Maker - A Deep Dive Into The World’s First Unbiased Global Financial System

Maker is expected to generate over $250mm in annual revenue in 2024 and stands at the forefront of DeFi

INTRODUCTION

1. Overview

Founded in 2014 by Danish entrepreneur Rune Christensen and officially launched on the Ethereum network in 2017, Maker is a credit protocol with a decentralized stablecoin: DAI. A simple concept that, over the course of 10 years, has grown to be the largest decentralized stablecoin in the world. With over $10 billion in TVL, Maker currently sits as one of the giants of DeFi on Ethereum.

We believe that Maker as a fundamental asset faces incredible tailwinds from an increasingly institutionalized digital world. The pitch is simple: With the launch of Bitcoin & Ethereum ETFs, and the tokenization of real-world assets (RWA), Maker sits at the intersection of institutional adoption and DeFi.

However, Maker as a protocol is notoriously complex, with most research pieces focusing on the high-level overview. Here at Artemis, we believe in an increasingly fundamentally driven world - as such, the purpose of this paper is to build a fundamentals-first paper that truly understands the mechanisms of Maker, before going on to build the case for it.

*Note: In this essay, Maker will refer to the general protocol, whereas MakerDAO references the decentralized autonomous organization (DAO) that manages the Maker Protocol.

Breakdown Of Maker

2.1 Maker’s History

Before we begin, it’s worth diving into Maker’s background. Founded in 2014, MakerDAO was the brainchild of Rune Christensen - he dreamt of a world with a more transparent and accessible financial system. Having lost his money in Mt. Gox, he went on a quest to develop a more stable alternative to volatile cryptocurrencies, and thus founded Maker.

In 2017, the DAI was officially launched - a decentralized stablecoin pegged to the US dollar and governed by a DAO. In its first year, it successfully maintained its peg to the US Dollar, even as the price of Ethereum declined by over 80%. Over the next 7 years, Maker continued to show resilience towards market-wide crashes - like Black Thursday in 2020, where the entire crypto-market lost one-third of its value.

Christensen's leadership has been an undeniable reason for Maker's anti-fragility: his ability to navigate challenges and guide the protocol has been crucial to its success. Even today, he continues to contribute to the strategic direction of MakerDAO, proposing Maker’s Endgame proposal. He continues to believe very strongly in a decentralized future, saying that he “welcomes the day in which he is no longer needed”.

2.2 A Walkthrough Of How Maker Works

Looking at Maker’s history, it’s clear that it has gone through many changes throughout the decade - from accepting more assets for its collateral, to introducing stability mechanisms ; And with every one of these upgrades comes added complexity. What started as a simple borrowing & lending protocol has evolved into something far more complex - but here at Artemis, we believe in building knowledge from first principles; as such, we will be diving deep into how it works.

a). Debt Borrowing & Repayment

Let’s first start with an overview. Bitcoin is $60,000 and Billy has 1 BTC. He needs liquidity, but doesn’t want to sell his Bitcoin during a bull market. He goes to Maker to get a loan - by depositing his BTC, he’s allowed to take a loan against his Bitcoin.

Some time passes, and Billy wants to pay back his loan. He has to pay back the debt he borrowed + the stability fees (interest) accrued on his loan (in DAI). Some of this interest goes to the System Surplus Buffer of Maker, while the rest gets paid to the Dai Savings Rate holders - i.e people that deposit DAI into Maker.

The Buffer has a ceiling though - sometimes, money that was supposed to go into the Surplus can’t because of the ceiling - in this case, a surplus auction will be initiated where the DAI is “sold” for Maker, which is then burnt.

b). Liquidation Auctions

However - what if Billy can’t pay back his debt? Let’s say Billy has a $30,000 loan against Bitcoin at $60,000, a Loan-To-Value (LTV) ratio of 0.5. The next day, Bitcoin falls to $40,000, and his LTV ratio shoots up to 0.75 - let’s assume this is the maximum allowable LTV before he gets liquidated. Billy also has to pay interest on his loan, and a liquidation penalty if this happens.

