A Thesis On Conviction

I have "conviction" that this coin will go up. But when do I sell?

GM Frens. Holy shit, it’s been a while since my last substack post. Sorry about that folks, but full transparency: I’ve been busy with school + trying to find an internship LOL. Harder than it sounds.

Also, substack is my least favourite medium of discussion because I feel forced to write a long article or something. But worry not, I have recently made a telegram channel where I post snippets of thoughts that otherwise aren’t long enough to be made to a full-length article on Substack, yet not worthy of being posted on Twitter.

Link to the channel is: https://t.me/kylesthoughts

Anyways, to the main meat of today: A thesis on Conviction.

Conviction means nothing.

I would like to spend today discussing what conviction means, and my lessons learnt from being a conviction bagholder. This article can pretty much be summed up in simple terms: Depending on your timeframe, adjust your conviction accordingly, and at every point, consider when you should SELL. DO NOT BE A CONVICTION BAGHOLDER.

Conviction is a word widely thrown around in Crypto - “I have conviction X coin will go to $”, “I have the conviction that this coin will go up immensely”. Advice is given, “Oh, you gotta have conviction man, don’t sell too early”. Conviction seems to be one of the secret ingredients that make a coin’s price go up.

And I’m guilty of giving this advice. But recently I’ve been thinking about this a lot. Is this really true? If I have the conviction that my coin goes up, will it really go up?

Of course not. There’s a myriad of other different factors at play; I argue that conviction is the effect of a good product, rather than the cause. The cause → effect chain looks something like this:

Good product → Conviction → Many people see this product, and have similar convictions → Many people buy the product → More buyers than sellers → Number go up.

Having conviction is never the cause of a number going up; it is something that is BUILT from the result of a good product; and when enough people see that this product is truly good, they believe that its day will come, they flock in and they buy it up, causing the price to go up.

But the key thing to realise is that when people have “conviction” they hardly consider the anti-thesis of conviction. As important as building your own conviction in a product is, it’s EQUALLY important to consider when you should sell.

I know some of you may think this is a super common sense topic, that it’s something everyone knows. But this has happened to me, it has happened to many other people as well. You can sell and still have conviction in the product. I didn’t, and it has cost me greatly to the point that I’m now writing an article on it. SELLING doesn’t mean you’re “not convinced”.

Timeline Of A Conviction Play

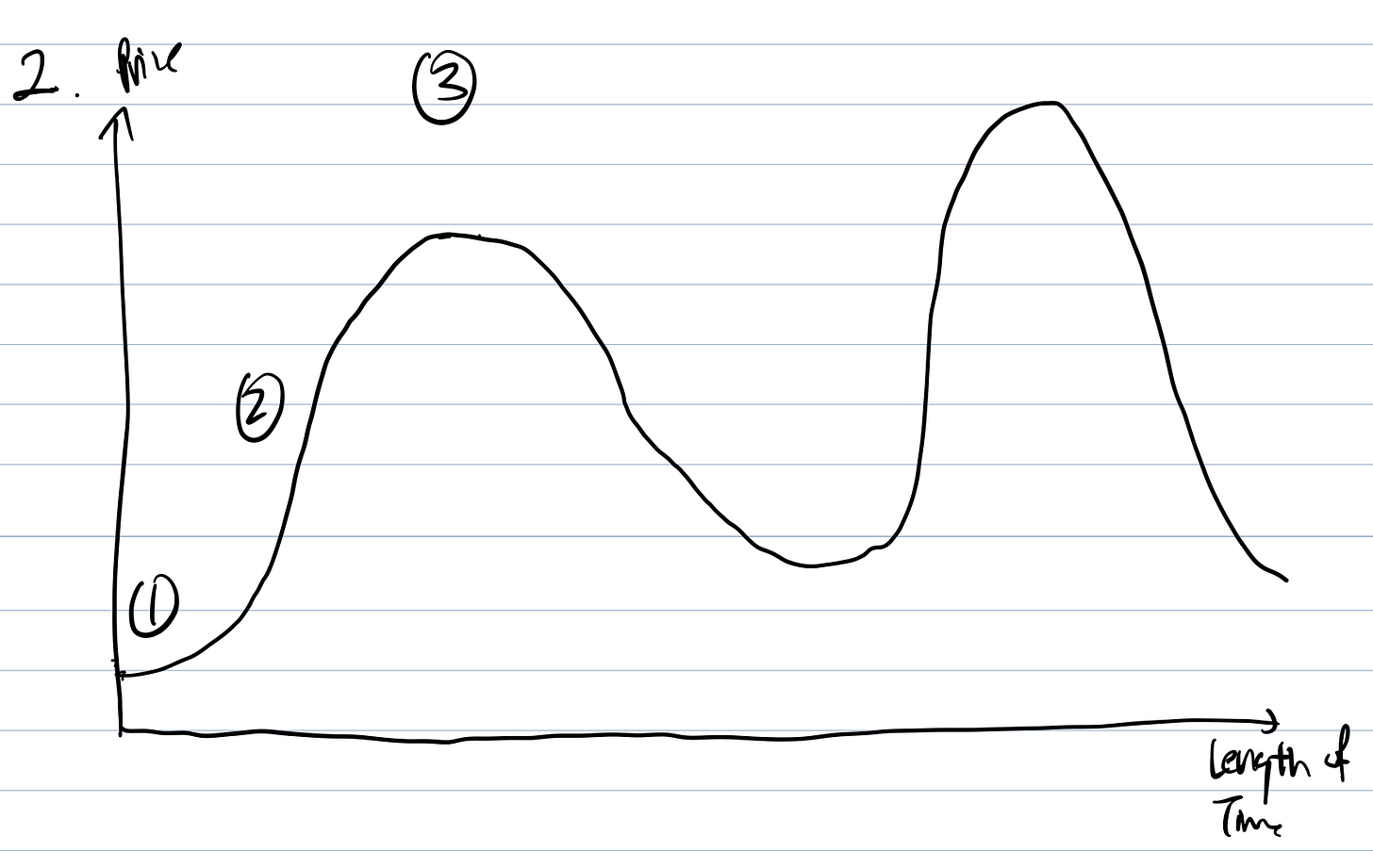

Still don’t know what I’m talking about? Well, let’s look at the chart below.

