0xKyle's Weekly Market Updates #10

GOOD MORNING ENJOYOOORS. 3 April - 9 April, 2023

DISCLAIMER: The information contained in this newsletter is for informational purposes only and should not be considered financial or investment advice. Any opinions expressed in this newsletter are solely mine.

It’s the 10th week of this weekly market update newsletter (changed the name to better reflect the content). Moving forward, I will try to continually increase the quality of content - been missing out on many things lately due to finals and life stuff.

Anyways, today’s substack is brought to you by: ALTITUDE DEFI

Powered by LayerZero, Altitude is a cross-chain bridging protocol that enables you to bridge your favourite alts - instead of stables, which Stargate Finance is famous for! Altitude utilises LayerZero technology to allow assets to go from one chain to another way faster than current solutions will! If you’re interested in learning more, refer to the thread I did for them below:

Executive Summary

$BTC 7D: +2% | $ETH 7D: +3.4%

GM Enjoyoors. I hope you’ve been good, and haven’t lost too much money trading this past range that we’ve been in.

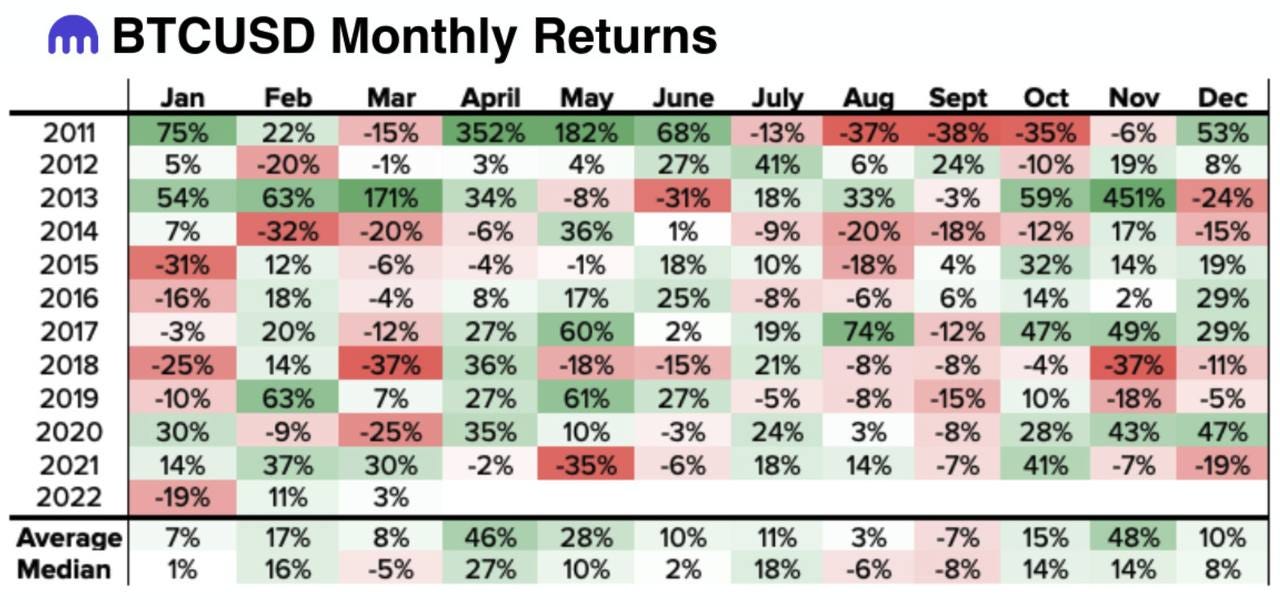

April has historically been a good month for crypto assets, and so I’m praying that it shapes up to be a good month. Everyone’s sort of expecting a “Sell in May, Walk Away” kind of vibe in May, so if April doesn’t exhibit performance similar to previous years, we might instead experience a very hellish and choppy few months.

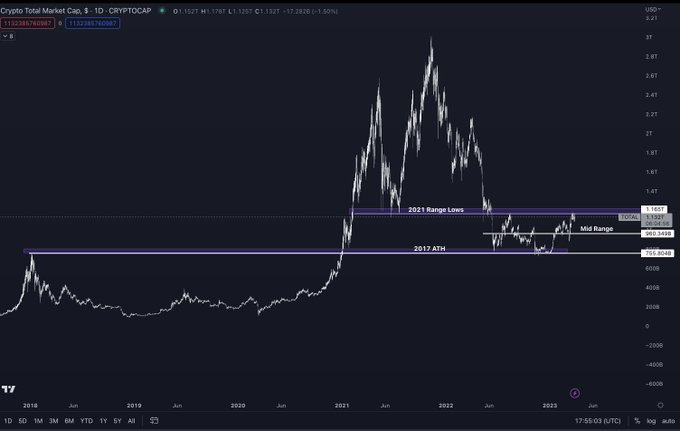

The playbook I have is simple: if BTC breaks 30k on a sustained timeframe, that is an extremely bullish signal - on a technical point of view, breaking the 2021 range lows will push us higher and fill that lack of liquidity on the weekly timeframe.

On a more macro / narrative-driven point of view, Bitcoin has had the pleasure of being the hot topic given recent events. As more people realise the “true utility” of the fully sovereign, peer-to-peer electronic gold, it could push higher with this wind at its back.

