DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

Thesis

Overview:

On 31 July, Curve was exploited. Due to certain smart contracts running different versions of Vyper (Versions 0.2.15, 0.2.16 and 0.3.0 are affected according to mimaklas, a member of the Curve Team), a re-entrancy exploit was conducted. In doing so, the attacker drained the following pools:

CRV/ETH

alETH/ETH

msETH/ETH

pETH/ETH

We will be focusing on the amount of $CRV drained, as it is the crux of the trade idea. According to Nansen, the exploiter made away with about 32 million CRV.

Impact:

This subsequently caused the token on-chain to crash to $0.20. The potential implications are of major focus because it plays a big part in the trade idea. Firstly, the token:

Brought focus to the $100 million CRV debt of Mich’s on Aave once again

Was halted on Korean exchange Bithumb and Upbit

TVL on Curve dropped from $3.25b to $1.84b (43.3% drop)

Thesis: Long $CRV

because it’s oversold, highly negatively emotionally skewed.

Traders are trying to hunt the liquidation threshold by shorting CRV. While Aave health factors have always been a source of contention, they’ve not actually ever been low enough to justify liquidation.

The overhanging risk here lies in the fraxlend pool, which remains the clear line in the sand due to interest rate payments.

Curve’s Relative Performance:

Price of $CRV (as of writing): $0.513

Liquidation Prices: $0.35 - $0.39 (but Frax is the volatile one)

Technicals:

On the initial huge wick down (-11.73% move), OI/MC ratio increased from 7.73 – 12.29 (59% increase)

Since then, OI/MC has increased by ~12.58 (104%) where it currently sits at ~24.8

Most traders seem to be positioned short, as OI is steadily climbing while price is moving downwards

Funding rate of CRV currently sits at -186% annualized. For reference, BTC and ETH are at +6.02% and +4.62% respectively. It is the 3rd most negative funding rate coin on Binance at the moment

Aggregated CVD dipped heavily negative (presumably from the hacker selling the tokens / fud), but has steadily climbed +50%, to an aggregate of 4M spot, but has since gone down even further to -10M

It seems to me that the combination of these factors means that:

People are really hunting his stops

Perps will have to unwind eventually – with OI increasing and price not budging, it’s presumably bullish – short sellers aren’t able to push through the bid wall

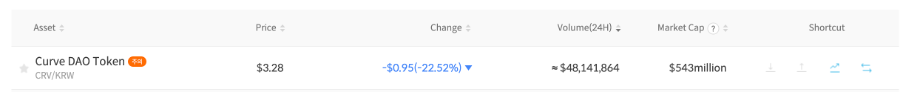

On Korean exchanges, they have disabled the withdrawal / deposit of CRV. This has caused price to fluctuate violently. The prices of CRV on the following exchanges are:

Bithumb: $3.28 (+437.7%)

Upbit: $0.81 (+32.7%)

Assuming that withdrawals / deposits gets re-enabled, this would encourage arbitrageurs to step in, selling CRV on Korean exchanges and buying CRV on CEXes. At current prices, $0.613 CRV is ~782.59 KRW. On Bithumb’s Orderbooks, we can see that there are limit bids at the following prices:

Taking Bithumb as an example, an upper limit of ~$259,355 can be arbed. Looking at Binance, it’s quite telling when the upper 2% depth is only $187,018 – assuming a full arb, it’s possible to move $CRV’s price on Binance by 2%. Obviously it won’t play out like that, but the model shows us that even there is more upside than downside on CRV, especially when looking at +/- 2% depth on Binance.

Curve’s Previous Short Squeeze

The biggest reason to be long $CRV has to be due to the previous short squeeze. On 15 June 2023, Michael Egorov ($CRV’s Founder) was also thrown into the spotlight for borrowing $63 million in USDT against collateral of 288 million ($180 million) in CRV. Risk analytics company Gauntlet proposed Aave to freeze CRV collateral.

However, it didn’t work before – and to reach .39, it’ll have to reach FTX levels of contagion.

Risk

Worst-Case Scenario

Some possible worst case scenarios:

Curve gets hacked again, either by the same way or a different way

Somehow price of $CRV gets to Mich’s liquidation levels

Fraxlend pool doesn’t get refilled / he doesn’t repay the fraxlend pool

Execution

For the worst case scenario to come true, we need the following to happen:

Enough sell pressure to come true to push CRV to liquidation price. From previous events we’ve seen that this is extremely hard to do (at 0.39, that’s a -20% from current price)

Mich’s inability to repay his loan

For shorts to unwind, these are possible scenarios:

Mich repays Fraxlend Pool (the most dangerous pool right now due to interest rates)

In essence, this is a bet of Mich’s ability to repay his loan on Fraxlend, versus him not wanting De-Fi to collapse. As the days go by, the probabilities increase in the shorts favour.

I’d estimate that currently it’s a 60 (no collapse), 40 (collapse) trade, versus the 80-20 probability just a few days ago. But these numbers will exponentially increase the longer he doesn’t pay, as people continually lose faith.

On the other side, the moment he repays his fraxloan, I’d assume he’s out of the red – his Aave stops have shown to be only hit when a FTX level event hits, so it’s quite hard to reach. This will cause a short squeeze.

Possible LONG Execution:

Either long on the news of Frax repayment confirmation (on-chain information has no asymmetry, so you’ll be competing with bots)

Long in anticipation of repayment

Market can remain retarded longer than you can remain solvent, so it’s probably best to add on dips. This can go lower than you expect

Possible SHORT Execution:

Short in favour of him not being able to repay

Open shorts once frax liquidation has been hit, expecting a liquidation cascade

Misc. Resources