In a liquidation scenario, the debtor thus not only has to pay his debt, but also the interest accrued on debt, and the liquidation penalty. The overview is as such:

Maker has 1 BTC ($40,000)

Billy owes $30,000 (debt)

Billy owes $3,000 (stability fees)

Billy owes $2,000 (liquidation fees)

The protocol thus has a couple of ways to deal with this:

Collateral auctions. The protocol will first auction off the collateral (in this case, 1 BTC) to anyone who wants to buy it for a slight discount. In the best case, someone pays $35,000 for the BTC for a slight arbitrage - this money goes straight to plugging the hole.

In the case where the collateral auctions don’t raise enough money, Maker draws on its System Surplus Buffer.

In the case where it doesn’t have enough in the Buffer, it falls on its final resort - a Debt Auction, where Maker mints fresh MKR and auctions it for DAI to cover the bad debt.

It’s worth noting that the Debt Auction is really only activated when the system incurs a deficit, meaning that the total value of the collateral backing DAI loans falls below the required level, resulting in under-collateralized debt. This means that the Debt Auction only happens at the extremes, and thus, has only happened once - during the 2020 Covid black swan that caused a market-wide drawdown.

c). $DAI’s Peg Maintenance

Now let’s say Billy isn’t interested in collateralizing in debt, but wants to instead run an arbitrage operation - with DAI being a decentralized stablecoin, he wants to take advantage everytime it de-pegs. How does Maker incentivise this?

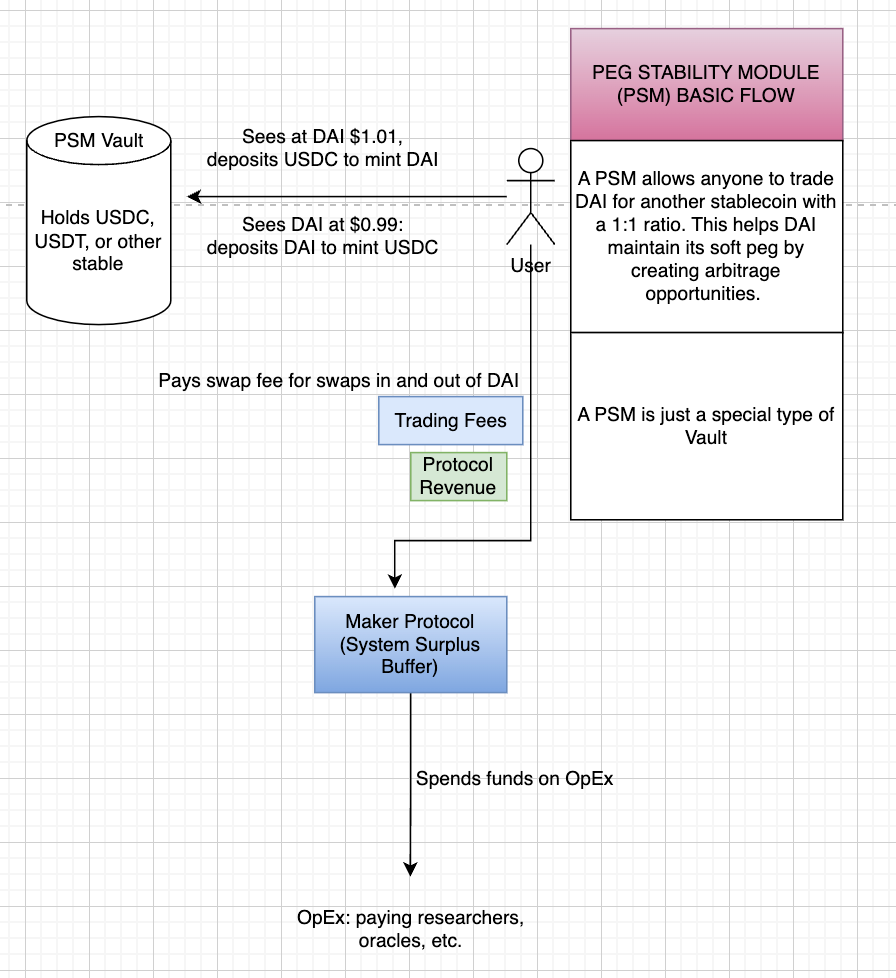

We now have the Peg Stability Module (PSM) - this is a special vault that allows anyone to trade DAI for another stablecoin with a 1:1 ratio.

