$LMR- The Bitcoin Hashpower Marketplace

Deep Dive Into Lumerin: Funded By Coinbase Ventures, Fenbushi, and more!

Henlo. Today I bring to you a project I’ve been looking into. Hope you enjoy this report with a cup of coffee or something~

Disclaimer is at the bottom, but I do hold tokens in this project.

Introduction

Overview

Lumerin is one of the more interesting projects that spun out of the bear market. Launching in March 2022, they’ve grown to be a $50M marketcap project with not much advertising. Their product is simple - they view hashpower as a commodity and are building a decentralized marketplace to buy and sell hashpower.

Hashpower currently lacks an effective and transparent means of trading - the Titan network introduces a new protocol for provable hashpower. The result is a platform that can trade hashpower.

Lumerin assures that the hashpower participants are trading is real by using hashrate oracles, and they aim to eventually decentralize the entire process in which this is done.

Like all protocols, I want to focus on the problem it solves so that we can evaluate whether we’re dealing with a good product. Let’s dive in.

Problem It Solves

Lumerin seems more like a B2B solution than a B2C solution - individuals themselves wouldn’t be too interested in buying hashpower, I feel. So here are the arguments as to why miners would use this product:

Buyers:

Risk Mitigation

It allows miners to hedge against market volatility and the fluctuating value of cryptocurrencies. Miners can use hashpower futures to hedge against the risk of future price fluctuations in their koins. By locking in a price for their future hashpower, they can mitigate the risk of declining prices.

Cost Efficiency

Selling hashpower can help cover operational costs, such as electricity and maintenance, making their mining operations more sustainable.

Miners located in regions with particularly high prices may never be able to run a sustainable operation. In that context, it may be more convenient for them to buy hashpower from another miner in a cheaper location than mining at high costs themselves.

Keeping Up With Difficulty

Large miners can take advantage of instant, remote, and on-chain hashrate acquisition to keep up with higher mining difficulty in real time, maintaining their competitive advantage until they can expand their physical operations and install new hardware.

This enables them to remain competitive without having to wait for manufacturing and shipping of new machines.

Sellers:

An Additional Revenue Stream

Selling excess hashpower provides additional income, especially during periods when mining profitability is low. This will provide miners with more predictable revenue streams, reducing their exposure to both crypto market volatility and fluctuations in mining difficulty.

Hedging Against Bitcoin Volatility

Keeping the treasury solely in Bitcoin is a double-edged sword, and it can have catastrophic consequences during a strong market correction. In that regard, miners can split their revenue into two different BTC and LMR streams to mitigate Bitcoin volatility risks, meanwhile building a tokenized hashrate reserve to boost their Bitcoin mining capacity when needed.

Tokenomics

Total Supply: 1 billion | Market Cap: 49.5 million | Circulating Supply: Unsure

Price: $0.04751

Supply Breakdown:

Team: 47.6% (25 + 22.6)

VCs / Insiders: 23.1% (8 + 15 + 0.1)

Public: 4.3%

Miners: 25%

Pretty subpar tokenomics. Generally, tokens being vested each month create a source of supply that will constantly be dumped on the market.

Thesis & Risks

Thesis - Why Can Lumerin Succeed?

ICO Won’t Dump On You

It’s lower than the ICO price of 0.45 USD per LMR currently (https://icodrops.com/lumerin/). This is a double-edged sword, as it could also mean that this coin is cursed to permanently not pump beyond a certain price due to bagholders offloading at every pump. That would suck.

Team Is Pretty Stacked

Ryan Condron - Co-Founder:

Started Bitcoin mining in his garage since 2012.

Created the 1st profit-switching mining pools

CEO of Titan (for-profit mining company)

Jeff Garzik - Partner:

Core dev for Bitcoin that supposedly received code from Satoshi.

Created one of first $BTC mining pools

I’m not sure whether the venture firms involved are notorious dumping bandits, but I’d say that some names like Titan and Coinbase Ventures are generally in it for the long term. Also, I’ll highlight this point in the risks section, but having a good team is makes or breaks this product, imo.

