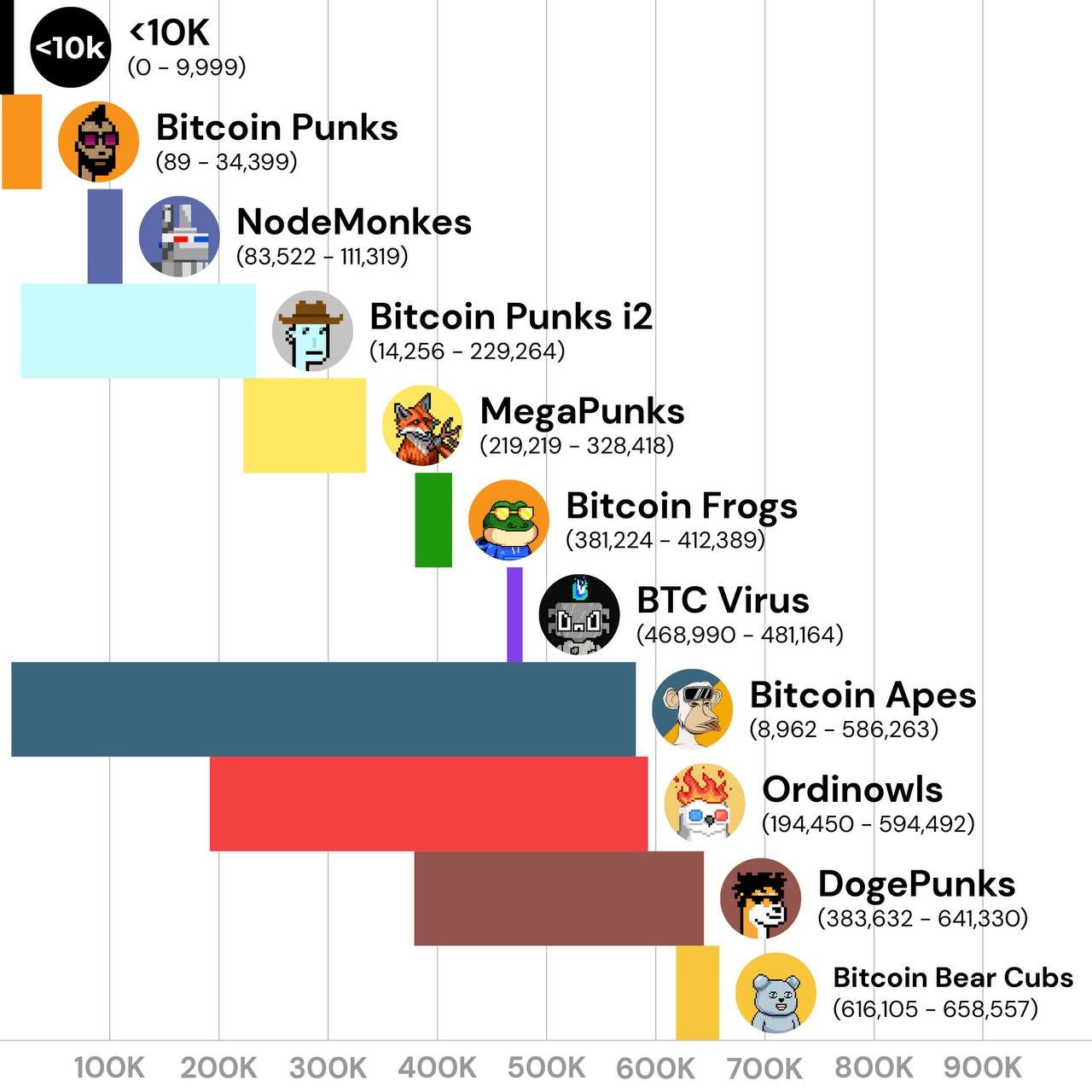

On top of that, amongst all existing collections, Node Monkes are original. Of the top 10 collections by volume, many are derivatives – BTC Degods, Ordinal Punks, Dogepunks, etc.

