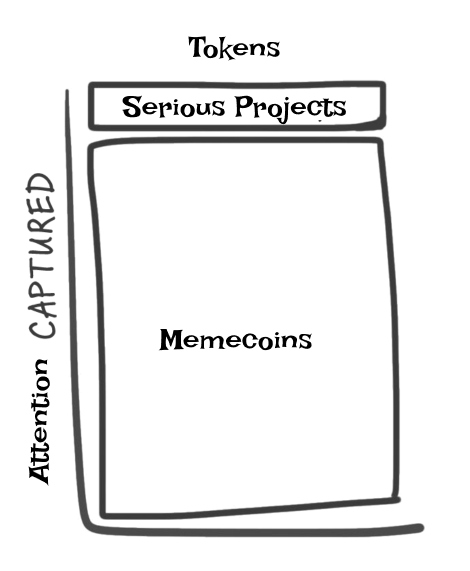

Out of all the speculative assets in crypto, memecoins are THE most speculative. If I had to draw it out on a chart, it’d look something like this:

This is crazy to me because even the left side of crypto - BTC / ETH / your L1s / alts, is already considered highly speculative relative to traditional investing.

Tell any tradfi you’re buying Bitcoin - they’ll think you’re some Gen-Z Zoomer who knows nothing. Even after the Bitcoin ETF, I’ve had friends going to digital assets conferences hosted by big traditional banks, telling me that the attendees were convinced this would “all get shut down soon”.

Yet, this week we’ve seen the following:

BOME presale, where you could put in 10k and turn it into 1 million at the top

This caused presale mania, where someone even sent a few million in SOL into the burner address, causing presales to go insane about losing money (the token then mooned, which of course it did)

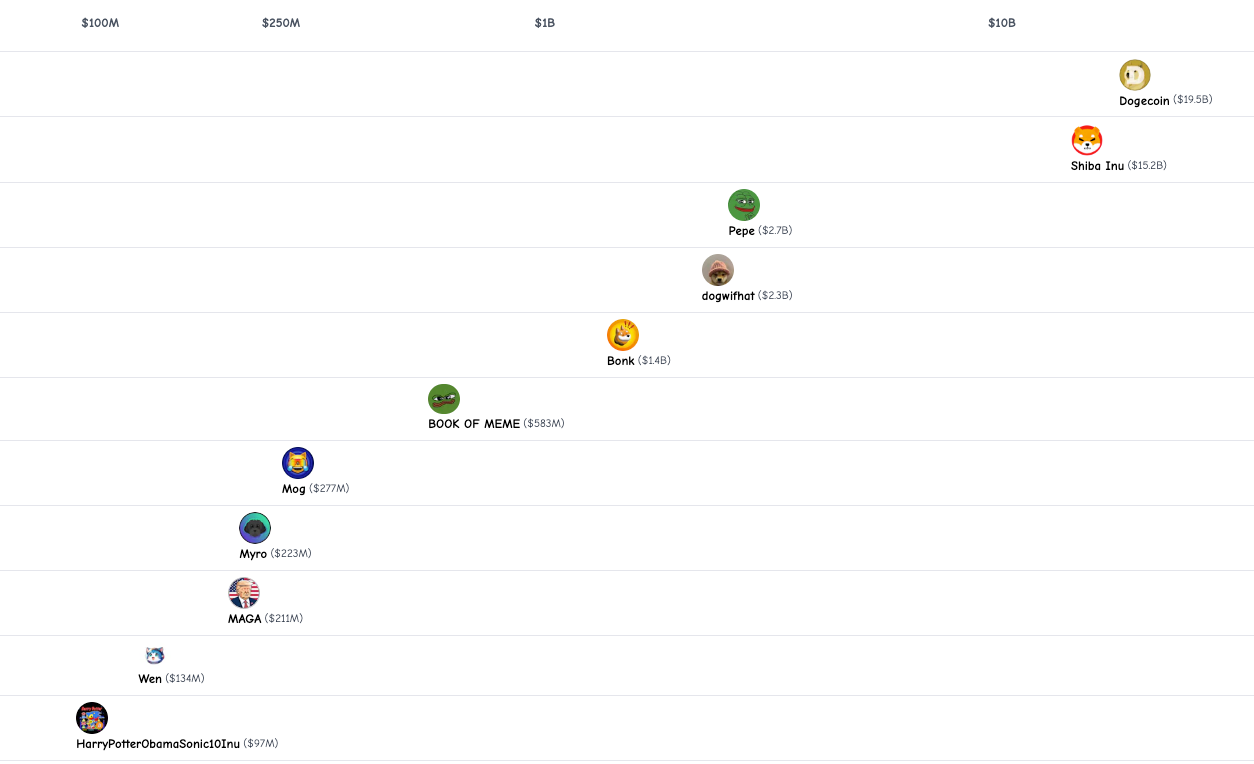

And before that, you had general memecoin mania - with WIF / PEPE / MOG / memes on SOL/memes on Base

Memecoins are traditionally a sign of “top signals” in previous market cycles because they indicate an extremely high-risk appetite - something that tends to come only after price has gone up to a point where people feel “invincible”, and that “there is no more bera market”.

Combined with the FOMO of people who missed the entire move up and seeking profits, this creates a cesspool of coins that instantly gratify you - you either make a lot, lose a lot, and you move on.

So - why are memecoins so prevalent in this cycle, even in the early stages? What does it mean - and more importantly, what is the thesis behind it?

The Memecoin Thesis

Memecoins are in a league of their own. They do something better than every other crypto asset - and that is, they can go up an astronomical amount.