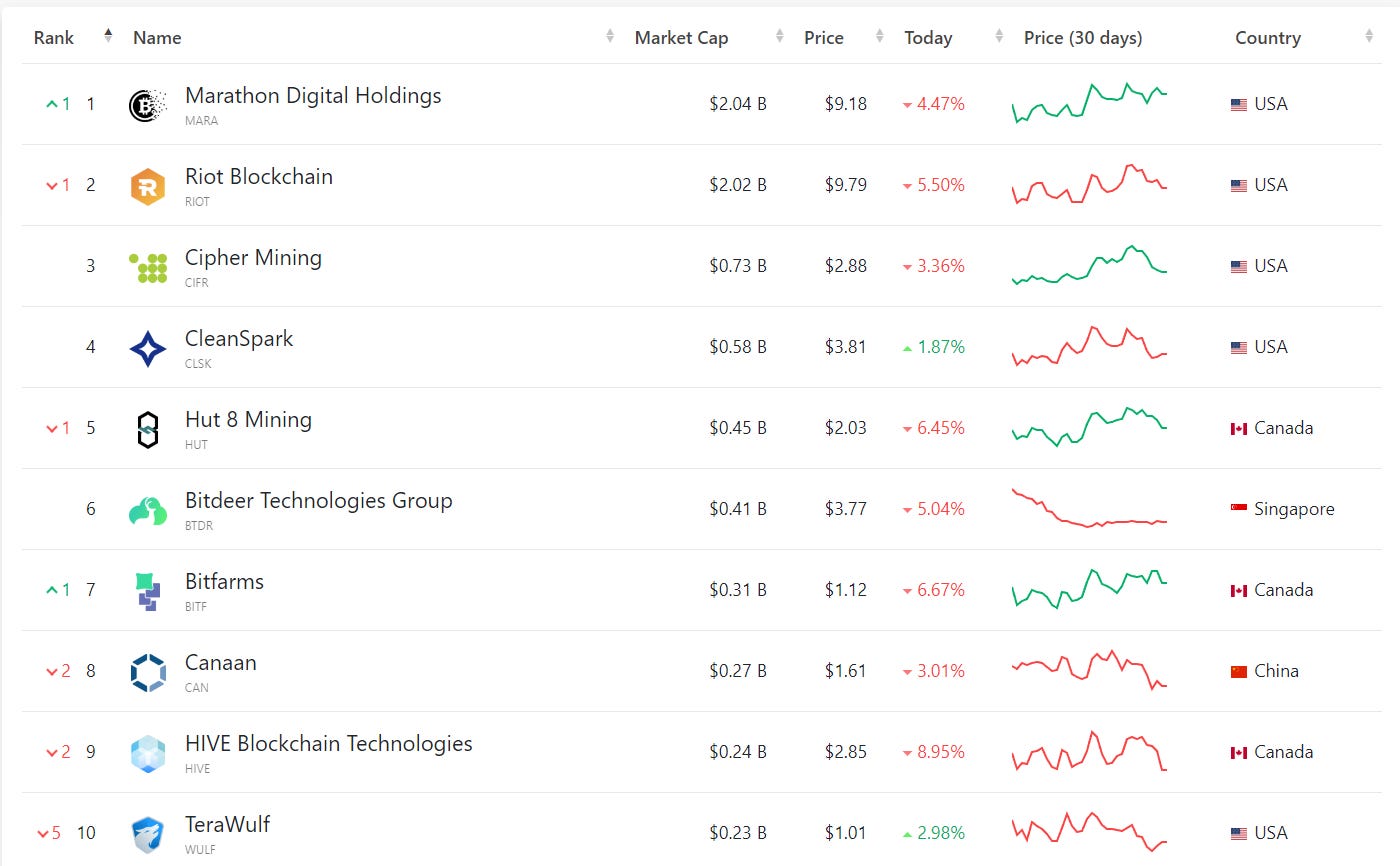

From what I’ve seen in my research, Hive and Bitdeer are also #9 and #7 respectively on the list of Bitcoin miners by market capitalization. This is bullish.

Bitcoin Beta On Chain

Like I mentioned earlier, miners generally outperform Bitcoin. This cycle so far has been focused on “Bitcoin”, due to the BTC ETFs being filed. While I doubt that people use LMR as meaningful exposure to Bitcoin, I think that it can be viewed as an underlying speculative bet on Bitcoin.

