GM. Another week of 0xKyle’s substack! If you’ve been enjoying my content, do consider becoming a premium sub! I cover project deep dives and token picks for you guys who can’t keep up with crypto all day~

Executive Summary 📝

Last week I talked about the top being near, and lo and behold - we have had fund managers and CT icons talking about “taking money off the table” this week.

Now, while I would like to say “I told you so”, my “top is near” thesis was on a higher time frame, while this seemed like a flush on the lower time frames.

No matter, as I found myself bidding on this flush. If there’s anything I learned from 2023, it’s that a flush while BTC remains relatively stable is almost always a decent area to bid. Also, if you remember what I wrote last week, you’ll know that I advocate for a net long spot portfolio that’s not overly leveraged precisely because of this scenario - a slow choppy grind-up that screws over anyone who uses too much leverage.

Worst case scenario is that the top isn’t in, and we get another flush while you sit comfy on your hands. Best case scenario is that there is no top, I’m wrong, we grind up and then enjoy the rewards in 2024. Win-win.

Market Narratives

Last week I wrote about market narratives tapering off - and I was right. You know the market is PvP when everyone is scrambling to buy a weird no-name coin on the shadiest exchange I’ve ever seen that even went down for “server repairs”. You can’t get more PvP than that.

(You don’t really have to know what I’m referring to - just know that it happened. )

However, certain segments of narratives popped off with the recent drama revolving around Sam Altman. Particularly was WLD - which dumped on the news of Sam Altman being fired, and pumped on the hearing that he was being invited back, and dumped a few hours ago on his declination of that invitation.

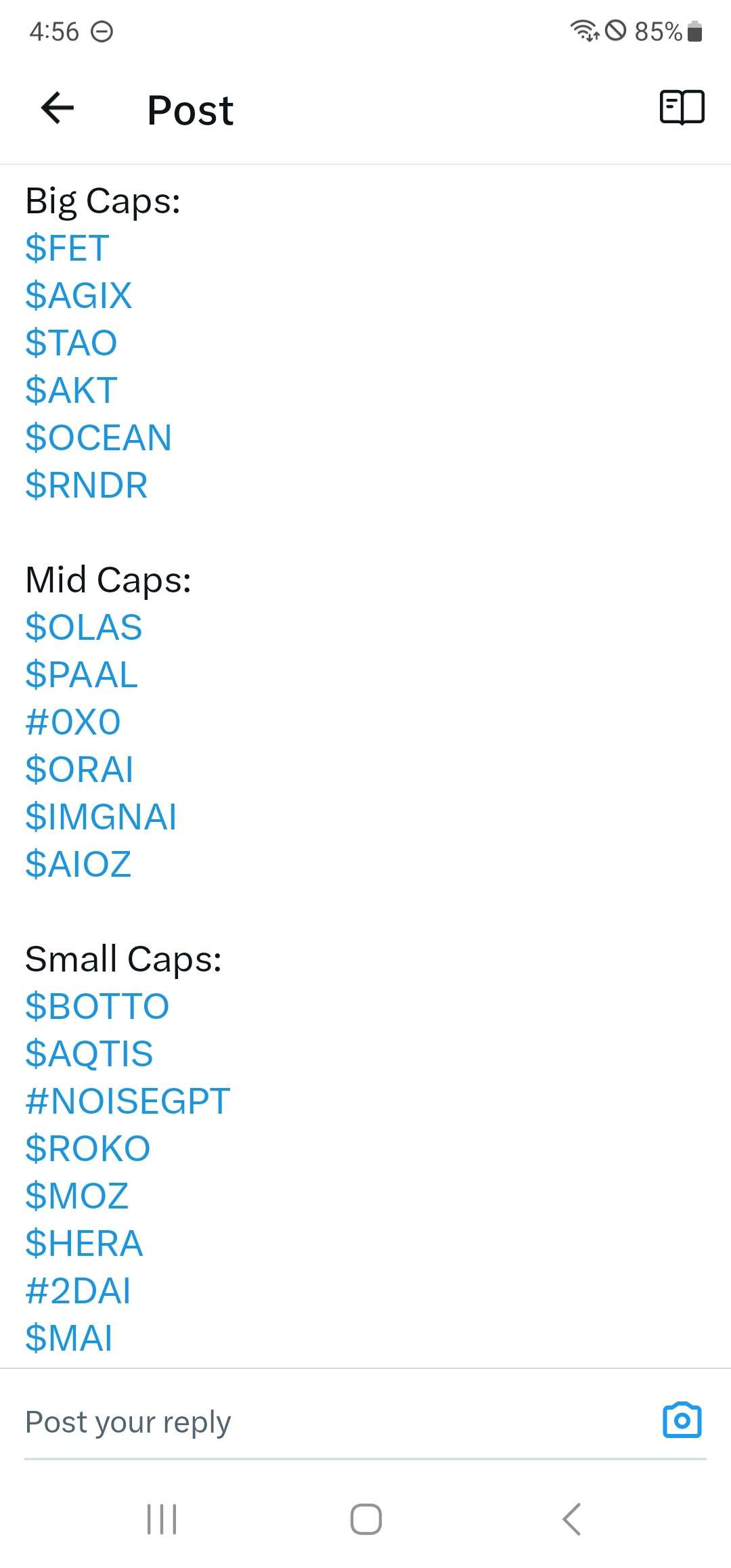

EVERY AI COIN EVER. $RNDR is probably the top CEX outperformer, but you also have the infamous TAO that has caught everyone’s attention. Here’s a list of CEX / On-chain AI coins.

$TIA is still being preached as “this cycle’s Solana”. With rumours of a Celestia 100m+ round, this coin has become the darling of Crypto.

Synthetix and dYdX seems to have gotten better tech recently as price has been slowly grinding up. dYdX’s standalone appchain is officially live;

Near has been doing well post conference, despite no news. However, spot holdings have been uponly for quite sometime, indicating longer-term investors positioned bullish.

Avalanche saw a 141% increase this month over the trickle down effect of Solana - as SOLUNAVAX narrators narrated. The timely was just right, as AVAX started pumping out huge amounts of news - like JPMorgan testing on an Avax Subnet

RUNE hit 6 as the DEX hit a trading volume of $1.32 billion, a week-over-week spike of 101%. With newer coins like CACAO coming out, interest in Thorchain seems heightened.

On-Chain

SOL Tokens: Too many to name, but some notable tickers are Nosana (NOS), SHDW, MNDE, BONK (resident memecoin). With Jupiter and Pyth airdrop on its way, I’d like to believe that the Solana ecosystem will see De-Fi summer - just on Solana.

BTC Ordinals. I don’t follow closely, but anything remotely BTC related is seeing a large influx of narratooors. From MUBI (BTC Bridge), to Trac an dothers - it’s not something I’m familiar with, sadly.

AI Coins. All the coins I posted above saw insane returns this week, with some notable names like TAO, OLAS, NoiseGPT taking the cake.

Gaming tokens continue to chad as Prime takes the 7 dollar mark. Good god, I faded this at 3$.

Overall, attention is very split - everyone’s trying to chase higher beta returns. I’ve always said this and will say it again - buy what’s low attention, sit on your hands, and outperform.

DISCLAIMER: The information provided in this document is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. The document may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The author(s) of this document may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The author(s) disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing this document, you agree to the terms of this disclaimer.

Thank you Kyle