High Conviction Bets #6

Changes in positioning, how I screwed up last mini-cycle, and more!

gmgmgmgmgm. It’s been a while since my last portfolio update, so really excited to be back at my desk and trading. As always, this is not financial advice, and and you should always form your own opinions instead of fully piggybacking off others. Every coin in here will be sold to USD, so don’t go marrying the bag.

Market Read 📊

I’ll keep this one short and sweet - I believe it’s time to pay attention again. This is round 6 of the bull run, and the start of another mini-cycle. The past few weeks have been incredibly choppy, with BTC ranging around 42-43k.

Of course, sell the news ETF played out as expected, and the “short-term bearish, long term bullish” event started forming as BTC broke out of the range to 47k. I’ve repeated this in my Telegram channel (link here) as well - HTF, it makes no sense to be bearish post-ETF.

With millions of dollars buying BTC everyday, I just don’t see the case for being bearish.

The next macro event that I see affecting the markets disproportionately will be rate cuts - but until then, we remain long. And as always, as BTC goes up, alts will fall in BTC terms - but when it starts consolidating, that would be the starting signal for an alt rally.

I simply believe the vibes in the market have changed from just a week ago - things couldn’t catch a bid, most people were getting chopped up; we’re finally getting easy mode again, the same mode we saw late November - January 2023.

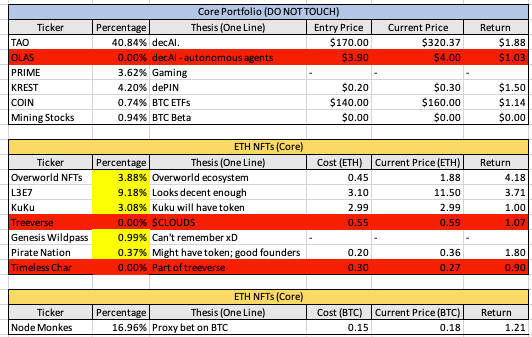

Current Portfolio 💼

I’ve cut OLAS, Treeverse and Timeless from my portfolio. This is where I want to talk about how I screwed up my positioning last “mini-cycle”. At some point, I believe the OLAS position was > 15% of my portfolio when OLAS was at $8. It then went to $3, and the same with a lot of the NFTs and tokens that I held.

One of the biggest lessons I’ve learnt through that was: there is a major cycle and many mini-cycles. And the drawdowns of these mini-cycles can be intense. In essence, it’s really difficult to justify having a “long term position” in some of these coins when you really don’t know.

Sure, high-conviction bets take a longer-term investment horizon, but I feel that I was

Sizing too much

Into higher time-frame investments

That drew down 50% when the mini-cycle ended

And not taking profit in the mini-cycle

Every position I had, I thought was a “cycle hold” - which, basically meant I left a lot of the money on the table. Even if OLAS goes back to $6, it still doesn’t change the fact that I ate a >50% drawdown in between from $8 → $3.

Another thing to remember is that I’m no whale - and so it doesn’t make sense for the entirety of my portfolio to be “long term-holds”. I feel that I really sized too much into many of these on-chain shitters.

Moving forward, I’ve decided to basically split my portfolio into 60-40 - 60 being spot cycle holds, 40 being the trading / swing part of my portfolio. Spot cycle holds should also be trimmed down to a maximum of 3 positions, because I think that predicting “cycle holds” is way harder than it looks.

I believe in Node Monkes, but honestly, no one knows if it’s gonna be a cycle hold. And everyone has their own “cycle hold” - some have ONDO, some have BEAM, some have UNIBOT - you get the point. Everything that glitters is not gold, and that’s really something to think about.

I haven’t really rebalanced my portfolio yet, so it’s currently still something like 80-20, but I’m working on it. In the upcoming mini-cycle, I want to turn my trading portfolio way bigger and roll those profits into my spot-long portfolio.

Anyways, thanks for listening to my Ted Talk. I’m definitely not a great trader, but I’m working on it real hard.

Trades 🖥️

Many, many coins look good. I’m so excited to dive right in:

TIA: Celestia needs no explanation. One of the best performing coins last mini-cycle

DYM: Celestias new younger brother. DYM launched with Airdrop claim FUD, but it 2x’ed straight out of the gate. I think this has potential to do well if TIA does well, and with quite a large amount of DYM airdropped staked, I think this low circ / high FDV coin can absolutely print

MAVIA: A gaming coin by the Heroes of Mavia game that went absolutely parabolic on a Rewkang thread.

BEAM: The gaming “index” coin, that is seeing a pump due to the increased interest in GameFi again

PRIME: Prime looks fantastic as it touches $9 yet again. Now being narrated as “AI” as well due to their inclusion of AI agents, PRIME truly has the best of both worlds

AI, of course. With Sam Altman looking to raise in the trillions for AI, AI coins caught a bid last night

TAO flirts with $600 as the biggest performer in my portfolio (thank god)

RNDR might catch a bid

Many AI coins are launching in Q1 - Morpheus, IONet, etc. Other projects that are good to look into are HyperspaceAI, Ritual, Gensyn

Interestingly enough, WLD didn’t catch a bid. The whole “Sam coin” narrative may not turn out in favour of WLD buyers

SUI. SUICUNE is the newest narrative to form, and may be the “SEI” of this cycle

Past performers, like:

INJ / LDO / PENDLE / SOL / LINK

On-Chain

404s: Pandora absolutely blew out the 404 meta, making a 60x, from 500 → 30,000. Crazy.

BRC-20s: This may catch a bid, with recent launches like Quantum Cats and RSICs heating up the BRC20 eco.

MOBY: A recent ICO launch that got up to 4,000 in ETH contributed - if this does well, it may signal a comeback of the ICO era - the greatest era of our lives

That’s it for this week! See you guys next week <3

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

Cut TRAC?