High Conviction Bets #6

ETF! ETF! ETF!

GM! Welcome to the first High Conviction Bet of 2024. I hope you guys have had a wonderful new year, and without further ado, let’s get straight into it.

Market Read 📊

Before we start, I’m plugging my Christmas Special newsletter for those who haven’t read it. I’ve gotten a really positive reception about it, so I just figured I’d put it here in case you haven’t taken a look at it.

Now moving on to the good part.

ETF. The ETF approval is expected to come somewhere next week, between the 11th and 15th of January. Unfortunately, I myself am not immune to the flip-flopping bias we’ve seen and I’ve had to constantly re-evaluate where exactly I stand on this trade.

Previously, I thought it’d be buy the news. But after seeing the current market state, I firmly believe it’s sell the news. This is why:

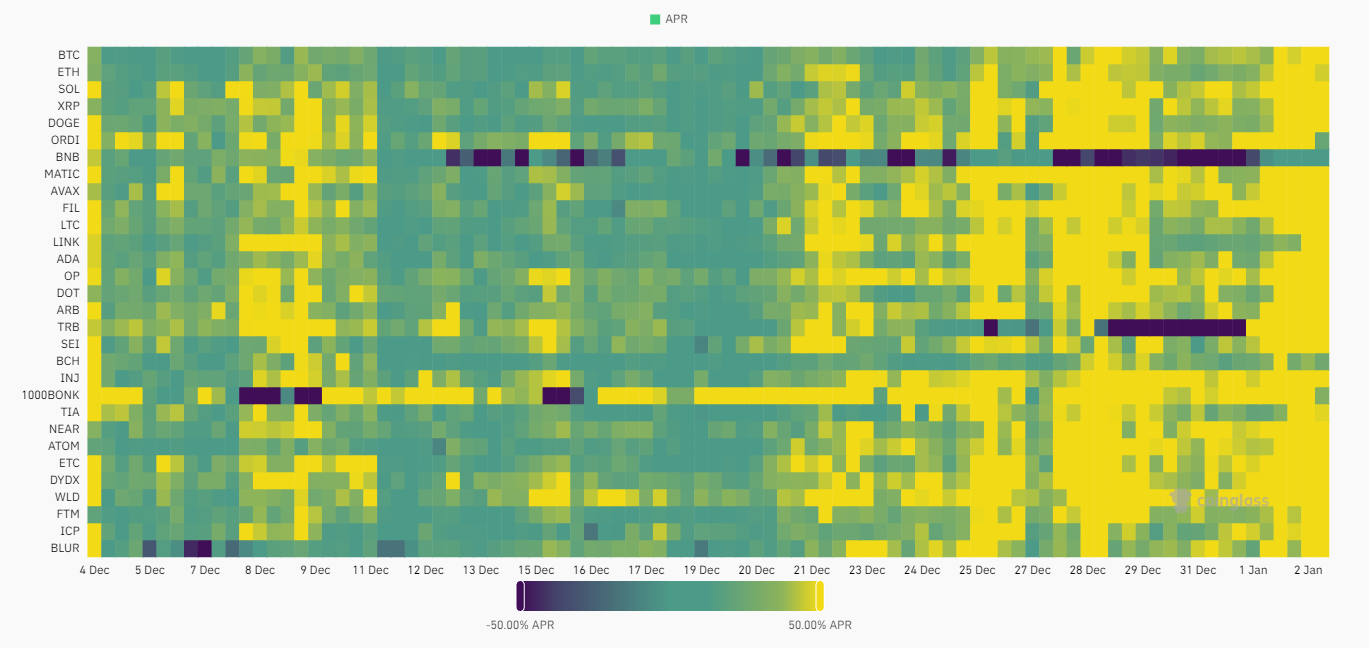

Many people are paying >50% APR to long alts, with most alts around 80 - 100% APR.