L1s go up 10x? They go up 100x. They are designed to be the most reflexive asset on the planet. That reflexiveness works on the downside too, of course - but we shall not talk about that

Philosophically, I believe that memecoins work because they don’t promise anything. With any other crypto project, things must be promised for the price to pump. Roadmaps must be made, deals struck, raises done - and memecoins are the antithesis of all that. They simply exist.

That in itself is a double-edged sword - if a memecoin somehow gains traction in this attention casino, it can find itself gaining size with the snowball effect - but this also means that when the inevitable correction happens, and attention dies off - it can make or break a memecoin.

Many memecoins then go to zero after that initial run-up - see JOE / SPX / any memecoin from last cycle. The worst part is, they’re so easy to make - and there’s so many of em, that it’s hard to bet on the winning horse. Memecoin traders often find themselves spraying and praying.

So - with this, I hope I’ve painted a clear picture of the true volatility of memecoins. A class of tokens that are easily reproducible, hard to bet on winners, and when the winner does emerge, may find itself losing steam as quickly as it gained it - the market is fickle, after all.

And now, you’re probably thinking: Kyle, this does not sound like something I should even touch with a 10-foot pole. And you’re probably right - but I want to put this in context of the 2024 Cycle.

Memecoins in 2024

We’ve seen something quite amazing in this cycle - the emergence of memecoins so early on in the cycle as a prevailing narrative. Recall what I said above - memecoins were traditionally a “top signal” and a sign of frothiness in the markets.

This time, we got them in the very beginning, and anyone who took it as a top signal would find themselves sidelined for most of the rally. Why this happened is anyone’s guess - late stage hyper-capitalism / financial nihilism that prompted a more hyper-gamble attitude; who knows?

What matters is what this means. Crypto is by an attention market, and you always want to buy what has the market’s attention. In this cycle, we’re seeing that memecoins stick. Not all of em - but the ones that have staying power look poised to become the DOGE/SHIB of this cycle.

It should be emphasized that not all memes are created equal. Again, in this hyper-attention-optimized game of memecoins, you cannot expect long-term outcomes for short-term coins. It is prudent & necessary only to have long-term views for long-term memecoins - as stupid as that sounds.

I genuinely believe that PEPE and WIF are great in this regard. There is a chasm that every memecoin has to cross - the chasm that I mentioned above, where they gain in astronomical value, before crashing to 0.

PEPE and WIF have shown to have crossed that particular chasm, so betting on winners here seems like a clear trade idea that I’d like to take.

This thesis is extremely fundamental driven, and can be simply boiled down to:

These two memecoins have shown to drive the most attention, and attention on memecoins are a positive flywheel that goes upOnly

There is still a 5x to catch up to SHIB

Risk of trade wise - wait, are you seriously asking me the risk of a trade of a memecoin? Memecoins are extremely hard to put a technical stop-loss to, just because of the insane volatility. You’d find yourself shaken out multiple times before you could build a substantial position size.

The best I can do is approach this like any other fundamental trade, and think of the SL in terms of the thesis - in this case, a bearish scenario would be if attention fades from WIF / PEPE and people no longer care about the meme. Unfortunately, this practically means “I am wrong wen coin is zero” because attention correlates with price.

As you can see, betting on memecoins is generally hard when you try to approach it with a legitimate process with defined boundaries, because the volatility of the said asset would smash those boundaries into a million broken pieces.

Ultimately, you kind of unironically have to turn off your brain - “left curve” it, as commonly said in crypto-speak. So once again, for the people in the back, the thesis is -

Memecoins rising early in the 2024 cycle shows that it might be mainstay and no longer frothiness - but a genuine narrative

This gives it better r/r, and longing the memecoins that crossed that chasm for long-term catch up play to DOGE / SHIB boosts those odds

No leverage, spot accumulation over the cycle - don’t get shaken out, nor try not to think too much about it. Just continuous buying of the dip

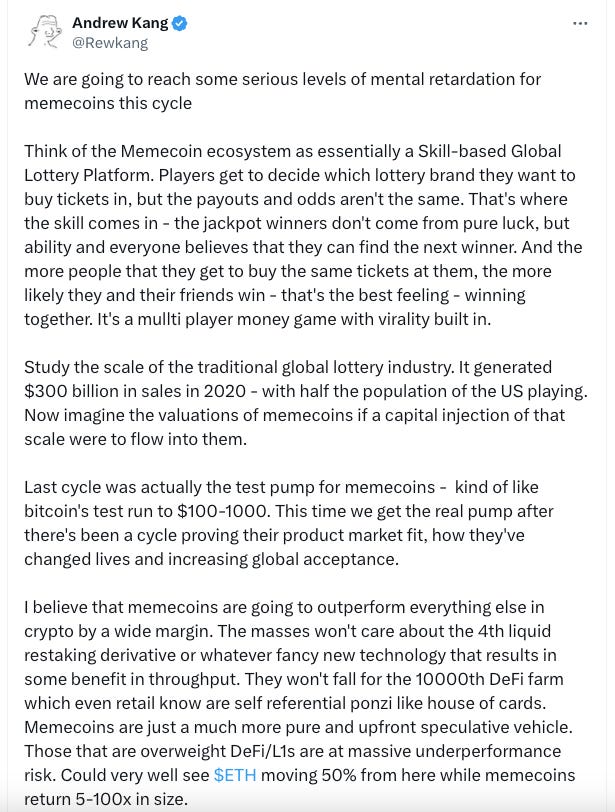

Lastly, Rewkang has some genuinely good tweets about memecoins you can read here:

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.