If DAI is at $1.01, you can deposit 1 $USDC to mint 1 $DAI, thus making a profit of $0.01.

If DAI is at $0.99, you can deposit $DAI to mint 1 $USDC, thus making a profit of $0.01 as well.

And so, the PSM allows for arbitrageurs to maintain the price of $DAI - there is no swap fees charged on this.

d). How A Normal User Utilizes Maker

In the final case, Billy doesn’t want anything complex - he just wants to collect some yield. Using the Dai Savings Rate (DSR) Pot, Billy can deposit DAI and earn a competitive interest rate on the DAI. This yield comes from multiple sources, with the primary source being the stability fees that borrowers would pay on their collateral.

And this concludes the walkthrough of how Maker works - now that we have a better idea of its moving parts, we can dive deeper into the intricacies.

2.3 Maker’s Mechanisms

Depositing Collateral

There are two main ways Maker allows you to take a loan against your collateral:

Spark: Maker’s website will redirect Billy to Spark.fi, a Maker SubDAO. The difference between Spark and MakerDAO vaults is that Spark offers loans over a wider range of assets while MakerDAO’s vaults are individualistic, with each vault offering different liquidation ratios and debt ceilings.

sDAI: Spark also introduces sDAI, a yield-bearing version of DAI, and implements advanced risk management features like Efficiency Mode and Isolation Mode

D3M: Spark is connected to Maker through the D3M - a direct liquidity line. It enables interaction between the Maker ecosystem and third-party lending protocols

MakerDAO Vaults - Accessed through Summer.fi, these allow users to deposit collateral assets to mint new DAI. MakerDAO vaults are thus more individualistic in nature - with the same asset having different vaults depending on how much you want to borrow against it.

You can see that TVL in Maker’s vaults are much lesser than that in Spark. For Maker’s vaults, the differences between A/B/C are their stability fees, liquidation ratios, and debt ceilings. A big reason for this TVL differential could be how Maker makes no effort to push these vaults - as mentioned above, Maker’s vaults are hosted on Summer.fi, whereas Maker’s main web-page takes you directly to Spark.

Maker’s Auctions

Maker has 3 main auctions: the Surplus Auction, the Collateral Auction, and the Debt Auction. The market actors who participate in these auctions are known as “Keepers”, and each auction serves a different purpose, and shall be elaborated on below:

Surplus Auction

When everything in the system is going well, stability fees are accrued through the interest paid on loans by borrowers. This interest is in the form of $DAI and goes towards the Maker Protocol’s System Surplus Buffer. The System Surplus Buffer is a buffer that is used to pay Maker’s operating expenses, such as oracles, researchers, etc. This system buffer can be adjusted through MakerDAO’s governance - it was raised from $30M to $60M in a proposal from 2021.

And so - the system prioritizes filling the buffer to its cap using revenue first - but once the buffer hits the limit, the surplus in DAI is auctioned off to external actors for MKR, In this auction, bidders compete with increasing bids of MKR. Once the auction has ended, the auctioned Dai is sent to the winning bidder, and the system burns the MKR received from the winning bidder.

This system is thus known as the Surplus Auction.

Collateral Auction

The Collateral Auction is the first measure of defense for liquidations. They are served collateral as a means to recover debt in liquidated vaults. For each collateral, there are different specific risk parameters, but the general mechanism is as such:

The Collateral Auction is triggered when a Vault is liquidated. Any user can liquidate a Vault that is unsafe by sending the bite transaction identifying the Vault. This will launch a collateral auction.

