Are You A Trader Or Are You Just A Lucky Gambler?

You and I are probably more of the latter, if I were to be honest

Have you ever entered a trade on the edge of your seat, praying that the price would move in your direction, exiting upon a 10% move in the opposite direction, just for it to revert back and put you in imaginary profit?

Have you ever entered a trade where you were vaguely aware of the idea behind the trade, and knew that it “wasn’t the best idea”, but did it anyways because “you didn’t want to miss out”?

Have you ever entered a trade where it felt like it wouldn’t turn out in your favour, but just because everyone was winning and you weren’t, so you just had to enter it in the hopes of making a win?

Congratulations, you’re a gambler!

What’s The Difference?

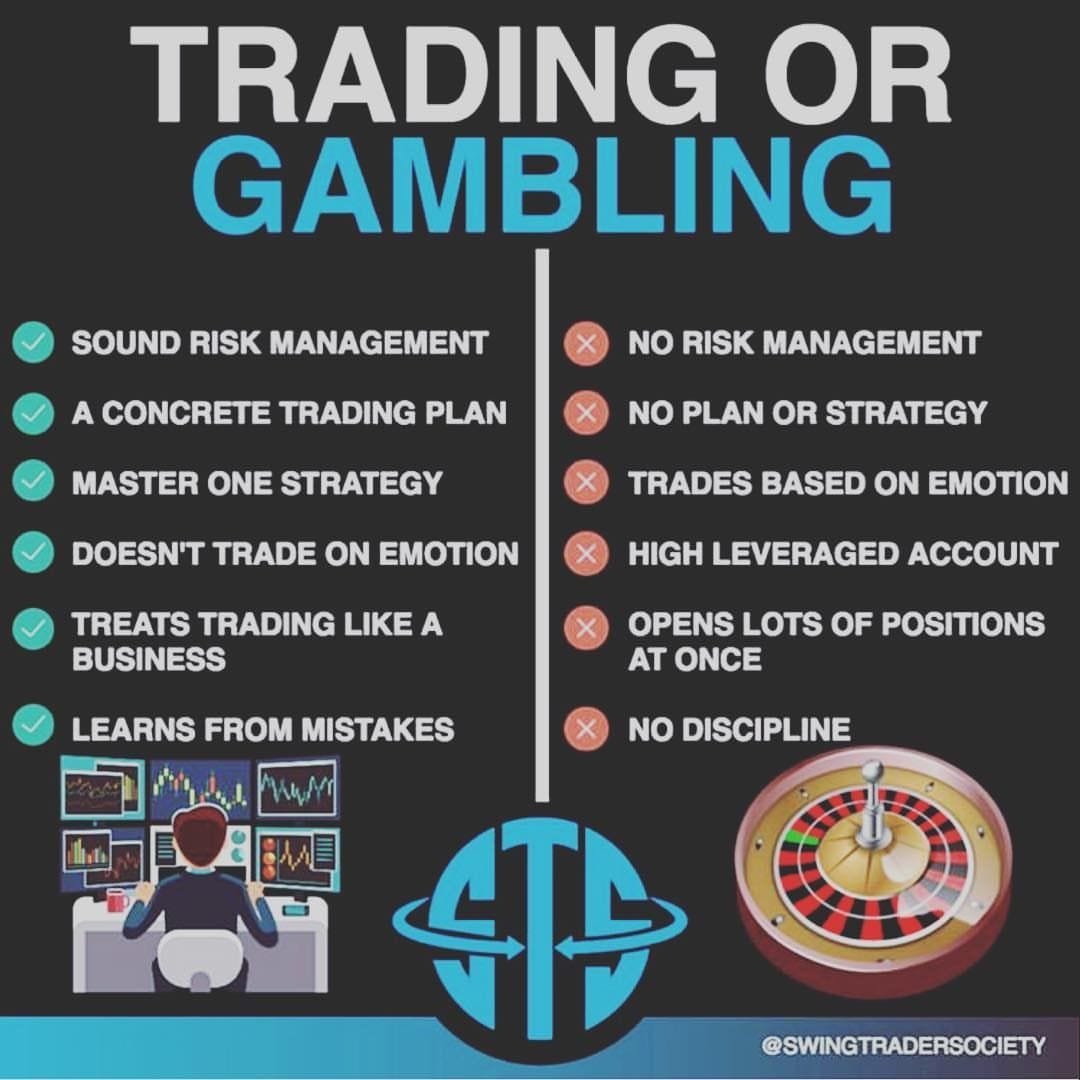

I googled Trading Vs Gambling; this was the first picture on Google Images. It’s one of those posts that you would expect to find on a finance infographic Instagram account, yet I find that it accurately reflects Crypto Twitter (CT).

No risk management, no plan or strategy, highly leveraged, opening lots of positions at once? Sounds like most of CT. The thing you have to understand is, crypto is a casino in which the average player actually stands an above-average chance of winning - and honestly, they can very well just keep winning.

Let’s look at the people who minted Bored Apes. Do you think they’re some sort of “revolutionary insightful genius trader” who could accurately predict that their JPEG would go to $500k at ATH? I doubt it. In reality, crypto is a casino in which the player has a marginally good chance of making it big, just because the markets are so inefficient here.

Still not convinced? Let’s look at another example. Say Person A decides to leverage long the top at $60K, with no regard for risk-management strategies, trading based on emotion, and no downside hedging at all. Would you call him a trader or a gambler?

It turns out Person A was 3AC, and their “hedge fund” was just a degenerate gambling fund after all. Many people - even the top minds in CT, are just degenerate gamblers who got lucky over and over again. And it’s honestly possible to keep winning without losing because that’s just how easy the crypto markets are to play.

