How I'm Playing This Market

This is definitely the most difficult period in markets thus far

Gmeow, here’s a q2 update for how i’m adjusting my playing style for crypto markets. It’s been a very tough year, and the game has been getting exponentially more difficult since 2021; this article serves to help me structure down how exactly i’m playing this, and I hope in the writing of this you can get some insight too.

long disclaimer inc, rest of the post is below:

Disclaimer

This content, which contain opinions and/or information related to any products, services, tokens, or projects, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or to be regarded as an endorsement of any products, services, tokens, or projects. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. Investments in any products, services, tokens, or projects involve the risk of loss. Past performance is no guarantee of future results. You should always consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

Views expressed are my own

The commentary in any of my posts (including but not limited to those on my blog (https://0xkyle.substack.com/), and social media (https://x.com/0xkyle__)) reflect the personal opinions, viewpoints, and analyses of myself only, and should not be regarded as the views of my employer DeFiance Capital or its respective affiliates. Commentary on any projects, protocols, companies or other subject matter discussed in my posts should not be taken or interpreted as an indication that DeFiance Capital holds any interest in the subject matter discussed. Neither DeFiance Capital nor myself will be liable for any actions arising from assumptions made with respect to myself or DeFiance Capital based on my posts.

Views expressed are not investment advice, endorsements or recommendations

Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by me. I may invest in any of the projects, protocols, companies or other subject matter discussed without obligations to inform or disclose such investments to you, the reader. The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular product, service, token, project, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any product, service, token, or project mentioned. Nor should it be construed as an offer to provide investment advisory services by myself. Any mention of a particular product, service, token, or project and related performance data is not a recommendation to buy or sell that product, service, token, or project.

Statistics are only informative

Any charts provided here or on any of my personal platforms are for informational purposes only and should not be relied upon when making any investment decision. Any indices referenced for comparison are unmanaged and cannot be invested into directly. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Information in charts have been obtained from third-party sources and data. While taken from sources believed to be reliable, I have not independently verified such information and make no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, posts may include third-party advertisements; I make no representations of having reviewed such advertisements and do not endorse any advertising content contained therein. All content speaks only as of the date indicated. The information provided here (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information.

Advertisements

I may receive payment from various entities for advertisements on my blog or social media from time to time. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith by me. In addition, any mention of a particular product, service, token, or project and related performance data is not a recommendation to buy or sell that product, service, token, or project.

I DO NOT WARRANT, ENDORSE, GUARANTEE, OR ASSUME RESPONSIBILITY FOR ANY PRODUCT OR SERVICE ADVERTISED OR OFFERED BY A THIRD-PARTY WEBSITE, AND I WILL NOT BE A PARTY TO OR IN ANY WAY MONITOR ANY TRANSACTION BETWEEN YOU AND THIRD-PARTY PROVIDERS OF PRODUCTS OR SERVICES. I SHALL NOT BE LIABLE FOR ANY DAMAGES OR COSTS OF ANY TYPE ARISING OUT OF OR IN ANY WAY CONNECTED WITH YOUR USE OF THE SERVICES OF ANY BROKERAGE COMPANY.

As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

It’s the best month of May for the market since 2000s - yet, it feels exponentially more difficult

Last month was the best month of May for markets in the past 25 years. While intuitive (crashing prices = more room for upside), capturing it seems to be a different monster entirely. In fact, if you ask me, it doesn’t FEEL like it’s the best month of May - there seems to be a massive dislocation between what sentiment, and what the market has returned since Liberation Day (April 2nd);

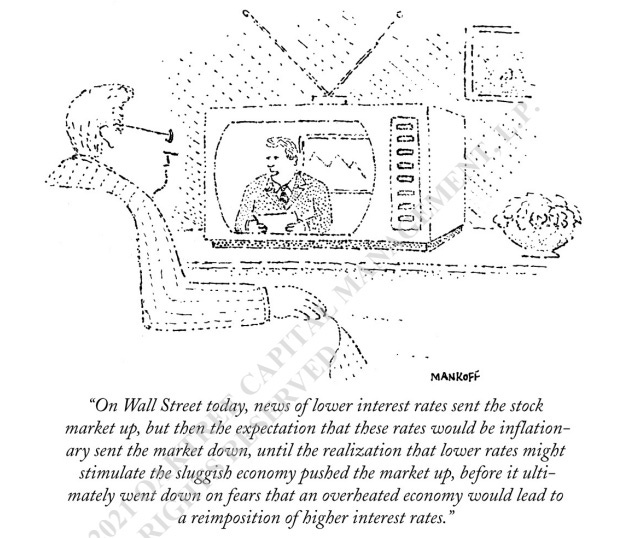

This is because we’ve been observing levels of uncertainty and volatility in the markets unseen since, well, the last time Trump was elected. Trump is basically uncertainty incarnate - he chooses to tweet market-moving news on Friday nights when markets are closed, he tells people that “it’s the best time to buy” (and the stocks actually move up), and everyone is just sitting on the edge of their seats waiting for the next Truth Social bomb (everyone gets a tariff!)