If the amount of collateral in the Vault being “bitten” is less than the lot size for the auction, then there will be one auction for all collateral in the Vault.

If the amount of collateral in the Vault being “bitten” is larger than the lot size for the auction, then an auction will launch with the full lot size of collateral, and the Vault can be “bitten” again to launch another auction until all collateral in the Vault is up for bidding in Collateral Auctions.

An important aspect of a Collateral Auction is that the auction expiration and bid expiration parameters are dependent on the specific type of collateral, where more liquid collateral types have shorter expiration times and vice-versa.

At the end of the collateral auction, the winning bidder pays Dai for collateral from a liquidated vault. The Dai received is used to cover the outstanding debt in the liquidated vault.

Debt Auction

Last but not least, the Debt Auction is only triggered when the system has Dai debt that has passed the specified debt limit and there is not enough in the surplus buffer to cover the hole.

The Debt Auctions are used to recapitalize the system by auctioning off MKR for a fixed amount of Dai. This is a reverse auction, where Keepers bid on how little MKR they are willing to accept for the fixed Dai amount.

Because this is such a rare scenario, it has only happened once in MakerDAO’s history: during 2020’s Covid crisis. There, 40 individual lots, valued at 50,000 DAI each, were released - and bidders committed to buy ever-decreasing amounts of MKR for their 50,000 DAI bids.

Once the auction is over, the Dai, paid into the system by bidders in exchange for newly minted MKR, reduces the original debt balance in the system, while the circulating supply of Maker goes up.

Peg Stability Module

Next, we have the Peg Stability Module (PSM) - a key mechanism in MakerDAO's system designed to help maintain DAI's peg to the US dollar. Because of its decentralized nature, $DAI has to have safeguards in place to maintain its peg, and the PSM has a few mechanisms to allow for that:

Direct 1:1 Swaps: The Peg Stability Module which allows users to swap fiat-backed stablecoins (e.g. USDC, USDP) for Dai at a 1:1 ratio for a small fee, and vice versa. This essentially is meant to create an arbitrage opportunity for Dai to maintain its peg, and is subject to any fees set by the protocol.

If demand for Dai pushes the price > $1, arbitrageurs can deposit 1 USDC into the PSM to mint 1 Dai and sell Dai.

Conversely, if Dai < $1, arbitrageurs purchase Dai in the open market, deposit it into the PSM and get 1 USDC for a profit. This burns Dai (supply reduction) and forces it towards $1

Collateral Backing: Instead of swapping, users can opt to deposit USDC into the PSM - In return, they receive an equivalent amount of DAI, making the DAI backed 1:1 by the deposited USDC.

On top of that, Maker has two additional capabilities that, while not core to how they maintain the peg of $DAI, are still features that help to maintain $DAI’s price:

MakerDAO can adjust the Stability Fee through governance voting to maintain the peg of DAI.

If DAI > $1, increasing the stability fee makes it more expensive to borrow against collateral in vaults, which discourages DAI creation and reduces supply.

If DAI < $1, decreasing the stability fee stimulates DAI demand by making it cheaper to create, increasing supply and nudging DAI’s price up towards $1.

The Dai Savings Rate is essentially an interest rate that Dai users can accrue by locking up their Dai. While on the surface it provides an incentive for holding DAI, it also helps to maintain Dai’s peg on the US dollar because the DSR can be adjusted by MKR token holders to help steer Dai towards the peg (but in the opposite direction as the Stability Fee).

The primary source of DSR yield comes from stability fees, protocol revenue, protocol surplus and general market dynamics. The DSR rate is set by MakerDAO governance as a tool to balance supply and demand for DAI. When DAI demand needs to be increased, the DSR may be raised, which requires allocating more funds to support the higher rate. The DSR is not funded by external sources or traditional investments

The DSR as of July 2024 sits at 8% annually.

