Preface:

Happy New Year from Asia, my dear readers. It’s been a while since I’ve posted, and before I get into this article, I want to say thank you to the 860 of you that are subscribed. My numbers aren’t great, but that’s entirely my fault. To me, Substack was just a place to pen down long-form content as and when I wanted to. But as time goes on, I’ve realised that I want to actually consistently put out content.

2023 will see the introduction of a weekly market analysis newsletter (short bites to read), more trading wisdom that I’ve learnt through making mistakes, and more research. I’ve changed the layout of my substack to reflect this. It’s been a great 2022, and I hope 2023 will be even better. Happy New Year to you all <3.

0xKyle

Life can only be understood backwards, but it must be lived forwards. - Soren Kierkegaard

Where Are We Now?

With 2022 behind us, we can look back and safely agree that it was an absolute shitshow. From LUNA to Celsius, 3AC, FTX, 3Commas, and the many other unfortunate events that plagued us in between, 2022 is already being quoted as the “Lehman Year” for crypto in some circles.

The silver lining here is that we are nowhere close to where the industry was in 2018. We’ve made major breakthroughs in all fields: from Decentralized Finance where we’ve brought perps on-chain, to more technical aspects like enabling general-purpose computation for zk-Rollups. All in all, a terrible year for branding, but a year full of progress in the industry.

So, where are we now? And where are we going? Well, how I like to approach this question is through a multi-dimensional lens. After all, crypto is so much more than the price of Bitcoin / ETH. It’s De-Fi, it’s NFTs, it’s cryptography, it’s digital assets in an ever-growing digital world.

And so, this question can only be answered in parts - price-wise, and technology-wise.

2023 Price-Wise Market Outlook

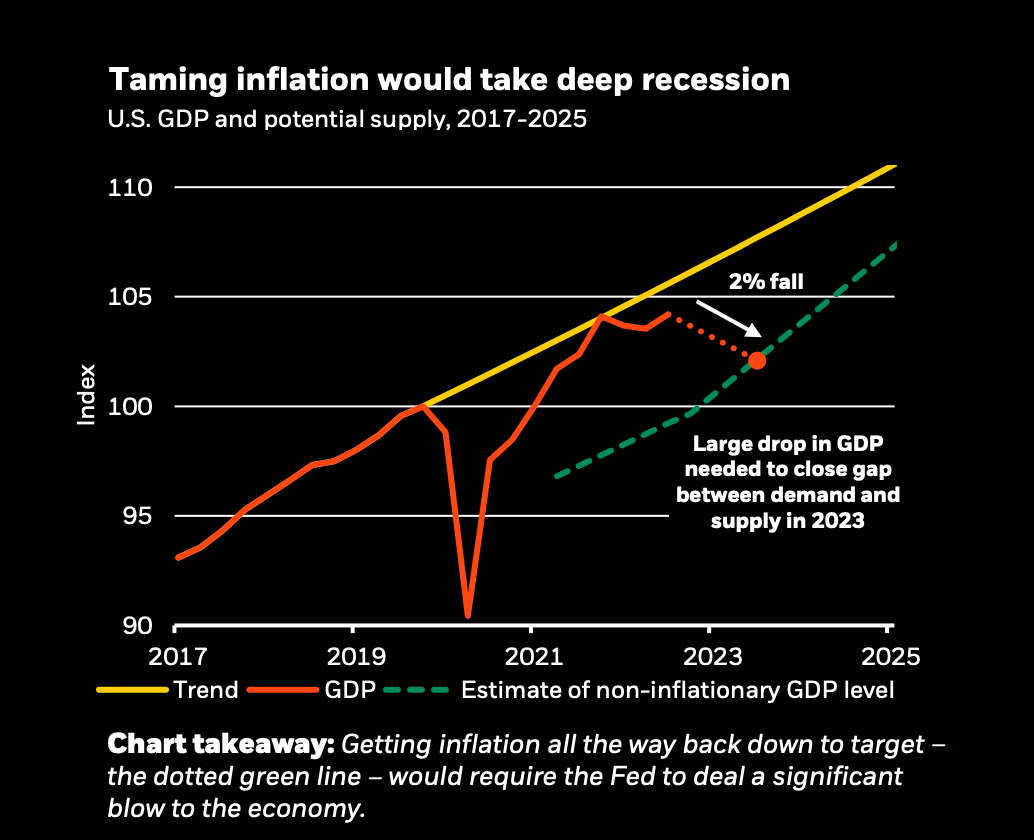

I believe in the Fed. And that means I believe that they will continue demand destruction until inflation reaches a rate that they’re comfortable with. The macroeconomic environment isn’t all too complicated to predict when you go back to the first principles. The Fed wants inflation to drop, and the only way that they can do that is by tightening monetary policy, which in return will hopefully lead to less money flowing in the markets. This is, of course, a very simplified explanation of what happens, but the gist is there.

And with that, I believe 2023 will be a continuous slow grind down for equities. Crypto being the equivalent of a tech stock means that it’ll follow the same pattern as well. But predicting macro is a fool’s errand, and honestly, I’m not saying anything that you haven’t heard before. Instead, let’s focus on the stuff that matters. And that’s answering the question of “How do I make money in crypto?”