Words cannot really describe how shaky the markets have been. I remember on Liberation Day, most people were calling for new lows - many macro traders were firmly bearish and felt that it was Great Depression v2. Smart money everywhere was calling to be in cash - I bet that if you went back in time and told these people that S&P would V-reversal back post April, few would actually believe you.

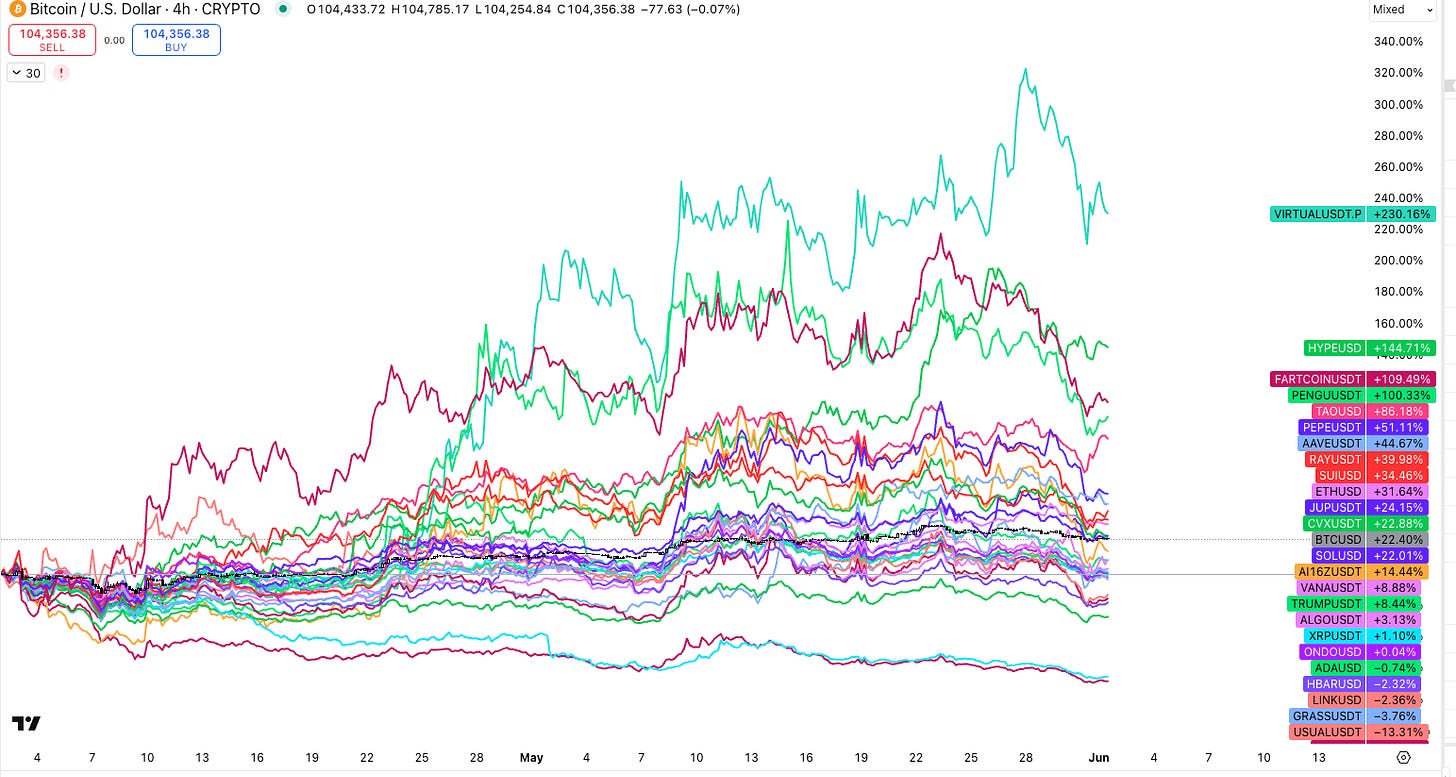

And if you look into our very niche internet bubble, we can see that it’s difficulty squared. Why do I say this? If you look at the spaghetti chart of different tokens that have outperformed Bitcoin (I probably missed quite a few), you can actually see quite a few high profile names that have done well. On the surface, it may actually look like it was pretty easy to outperform, right?