DAI Savings Rate (DSR)

As mentioned above, the DAI-Savings Rate (DSR) is a special module that DAI holders can deposit to earn yield on their DAI. A person who holds Dai can lock and unlock Dai into a DSR contract at any time. Once locked into the DSR contract, Dai continuously accrues, based on a global system variable called the DSR.

Essentially, DSR depositors get to earn a share of the revenue generated by Maker. The revenue for the DSR comes from the profits generated by MakerDAO, which include stability fees from borrowers, liquidation fees, and other protocol earnings like yield on the T-bills in Maker’s vaults.

Currently, there’s over $2 billion DAI in the DSR, and it’s paying an annual rate of 7%.

The MKR Token

Lastly, Maker is governed by its token, MKR. Holders of MKR get to vote on key parameters of the system. MakerDAO's governance is community-driven, with decisions made by holders of the MKR token through a system of scientific governance. This includes Executive Voting and Governance Polling, allowing MKR holders to manage the protocol and ensure DAI's stability, transparency, and efficiency.

By leveraging all the mechanisms we described above, Maker provides a secure, decentralized, and stable financial system that allows users to generate and utilize DAI without relying on traditional financial intermediaries. This approach embodies the core tenets of crypto ideology, offering a decentralized alternative to traditional financial systems and enabling permissionless access to a range of financial services.

Maker’s Sources Of Revenue

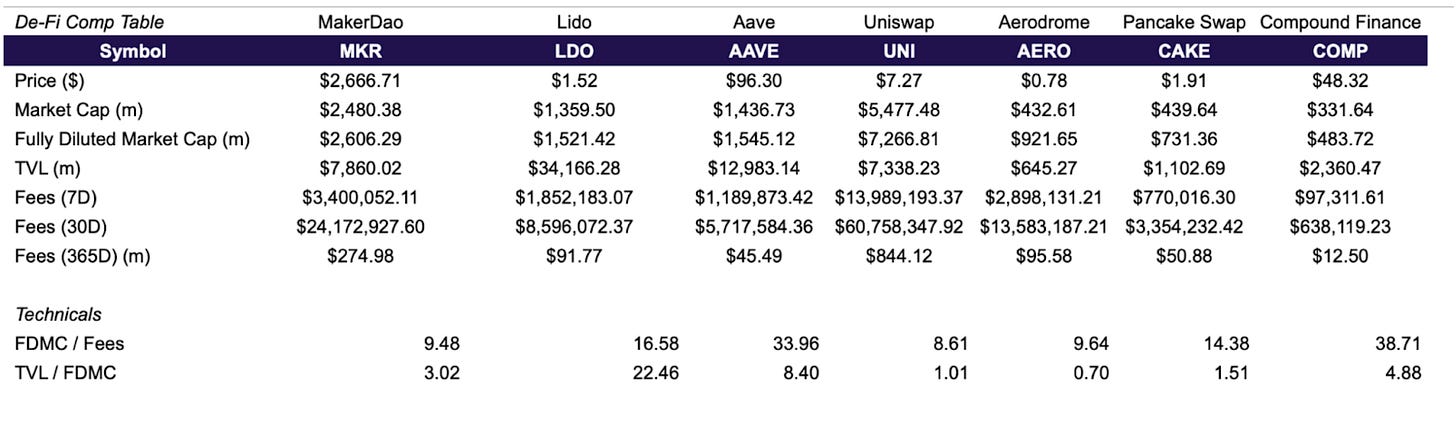

Now that we’ve covered the various mechanisms of Maker, we can move on to how they primarily make money. Amongst all De-Fi protocols, Maker generates the most revenue annually. In the graph below, we compare the De-Fi protocol revenue on a 30D basis for a more minute look into how protocols perform day-to-day.

It’s worth noting that for Uniswap, the numbers provided are the fees they make - because revenue generated goes to Liquidity Providers, they don’t actually make any revenue - but for comparisons’ sake, we used Fees as a proxy of Revenue.

Amongst all the DeFi protocols, Maker presents one of the best FDMC/Fees ratio, trading at a 9.48x multiple. Amongst the other money markets (Aave & Compound), Maker takes the lead by quite a wide margin - and across all DeFi protocols excluding DEXes, Maker generates the most in fees.

