Welcome to the first Weekly Market Update! There are lots of substacks out there that give you brief updates on the ecosystem so I’m trying to build something different.

Each week I’ll focus on my takes on the markets + possible narrative plays / projects that I see/think might pop off. Also trying to make this as short and minimal effort to read as possible so that you’ll have more time in your day :)

A reminder that none of this is investment advice, just educational - I’m not some OG, I’m on this journey learning with you guys as well.

Executive Summary

The crypto market has rallied HARD in the past week post-New Years. While nothing has changed in the macro-economic scene, this could be the start of an extreme bear market rally. Either way, the way forward is to continue playing the game while always hedging for the downside. We’ve had quite a few narratives pop off, and they’ve been incredible profit-making opportunities for everyone. Shorting the rips of the most recent coins would have been madly unprofitable, signalling a change in the current regime for the time being.

This upcoming few weeks/months (however long it lasts) will also probably be great for narrative/news traders (hence all the more you should subscribe) - sophisticated teams who know what they’re doing understand that announcing the news in a bull market yields much more reflexive returns to the upside, and will look to do that.

In general, longs seem to be more EV than shorts.

Market Analysis

BTC 7D: +3.3%

ETH 7D: +7.7%

SOL 7D: +54.8%

ATOM 7D: +17.1%

BNB 7D: +14.2%

Smart Money Stablecoin Inflows:

Smart money still seems to be sitting heavily in stablecoins - with 30% of their total holdings in stablecoins. However, if current conditions last, I expect this number to dwindle over the next few weeks.

Key Events:

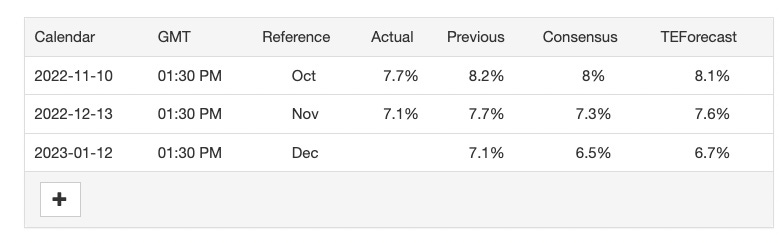

Jan 12 - CPI Announcement

While people are already disregarding inflation, quoting a seeming downtrend of the past few CPIs, this event will, in my opinion, still be crucial in the continuation of the mini-bull run that we’re seeing - if the inflation rate meets the consensus, I’m predicting the continuation of this extremely risk-on attitude that might bring us back to 2K $ETH.

On the other hand, if we’re above consensus, it’s hard to tell how the markets will react. On one hand, I can imagine that this isn’t that “big of a deal”, and that markets will continue pricing in a long-term downtrend. One thing I’m confident of, however, that is if we don’t see any huge macro-economic catalysts, this lull is more bullish than bearish.

Narratives / Projects

LSD Narrative

This has been the over-arching narrative all week, and just when I thought it was cooling off, it rebounded back. IMO this dictates a new regime change from the range-bound market we saw; shorting rips is -EV now.

The time to rotate might already be over, but this was the list I sent to my friends (the coins are in no particular order):

Prio 1 - the most obvious, the LSD Rotation: $FXS/$SWISE/$RPL/$BTRFLY

Prio 2 - PoS rotation: $ATOM/$SOL

Prio 3 - “Ethereum” Rotation: $OP/$MATIC

SOL Shitcoins Narrative

With the release of $BONK (something I missed entirely), the $SOL shitcoin scene seems to have welcomed itself. I think some people might make the argument that because $SOL is so cheap, it’s cheaper to deploy contracts and ape on that chain. But in reality, it’s simply a game of reflexivity - $BONK gave the market enough momentum and reason to simply just spark a shitcoin season on $SOL.

Or perhaps the more simple solution is to buy $SOL, as it has seen a close to 100% rally off the lows.

Metaverse Coins

$GALA/$SAND/$MANA/$AXS are suddenly seeing a tear. With low unit bias and an ability to suddenly create pumpamentals through news, they might see increased attention in the coming weeks. I don’t really like this narrative because it’s quite divorced from what’s happening in the rest of the market, but will definitely keep my eye on it.

I don’t necessarily think that this has a trickle-down effect to gaming coins, but it’s always good to keep a keen ear on the ground.

Artblocks / Gen. ART Narrative

This narrative has been here since December, but with Friendship Bracelets by Snowfro going through the roof despite being a 30k collection, I expect it to last even longer.

With collections like the reliquary going from a free mint to 0.5 ETH, it’s a good sign that the NFT market is slowly crawling back. If you read my 2023 Market Outlook, I think that NFTs will be a huge part of the echo bubble. You can read it below:

I’m actually super bullish on this narrative and think this will be where I’ll be spending most of my time - NFTs remain the easiest way for retail to dump their money into; it’s much easier for liquidity to flow towards NFTs through platforms like Opensea, than for someone to use exchanges which, due to the FTX fiasco, just seem to generally have a negative mindshare.

