0xKyle's Market Color #32

Range highs - will the bulls win? Or will the bears smack down the range breakout

GM! Didn’t post last week bc the ETH ETF trade took too much of my time, and the market was kinda boring. Hope everyone has had a great week! This week I had 3 hotpots in a row - crazy stuff! Anyways, have a great read

Executive Summary 📝

If you read my old posts, you’ll probably see the exact same sentiment right now as we saw when BTC climbed from 49k → 59k → 69k: People being bearish despite all the bullish signals etcetc.

We didn’t get the ideal NFP this week; I’m no macro guru, but we might see the same things we saw last month with FOMC - people start pricing in a bearish FED, Mr Powell comes out and says “all is fine guys” and then everyone starts being bullish again.

This time is slightly different though - Banks all around the world have been announcing rate cuts, in a startling move by the European Central Bank (ECB) & Bank Of Canada. People are thus speculating that the Fed will cut rates.

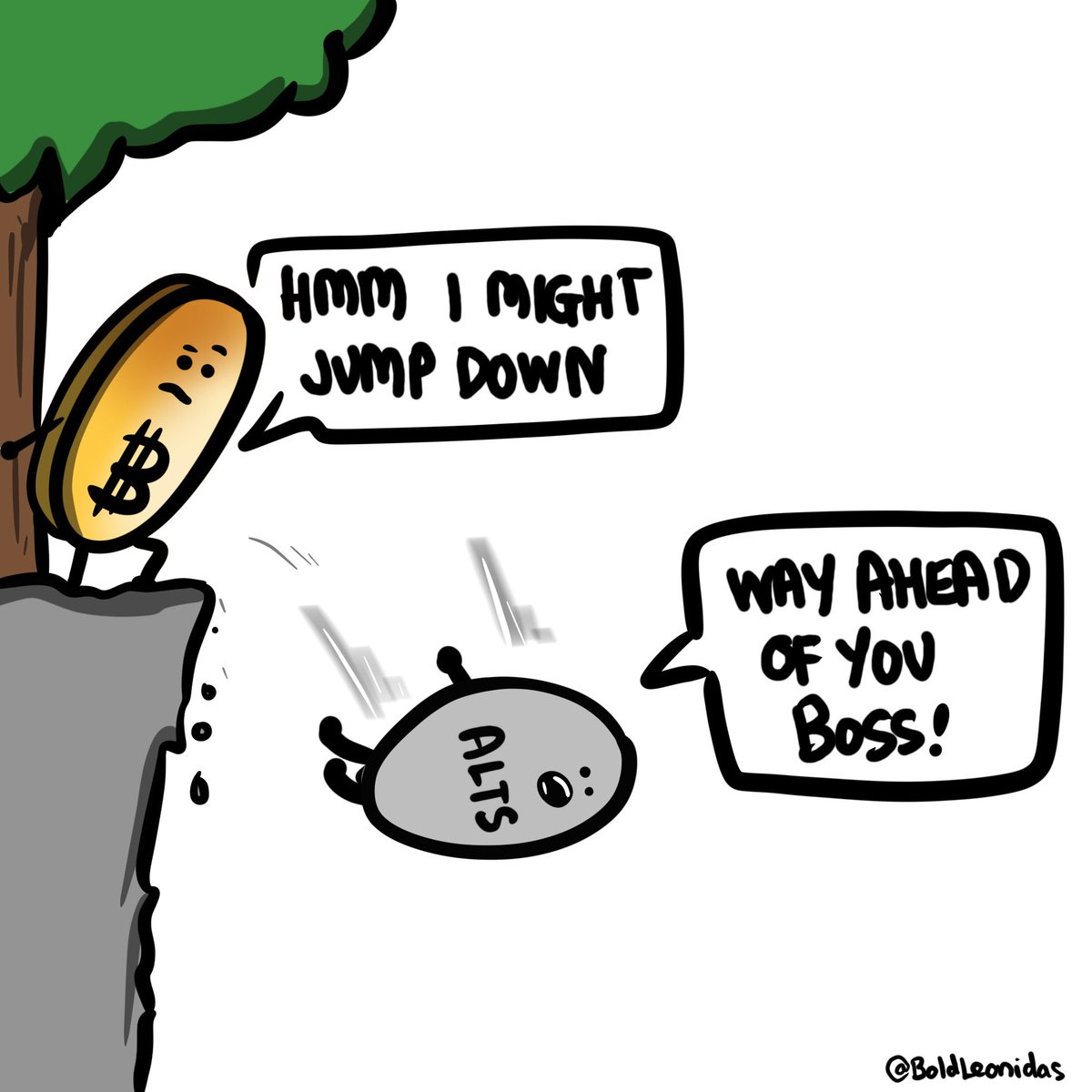

In general, I remain bullish. I think Chris Burniske has said it well - and with all the recent talks about how ALT/BTC has been downonly, I believe that this cycle has been dominated by longer time-horizon views on majors, and high rates of profit-taking on alts.

This cycle is definitely not a “hold my alt to infinity or zero” kind of cycle - the only thing you should be holding is BTC; but that doesn’t mean that there’s no room for outperformance so far. You just have to religiously take profits - something I’m trying to work on.

But to recap - plan this week is to either:

A) Take a position pre-fomc if you think you have edge (most risk, most reward)

B) Take a position post-fomc (least risk, least reward).

Expect most people to go with option B - in which case, you’ll have to evaluate the three possible outcomes:

Rates cut - probably bullish (?). I’d think so.

Rates same - again, last month - people priced in hawkish, thus when JPow came out and said it was unchanged, it was acutally bullish. Sort of like if you thought you failed a test, but you only barely passed. Despite the still-low score, you’ll be ecastatic because you expected something even worse.

