P.S. I’m heading to New York City (NYC) for a year in January 2024, and am looking for a crypto internship as an analyst for that duration! Open to anything from working at protocols & startups to venture / liquid funds. If you know anyone interested / you’re looking for one yourself, please feel free email me at 0x.kyle3@gmail.com, or DM me on Twitter! <3

Introduction

This is a new series I’m trying to start where I talk about my personal bets. While my weekly narratives posts serves as a backward-looking summary, this series will be more forward looking and focused on plays that I’m in or looking at.

I want to emphasise that as traders, we don’t marry our positions - as the saying goes: strong opinions, loosely held. My conviction level from token to token differs, and just because the series is titled “High Conviction” doesn’t mean I’ll hold any of these tokens to zero.

The value proposition of this series is not for you to copytrade (please don’t) - but for it to serve as a signpost, telling you which tokens might be good to look into, how I view the market currently, and possible trade ideas I’m looking to take.

Think of me as your very own analyst that’s churning out ideas - some are good, some are bad, but all are informative. The burden of discernment lies with the reader.

At the end of the day, trading is a very individual sport, and you should always form your own opinions instead of fully piggybacking off others.

Now let’s dive in.

Market Read

Verdict: Trending, Buy The Pullback

There’s one rule that’s strictly followed - impulse moves are always followed by a pullback. It’s simply the market realising its exuberance, and moving towards a price that most accurately reflects the aggregate of all information that exists of that product, at that time.

After a year of being in a range, we’re finally out. The vibes are immaculate, and I think that the overarching market regime is a trending one. Assume range until otherwise is now broken.

Current market conditions are also conducive of altcoin news plays, and general altcoin bets (if you can find the right ones). An indicator I always like to use is how market reacts to news - the dYdX v4 announcement, something that everyone already knows, still saw a 6% pump on the token for an extended period of time, with the token not retracing fully.

These bolded factors are important because they are an accurate reflection of how the market feels. Pump retrace? People take profit quickly. Pump is quick and short? People are risk-off and don’t want to be hold for longer.

Where am I wrong?

I’ll have to reconsider my position on this if sentiment and price changes. But I would assume anywhere under 30k people would start being bearish again. Of course, those are great prices to add (if you’re into “longing into BTC ETF”), but I expect a breakdown back into range to be an extremely bearish scenario that would reverse all the work we have done.

On the more longer-term front, I think that we see one more mega pullback in Nov / December, where you want to BTFD before we slingshot into January.

Probability wise, I think P(bullish) > P(bearish). Let’s go.

EDIT: This was in the draft on Wednesday Night. It’s now Thursday and everything is pumping. Waaaa

Trades

BTC Kingmaker

Need I say more? BTC has led the rally, BTC.D is skyrocketing. BTC ETF is coming, so long BTC.

ETH Showmaker

Lots of people have been saying “ETHBTC looks like it’s fallen off a cliff” but they forget to add the second part of the sentence: “but it’ll fly back up”. If 4 year cycles can hold, ETH catchup to BTC patterns can too. This is one of the trades I’m sizing up into - I just don’t see a world where BTC goes to 40k and ETH doesn’t even break 2k.

Just a matter of time

Solana Soldiers

I’ve been vocally bullish on Solana, even publishing a 10 pager for you guys. It’s great to see a thesis play out, and this is quite rarely one of the coins I’m considering holding throughout 2024. I’m in this for the long term.

These 3 are the trades I’m in. Currently, here are more trades I’m looking at:

LINK. I considered going in this - SOLINK is the name of the game, after all. But I’m content with being long SOL, and I did have limits on LINK which never got filled. The multi-year trend breakout should NOT be faded.

CFX. I closed this trade a day ago on news about digital yuan being used to settle international currency. I think China narrative may re-emerge, but I can’t see a suitable context in which it would take up lots of mindshare. The China narrative heavily depends on macroeconomic conditions - in mid 2023, it was about Hong Kong opening, and now that that’s “priced in”, I don’t think it takes the main stage.

DOGE SHIB FLOKI. Kabosu’s birthday is coming up (November 2nd, I believe) and with the Elon rocket being launched soon as well (hearsay it’s named after Doge), I would assume a simple tweet by Elon would send this coin skyrocketing.

INJ THB. These are in the basket of “cartel coins” - just perma uponly stuff. I haven’t done enough research and can’t build enough conviction to justify buying them, so I’ve avoided them all this while. But their performance can’t be ignored.

PEPE. I’m overexposed to memes onchain so I’m fine missing out on this one.

LDO. I’m soooo annoyed I missed this one. My fault for not paying enough attention in the bear market, but remember - LSDs are a key part of DegenSpartan’s thesis, and I like his thesis.

MAV. Bleeker called it, that’s it.

STG. Nacho called it, that’s it.

APE BLUR. BLUR is NFT, APE is simply because $1 is a nice number.

Possible Narratives:

GameFi

I’m gradually seeing more chatter of this in my Discord groups. People are speculating on “the return of GameFi”, and I want to be well positioned for this. Coins like GALA SAND MANA will do well if it returns, but won’t cut it. Quite possibly PRIME might be the prime candidate (kek), and if it gets listed it has all the traits of a good coin (new, listing, gamefi, etc.)

I haven’t found anything on DEXs yet (maybe one of those Binance launchpad coins), but honestly with everything going up, it’s hard to focus.

AI

This will be huge in 2024, and current tokens are RNDR / TAO / IMGNAI / AKASH.

China

LSDs

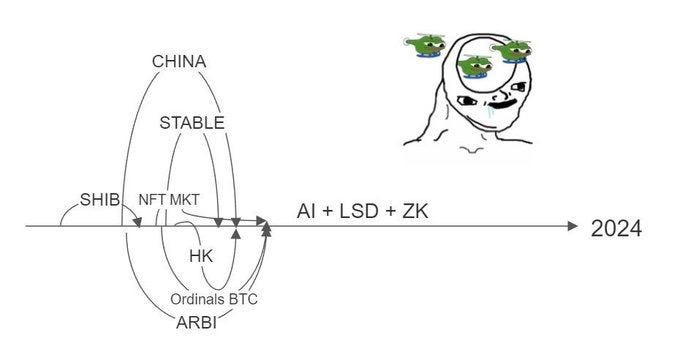

Anytime I find myself wondering what’s next, I refer to this picture:

Lots of alpha in that.

On-Chain

Currently In:

RLB / SPX / JOE / LMR /

MEMES:

SPX

JOE

BITCOIN

LMI

RMD

MOG

If I had to be honest, I like SPX the best. But realistically, BITCOIN has been outperforming - and outperformers outperform. LMI interesting because it’s a “war narrative” (jfc).

Bookiebot / Unibot / Pear / HiLO

Dumped this bag I talked about last week because of their relative underperformance. A real shame, considering how they had catalysts coming up. Unibot is particularly sad but it’s really getting eclipsed hard man. I like their product, I use it everyday, but the numbers don’t look too good.

TAO / LMR / CROWN / MAV / BOTTO / IMGNAI

I haven’t done too much research on most of these - LMR is basically a place where you can trade hashpower. At 30m market cap, the upside is potentially 100m - ATOR is sitting comfy. I’d say that’s possible, but I wouldn’t risk too much.

I’m buying IMGNAI and BOTTO for some AI exposure, and I like TAO and the whole world likes TAO - and that makes me wary. I haven’t bought any, and will monitor the situation closely.

That’s about it. I hope you enjoyed this, and let me know in the comments how you think I can improve this series / other stuff you might want to see! Cheers.

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.