Well, no - this chart measures the returns since April 2nd. However, many forgot that prior to April 2nd, many tokens drew down 60-80%. Take Hyperliquid, for example. From February to April, Hype basically had a 60% drawdown to $10~ before it rebounded back to ATHs.

My point is as such: Volatility is immense right now. Hyperliquid is by no means a niche, obscure name - yet despite being such a popular long, investors would likely have suffered a sizeable drawdown in longing this. The returns shown in the spaghetti chart forget to account that no one times the bottom, and that in this era of investing, path dependency is a bitch.

Case in point: Myself; I bought Hype at $18, thinking it was a pretty value buy. I had no idea of knowing that it would bottom at $10 - I was just thinking that below $18, it was a pretty fair buy and was willing to DCA downwards. Of course, it went to $15 - I was fine. It went to $12 - I was fine. And then Jelly-Jelly hit it - if you don’t know what happened then, here’s a link to a short synopsis by Coindesk. And then it went to $10, and at its lows of $9, that was a -50% drawdown I took, on a $6 billion market cap token.

Now, I know that many of you reading this are going like “yea, but it’s crypto, you gotta expect a 50% drawdown” - well, when you’re sized heavily into a coin, expectations and seeing it happen are two different things. The past month has forced me to re-visit how I’ve looked at the crypto markets thus far, and re-evaluate how I have to invest moving forward.

This article is sort of a letter to myself as well, to internalize what I’ve learnt and how I will approach the markets in a new manner.

Strategies & Lessons

Let’s start with empirical observations that I’ve observed about the markets

Path dependency is a bitch.

In the past month, we can see that tokens, stocks, etc. can all drawdown huge amounts before making new highs. I.e A stock/token could, as in the case above, do a -50%/60% drawdown before rebounding back to new highs.

This is a problem, because prudent risk management dictates that you should have a price level at which your thesis is wrong - i.e “if price hits X level, I will cut my losses”; of course, this depends on the type of trader you are - and I believe this is my Lesson #1: I made the mistake of looking at price while being a thesis based investor. This means that instead of having a price where I’m wrong, I should look purely at the thesis and have an invalidation for the thesis; e.g in the case of Hyperliquid, it might be something like “Hyperliquid fails to show growth in total Perp Dex volume over time”

This is probably highly contentious and very, very context-driven & up to the individual. What works for me will probably not work for you - but I believe that this is the right way for me to navigate such markets. What I’m saying is that I should learn to accept the volatility that will come from uncertainty - i.e accept and embrace even more volatility that will come in the future, and underwrite it based on thesis instead of having price based stops.

The otherside of consequence of this is, of course, that price always acts first, and data takes time to come in. By the time data comes in, the thesis could have collapsed. The second consequence is that this is a pretty bull-headed tech that completely ignores the perils of macroeconomics and is probably quite frankly, surface level stupid way of investing.

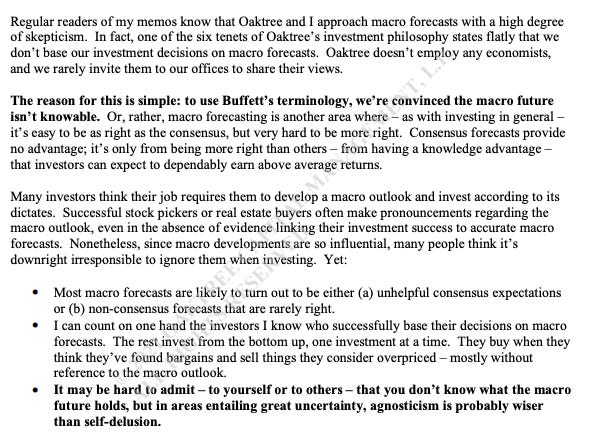

But then I’m reminded of the above tweet, plus in Howard Marks’s Thinking About Macro memo, he writes:

Working from first principles, I believe this approach suits me as I don’t pretend to trade around a subject I don’t know much about (macro), and I simply base my investment decisions on structural fundamentals regarding a token. This aligns with 1) sticking to what I’m good at, 2) me getting chopped up trying to align macro policy with bitcoin price, and then bitcoin price with altcoin price (btc down, alts down)

And at the end of the memo, Howard Marks concludes with this:

Which leads me on to my next point:

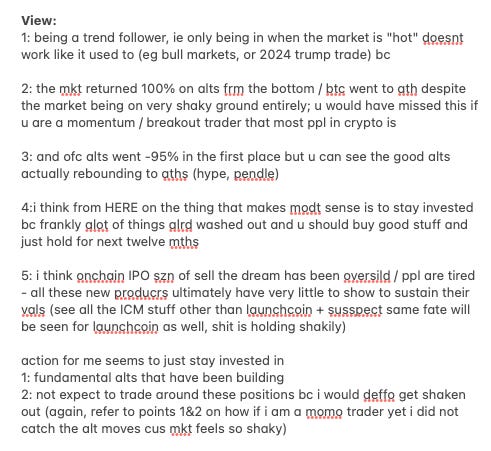

Alt season doesn’t exist anymore, we cannot compare to the past ; staying invested matters more than anything

Simply put, my lesson here is that I have realised that being invested matters more than anything now. To be honest, many in crypto including myself are more momentum traders that rely on Bitcoin breaking ATHs and getting that wave of “altszn” upon us, where everything goes up. However, I believe that paradigm simply doesn’t exist anymore.

The alt season we saw in the month of May turns out to be a wick as many alts have retraced. However, I would like to point out to Hyperliquid who’s still up 3-4x from the bottom - while of course an outlier, the lesson here is that if you were only planning to trade in “hot markets”, you’d probably miss this entire rally - because there were no usual signs of frothiness that you’d expect seeing Bitcoin rip new highs.

This is another mistake I made - to always reference 2021 in expectations of alt seasons. It’s good to have history, but it’s bad to keep using history as a benchmark expectation of what’s to come. It’s time to start with a fresh slate - and as such, I think “the old ways” of only investing in “hot markets” (i.e alt season) are kind of a figment of the past. Instead, it’s more important than ever to stay invested in indivdual coins, to do due diligence on singular projects, instead of having broad based “narratives” or “metas” that we’re so used to having.

Of course, hot markets still exist in crypto (i.e the whole ICM meta); however, they shouldn’t be thought of as the norm - if not, you’d wait the entire year for this short ICM meta that lasted 2 weeks to make money. It’s not a very consistent nor outperforming strategy if you ask me.

It’s time to be more aggressive while underwriting longer time frames now; and find singular good names

This idea of aggressive / defensive has served me well in helping to navigate the crypto markets. In January of 2025, I was highly defensive when I saw prices just skyrocketing - and now, I believe that it’s time to be more aggressive. After the -80% across the board in many on-chain coins and the drawdown in most alts, we’ve had a nice little rally - and while many coins seem to be pulling back now, I believe that it is time to change the way I invest.

When I say it’s time to stay invested, we cannot just invest into any old thing. This is where this lesson comes in - it’s time to underwrite longer time frames, on good coins. Underwriting longer time frames is important because there are many “potential Hyperliquids”, but none have reached the same level of revenue generation just because they simply don’t have as large of a traction yet - a good case in point is Pendle - you can read Modular Capital’s thesis on Pendle here.

I’m not going to cover it, but the idea is that there ARE good tokens out there with strong product moats that may not have huge amounts of revenue yet. Hyperliquid is an outlier because it’s based off of speculation - the most profitable thing in crypto. You can see the same outcomes in AMMs / Trading bots. However, this doesn’t mean that more boring products can’t succeed.

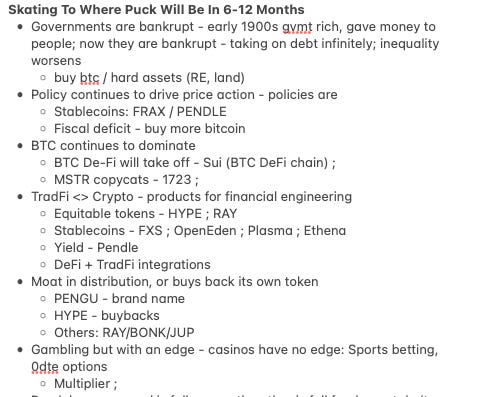

Stablecoins are the largest thing that is coming to TradFi, and as I wrote previously, FRAX is a pretty decent long. Pendle, as written by Modular Capital, is also a good bet on stablecoins, yet it doesn’t show any sign of price outperformance. The key here is that we need to extend our timeframes and position ourselves for the inevitable puck that will come in 6 months.

With that in mind, here are some lines I’m investing under.

In this current market, it’s more important than ever to be highly concentrated in few names. Identification of those names will be key.

Summary

Path dependency is a bitch. Become a thesis based investor, accept volatility and price declines

Market structure is different. Being active only in “alt szn” isn’t a good strategy as alt szns don’t seem to exist anymore - instead, it’s more important to stay invested.

And lastly, asset selection matters. Stay invested in tokens that have distribution or revenue moats. Underwrite longer timeframes to avoid uncertainty / volatility.

Great article 🤝

Thank you for making the article accessible. Great material! I hope you'll return to TG someday.