0xKyle's Market Color #26

The dog has a fckin hat. Also, financial nihilism, and why memes are the best performers this cycle

GM - how has your week been? I had a great week, going to Solana’s Hacker House and meeting some cool people. Well, hope you guys are seated with a nice cup of coffee before reading my substack! As usual - enjoy ^-^

Executive Summary 📝

The market seems to have an obsession with calling tops every time BTC retests 72k; I spent a good chunk of my time planning out the different scenarios I’d have to see if this was truly the top. A monthly close below 61k, coinciding with a weekly close below 66k would be extremely bad. This, coupled with negative ETF flows would be a signal to revert. But as long as we don’t get that, I’m inclined to believe that the trend will continue for longer, and that any chop in between is considered “noise”.

Once again, the advice is: Zoom out. CT has the memory of a goldfish, and can’t seem to remember the fact that we faced this sort of choppy PA on the way up. Not every retest of 72k has to be an immediate smackdown to 60k, and not every breakdown of 69k means we’re going to 52k.

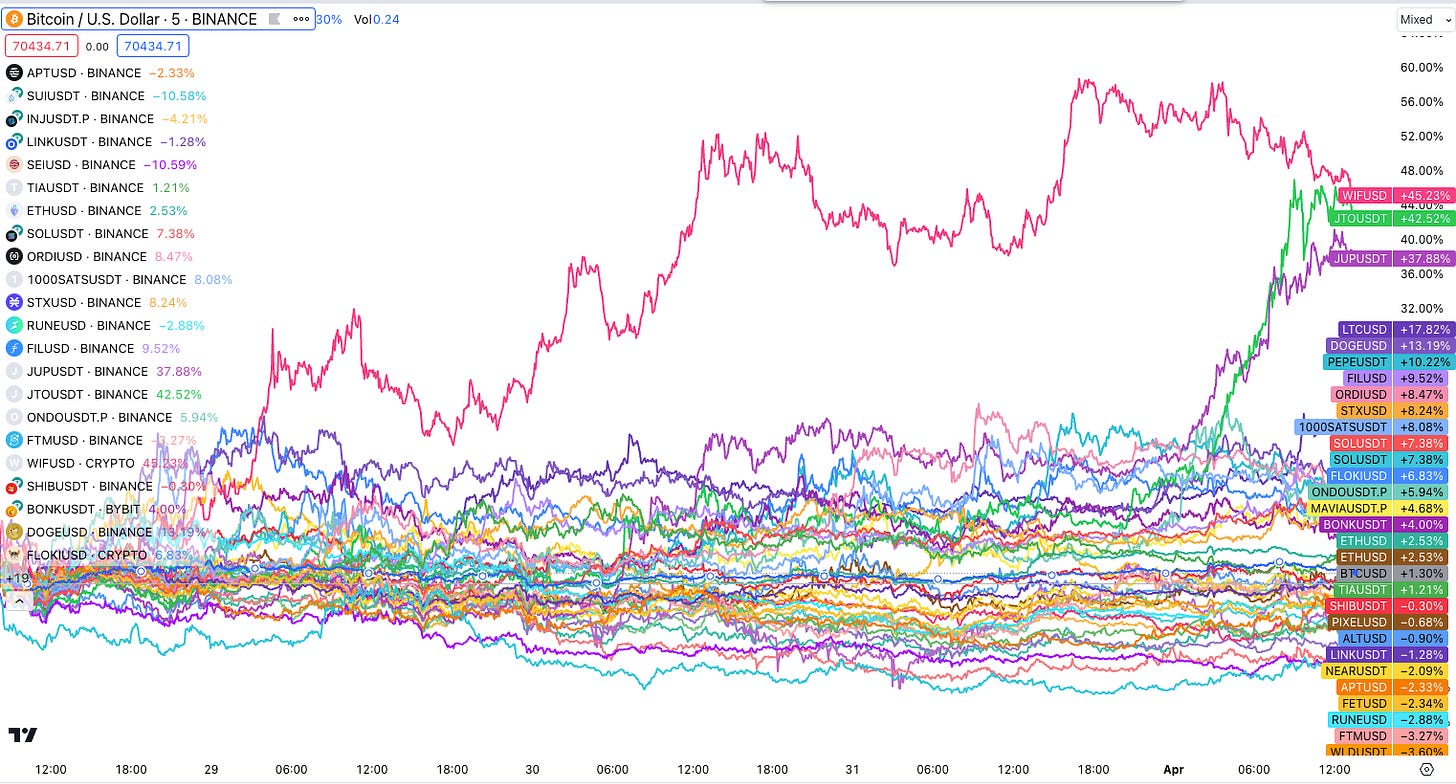

On the weekly, we’ve had an insane performance from memecoins. If you read my latest Substack thesis (linked below) you’ll know that I believe in the memecoin supercycle - and over the weekend, we’ve suddenly had an inflow of people who’ve been rehashing the thesis.

The idea is that people are tired of the “VC dump on retail” game, and are embracing memecoins because they are more “egalitarian” - for example, see this thread. Personally, I believe that the reasons don’t matter - what matters is that the market has shown its hand, and that it really, really likes memes.

Either way, there are only a few narratives so far - BRC NFTs, AI, Memecoins, Solana are the strongest ones. Others have not performed as reliably as these. This could be argued as a sign of how nascent we are in the cycle, but my advice is to just continue longing the strong.