When looking at their financials, Maker makes a whopping $274mm in annualized revenue - definitely one of the best performing De-Fi protocols out there. It’s only prudent to ask - where does Maker get their money?

3.1 Maker’s Revenue Streams

Maker has 3 different revenue streams:

Interest Rate Payments, also known as Stability Fees: These are the primary source of revenue for Maker. Users pay these fees when borrowing DAI against their collateral. For example, the D3M (Spark) vault generates over $84mm in revenue annually.

Real-World Assets (RWA): This has become a major source of income for Maker. Maker has public credit vaults like Monetalis Clydesdale, a 1.11 billion DAI vault that is collateralized by short-term United States Treasuries.

As of 2023, nearly 80% of Maker's fee revenue was generated from real-world assets over the past year. This accounted for $13.5 million for the protocol's treasury over a 12-month period.

Operationally, users don’t directly deposit RWA into Maker - instead, vaults like Monetalis Clydescale (discussed in MIP65) acquire USDC via the Peg-Stability Module, and invests them in liquid bonds

Liquidation Fees: Their third and final revenue stream is from liquidation fees, which are collected when collateral is liquidated due to insufficient collateralization. However, because of the infrequency of this event, not much revenue comes from liquidation. The revenue collected decreased from 28.8 million DAI in 2022 to just 0.4 million DAI in 2023.

3.2 Maker and RWA

And now, we get to why Maker has been the talk of the town in Q3 2024. The most noteworthy point about Maker is not their numbers - rather, it stems from the pivotal moment in Maker's history where, in 2022, they decided to strategically expand into real-world assets.

This move marked a significant shift in the DeFi landscape because it was the first large-scale integration of real-world financial products by a DeFi protocol. Maker increased its RWA exposure from $17 million to $640 million in 2022, through initiatives such as:

Deploying of 500 million USDC into short-term bonds, ETFs, and treasuries (Monetalis Clydesdale, Blocktower Andromeda)

Launch of a 100 million DAI vault for Huntingdon Valley Bank, a 151-year-old Pennsylvanian financial institution

Today, real world assets currently make up approximately 25% of the Maker balance sheet and DAI backings. Maker’s success in integrating RWAs has not only driven overall fees, but also allows Maker to tap into more stable and diverse revenue sources - an evolution crucial in maintaining Maker's moat and cementing its position as a leading DeFi protocol, even during challenging market conditions.

This is an underrated point that has to be expounded on - the crypto markets are known to be very cyclical and reflexive, both to the upside and downside. As the market matures, investors look for safer investments - Maker’s foray into RWAs create a more stable and consistent revenue stream, instead of fluctuating to the whim of market conditions.

Maker now stands as a testament to the potential of DeFi to integrate with and enhance traditional finance, setting a new standard for innovation and real-world applicability in the space. It represents a significant step in bridging the gap between decentralized finance and traditional financial products, positioning Maker at the forefront of DeFi innovation, riding the wave of institutional demand for digital assets.

The Case For Maker

4.1 The 2024 RWA Boom

Now that we have covered how Maker pivoted into RWA, we can make the case for why RWAs are important - 2024 has been the year of maturity for the crypto asset markets; With the launch of the BTC ETF, we have seen over $14 billion net inflows into Bitcoin. This surge in institutional participation extends beyond Bitcoin ETFs, with major banks and financial institutions increasingly embracing crypto assets:

Standard Chartered and Nomura have deployed their in-house technology to establish digital asset custody solutions through Zodia custody and Laser Digital, respectively

Citi, JPMorgan, and BNY Mellon have partnered with crypto firms like Metaco, NYDIG, and Fireblocks respectively to provide cryptocurrency custody services.

Visa and Mastercard have expanded their crypto card programs, partnering with major exchanges to offer crypto-linked cards to both retail and institutional customers.

