gmmmm! Hope everyone has had a great week. This week I had some good sashimi, and am looking to pick up a couple of hobbies to tide this boring period - am trying to learn magic the gathering! I used to play Duel Masters when I was a kid so it’s pretty cool to play the “grown up” version i guess. Anyways, i wish ya’ll a good week ahead!

Executive Summary 📝

Once again, we are back in chop-suey season as BTC ping-pongs between 60k and 64k. At 60k, everyone goes to touch grass, and at 64k, everyone shouts to reclaim ATHs. The truth is neither here nor there, but I’m obviously more bullish than bearish here, given that such a large downside move has already happened / been happening for the past few months.

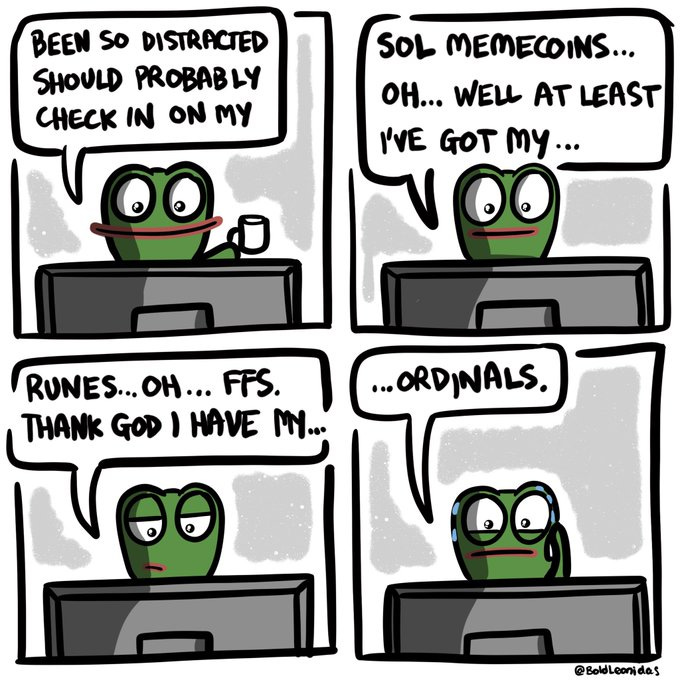

Cobie’s tweet seems to have gotten people on edge, but this is one data point in the sea of many. I will agree with his more salient point on forming your own convictions instead of bandwagoning on the latest CT influencer that takes centre stage.

Looking at what I wrote last week, I was probably a bit too hasty to call it “a bull market” - I feel like I gave off the impression that we’d send to 72k in a heartbeat. I do not think so. Neither do I think we go to 50k, barring some insane macro action. Given that CPI is this Wednesday, I’d say that the game plan will be the same as always - market de-risks into CPI, and depending on the numbers, it’ll either spike up or down (what a surprise!).

The only difference might be that JPow has allayed the markets’ fears of a rate hike in the latest FOMC, which prompted the move up from 57k.

I believe in the Fed, in the sense that I take whatever JPow says at face value. If CPI comes in hot, the markets might start pricing in another hike, but I will continue believing in his statements that the current rates are enough to bring inflation down to the Fed’s targets.

This means that I believe the CPI numbers to be a non-event in the medium term, since it wouldn’t lead to a rate hike, and would just lead to short-term downside volatility but no real “impact” on Fed policy (CPI is just a proxy to rate hikes / cuts, really).

Spelling this out: CPI comes in hot → markets might spike down → but I believe that rate hikes aren’t in the cards, and thus this spike down is a short term move but in the long term CPI will eventually come down → buy opportunity’

And if CPI comes in cooler than expected → bullish

All that is to say, I’m long even before CPI. Well, if I were to be honest, I’ve been long way before CPI, so you should take me talking about my positions with a pinch of salt.

I will say though, taking a position pre-CPI goes against every traditional benchmark in the book - We’re now sort of in no man’s land right now - markets hate uncertainty, and many people are waiting to take a position after CPI, which would be the “common-sensical” thing to do.

But no risk, no reward, right? On higher time-frames, as I’m sure you can tell, I continue to lean bullish on the crypto markets - that this is an incredible value opportunity to start dollar-cost averaging your favourite tokens.

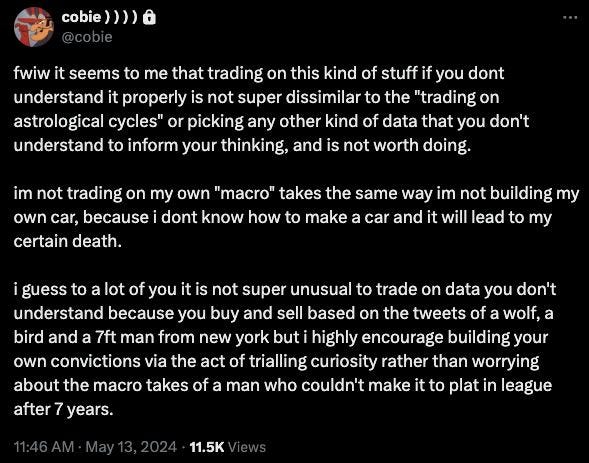

All in all, I don’t see a reason to be very spooked - especially given how alts are performing. I talk more about this down below, but many of the stronger alts are actually in an uptrend, with certain alts slightly below January ATHs!