So Why Are You Telling Me This?

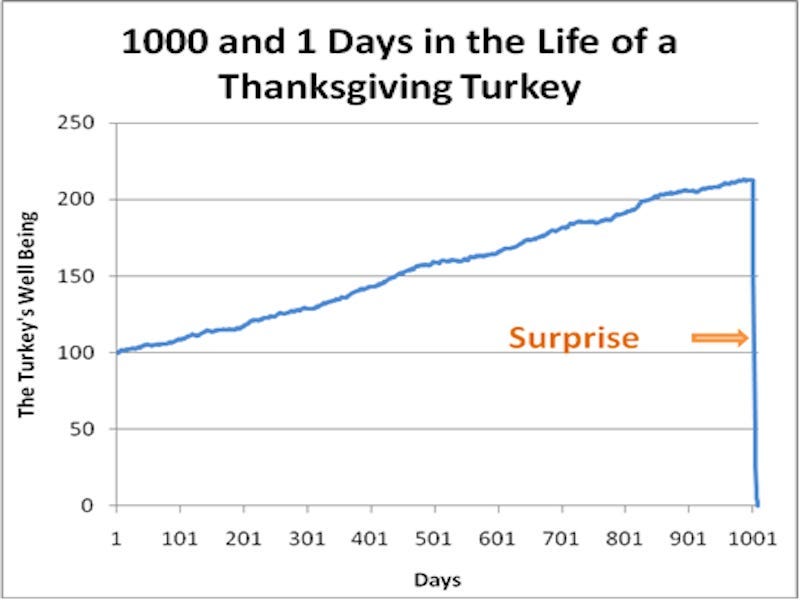

Yes, crypto markets are extremely inefficient. But gambling works, so why not just keep doing it?

Because it only works until it doesn’t. 3AC literally made so much money, and it kept working for them - until it didn’t. And what makes you think that you’re more intelligent than 3AC? Because you didn’t blow up?

But how do you know you won’t blow up tomorrow? In my opinion, gambling is only successful if you cash out - which means you actually buy something tangible with your winnings. As far as I’m concerned, even if you have 7 figs in magic internet money, if none of that hits your bank account, you’re just a gambler.

And I know because I’ve been there. Last cycle I was at mid-6-figs, but I didn’t cash out. Guess what happened? Now I’m down -85% - can you still call me successful?

Recognizing This Is Your Step To Being A Trader

But I didn’t make this article just to call you guys (& myself) out. I actually made it because, in my journey to find and hone my edge, this was the realization that I’ve come to. But it doesn’t have to end that way - in my opinion, every trader on CT more or less starts off as a gambler. The markets here are incredibly easy to play - in a bull market, you can literally pick any coin and basically make money off of it. How can you not think that you’re a genius?

But in my opinion, outperformance will come by evolving and iteratively improving your processes. Build systems, and sooner or later you’ll find yourself becoming less of a gambler and more of a trader.

In essence, a trader is someone who has a plan and sticks to it and knows when it’s invalidated.

Let’s do another analogy. Let’s say you know a self-proclaimed trader, John. John says that he believes the market will go up post-FOMC. You agree.

Tomorrow, John says that he saw this “never wrong, always right” guy on Twitter say the market will crash post-FOMC. You start doubting his words - "how can he believe some random guy on the Internet?”. But you go along.

The day after tomorrow, John says that a LARGER “never wrong, always right” guy says that we will, in fact, go up post-FOMC. So he’s now positioned for the upside, once again.

At this point, your trust in John evaporates. “Is he really a trader?” you ask yourself. This man claimed that he trades, yet bases his prediction on internet characters, and doesn’t seem to have an opinion of his own that he can logically justify. When asked “why he believes in opinion Y”, he says “Oh, because magic internet character 0xKyle told me so.”

Would you put your trust in John, as a trader? Would you even believe that he’s a trader? He just sounds like some dude who knows nothing about the markets, but has been making a killing! He sounds… like a gambler.

What John doesn’t understand is that the markets will always be full of differing opinions. That’s how markets function - if everyone was bullish, there would be no one left to buy. If everyone was bearish, there would be no one left to sell. Markets are a function of differing opinions, and so as an individual trader, the most important thing is to learn to believe and listen to yourself.

Your Journey To Becoming A Trader Starts Now

I’ll be honest. I don’t think I’m much more a trader than a gambler. I may still be profitable, but I know that I’m not the best at this game. But that’s the thing though - I think that at the end of the day - be it 1, 3 or 5 years from now; I’ll be way better at this than who I am today.

Why? Because I’m learning from my mistakes. Slowly, but steadily, I’m finding what I’m good at, and what I’m bad at - focusing on what I’m good at, and forming my own opinions. I’m planning for every trade and writing down their invalidations.

Treat it like a business - have a plan, have some sort of direction (mission statement). But also, know when it’s time to pivot. Have insurance (risk management) in case your business goes up in flames. But also, have take profit strategies (revenue) and always, always evaluate your business (trading) so that you make sure you’re profitable.

If you’re reading this and it resonates with you, I believe this is the sign for you to start turning your gambling into trading, if you want to get good at this game.

"I'm only rich because I know when I'm wrong. I basically have survived by recognizing my mistakes." - George Soros

"The thing you have to understand is, crypto is a casino in which the average player actually stands an above-average chance of winning"

- coming from a background of professional gambling I strongly disagree with this. The crypto market is a zero-sum game, meaning every dollar you make is a dollar somebody else has to lose (and vice versa). So the average player loses money over the long time, anything else is mathematically impossible.

Good read.