P.S. I’m heading to New York City (NYC) for a year in January 2024! If you want to meet and have coffee, lmk <3

Introduction

GM. Welcome to Week 3 of the series “High Conviction Bets”, where your trusty analyst 0xKyle (me) updates you with trade ideas and portfolio updates. Remember - at the end of the day, trading is a very individual sport, and you should always form your own opinions instead of fully piggybacking off others.

Every coin in here will be sold to USD at the end of the day, so don’t go marrying the bag. That being said, let’s dive in.

Market Read

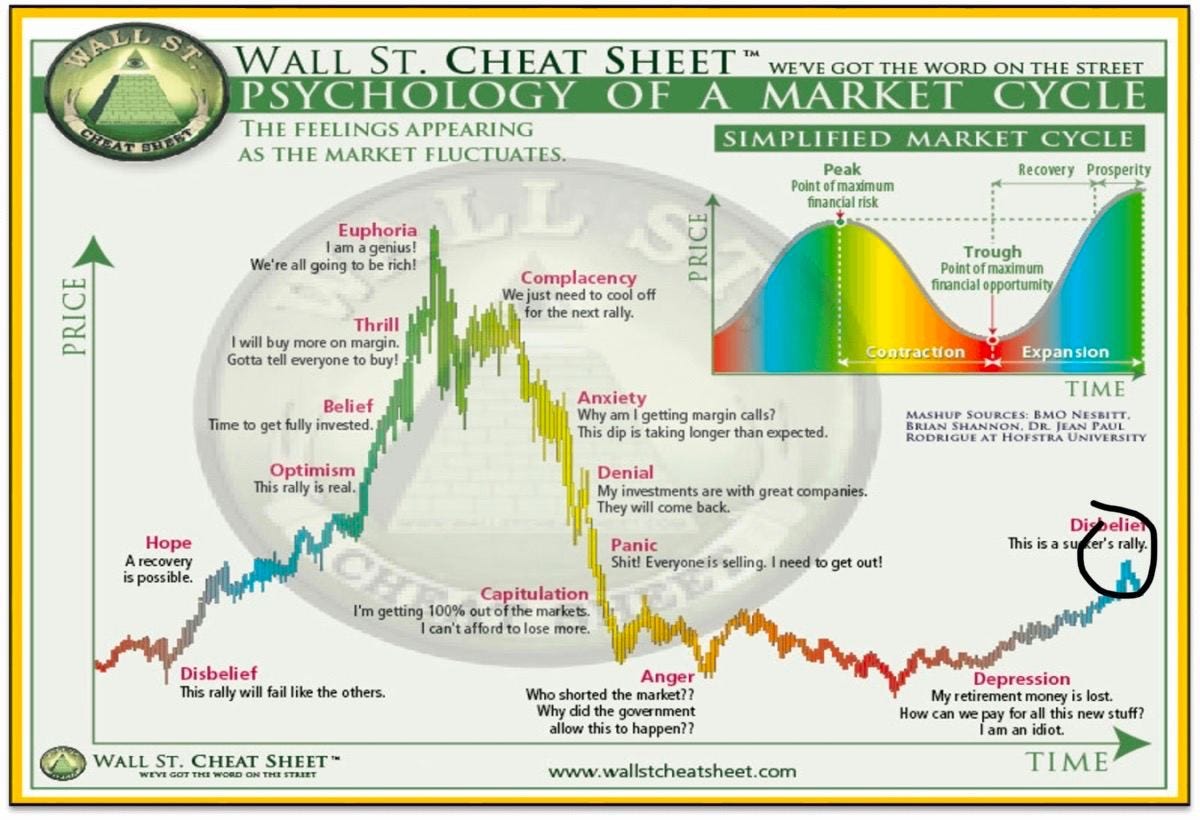

Beautiful chart - I hope this chart cleanses you of any HTF bearish bias you might have left. But on the lower time frames, I’ve been pretty vocal about this view of mine: I think that rate cuts and ETFs will be sell the news events that will precede the most glorious bull run of our lifetimes in 2024.

You see that disbelief dump? Yea, that’s where I think we’re headed. We’ll see a flush soon and people will be clamoring “boo ETF did nothing” - and then the firing pistol goes off and we head to the highs.

And for the decorrelators out there, I’m sorry to say that I’m not buying it. Bitcoin will not decorrelate, and especially ironic that the reason for that is why we pumped in the first place - with more tradfi money coming through ETFs, you can bet that the crypto world will see more “tradfi-interpretations”.

So what’s the play? Short? Nah - I’m not a big fan of shorts, especially on the incredibly volatile market that is crypto. As a retailer, my position is simple - spot long, and spot long on alts on-chain for that extra leverage. That’s really all you need, imo.

Current Portfolio

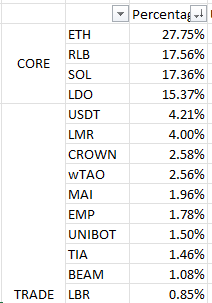

Here’s the breakdown of my current portfolio. I’m still in the midst of doing research, and so I’m not fully allocated yet. Here’s how I’m going to change it.

I want more TAO

I want to add OLAS, and PRIME

I probably want more CROWN

I’m probably not going to hold UNIBOT anymore

I’ll elaborate more on why I’m buying certain stuff in the next section. Anyways, CORE = the long term bags I have conviction on the HTF, and TRADE = the trading back that I hope will eclipse my core bags.

Trades

Perps

NEAR - this thing’s a beast - I think breakout of 1.71 was a key resistance of the past 170 days - honestly clear skies till 2.3~ ish.

RUNE - I’m not in it, but I’m doing research… I wouldn’t want to long an asset after it has 3x’ed, maybe wait for a pullback.

DOGE? Tomorrow’s the launch of the spaceship, but it’s already up 8%… but if it’s a bull market, maybe it can go up more! I’m not touching that though.

Honestly I was late to all the perps trades that did well - AVAX, SEI, NTRN, ORDI, RNDR, etc. Haven’t really been focused too much on perps, cus I’m doing more on-chain right now.

On-Chain

CROWN: God I love this project. I’ll probably do a deep dive on it soon, but tldr it’s a horse-racing platform built by people with insane experience. The team has over 10+ years at EA, and are all solid game developers.

UNIBOT: I decided to sell this because UNIBOT quite sadly threw the lead they had to Banana. Across all metrics - weekly volume, # of users, # of trades - they are losing. I simply cut my losses and move on to the next one.

PRIME: I think Game-fi is coming back, and I wouldn’t be surprised if PRIME was the “leading coin” in the gamefi rally. I want in on this.

TAO: TAO is probably going to also be the “leading coin” in the AI rally, with how big-brained what they’re building is.

So my overall strategy is simple - ideally, I’d want a 50/50 core position : trading portfolio, and then I’ll sit tight, buckle up and get sent to the moon.

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

Another great post, thanks for the update Kyle

Hey Kyle, would be helpful if the tickers are clickable links that redirect to coingecko/dextools.