Asymmetric Risk On Long Term

I feel that Lumerin has the potential to give asymmetric r/r if it does deliver. The potential of creating the first market that trades one of the most important commodities of the future (hashpower) could have divine implications that would warrant a mass re-pricing.

Obviously, this is a huge IF - but with Titan, Bitdeer and Hive, I like to lean on the side of positives. Their catalyst roadmap looks promising, with Q1 2024 looking good.

Risks - What Does Lumerin Need To Succeed?

What it needs to succeed conversely also becomes points of failure when it doesn’t come through. While Lumerin isn’t the first of its kind for these sort of products, I’d say that it’s one that has

Caught the attention of CT

Has quite an incredible team

Has been building through the bear market

Any investor knows that it’s not so much about the product - very rare do you get to invest in “firsts”. Rather, it’s about the people leading it - and so far, Lumerin has shown their hand in this. Generally, I favor any product that has been building in the bera - it shows long-term commitment, which is the foundation for success.

Moving on, I think that these are some factors that you should consider when evaluating whether this product can succeed:

It Needs Strong Partnerships

As an exchange, the product really only finds PMF once it gets validated by users using it. Just imagine this headline: “Biggest Bitcoin miner sells Hashpower on Lumerin”. You just know that immediately validates the product as a whole.

This is probably the biggest risk in this trade - any failure to gain traction will spell doom for the product. On the other hand, you also know that Titan, the CEO’s Bitcoin mining company, will probably be onboarded. So that’s a boon for the thesis.

It Needs Revenue To Show Growth

Another driver of numba go up is your trusty “revenue driver” - a key schelling point for any crypto product this cycle - especially when it comes to “real-world products”. This product doesn’t sound very short-termish, so I’d expect initial numbers to be quite lackluster, which is a headwind for speculation I’m sure.

Tokenomics…

You can’t change this, but it’s important to have good vesting dates with not too much “vc dumperinos”. Traditionally, low float and high FDV coins tend to do well - and going into the bull market, you’d want as small as a market cap as possible for the pamp.

I’d say that the tokenomics aren’t necessarily facilitating of a pump, and in fact lie more on the predatory side, but since its a product that warrants long term thinking, I can only pray that the people involved are in it for the long haul.

However, if you want to err on the side of caution, you’d best be assuming that everyone involved can and will be dumping immediately.

It’s important to understand that I’m arguing from the PoV of what makes “coin go up” - and that, most of the time, deviates from the actual fundamentals of the product. An announcement like in (1) will be extremely bullish, even if the actual use-case still needs half a year for the company to be onboarded.

Technicals

There’s not much to discuss here, LOL. The chart is uponly, and clearly is a relatively fresh chart (Aug 2023). It may have 5x’ed from the bottom, but remember - if you’re always worried for people who got in at a better price, you’ll never buy anything in crypto.

Verdict

My honest opinion: It’s not a bad product, and I think it really has potential. I wouldn’t go balls to the wall on it, but I’d think that it’s one of the better products you can bet on with such a strong team and background.

The issue here is this: Very simply, this product is an exchange. Like Binance, like FTX - and all exchanges need users. Ultimately, if it can get users - great! If not, it’s doomed to fail. While you can make this same argument for every d-App in the crypto space, Lumerin is tackling a particularly niche space. Bitcoin hashpower isn’t exactly the greatest narrative - unlike AI, it’s really not consumer friendly.

Possible Outcomes

Is there a world where this doesn’t succeed at all?

That would likely mean either:

Product fails (Team abandons, etc.)

Interest in Bitcoin wanes and we get a bear market

People just aren’t interested in on-chain Bitcoin

This is purely just numbers off of the top of my head, but I’d say the probability of each respectively is <10%, <5%, <15%. I don’t think the team will abandon ship, neither do I think interest in Bitcoin will wane with BTC ETFs. I think that there is a chance no one bids Lumerin despite the good product, but it’s not a huge number.