It is clear that the largest institutional players believe in digital assets - but not just Bitcoin. Major asset managers have talked at length about tokenization - BlackRock, the world’s largest asset manager, is currently dipping their toes into tokenization

BlackRock USD Institutional Digital Liquidity Fund: Launched in March 2024, this fund is represented by the blockchain-based BUIDL token on the Ethereum network. It's fully backed by cash, U.S. Treasury bills, and repurchase agreements, providing yield paid out via blockchain rails daily to token holders. (

$10 Trillion Tokenization Vision: BlackRock is pioneering a digital transformation in finance, aiming to tokenize a diverse range of assets including bonds, equities, real estate, and cultural assets.

This has of course, sparked a race amongst the largest financial institutions to all tokenize their assets:

JPMorgan: Introduced programmable payments functionality through its blockchain platform, Onyx, allowing institutional clients to benefit from real-time, programmable treasury functionality.

HSBC: Introduced a blockchain-based platform called Digital Vault for custody clients to instantly access their private assets (debt, equity, and real estate)

Goldman Sachs invested in and supports the USDC stablecoin by Circle, allowing for large-scale global money transfers without volatility risks and are exploring the tokenization of real assets as a new financial instrument.

It is clear that the next decade will be defined by the intersection of institutional adoption and crypto, positioning Maker at a crucial juncture in this evolving landscape. Maker has established a strong presence at the intersection of RWA tokenization, Defi, while being institutionally facing - in fact, just a few days ago, Maker announced on Thursday an open competition to invest $1 billion in tokenized U.S. Treasury offerings - and top issuers such as BlackRock with Securitize, Ondo Finance and Superstate plan to apply.

We believe RWAs will continue to grow as a proportion of Maker’s balance sheet. Maker is thus in a strategic position as one of the biggest De-Fi protocols, with one of the largest integrations with real-world assets thus far. This, combined with the potential of an ETH ETF in Q3/4 2024 gives an even larger tailwind to the long-term bull-case of Maker. As Ethereum continues to be the backbone of DeFi, Maker’s prominence within this ecosystem further cements its role in facilitating institutional adoption.

4.2 Maker’s Stability & Resilience

As major financial institutions increasingly embrace crypto and blockchain technology, they also look towards “established” names in the space. In an industry dominated by hacks and rugs, protocols like Maker who have withstood the test of time have greater legitimacy and legacy in leading the upcoming institutional wave of interest.

On top of that, Maker has shown ability to handle large-scale financial operations and demonstrated remarkable stability and resilience in the face of market downturns - they have shown to be capable of adapting to changing market conditions: diversifying their collateral pool to mitigate risks of a decentralized stablecoin, building adaptive mechanisms like the Peg Stability Module, and flexible governance to allow dynamic adjustments when the need calls for it.

This antifragility has given necessary legitimacy to Maker - and now, with institutional-grade infrastructure and risk management protocols, this makes them the most dominant platform for institutional participation.

4.3 Endgame

Maker is positioned as one of the leading decentralized banks with the potential to become one of the largest financial institutions globally. With DAI being the most widely used decentralized stablecoin, being able to provide structurally cheaper credit than its competitors, alongside its strategic position as a leader in the space, the case has been made for Maker.

However, perhaps the largest catalyst has yet to be explained - Maker’s ongoing “Endgame” rollout is transforming it into a more scalable ecosystem of modular protocols, potentially making it one of the biggest stories in the upcoming crypto cycle. The upgrade is huge, and is divided into four main phases:

Phase 1: Launch Season - New tokens and infrastructure

New Tokens: Introduction of "NewStable" and "NewGovToken" (placeholder names) as optional upgrades to DAI and MKR, respectively.

Lockstake Engine (LSE): A new feature allowing NewGovToken and MKR holders to earn yields on locked tokens.

NewBridge: A low-cost bridge connecting Maker ecosystem tokens from Ethereum to a major Layer 2 network

Tokenomics Updates: Modifications to the MKR burn mechanism and new token distribution methods.

