Market Read 📊

The Bull Market of 2024 has not been an exceptionally easy one to navigate, despite what CT tells you. Many, many people have been caught offside on the meme pump, only select alts are pumping, and perhaps more pertinent for me, is the fact that profits in this market have to be secured quickly.

Q1 2024 and the tail end of Q4 2023 saw ETF inflows coming in hot, pushing BTC all the way from 40k to where we are now, ranging around the 60k-70k region.

The biggest takeaways I have are:

It is not a hodlers market anymore. Rotations exist, and it is extremely important to learn to rotate. In other words, secure the profits, and then choose the next narrative to ride.

This could be seen in the many mini-cycles we had at 60k range so far, and the performance of certain once stellar narratives, such as BRC-20 coins (ORDI / SATS) into underperformers. You also have certain narratives like LSTs vastly underperform the broader market, and really the top “high sustaining” narratives this mini-cycle were just BRCs, AI, Memes and Solana.

Past performing tokens like INJ / SEI were nowhere to be seen - sure, a rising tide lifts all boats, but their outperformance was by no means great.

Accept that you’re wrong, and accept it quickly

I think what comes in a bull market are thesis that go something like “this is X beta, this will outperform” and the pure belief that “everything goes up in the long term”. As such, it’s very easy to fall prey into moving your goalposts when price doesn’t go up in a straight line - first you say this is a pull back, and you add. Then on a deeper dip, you say that the thesis is still solid, and you add more. On the third leg down, you’re underwater and don’t know where you’re wrong.

In a bull market, your trades are often right, but come at the wrong time. THAT’s the key lesson I learnt - my trade is right; of course everything goes up in the end! But timing it is a whole different ball game. SOL Defi season - longing JUP / JTO would have greatly underperformed until very recently. AI post GTC also greatly underperformed, despite any “long term AI thesis”.

As such, it’s important to just accept that you’re wrong fast, and pivot quickly.

Take profits, and take them quickly

Mini-cycles exist, and in this market, when the trend shifts, you’re left with very little time to secure the bag. In a blink of an eye, a position that was up 300% could quickly turn to 100%, meaning you left a huge ton of profits on the table. I’ve learnt this the hard way, watching 5 figure P&L profits literally vanish. The profit-taking this cycle is severe, and so - in the wise words of some guy on Youtube - “I sell not because I’m bearish, but because selling is the only way I can make money”.

Choppy markets are still best managed through spot strategies, instead of perpetual positions. This is more of a “learners point” than a specific market read, if anything.

Perhaps this point is more for myself than anything else. For the fund managers / rich whales reading my newsletter, there is probably no need to touch anything but spot. But if you’re a tuna like myself, the urge to use perpetuals to “add on more size” to your existing spot positions is highly attractive.

Honestly, making a difference between instruments is pretty amateurish, but I believe that my argument for spot > perps personally goes deeper than that - it’s way harder to “don’t sweat the P&L, sweat the trade” when you’re trading on perps. The nature of this market makes it such that not only are the best performing gains made on spot holding, deep corrections makes it painful for you to hold leveraged positions through.

Memes. Don’t let your memes be dreams.

There is really no reason to fade the meme rally unless you’re a fund with a mandate. I admit that I got on the meme rally a tad too late - only entering WIF at around $2, despite seeing it all the way up. I sort of brushed the entire meme rally at the start (when PEPE first 2x’ed) as a sort of one-off trend, but learnt to switch bias quickly after realising how much I’ve missed.

Unfortunately, the real alpha lies in trading memes on-chain, but between juggling a Web2 job and trading, I can’t find the time to degen on-chain 24/7. I do think that if you’re an up-and-coming degen hoping to make it, you definitely shouldn’t fade shitcoin szn - it is and will probably continue to be extremely profitable.

Ultimately, I think my portfolio performance was pretty disappointing - a 5x on the total portfolio at ATHs, but gave more than 50% of that back to the markets. But oh well, the past is in the past. There’s nothing we can do but march forward, and play it better next time.

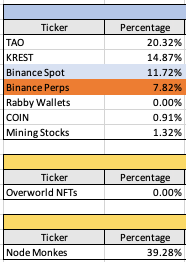

Current Portfolio 💼

I have consolidated my positions even further, and am now sitting comfy on my tripartite of memes, AI, and Ordinals. I believe that this is a cycle where the tech does not matter - no one’s falling for the ol’ ponzi schemes of 2020 Defi Summer, or the “new parallelized EVM” scalability nonsense.

It seems like the wishy washy hand-wavy tech jargon of the 2021 has been “priced in” - the only tech that matters is numba go up. As such, to outperform, one must find narratives that best reflect the numba go up technology.

I find these to be mainly memes and Ordinals. Memes are self-explanatory, but why Ordinals you may ask? Well - do you remember NFT 2021? NFTs were one of the most “numba go up” technologies back in the 2021 cycle - and I have no doubt that NFTs but on Bitcoin are the same thing.

Trades 🖥️

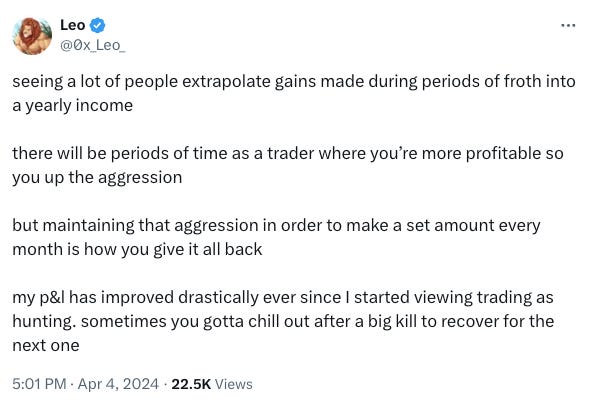

This tweet sums up the lesson I very recently learnt (probably should have included it above); “maintaining that aggression in order to make a set amount every month is how you give it all back”.

I’ve sort of been trying to slam bids the same way I did from the entire run up pre-72k, and I’ve given back so much money to the markets that it’s embarrassing. My outlook for current markets is that we’re going to chop under ATHs into halving, but I’m biased towards the downside.

I believe that we’re not going to range between 60-69k forever, and instead we’ll be breaking below at some point. Either way, I’ve had bids set for lower.

Here’s my list of what I’m looking to bid:

GALA

WIF

JUP

ENA

ARWEAVE

But I’m 100% flat cash on my spot positions right now. Also, not doing anything on-chain.

Well, I hope you guys enjoyed this article! I know it was a lil lengthy, but I really thought someone would read this and hopefully not repeat the same mistakes I made. As always, stay safe, stay healthy, and I’ll see you guys soon.

<3, Kyle

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.