Discussing ICO Incentive Designs and VCs Adversarial Participation

Crypto analyst teaching you how to think. Thought leadership, wisdom, key ideas and more.

Welcome to Exit Liquidity: A newsletter written by a crypto investor, talking shop about finance & life insights. If you want to join this tight-knight community, subscribe below:

Check out the rest of my articles here, and follow me on Twitter for more crypto insight!

Now, to the article ☕

Discussing ICO Incentive Designs and VCs Adversarial Participation

It goes without saying that markets are adversarial. It is a zero-sum game - there is always someone on the opposite side of your trade. This is a fundamental rule that cannot be changed. Crypto doesn't change this - what they did was to make markets more equitable for everyone - Bitcoin wasn't something that only the upper-class could buy; ICOs make token equity easily accessible without being gated; You don't have to be an accredited investor to invest in sophisticated crypto products.

However, it seems that time is a flat circle, and as crypto progresses I see that we are slowly reverting to the old ways of doing things; as we make more mistakes we realise why certain things are built in certain ways. I don't think this is bad - on the contrary, I think it's great. In particular, I would like to talk about ICOs vs the "old ways" of doing things, and how the incentive structures for ICOs are misaligned and disingenuous.

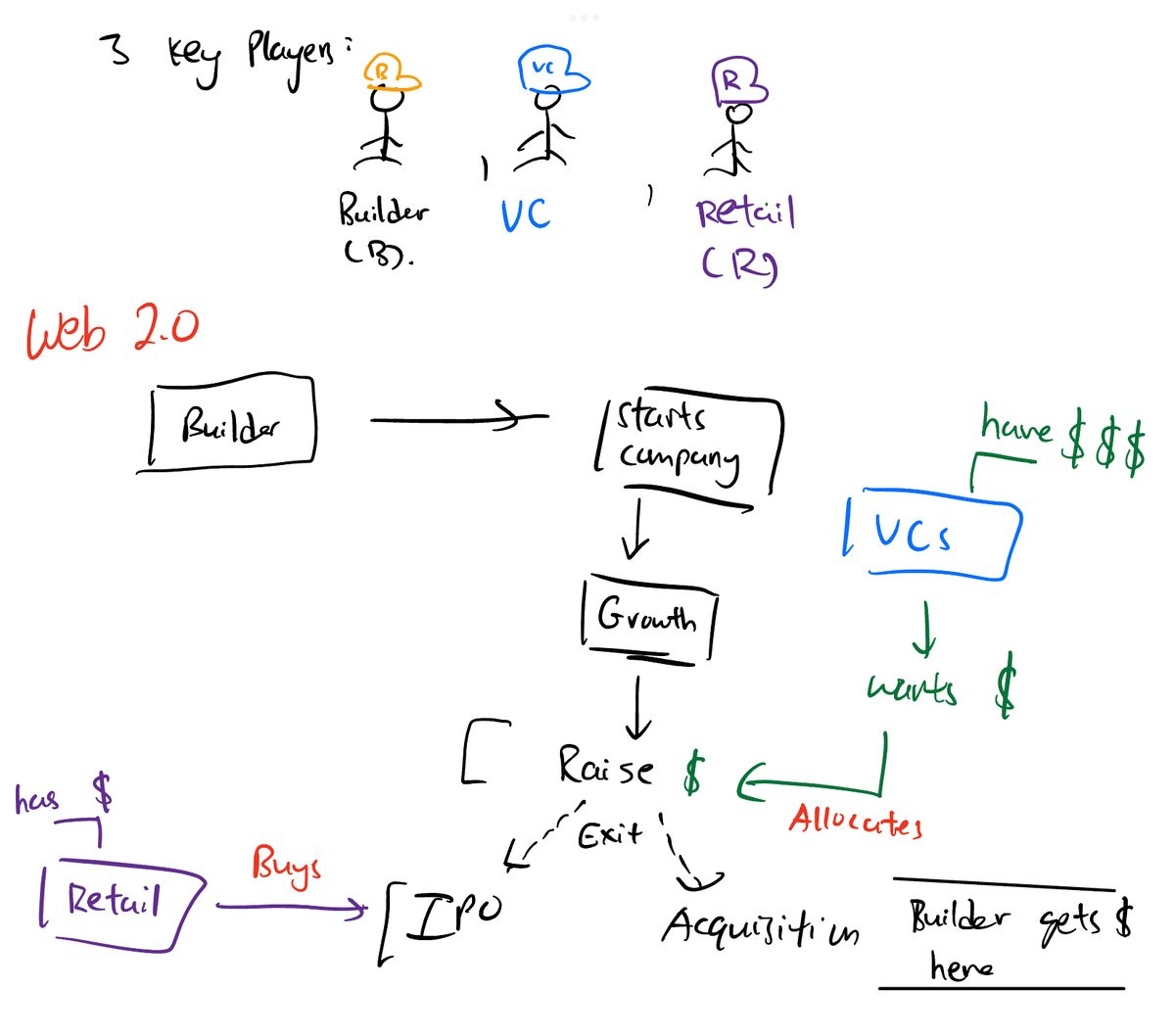

A classic Web2.0 company's raise looks like the following:

Let me break it down for you:

Builders (Entrepreneurs) have an idea - hence they start a company, and they're incentivised to grow that company to a size large enough such that they can raise - because without doing so, they don't get the monetary compensation that comes with taking such a large risk (starting a company).

VCs are basically retailers with money - in exchange for giving larger cheques, they get to invest in companies early on in their cycle; and in exchange for taking on more risk by helping unestablished companies, they get cheaper entry points. Retail comes in at the end, only when a company decides to make itself public for retail to buy into.

The incentives are designed in a way such that builders have to actually build a good product so that they can finance their operations, and eventually hope to get acquired / IPO - only then will they get rich. VCs also hope that the company does well for them to make a profit on their equity, but the sad retailer is the last to enter on this.

The Web3 structure on the other hand, looks something like this:

Anyone in Web3 is familiar with the stories of people submitting slide decks, getting funding and doing an ICO even before having an actual product. Unfortunately, this creates some unfavourable circumstances.

Problem 1: Builders have no incentives to build

The problem with the Web3 style of doing things is that builders are getting paid upfront - this is why many NFT projects don't commit to their roadmap - they've already gotten rich from the initial raise! In contrast, the Web2 style only rewards you after you've actually designed something of value.

Now the current proposed solution to this is to "lock the team's tokens", or create some sort of monthly payment from their treasury without making it directly accessible. While this is a *solution* to the current problem, it does not truly tackle the issue with raising before even making a product: that it disincentivises builders from building.

Scenario 1: Locking the team's tokens - sure, this works, but as we all know the market for cryptocurrency is that everything is a higher beta of BTCETH. Imagine you're a founder, and you see your token price dropping -90%, and that your "raise" is basically now worth 90% less than it used to be. As much as people say that you shouldn't "check the prices daily" - if you're paid in the token, it's impossible to not do this. And if you see your future payment being way less than it used to be, some might quit entirely.

Scenario 2: Treasury in USD, weekly payouts. Sure, but at what point does the entrepreneur reap the rewards of starting a company? Someone has to be in control of the treasury, or all that money is lost. This just isn't a smart way of doing things, in my opinion.

In general, the truth is not all web3 companies need to launch a token immediately. In fact, it is preferable (in my opinion) that companies focus on building a product first. And for retailers, be wary of the things I've mentioned above - there is little incentive for a product to be continually developed after all the money has been squeezed out.

Problem 2: VCs are adversarial to retailers

This is true, and this will continue to be true. VCs take a risk in investing in early-stage companies, and in return, they get more significant allocations / cheaper rates. However, what's happening now in Web3 is nothing like that.

In Web2, there are normally improvements made on the product before retailers come in; while VCs still have cheaper entries, the risk/reward play is more apparent - there is a clear risk VCs take when investing in an early-stage startup - there's no guarantee that it performs well.

But in Web3, these VCs can invest knowing that the coin will pump; retailers are literally buying the same coin the VCs bought into just days apart, with no change on the product side. This makes the asymmetric risk of buying in at early rounds extremely apparent, knowing that your exit liquidity is just days ahead.

To me, there's no issue if VCs get cheaper allocations - after all, it's a trade-off for investing in a risky startup. But in Web3, this is not the case - it's like investing in a product you know will definitely IPO at a higher price than your entry; it's just plain unfair!

The solution proposed is to "increase token vesting times"; I do think that this does mitigate some of the unfairness, but the problem lies in finding that sweet spot in which parties involved are content with the lock-up period.

In conclusion, I believe that:

Not everything needs a token

Sometimes old is gold

Take note that the points I have raised above obviously do not carry across all deals, but they're just generalizable characteristics I have seen since participating in this space.

Tokens, in my opinion, should be used either for governance or for easy investment products for retailers; not as get rich quick schemes. Sadly, the current model encourages the latter, as people raise just to drain treasuries and leave the scene. But on the bright side, I believe that as the industry grows, we will find better solutions to address these issues.

- Kyle

If you liked this piece, subscribe here!