Bear Case

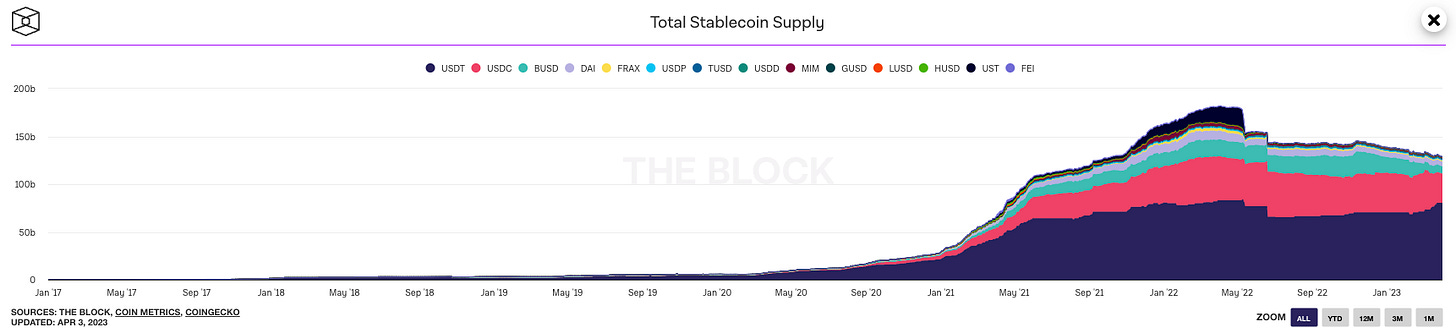

I’m going to be honest with you guys - the bear case is way stronger than the bull case. Total stablecoin supply has pretty much been close to flat for the past 3 months, in the ~130b range. There’s not much new money coming in - well evidenced by the GCR tweets that this all has just been “the same money sloshing around”.

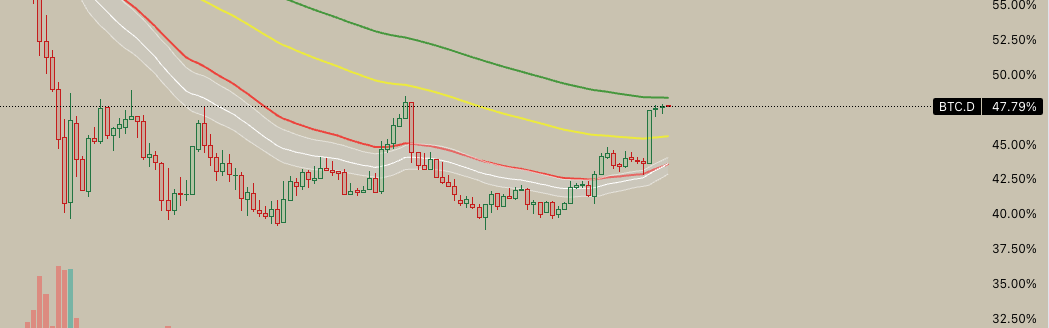

BTC Dom is another cautious metric that I’m looking at - while I don’t have much experience with what happens at range highs of BTC Doms, I can only imagine that for it to go back down, we’ll need to see a nuke across the board.

Lastly, macroeconomic conditions haven’t changed much, and likely won’t change anytime soon. Markets really hate uncertainty, and there’s just this enormous cloud of “what’s going to happen next” that pushes us from going up.

Economic fluctuations also don’t cure in a matter of months - I expect that we won’t see a new bull run until 2024, at least. That isn’t to say that we can’t remake January’s conditions - but keep your expectations in check.

All in all, while waiting for April to show its hand, I will be chilling. I’m not particularly long or short right now - and on-chain, you can really see that the top gainers aren’t anything amazing.

HTF Thoughts

I don’t think people give enough credit to HTF thinking. Zooming out, we’re literally in *the* bear market. Many of us are glued to the 15m chart when in reality, if you’re willing to take a multi-year timeframe, you can’t really complain about the prices we’re at.

Think of the market as something you’re buying - if it goes down in price, shouldn’t you buy more of it? And why are you scrimping about the few hundred dollars difference of where you enter, versus the thousands of dollars upside that you’re so convinced on?

And so, DegenSpartan’s tweet really put things into perspective. Of course, note that this is purely from the perspective of someone that does not full-time trade. In my opinion, you do not have to min/max capital efficiency as a retailer - you can perform in-line with ETH, which theoretically should already outperform SPX, and you’re doing better than most people.

There’s actually a lot more to say about this topic, but I’ll stop it there for brevity’s sake.

Market Narratives

Ethereum’s Shapella Upgrade

With Shapella (Shanghai + Capella, apparently) coming up, I’m pretty sure it’ll play out like the Merge - upgrade happens, market dumps, and the dip is bought. Eyes will be on LSDs afterwards - I’ll probably look to unload my LSDs pre-Shapella ; logic here is that the whole staking / un-staking on the “product” side of things wasn’t the main reason for the trade - it was more of an attention flows kind of thing. With Shapella out of the way, I don’t want to be in the trade for reasons apart from why I took it.

OPNX (h/t DefiMaestro)

If you don’t know, OPNX is a to-be-launched exchange that’ll allow you to trade your claims on defunct exchanges - from FTX, to Celsius. The catch? It’s run by ex-3AC traders, Su and Kyle (Davies, not me).

I’m not sure how much traction it’ll get, but if people are willing to get some semblance of their money back, I can see the native coin FLEX going up from here.

zkSync + Scroll + Whatever

Because everyone’s farming for the “self proclaimed” ZK-Rollup token, you can expect there to be more liquidity on these chains. But I’ll be careful - this is way more PvP than Cantofornia ever was, and you can expect the musical chairs to run extremely fast.

Personally, I’m not on that chain - I don’t think they’ll airdrop a token so soon.

Others

Frax v3 launch confirmed by the team

Mugen’s cross-chain swap built on LayerZero has been released

BTRFLY alpha

Nice