Again - I’m no macro guru. But NFP → people hawk → but rates cut by ECB → good chance that people are overly bearish. Idk tho. NFA.

Rates hike - probably bearish.

Market Narratives 🎙️

Narratives have quietened down since two weeks ago, with many meme coins and AI coins off their highs by 10-20%. This may be an attractive area to pick up your favourite alt, though. Personally, my favourite coins are:

ONDO

TON

PEOPLE

With idiosyncratic pumps across the board (STX, INJ) - it’s hard to outperform. My best advice is to allocate into fundamental tokens that you can build a thesis around. The lack of narratives makes this market extremely dry, but BTC allocation is always a good choice

On-Chain ⛓️

Onchain is actually doing a lot better than CEX (well, depending on who you ask and what you look at)

Celebrity memecoins on SOL - Recently, MOTHER (Iggy azalea’s coin) 10xed, and Andrew Tate’s coin seems to be doing really well (I’m not in either of this). Base coin BRETT also hit 1bn this week (crazy shit) and you’re not seeing anyone talk about this

RUNES on Bitcoin had a mini pump this week, and are now selling off

PURR - Hyperliquid’s main coin, 2x’ed as HL announces that their L1 is in testnet

BANANA is doing extremely well as it continues to maintain market dominance

Bunch of Chinese names doing well:

Chinese memes (PEIPEI did well recently, BIAO)

RCH - apparently chinese money

SHFL announcing tokenomics change

To conclude, I shall repeat what I’ve been saying for the past weeks since 57k - I believe the worst is behind us.

Phase 1: Oct 2023 - Mar 2024, slow grind up

Phase 2: Mar 2024 - Hopefully end of summer 2024 (July / etc.): Consolidation

Phase 3: Higher

I don’t think this is the macro top, but there’s some chance of it being the range top if it fails to breakout - in which case, worst case is probably 57k. But again, a range is a range.

Don’t chop yourself up, and chill. Cheers!

I hope you guys stay safe, healthy, and happy!

<3, Kyle

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.