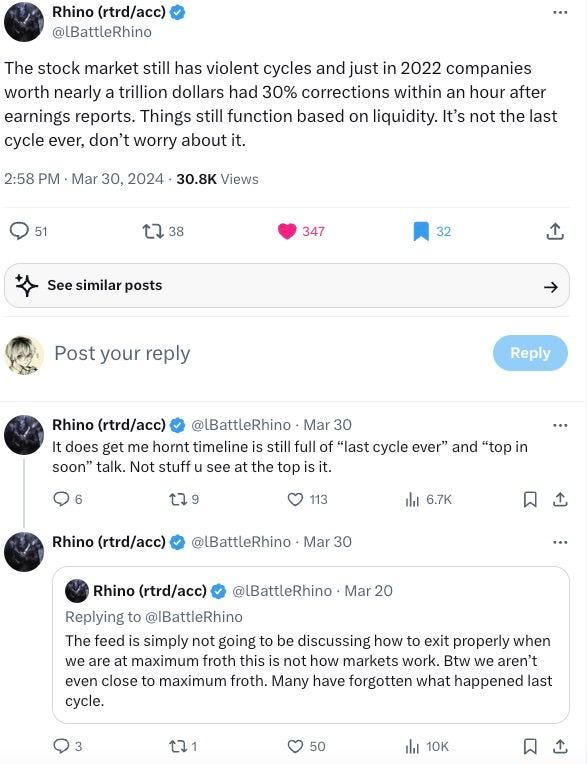

Lastly, a bit of copium for those thinking its the last cycle, or that the cycle is ending soon (these are thoughts I’ve been struggling with as well - the idea that maybe this is the top):

Market Narratives 🎙️

Some of my favourite trades:

Spot long WIF

Spot long JUP / JTO as a beta bet to SOL breaking 200 and having continued strength

APT strength into the announcement season in April, with rumors flying around about RWA / AI / I don’t even know.

FIL into ionet’s launch in April (hopefully)

Others:

Pendle has been a silent mooner - and as people call for ETHBTC bottoms, it may continue to outperform

Litecoin rallied last week following CFTS’s announcement that ETH and LTC were “commodities”

FET, AGIX and OCEAN rallied last week on news that they were merging their tokens - honestly we might see more of this soon

With BTC having a very nice monthly and weekly close, we could be primed to break 72k - longing STX / other BTC beta like SATS / RATS / CFX might be a good idea (although, STX probably has highest beta)

On-Chain ⛓️

Memes are still heating up, on SOL, BASE, and the new L3 on Base - DEGENchain!

Degen chain: DEGEN on degen seems to be doing extremely well

Solana: Popcat / Nubcat / cats are in season, as many cats saw rallies of over 100%

Blast seems to have taken a hit after two major protocols got exploited - SSS and Munchables. While in both cases, not much money was stolen and all the ETH is going to be refunded, you can expect that this will damage the integrity of the ecosystem

Unfortunately, I’m quite busy with my non-crypto job, and so this is all I have for you guys this week :(

Remember, keep yourselves safe and healthy! See you guys next week <3

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.