High Conviction Bets #7

A nice breather in the markets after the mania. But how long will it last?

gmgmgmgmgm. I have an announcements - I’m trying to find a better structure for High Conviction Bets (HCB). The nature of this paid newsletter was first to provide portfolio updates, but because the nature of a spot-long portfolio is that it remains static most of the time, I feel like I’m not providing maximum value.

I think maximum value comes from the trading portfolio that I have, so I’m going to try playing with different structures - spending less time on the spot portfolio, and more on the trades. I’m also more of a HTF trader, and try not to trade below the D1, so it fits nicely w the weekly pace of the substack

Market Read 📊

My telegram channel correctly forecasted the arrival of a downtrend:

I also think another top signal for me was this:

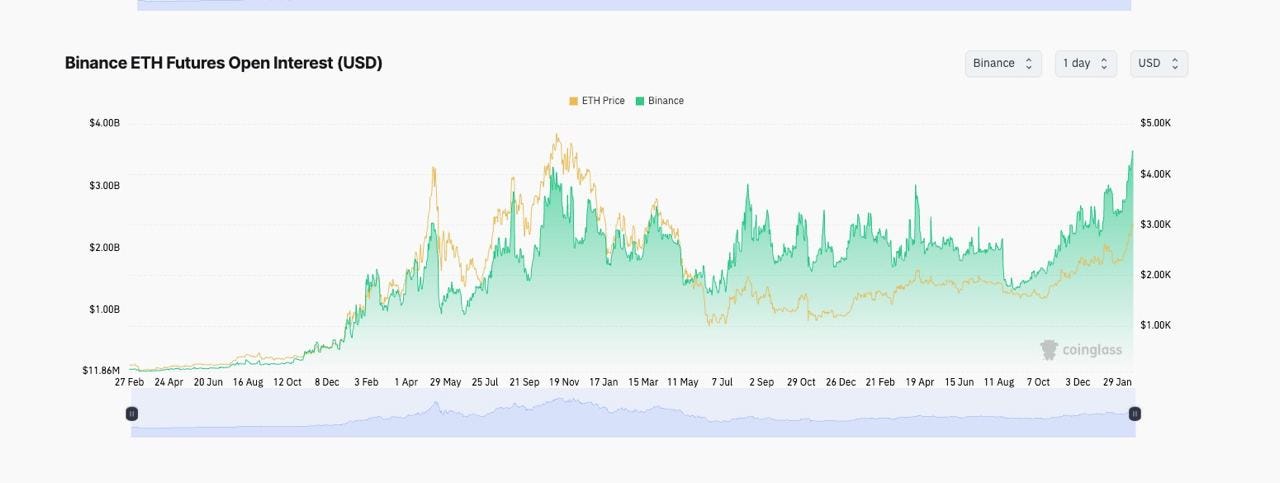

where ETH OI simply blew past OI at ATH prices. Funding was incredibly negative, and generally everyone was frothing at the mouth expecting higher prices. Now that we’ve gotten a pullback, the issue with being a bera is that you never know when to stop.

I will be honest - I have no idea where the bottom is. No one does. In an ideal world though, I will say that my bera thesis plays out if prices goes to 48k. The problem is where I’m wrong - it looks something like:

OI goes up price goes up, showing that market can be even more stupid than it currently is

Alts have a sustained rally as BTC trades sideways here

CME inflows become positive AND it pushes prices (CME has not been pushing prices lately)

I simply do nothing in these conditions. Other than AI coins, BTC and ETH, nothing feels good to long. I think this is a sit on hands season, and patience will pay off.

Keep reading with a 7-day free trial

Subscribe to 0xKyle's Research to keep reading this post and get 7 days of free access to the full post archives.