Welcome to Exit Liquidity! If you want to join this tight-knight community learning about finance & life insights, subscribe below:

You can check out the rest of my articles, and follow me on Twitter too!

Disclaimer: Any views expressed below are personal views, and the content is purely for educational purposes. Any information should not form the basis for investment decisions.

Now, to the article ☕

The Dollar Milkshake Theory Explained

The Dollar Milkshake Theory (DMT) is a case for a rapidly appreciating dollar. Theorized by Brent Johnson, CEO of Santiago Capital, it's how he believes a sovereign currency crisis develops when debt finally matters again.

Simply put, the DMT assures that in a dollar-denominated world, there will come a point in which dollar-denominated debts will have to be repaid - and in this situation, the USD will get squeezed much higher.

In this scenario, the dollar will be sucking up liquidity from every other country into itself, much like how you would suck up a milkshake through a straw - hence the Dollar Milkshake.

Now, let's break this down.

The Doomloop

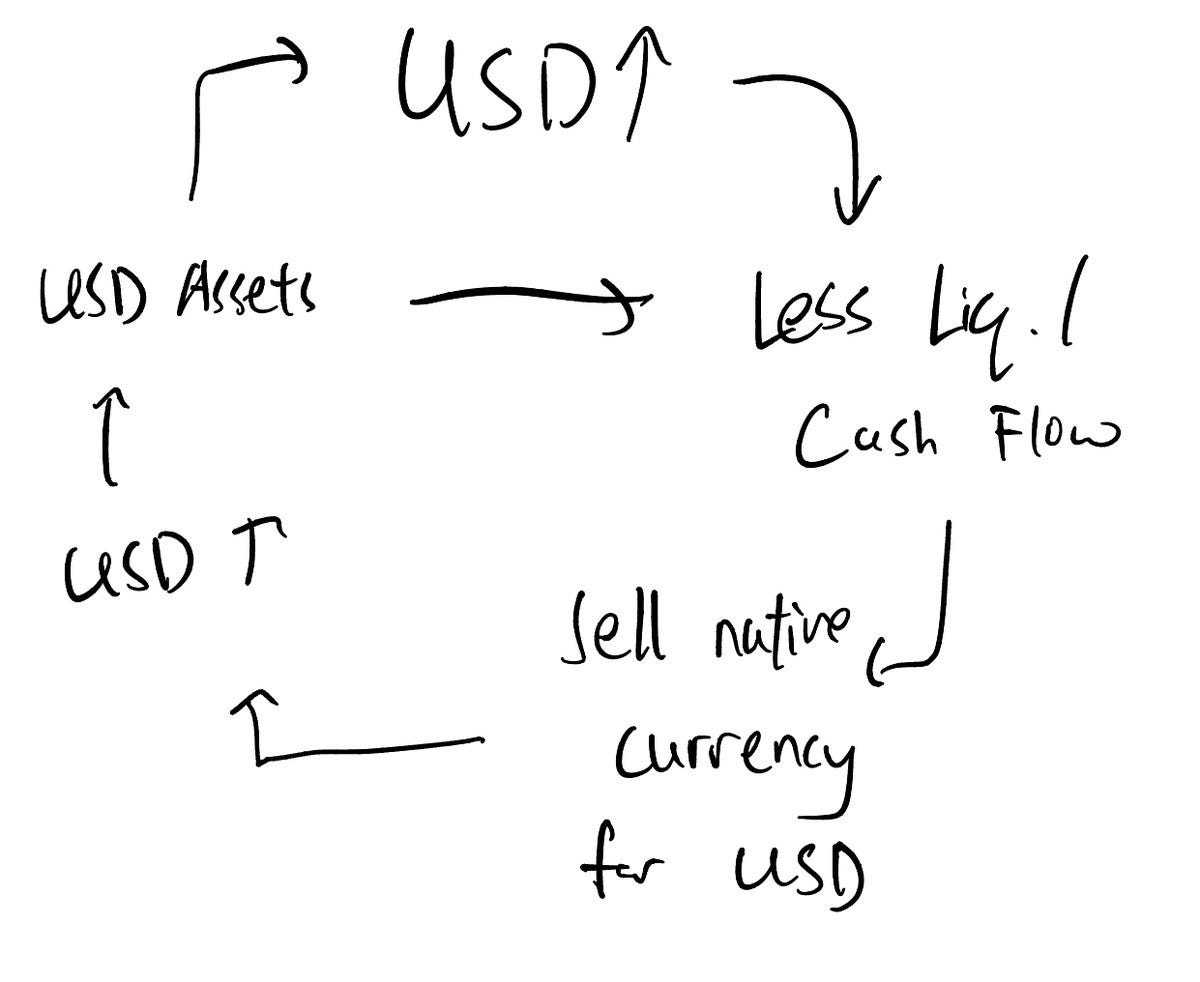

Recreated From George Gammon's Video About DMT

The world is denominated in dollar debt. There are only three ways to go about debt - pay it off, service it or default on it. Brent Johnson says that the only way this situation doesn't end up strengthening the dollar is if it gets paid off entirely - but counters that there just aren't enough dollars to go around.

Servicing the debt creates a structural bid for the dollar. And in the final event where it's defaulted on, money will be destroyed. In our credit-based economy, money is loaned into existence. Defaulting starts a chain reaction that goes back to the collateral. Even if demand for the dollar falls due to less debt needing to be repaid in a default, the supply of dollars falls even faster due to the destruction of money. Defaults increase the dollar's price through supply shocks.

Thus, 2/3 of cases are bullish for the dollar, and the last case is unlikely to happen. This isn't where it ends though. As seen in the picture above - when debt starts to matter and people start servicing it, USD goes up. This reduces dollar cash flow and liquidity in the global marketplace.

Foreign companies will find their dollar-denominated debt more expensive, or they will find their treasuries losing value to the dollar. In both cases, they will want to hold the dollar, hence creating greater demand. These corporations continue exchanging their local currency for the dollar, making the dollar look strong relative to their currencies.

Dollar-denominated assets hence become more attractive, which drives more liquidity to the dollar as people sell their currencies for dollars to buy those assets. All these factors work in tandem to create a feedback loop for the dollar: The dollar rises > It becomes more attractive to hold > More people rush to it > Pushing it up even further.

DXY New Highs, Unseen Since 2002