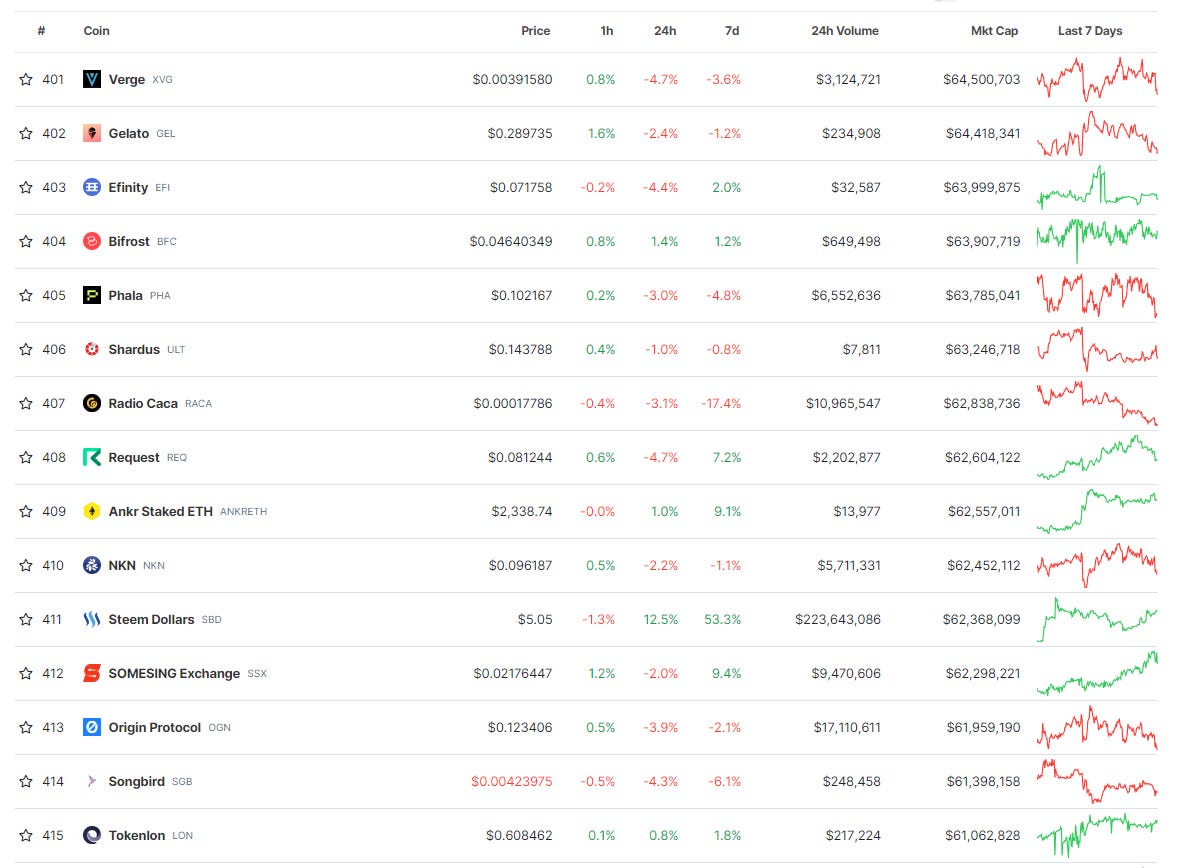

>50M mcap?

When in doubt, consult projects that are > 50m mcap. A vibe heuristic, as I call it. I don’t really know what all of these tokens do, so I’m leaning on the side of - yes, this project can probably go higher from here.

Execution

Well,,, the trendline does look good. I think spot DCAing isn’t that bad of a plan, and get in an amount you’re comfortable with. Like I said, we’re still near ICO price, which isn’t that bad of a time to get in.

The more important consideration is sizing - how much should you size in this? Personally, I like to size a number that fits in my conviction. In this case, since I’m not highly conviced unlike Rollbit or Solana, it’ll definitely be less than 20%. I’d say 5-10% is a reasonable amount - at 50m, a 6x to 300m at 5% will be equivalent to 30% of your portfolio. Decent returns, percentage wise.

Well, that’s it! I hope you enjoyed this report, and if you have any thoughts on Lumerin, you’re always free to DM me on Twitter ; I’ll see you guys next time!

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.