We’ve obviously entered a new regime - we are no longer in the game of researching undervalued tokens and longing them. Instead, the current crypto-economic activity favours something like mini-bubbles across the ecosystem. The last few months of 2022 have seen Arbi szn, Art NFT szn, Cold-wallet token szn, to name a few. And I believe that this trend will continue through into 2023, where we’ll have mini-narratives popping off here and there.

On top of that, there have been certain tokens like $GMX that have outperformed consistently as well. I find that in the coming year, the metrics to measure these good tokens will become more mature, as investors look for more developed products to bet on.

The edge here is to try and determine which narratives will pop off, or to hone your second principles thinking - Arbi szn normally led to a rally in Optimism coins; Art NFTs grails popping off meant that you could look for other collections by similar artists that are undervalued.

Speaking of NFTs, that is the one sector I believe will see a rebound. This is because the ponzinomics of NFTs - low float, manual buys and ability of certain high NW individuals to just control the direction of a collection makes it extremely easy for a mini-bubble. I can imagine that you just need these reflexive economics to pump 1-5 collections, and people will already start calling for a new cycle.

In all honesty though, I think that 2023 is the year for many of us to get a job. I think one of the most underrated pieces of advice is this tweet from MoonOverlord:

As to when we’ll bottom, I believe that if the Fed does pivot, it will signal the bottom, but we won’t return to ATHs. This is in line with GCR’s famous “echo bubble” tweet.

Why? Because not enough time has passed. I believe this is the inevitable necessary ingredient for the next cycle - enough time has to pass to erase the horrifying memories of FTX from people’s minds. Only then can we perhaps see a slow grind up back to ATHs again.

But before I end this section, I want to say one thing: This whole business of making predictions is just one-half of the game that we play in the markets. We buy/sell of future expectation of further upside/downside - henceforth, making a “prediction”.

But the other half of the game is learning to be flexible. I don’t really like putting these predictions out there because I believe that they force you to take some sort of “perma-bull / perma-bear” stance in your trades.

No, that’s not how money is made. It pays to have conviction, but it pays even more to learn to be flexible in that conviction. That isn’t the same as flip-flopping - no, it’s knowing where your idea is invalidated, and being cognizant enough to accept that you’re wrong.

2023 Technology-Wise Industry Outlook

Above is a picture of the general adoption curve of technology in the 21st century. I believe that we’re currently at the chasm. It is a nasty area to be in - the best parallel I can draw is the post-Dot-Com bubble of the 2000s. That was a time when the technology seemed dead - it is quite literally, a demand-less void where people all around the world just don’t believe in it anymore.

This is where ideas either prove themselves, or die.

I believe the next decade will be the defining decade for Web3 Technology. And I evidently don’t think it’s going to die - I think that the case for De-Fi is clearer than ever.

But above all, what drives my bullishness in crypto is because an ever increasingly digital world needs an ever increasingly digital economy. It just makes so much sense that you’re able to access your bank account on your browser, instead of through your credit card. Or to own a digital asset that correlates to something you own in real life. Or to just use a financial system that isn’t entirely filled with red tape and difficult policies.

I could really go on and on regarding this point, but to summarise: Crypto most definitely has a use-case. At this point, the problem lies in trying to convince the world after our massive PR failure.

Technology-wise, I’ve made a bunch of predictions for fun, but I don’t really like what I’ve come up with. I think instead it’s more pertinent to focus on what I’m really excited for / want to see in 2023, which is:

The emergence of phygital assets

The bridging between Trad-fi and De-Fi, whether be it through infrastructure, or introduction of basic digital products

Use-cases of $FRAX (I have very high hopes for this product)

Building out the $TON network (also quite high hopes)

More efficient decentralized exchanges

Synthetic Stocks introduced on the blockchain

An actual, widely used payment system that allows me to buy products with my Metamask

Undercollateralized lending becomes more built-out

DAOs find a better way to structure incentives than just leaving it all to the “community”

More financial primitives but with better structure and more real-world impact (i.e less money markets with high APYs to bootstrap liquidity, but instead more Maple Finances that actually connect lenders with borrowers in need)

Real-world endpoint for crypto (i.e similar to last point - crypto actually helps people in the real-world)

I could again list on a lot more, but for the sake of brevity I will stop here. I think that as individuals, the actionable alpha here is to learn as much as possible, and to leverage the fact that you are early in terms of how far adoption has to go. Use this time to build your audience, and if you’re really invested in this space, you can go as far as to build your career around it as well.

Concluding Thoughts

I’m honestly excited to see where we will go in 2023. Crypto is anti-fragile, and I believe that the mistakes we’ve made will enter our collective history and make the space a better place. And I think what’s cooler to think about is that there’s probably tons of use-cases that haven’t even been thought of, that are just waiting for someone to unearth them. Just like how someone thought of bringing a JPEG on-chain, someone will eventually think of “the next big crypto thing”, and that excites me.

Till next time,

Kyle.