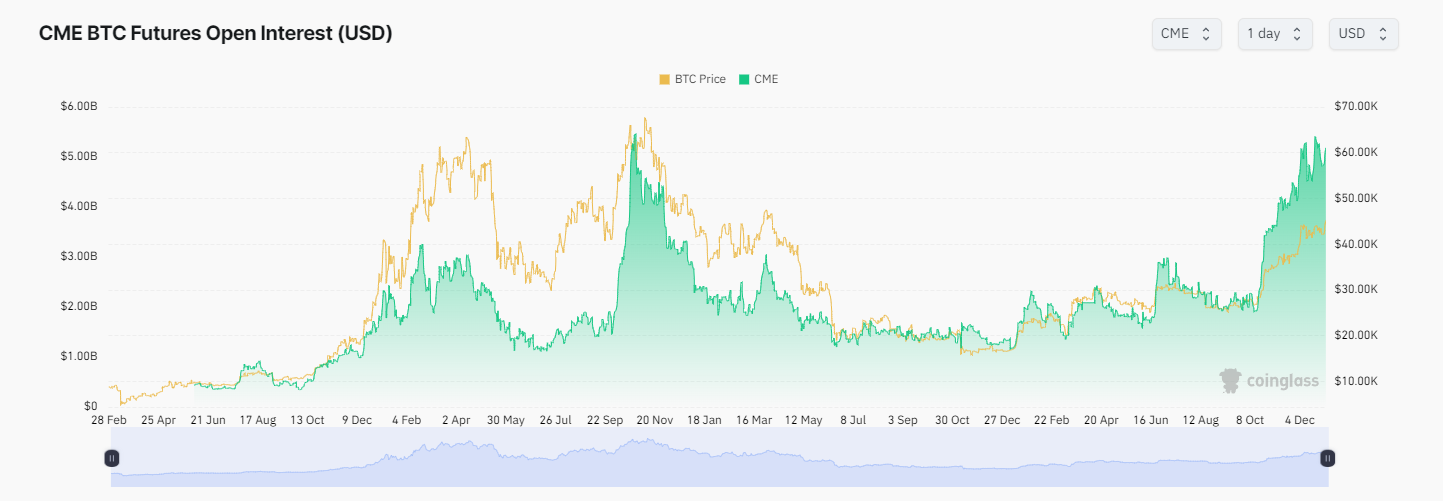

CME OI levels are equivalent to what we saw at 69k last bull run. The literal pico top of 2021.

This is how the Gold ETF played out.

As Husslin has very nicely drawn for us - this is basically how I expect the Bitcoin ETF to play out. TLDR: Sell the news. So, where am I wrong on this position? I can think of a couple reasons that will make me flip bias -

The launch of the ETF is startlingly close to the ETF approval date

I think that this majorly impacts the trade because the fundamental idea is that funds will start selling post-approval pre-launch, due to the time discrepancy of the catalyst. Flows would take a while to come in, so real buying pressure wouldn’t hit just yet. In the meantime, funds are up bigly on their trade - as such, many of them would start taking profit. However, if the ETF launches say - the day after the approval, this would drastically change the time horizon of the trade - leading me to buy back in.

ETF launches, everything pumps and sustains it for a couple of days

This is the scenario that I believe will happen if it doesn’t sell-the-news. I’m ok with this - it would mean that I lose out on a couple of pumps before I can enter with conviction. I do believe that if the ETF ends up being bullish, there is virtually nothing stopping us from going upOnly until Rate Cuts.

ETF is the “overhang” event that has got people on the edge of their seats. A bullish ETF approval would quite literally send the market. Note that I’m also already allocated spot-long, so when I say I’m ok with losing out on a couple of pumps, I’m talking more on the trading side than the spot allocation side.

Nuke Pre-ETF

I’m not sure what would cause this, but I guess if we see a giga nuke to 30k+ on BTC pre ETF, that would be the “sell the pre-news” and you can enjoy buying the dip.

Now that we have the market read out of the way, let’s move on to portfolio allocation:

UPDATE:

This was in the drafts since yesterday, and then the flush just happened. Funding just got reset, so I think we have space to go uponly for a bit (bought the blood). But still nuke after approval is a very likely scenario, imo.