PFPs / “Bluechip” Projects

Pudgy Penguins have been on an absolute tear, and I forever want to shoot myself for not getting one when it was at 3 ETH. Anyways, the thing about this project is that it’s very crypto-native - normally crypto-native projects see immense hype before dropping to 0, just because crypto traders are bad at being left-curve H0DLERs.

The fact that it’s clawed back is a good sign that it may very well run higher; this has also sparked a mini “cute PFP” szn, with other collections like Sappy Seals and Tubby Cats seeing some activity. But if you were to ask me, I’d say that buying a Pudgy would still be the play here.

Secondly, one particular Bluechip project has been on the rise throughout the bear - Terraforms. Don’t ask me what they do, I remember minting a bunch of these and selling at like .4/.5. They’re now close to 4 ETH, and they don’t look to be slowing down anytime soon.

AI Coins Narrative

AI coins have been sending ever since announcements of ChatGPT’s valuation at above $24 billion. AI coins are pretty far out on the risk curve, and like gaming coins, I don’t think it’s the core focus of the markets. But good proxies are $OCEAN and $ROSE. I haven’t really done my research on these yet, so PLEASE do not take my word for it.

Possible Upcoming Narratives:

Based on what we’re seeing, I do think these are some possibilities:

Arbi Szn v4

We’ve had Arbi szn like three times now, or something. The thing about narratives is that you always have to choose the path of least resistance. Pumps will always go from what hasn’t “pumped” in the same sector, to the most “similar” in regard.

I think that any narrative that has to do with $ETH upgrades will always have the chance to rotate into a L2 narrative, just because. With the Shanghai upgrade coming up, I have a feeling that people might start rotating into your arbi coins.

$GMX/$MAGIC as a proxy for the general arbi ecosystem, but you can probably look at $DPX/$PLS/etc.

“Gold” De-Fi coins

If you’ve read Fisher8’s report (you can scroll down for my Twitter thread of all reports), they talk about betting big on the next $SNX.

We’re looking for projects that have good mindshare and are still building. I feel like some of these projects include:

$BTRFLY/$FRAX/$LOOKS/$LDO (can’t fade DegenSpartan’s thesis)

“NFT” coins

With the Blur.io airdrop around the corner, we might see a pump in NFT coins. In particular, I’m looking at $APE/$LOOKS. $x2y2 might see a pump but I’m biased towards LooksRare.

Also, I heard that Yuga is launching something on 11th January. Unclear, but in these market conditions, news like that probably isn’t priced in UNLESS the news is lame. But if it’s substantial, you can expect a good nice pump.

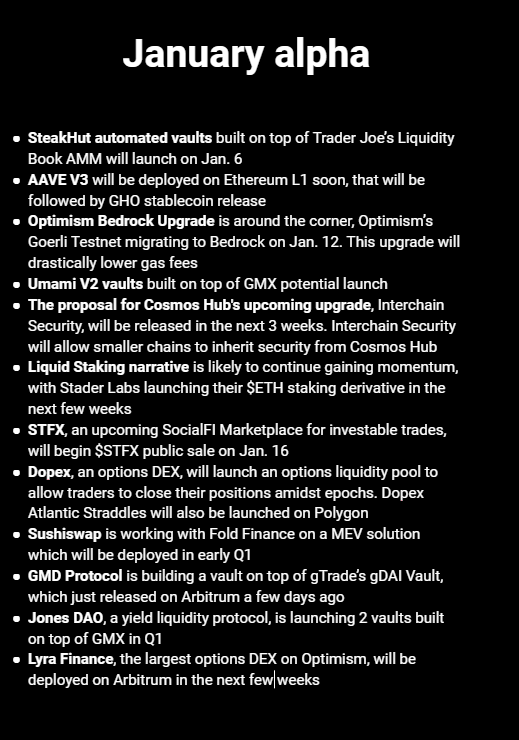

Upcoming Alpha

I forgot who posted this, but credit to whoever did!

Some Useful Reads

Personally, I don’t want to be one of those people that spam threads - in all honesty, with limited time each day, choosing what to read is important.

So these are the ones that I really liked.

Has Crypto Failed by Joel John

An EXCELLENT piece. You don’t have to read the whole thing, just the last part where he basically re-ignites the bullish thesis on crypto.

Web3 Tools Thread by Andrewhong5297

Just a cool infographic featuring web3 data tools, might be useful to some of you. I particularly found the part on transaction visualizer to be useful; haven’t tried it out, but I’ve always thought Etherscan was too bare bones to read all the time. Glad to see that these products are finally being launched!

Summary of all Crypto 2023 Outlooks by yours truly

I mean, it is objectively a good compilation of information

Lastly, keep an eye out on the Delphi Macro Summary I’m pushing out. I really think that’s a great piece that’s worth reading.

Cheers, and see you all next week!