It’s why I sub-titled this post with “Don’t touch grass” - because while BTC prices may be chopping around, many alts have been doing spectacularly well.

TLDR: We are still at 60k, alt prices are way higher than what they were the last time we were at 60k, and I think this trend continues grinding higher.

Market Narratives 🎙️

There have been not many changes to the two main core narratives: AI x Memes. For the sake of brevity, I will just list the tokens in each sector without elaboration. This is because they are literally the same narratives as last week - you can just refer to last week’s newsletter for a breakdown.

AI: RNDR / NEAR / TAO / WLD / AR

Memes: WIF / PEPE

Social Fi: TON

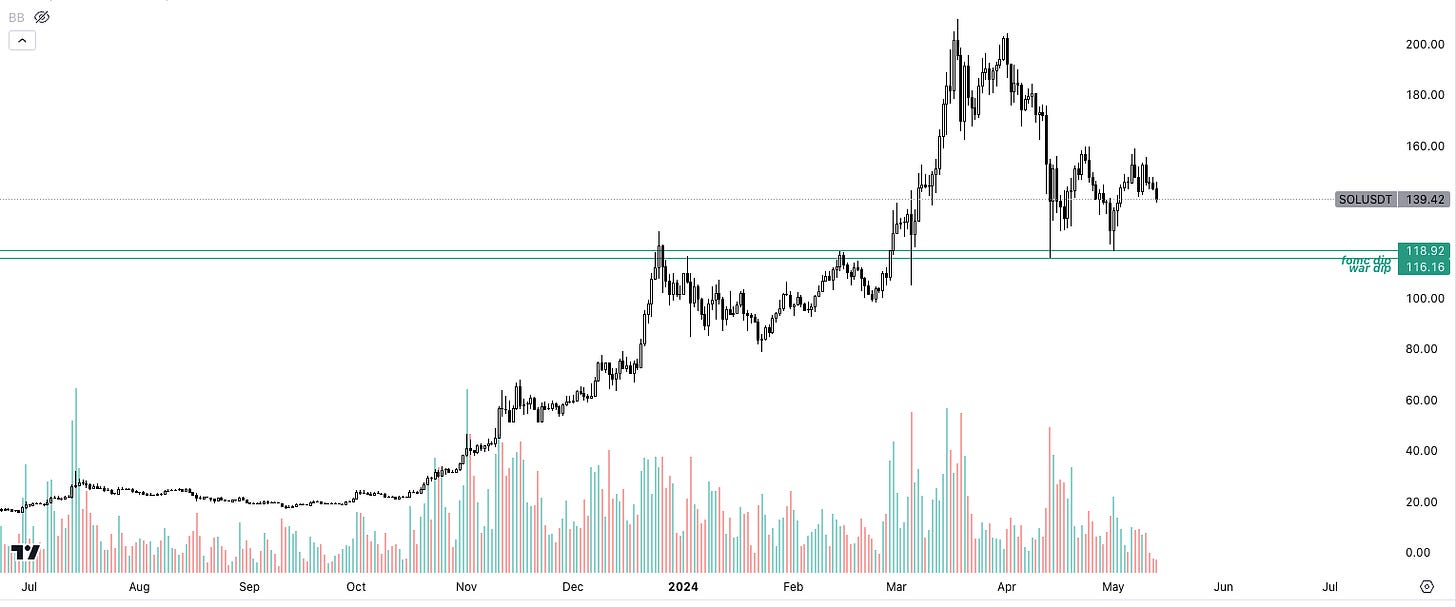

SOLANA Summer: SOL / JTO / JUP

Instead, I would like to examine a few alt-coin structures that we’re seeing across the board for strong tokens:

Like I said - many of the stronger alts have been in an uptrend eveer since the FOMC dip, with their pico bottoms being somewhere near the war dip (13th April). I point this out to once again re-emphasize that touching grass seems very psy-oppy to me ; these have been incredible HTF trade opportunities that CT seems to gloss over just because they don’t do a 2x overnight.

To the average CT-er, for a bull market we’d have to see 10% candles everyday for a month (i.e Jan / Feb 2024); unfortunately, I do not think we get such opportunities till late Q3 / Q4 2024. But fortunately, there are still many good trades to take.

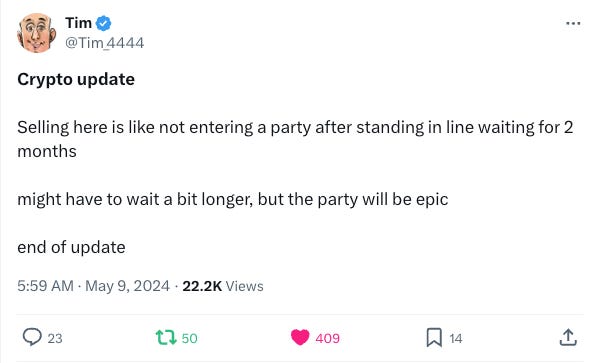

Once again, I would like to say that we’re closer to a bottom than we are a top, and I think Tim really describes it well:

Anyways, I hope that has been slightly more informative, and a good Monday / Tuesday read. I’m 60 subscribers away from hitting 10,000 readers, so please do share this with people (if you want!);

I hope you guys stay safe, and stay healthy, and stay happy!

<3, Kyle

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.