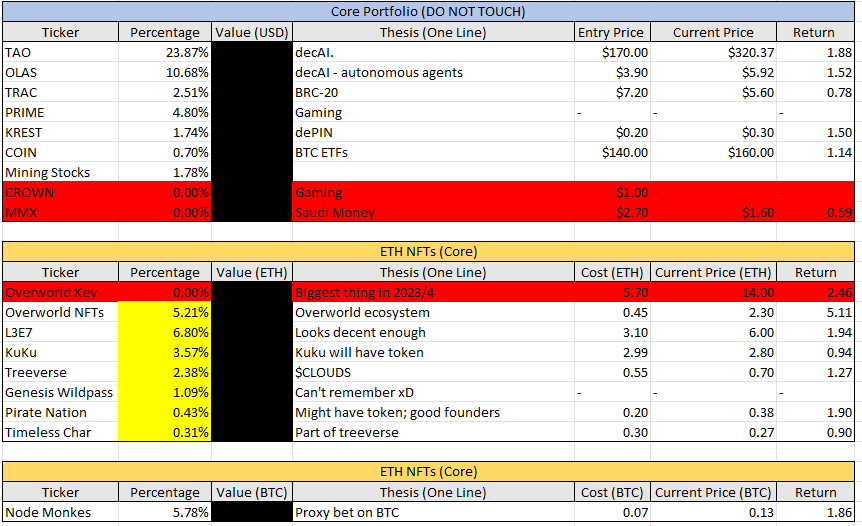

Current Portfolio 💼

Some changes I’ve made:

Sold MMX: This was a big L for me. I’m actually sorely disappointed by how bad PA has been, as if insiders have been dumping non-stop. For an exchange that was backed by Pheonix Group that was 33x over-subscribed on IPO, and also got Demi Lovato & Black Eyed Peas to perform - I really thought this would do well.

Sold Crown: I figured that given the Solana bull run, the fact that this still didn’t do well was a big sign of underperformance. It’s kind of like Rollbit - with everything pumping, Rollbit is still stuck at 14 cents. Pretty terrible performance, and not worth the R/R

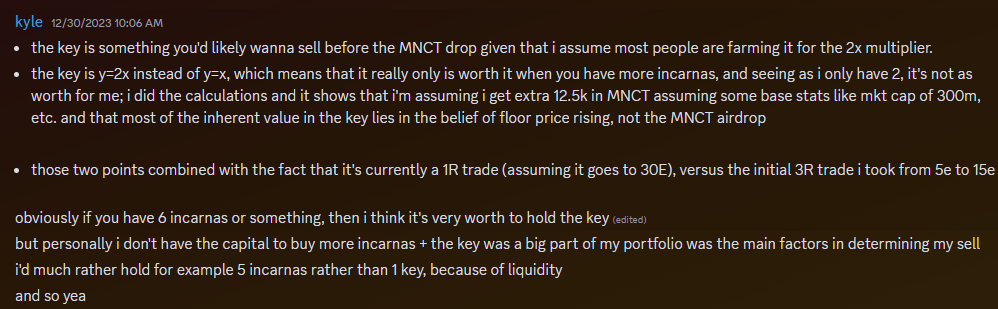

Sold my Overworld Key: This was a big W for me. It doesn’t mean I’m bearish on the Overworld Eco; Here was my thought process:

Sold 1 Overworld NFT: This was just to cover costs

Bought Node Monkes: This is a big one for me. This is my “high conviction bet” for the BTC Ecosystem; I think that there’s a strong chance this becomes the punks of Bitcoin. Obviously, a very high risk high reward bet. I will probably elaborate more in a separate Substack post, but I think the upside is there for this one.

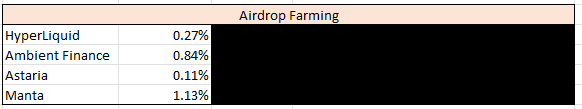

Here’s a new section on airdrops I’m farming. If you need a link, here’s mine:

Hyperliquid - A great Perp Dex on Arbitrum! Here’s a code: https://app.hyperliquid.xyz/join/KYLE

Manta - L2 built on Celestia

https://newparadigm.manta.network?inviteCode=NYCBN

https://newparadigm.manta.network?inviteCode=L2S9X

https://newparadigm.manta.network?inviteCode=POOCS

https://newparadigm.manta.network?inviteCode=NEBYL

Trades 🖥️

Perps

OP/ARB/ETH-BETA: These have been performing spectacularly well especially with EIP-4844 and ETH beta narrative

LSDs: Also ETH beta, and Lido TA chart looks spectacular.

De-Fi 1.0: I’ve seen this catch a bid lately, with OG names like AAVE and MKR making a return. Not sure if I like this trade that much, though

Game-Fi: The GameFi narrative seems to have low attention right now, would make it a nice place to bid

AI: Also low attention, could look into it. RNDR also has the Apple Conference confluence ;

On-Chain

Nothing interesting ATM, but can added to long term bags OLAS and PRIME and TAO.

Would you consider the OI wipe & leverage flush today big enough to shift your position on selling ETF news? Assuming no, unless we trail down further & market keeps bleeding lower into the event? Thanks!