Node Monkes have put incredible thought into their art, with traits like Asic Miners as a hat, Hoodies and Aliens as a tribute to crypto punks, Gold as a tribute to BAYC, Peer to represent a “peer node”, etc. The art is incredible, and this can be seen in the price action – it has seen regular above-the-floor trades

5. Whales love it

I cannot remember the last time I saw someone pay over 80k for a JPEG. Yet so far, we’ve had multiple sales above 1 BTC.

6. Mindshare

Many influencers can be seen rocking a node, and notable artists like Beeple and Jack Butcher have shown support for the nodes.

They made honoraries for famous NFT influencers (Claire, etc.)

Betty: 92k followers, CEO dead fellaz https://x.com/betty_nft/status/1741990272349720855?s=20

Grant River Yun, 53k followers, nft guy https://x.com/GrantYun2/status/1741976499715019158?s=20

Lucrece, artist that sold at Sothesby and Christie, 60k followers https://x.com/DesLucrece/status/1742041467097387412?s=20

Claire, 90k follower, big NFT https://x.com/ClaireSilver12/status/1742018676054802891?s=20

As I mentioned above - the attention game is something the NFT market heavily thrives on. Projects live and breathe attention - I’ve never seen a valuable PFP project not have some sort of crazy community on CT.

7. NFTs are an easier bet than tokens

Currently, I don’t believe that an “index” of the ecosystem exists for BTC – yet. With AI, you have TAO; Gamefi, you have PRIME. But BTC has a bunch of “nonsense” – ORDI, TRAC, MUBI, SATS, etc. While people talk about ORDI being the “king”, I think that it’s much easier to bet on NFTs.

NFTs are easy to understand, and a great way for Bitcoiners to flex their wealth.

Risk Of Trade

Node Monkes get outshone by a newer, or existing collection.

Here’s some competitor analysis:

BTC punks: non-native, derivative

Onchainmonkeys: Sitting at a quarter million inscriptions

Bitcoin Frogs: Almost half a million inscriptions

OMB: Probably the one with the best chances because it has a decent community - but ultimately, it is a punk derivative, fragmented across 14 million inscriptions

Taproot wizards: Also another one of the better bets because of the founder - and I think this is a collection with asymmetric r/r as well; but have no idea how to get one

Dogepunks: derivative fusion

Node Monkes don’t survive the capitulation

When Beeple posted his Node Monke art, that was the top signal because, at that point, there were no new buyers. Anyone who didn’t know what node monkes were now known - and with that, prices started stalling.

We’re now down 30+% since ATHs, sitting at around 0.17 BTC. While I think the worst of capitulation is behind us (we saw incredible celebratory tweets and attacks on founders which are classic signs of a bottom), I don’t know what the catalyst for it to go up soon will be.

We may remain in this range for the next few days/weeks, but I would argue that this builds anti-fragility; dumpers are out: everyone who wanted to dump already has.

Instead, what we’re left with are the strong-hands and believers in the ecosystem. If Node Monkes sees another move up, I believe that to be the confirmation signal that this is a collection that will stay.

Concluding Thoughts

Overall, I believe this trade is two-fold:

1) BTC Eco is an assymetric bet

2) The way to bet on it are through NFTs, and the best NFT are the Node Monkes.

I probably could have played it better by selling the Beeple top and buying on the confirmation signal instead of holding it like an idiot, but I’m not that good. All I can say is that these are my honest thoughts on Node Monkes, and if this article has piqued your interest, you may want to keep a close eye on the floor.

As I said, while I believe the worst is over, this lull period can last from days to weeks and will be an incredible testing period for the holders of the monkes.

That’s it for now – I hope you enjoyed this thesis!

PS: If you’re interested in the rarity rankings, the grails are: Hoodies / Aliens / Gold

Some nice skins: Ducks / Deathbots / Robots / Crown

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.