While DXY has hit new highs, it's unclear whether the DMT has started to play out. Nevertheless, the increasing strength of the dollar makes this an important theory to keep in mind. Now let's move on to the counterarguments.

QE + Money Printing + Inflation = Weaker Dollar

The prevailing argument against DMT is how people seem to believe that the dollar is weakening and will be "worthless" by the end of the decade because the money printer has been going brrr.

It's important to realise that everything is measured relative to each other. Fiat currencies have no real value - the strength of the dollar is only measured relative to the strength of other currencies such as the euro, the yen, etc.

Likewise, CPI is just the dollar's strength relative to the goods and services in America. Therefore, the DXY =/= CPI. You could very well have a dollar that loses value against goods and services, yet performs well against foreign currencies.

The second point to note is that despite America's money printer going brrr, every other country is doing the same. Japan's giving stimulus packages, UK's giving aid, etc. The truth is, every other country is doing some sort of quantitative easing. On a macro scale, this "balances out".

The bottom line is that this is a situation with no other alternatives. The dollar is the least dirty shirt in the hamper - foreign companies don't care about a weakening dollar by America's standards when their currency is weakening twice as fast.

Take Turkey, for example. Their CPI is at 78% YoY - what can they do? The best option they have is to either buy gold (inflation hedge), dollars, or dollar-denominated assets that go up with the dollar. But you can be sure that no one wants a currency that cuts your purchasing power by more than half next year.

Lastly, while moving away from the dollar might seem like a solution, there are major military and societal repercussions that I won't elaborate on. While not impossible, it will be a difficult path. I do believe that in the very long term, we will see the world shift towards "de-dollarizing". In the shorter term, however, the dollar will still remain king.

What Next?

There are no certainties, only probabilities. DMT is just one of the many possible scenarios that could play out. As such, it's pivotal for us to hedge our portfolios. The DMT advocates allocating a small percentage to US assets that will move asymmetrically in the face of a strengthening dollar.

Ultimately, this piece isn't meant to spread FUD. It's an informational piece - one that I hope has shed more light on what could happen in the future. Brent has specified that he "has been wrong and could be wrong", but just sees DMT as the one with the biggest potential risk.

I don't want you to take this piece at face value. You don't even have to agree with me - the point of this piece is for you to take a second to think: is this a possible scenario? As investors, it is our job to make money, but even more not to lose it. And as good investors, we must always hedge against the black swan event.

- Kyle

If you liked this piece, subscribe here!