0xKyle's Market Color #28

Billions in longs liquidated. Open interest -30% across the board. Absolute. Wipeout.

Holy. F*ckin. Shit. Three words to describe the past week, and I don’t think it really encapsulates what happened. Sit down, grab a cup of coffee, and brace yourselves as I take you through what happened in the past 5 days.

Executive Summary 📝

First things first - you might say: Kyle, the chart doesn’t look too bad. BTC is just at range lows, and we’re still rangebound within 61k! Yes, you are right. Let that not distract you from the fact that, however:

We wiped out almost a billion dollars in open interest

We saw two days where billions of longs got liquidated

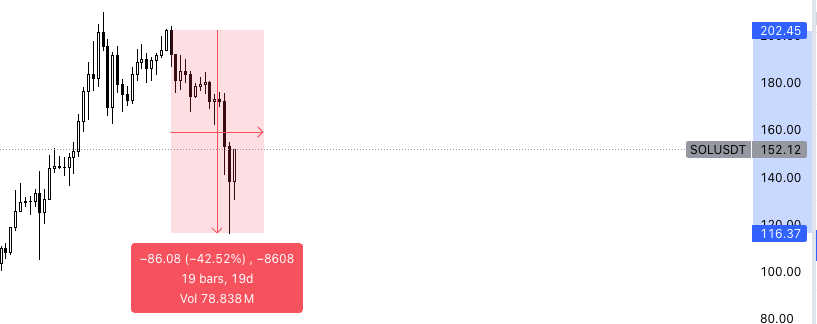

Most alts dropped 25-50%

We saw people on CT making threads about how they got liquidated in one candle, losing anywhere from 1m to 4m, a ton of pain on the timeline, and general “it’s so over” sentiment never seen before since FTX.

The cause, of course, was the announcement and pre-announcement of the war between Iran and Israel just days before. We basically had two huge dips, each one an escalation of the next. The first dip was the “announcement of the war”, and the second one was on “confirmation of war”.

Perhaps what affected most traders were the ones who bought the war dip on April 12th (i.e me) - they would wake to see that their portfolios were down an additional -25% despite already buying the dip. It was truly an amazing sight to see - alt/BTC charts getting reset back to 0.

And lo and behold, the market bottomed the moment this tweet was sent out - by the legendary trader, GCR himself. I felt literal shivers the moment I read this tweet - and whether by chance or by the collective belief in his tweets, the entire market bottomed shortly after this.

Now, with the benefit of hindsight, we can analyze this move calmly. Perhaps one of the most notable things that went unannounced this entire downturn was the strength of Bitcoin in this dump. While most alts were down -50% or more through the past two days, Bitcoin held steady above 60k - an impressive feat, but perhaps this can be better observed through looking at alt/btc charts - many of which are back at levels unseen seen the start of the bull market.

It really goes to show the strength of the ETF - with global institutional adoption of Bitcoin, it’s safe to say that Bitcoin is experiencing less volatility to the downside compared to what it would have seen in similar situations a year ago. Perhaps this will push more institutions to adopt Bitcoin - lower volatility in precarious situations. Time will tell.

Market Narratives 🎙️

Well, I believe the market has bottomed. The bad thing about being a 24/7 market is that crypto is the only thing people can touch when a black swan happens on a weekend. We saw PAXG (tokenized gold) rocket up on these news - perhaps a prophecy of what is to come on Monday open.

That’s why I also believe that we have bottomed before tradfi - while more downside is expected from Monday open, likely, the worst is over (famous last words!). Either way, these are excellent areas to start bidding, with many alt/BTC charts reset.

But more importantly will be identifying the coming narratives. During the liquidation cascade, I too was wondering - what would be the next narrative? Here are my top contenders:

BTC and its beta

BTC unironically is the “comfiest bid” during those times of stress - because of the reasons I stated above. Also, BTC dom has been slowly grinding up - a sign of the times!

I thus expect STX to also do just as well - being the best BTC beta thus far and with the Nakamoto upgrade coming soon, STX might see a bid once again.

While BRC-20 and Ordinals are picking up steam, you can look at the price action of ORDI to judge whether ORDI is a good bet on the Ordinals scene (surprise, it’s not) - a better bet would be PUPS, something I’ll talk more down below on the on-chain section.

ETH and it’s betas

Before the dump we saw an ETH-related rally, with top performers on certain betas like ENA and PENDLE. We might see this resurge as a narrative again - with PENDLE being one of the strongest coins that outperformed ont he dip.

SOL… and WIF

Many of our favourite CT influencers tweeted about buying SOL at 120s at its lows - and with SOL down 50% from the highs and being a top pick for memecoins / this cycle in general, it makes sense as a narrative. And if SOL pops off, you can expect its prodigal memecoin - WIF, to take off as well.

Individual outperformers

$ONDO - Blackrock RWA token

$TON - The Open Network, integrated with Telegram

These two coins are seeing a lot of attention right now and could poise to outperform in Q2.

On-Chain ⛓️

On-chain is now officially split up between ETH (Base), BTC, SOL

Ordinals and BRC tokens are taking off

PUPS as the mainstay token for BRCs, and Bitcoin Puppets as the main PFP right now that’s attracting all the money

Runes and any rune related tokens - Runestones, Rune pups, etc.

BRC tokens: PUPS / OMBI / SHID / PIZA / NODE

We might see a gen-art related run (it’s not here yet) - but some notable names. inthis section are Bitglphs, Flower x Harto, Stepepes, etc.

For Base, the main name I see is $DEGEN on Base

On SOL, cat tokens seem to be doing well - with certain names like Sharkcat and MEW - people are seemingly betting on the “first billion cat memecoin”

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.