DISCLAIMER: The information contained in this newsletter is for informational purposes only and should not be considered financial or investment advice. Any opinions expressed in this newsletter are solely mine.

Welcome to Week 13 of my newsletter! I have an announcement: I’ll be taking a break from April - Aug 2023 because of the compliance regulations regarding my internship over the summer! I won’t be allowed on Substack, so I’ll miss you guys :(

But worry not - in the past 13 weeks, I’ve slowly iterated how I do my weekly market colour reports for what I’m planning to push out post-August. I want my substack to be a space where I enjoy what I write and add value to all your lives. As the market revives, I want my substack to be a place full of alpha and actual helpful knowledge that helps you make better decisions in this game we all know and love.

Executive Summary 📝

It’s so embarrassing that last week I pushed out a substack where I was so confident in another rally, and just 3-4 days later it subsided completely. Since then we’ve seen a sharp drop in price and sentiment was all around bearish, with me mentioning that it felt like the market was “waiting for a ball to drop”.

On a HTF basis, it looks like we’ve entered a new range. As you can see, the weekly close has created a nice range for us to trade in - invalidations of a rangebound idea will obviously be a weekly close above/below these prices. If we were to retest the lows, I’d suspect we target 24k to fill the illiquidity in the market on the weekly.

There’s nothing too exciting to highlight in this week’s markets. Lots of influencers have retreated, with my patented Hsaka Indicator showing that the white wolf has gone back into hibernation. “Touch grass” has been the quote of the week.

But since this is the last market update till August, let me elaborate more on what I think we might see in the coming months. First, let’s get rid of the elephant in the room. I think there’s an extremely low chance that we see new ATHs this year - with less liquidity and less risk tolerance on the table, we don’t have the right conditions to push for new highs. Not to mention the industry is now in a precarious spot, regulation-wise.

Is the echo bubble over? Well, that’s a lot harder to answer. Firstly, an echo bubble implies that this current market has the capacity to go “pop” and bring us all along with them. Probabilistically, I think it’s highly unlikely we retest the 3AC lows of 16k/900, because too many people are “waiting for those prices”. As I’m sure we’re all aware, the market rarely makes it so easy.

But like everything in the market, always have a plan IF we do. And the plan is, well, smash the green button if we get back to those prices.

I definitely think there’s a more likely chance we retest 24k. As to when - I’m not sure. If I could predict the future, I’d most definitely be retired by now. But I’m leaning more on the side of the bulls - I think that it’s possible to see one more leg up towards 35k, before going back down to 24k and accumulating until the next cycle occurs.

Again, this is not a prediction. I’m simply identifying the possible scenarios that we could see happen, assigning probabilities to them, and acting accordingly. But the reasoning behind my thesis is clear - apart from a clean technical chart, we’re already starting to see the Fed slow down.

With FFR heading towards an inflexion point, I think we’re bound to see some bullishness. Take note - I’m no macro expert, but I’d like to think my edge lies in reading human sentiment and being able to forecast attention flows. In the past year or so, the market has been extremely focused on what the Fed is doing - it stands to reason that once the source of uncertainty announces a reduction/limit on the hikes, the market might react positively.

But between these two key swing points (24k / 35k) that I have identified, 99% of the time price will be rangebound (duh). In the past 6 months, there have basically been two types of conditions for rangebound conditions:

Crab and boring

Crab and fun

The first is what we saw post FTX / 3AC, and the latter is what we saw in January and last week (for like 4 days). I’d like to believe that more time in the coming months will be spent on the latter - in which case, engage your “long at range lows” build and act accordingly.

Market Narratives

Like, it’s been the same for the past 4 market updates guys. But here’s some alpha:

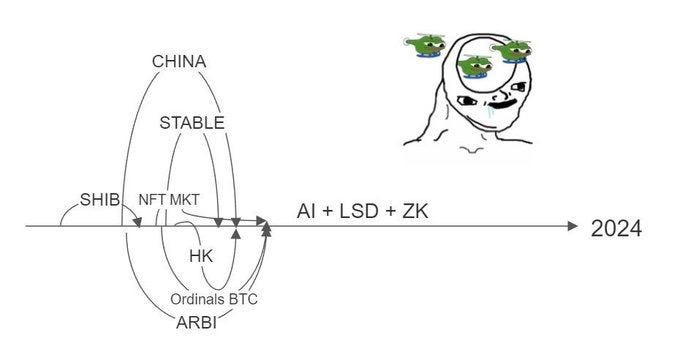

And those old coins will probably be the ones that we’re all trading right now. It really is the same ol’:

On-Chain

This is a new section that I want to add and elaborate more on in August. If you remember my humble beginnings back when I was 0xfren, I was wayyy more of an onchain person (I still am).

Current market conditions on-chain are way better than previous months, and here’s the full list of projects I’m meant to do DD on:

Memecoins are also popping off, but they rely on speed and attentiveness - two things that I, as a student, cannot afford to give. But if you’re interested, I’d highly suggest building a wallet tracker full of addresses that first ape into your favourite memecoins.

Concluding Thoughts

Well, that’s all for this week’s newsletter. Let me know what you think below, and any constructive criticisms that you might have!

See you guys in a few months. <3, Kyle

thank you so much for your alpha! You told few months that means this is your last post?

Been a great read the last few months, I hope the momentum you've built isn't lost while youre gone!