Essentially, every macro chart of every coin or NFT can be boiled down to this scenario

I’m going to be breaking it down from a first-principles level - analyzing WHY you buy something and what it means when you do.

(AT POINT 1) - Now, say you get in the coin at the very beginning. You see the product, you see that it’s a great product, you know it’s a great product, and you buy it because you believe that the product is so revolutionary that more people are going to want to own it hence driving prices up.

(AT POINT 2) Now, more people start noticing this product. They read its whitepaper, what it’s doing, and they’re like “Oh, this seems like a good bet.” They bet that more people (after themselves) will still continue to buy the product, that the product is undervalued right now and it’s fair value is something beyond it’s current price. They hence buy the product.

(AT POINT 3) After some ups and downs, you eventually reach a point where euphoria is at its max. It’s important to realise that crypto is an extremely catalytic place, that euphoria is generated through certain catalytic events that push the price to insane levels. Think - $LOOKS when everyone was saying how it’ll take over Opensea, $JEWEL when everyone on my TL was talking about it, even $MAGIC when everyone was just like “holy shit it’s gonna go up”

Now at this point, you have two choices - you either sell or you hold/buy more.

Let’s discuss the latter one first. WHAT exactly means when you buy more? It means that you believe that the current euphoria is still not a reflection of its true price, that the price can go way further than it is now. You believe that there will STILL be more buyers despite getting that buzzing feeling in your chest that everyone in the whole goddamn world is now talking about your NFT / Coin.

You believe in the long-term conviction of the project. This is very important to note because in my opinion conviction has a timeframe. When ethereum went to 4k, and you bought, you didn’t buy thinking it was going to 2k. You bought thinking it’ll go to 10k, that in the LONG TERM, when this project is fully executed, it’ll be worth >4k.

The issue here is that many, many people that buy at such levels don’t think like that. They think that AT THIS POINT, the coin can still go higher. And that’s just pure BS. If you held, you believed that it’ll go even FURTHER.

Now, if you sell here, what does that mean? That means you believe that the coin / NFT is overvalued, that everyone is euphoric as heck and that you believe that the progress of the project does not justify current price levels, and you recognise that being the catalytic place crypto is, catalysts are often short-term ignitions for explosive price levels but not a reflection of the true value.

You still have conviction in the project, but it has reached your point of short-term conviction - having hit all the necessary catalysts you believe to raise the price, you know that there are no more buyers, so you sell. Congratulations, your short-term conviction play has played out, and you dump.

When there are no more buyers, who is left to buy? At point 3, buyers exhaustion sets in. There are no more buyers, only sellers. Price dumps.

People who bought or bag held at point 3 are now the “conviction bagholders”. They believe in the long term vision of the project but forget that being the catalytic place crypto is, will now have to hold through drawdowns and max pain before the coin hopefully rises again.

If that was your gameplan from the beginning, good for you. But as an investor, I sure as heck am not holding a coin for 2-3 years waiting to see what they build. It’s called opportunity cost, and I can always buy back in later.

In Conclusion

Have conviction, but recognise - is it short term or long term conviction? Identify catalysts that will pump up prices in the short term, and it is equally important to identify when your “conviction” has played out.

Don’t hold conviction for the sake of it; when do you sell? Never? That’s stupid.

When you buy something, identify your timeframe / certain catalysts that you believe will ignite short term price pumps, and how long that’ll take.

Selling something doesn’t mean you don’t have faith in the project - the fundamentals are still the same, just that you believe that it’s overpriced / you don’t want to wait for the devs to push out everything before selling. Set a timeline for your conviction, and adjust accordingly.

Why is this topic important? Well, because this was a lesson that I was just taught (painfully), and just wanted to share it

At the local top, $MAGIC was worth $6, and now it’s at $2.4. Should I have sold it at $6? Yes. Could I sense that it was a top? Most definitely - my timeline was abuzz and I felt that feeling, that “we were going to the moon” despite having a worsening macro outlook at that point in time.

The best traders I knew sold because they felt that the price increase wasn’t sustainable, and guess what? They’re the best for a reason.

Now, who am I? Just a conviction bagholder - while I’m sure it won’t go into a death spiral, I now spend time waiting for the devs to push something out + for coins to go up to eventually catalyze the next price increase. I believe in the long term vision, but with 95% of my portfolio in a coin, it’s just not a good idea to wait 1 - 3 years for that to be executed.

This can be extrapolated to every coin / nft in the universe. With NFTs, you can so easily tell when there was some short term catalyst that drove prices up immensely.

But I’m honestly grateful for this lesson - I know people always say buy low sell high, but it’s through accumulating these painful experiences that I can build the intuition of dumping at the top.

Hopefully next time I won’t screw up.

Till next time

Kyle