GM! Welcome to the second Market Color of 2024. I know it’s taken a while, but I’m back! Currently based in NYC, so if you wanna have coffee do let me know! Would love to meet some NYC Crypto people.

Executive Summary 📝

God, the last Market Update on 8th Jan was covering the ETF launch - and I vividly remember being in the boat “sell the news”. I was right, as BTC had a 15% move down in the coming days.

We’re way past that now though, and for the past 25 days or so we’ve pretty much just ranged within 38k to 42k. Where do I think we go next? Well, I think this is extremely bullish for our cryptoassets - with the largest uncertain event now removed, I fail to see the argument against being a bull on higher time frames.

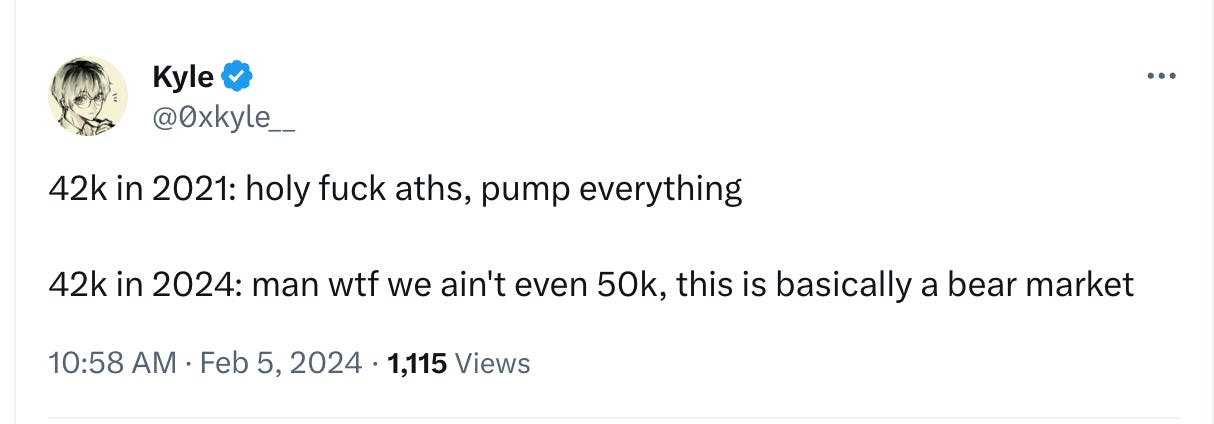

On the lower time frames, CT continues to scream and cry and flipping their bias everytime price moves 2% in the opposite direction. It’s a chop-fest out there, and I think my tweet very nicely packaged the sentiment I’m seeing.

Again, if you were here in the 2023 bera market, you know what to do in these situations - don’t overtrade, buy good coins, and wait.

Market Narratives 🎙️

There are no narratives right now except for TAO being at ATHs. Funnily enough, the last Market Color I wrote that “TAO is back at 200, if anyone is looking to pick some up”. Right now, TAO is sitting at 487, a nice 2.5x.

Pendle has been one of the best performers this month, and if LSDs come back in full force (which they should with Blackrock’s ETH ETF), this will probably be one of the best betas to buy

Pyth has finally broken out of its cursed coin pattern, going up 20% in a week

RON, the coin of the Ronin chain had been steadily grinding up for the past few weeks, dumped more than 20% on the Binance listing day, with clear chatter of “insidoor trading” all over Twitter

RNDR was one of the best coins to trade for the Apple Vision Pro launch, briefly touching $5 before going back down to $4.5, but still a nice 20% from where I talked about it.

On-Chain ⛓️

I’d say on-chain is more fun and more active than perps right now, based on what I’ve been seeing

LBPs did significantly well on launch, with VEC/INS/CAD all making multiples out of the gate. However, they dropped sharply after - making it known to everyone that it is still very much PvP. However, apeing the LBPs were almost always profitable despite the dump, which is great

Loot and Whales have been outperforming the broader market, with Whales being an OTC points exchange of tokens that haven’t launched, and Loot receiving 10% of Whales revenue

Emerald rugged, but it’s successor, Pandora, is up almost 10x from the bottom. It features some sort of new tech of ERC-404 - fungible non-fungible tokens

MOBY is a new ICO platform that saw 1,200 ETH being deposited in the first 18 minutes. Read my thread on it here.

Dymension airdrop is coming this week, which, if past airdrops have been any indicator, may be a dump upon arrival.

That’s all for now! It’s a slow week, so stay safe out there. See you guys next week <3

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.