P.S. I’m heading to New York City (NYC) for a year in January 2024, and am looking for a crypto internship as an analyst for that duration! Open to anything from working at protocols & startups to venture / liquid funds. If you know anyone interested / you’re looking for one yourself, please feel free to email me at 0x.kyle3@gmail.com, or DM me on Twitter! <3

Introduction

GM. Welcome to Week 2 of the series “High Conviction Bets”, where your trusty analyst 0xKyle (me) updates you with trade ideas and portfolio updates. Remember - at the end of the day, trading is a very individual sport, and you should always form your own opinions instead of fully piggybacking off others.

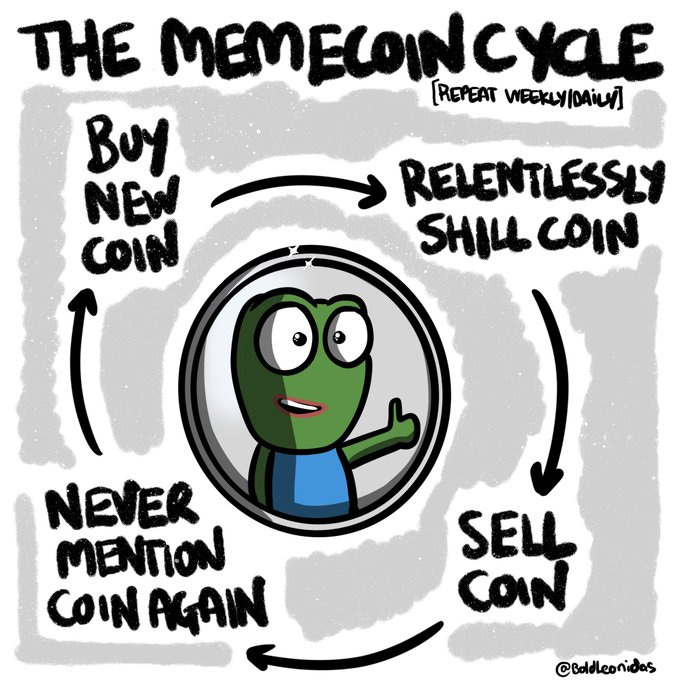

Every coin in here will be sold to USD at the end of the day, so don’t go marrying the bag. That being said, let’s dive in.

Market Read

Last week, I made the verdict of “trending, buy the pullback”. I’ve realized that it doesn’t really carry across the nuance in my beliefs, so I’ve scrapped that idea. Instead, I’ll just talk about what I see.

Generally, BTC has been trading in the range of 33k to 34k for most of the past two weeks. This compression has got me on the edge of my seat as it seems reminiscent of market conditions we’ve had a lot in 2023 - price trades in a tight range and it suddenly expands.

On LTFs - we can and will assume we’re in a range until we’re not.

Currently, I’ve observed that the bear market PTSD is still fresh in everyone’s minds. With the excitement of breaking YTD highs fading, altcoin rotations are slowing down.

Intuitively, it seems to me that alt selection will matter a lot more in the coming weeks. When we first broke the range highs, every alt was outperforming. Now, only a select few are seeing outperformance as the music slows down.

Quite frankly though, I think something fundamentally has changed in the higher time frames. It’s hard to describe it in quantitative terms - just that a certain switch has been flipped. Time-based capitulation has done its job when you see CT still remaining pretty desolate even after such a move to the upside.

Lastly, the ETH/BTC trade I talked about in the previous week might be one of those “idea is good, but execution is difficult” ideas. Going from past cycles, ETHBTC has bottomed near 0.02606. So while I still believe in the trade, it’s gonna be a pain in the ass to execute it perfectly on the higher time-frames.

Current Portfolio

Keep reading with a 7-day free trial

Subscribe to 0xKyle's Research to keep reading this post and get 7 days of free access to the full post archives.