Phase 2: New Horizons - Expanding Maker’s ecosystem

Launch of new SubDAOs: Creation of self-sustainable, specialized DAOs within the Maker ecosystem, starting with SparkDAO.

Phase 3: Launch of a dedicated Layer 1 blockchain to host core tokenomics and governance mechanics.

Phase 4: Core governance aspects of Maker and the SubDAO Ecosystem will become final and immutable.

With this gameplan, Maker aims to scale DAI from its current $4.5 billion market cap to "100 billion and beyond". For the most part, we won’t be focusing on many of these initiatives, because we believe that the main initiative that will spearhead growth is the addition of SubDAOs.

4.4 SubDAOs

The Endgame plan represents a comprehensive restructuring of Maker's ecosystem, transforming it into a modular network of interconnected protocols. At its core, this vision introduces SubDAOs - as their name suggests, they are projects that operate outside of Maker’s cost structure while ultimately being governed by MakerDAO.

This new architectural approach aims to streamline MakerDAO's operations and enhance its scalability. SubDAOs will have the ability to rapidly develop and launch new products in parallel, while Maker Core can focus on becoming a highly efficient Dai minting engine.

The intended outcomes of this reorganization include:

Accelerated ecosystem growth

Enhanced automation of processes

Greater decentralization

Significant reduction in operational expenses

SubDAOs each have their own unique governance token, governance processes, and workforce. SubDAOs are split into three types:

FacilitatorDAOs

They are administrative in nature, used to organize internal mechanisms of MakerDAO, AllocatorDAOs, and MiniDAOs. FacilitatorDAOs help to manage governance processes and enforce decisions and rules.

AllocatorDAOs

AllocatorDAOs serve three main functions:

Generating Dai from Maker and allocate it to profitable opportunities within the DeFi ecosystem

Providing an entry point to the Maker ecosystem

Spinning off MiniDAOs

MiniDAOs

MiniDAOs are experimental SubDAOs that do not have any specific mission other than furthering the growth of the Maker Protocol. They are spun off by AllocatorDAOs to further decentralize, promote, or consolidate specific ideas or products. Essentially, they serve as experimental offshoots, potentially with short lifespans.

Thus, SubDAOs are revolutionary for MakerDAO and the broader decentralized finance (DeFi) ecosystem because they represent a paradigm shift in how large-scale decentralized protocols can evolve, innovate, and manage risk.

For example, the below graphic is a simplified illustration of how post-Endgame MakerDAO would operate:

By introducing a multi-layered governance structure, SubDAOs enable MakerDAO to maintain its core stability while simultaneously fostering rapid experimentation and growth in specialized areas.

This approach addresses several critical challenges faced by mature DeFi protocols, including governance fatigue, innovation stagnation, and risk concentration. Sub DAOs allow for the decentralization of decision-making, empowering smaller, focused groups to drive innovation in specific domains without jeopardizing the entire ecosystem.

This structure not only enhances the protocol's ability to adapt to changing market conditions but also creates new opportunities for community engagement and value creation. Moreover, the SubDAO model extends MakerDAO's reach beyond the traditional boundaries of DeFi, potentially catalyzing real-world economic impact through localized initiatives and targeted capital deployment. Already, there are plans to launch a new bridge to transport DAI across Ethereum L2s, alongside existing SubDAOs like Spark - the first of Maker’s SubDAOs; while they aren’t doing anything revolutionary (their main product being a lending engine), they are proof that SubDAOs work. Spark will also have the ability to deploy capital into Real World Assets - again, showing how SubDAOs provide incredible flexibility for an otherwise monolithic protocol.

By enabling a more flexible and scalable governance framework, SubDAOs pave the way for MakerDAO to evolve from a single-purpose stablecoin issuer into a diverse, self-sustaining ecosystem of interconnected financial services and products. This revolutionary approach could set a new standard for how decentralized organizations manage growth, innovation, and risk in the rapidly evolving landscape of blockchain-based finance.

Concluding Thoughts

Maker is at the forefront of bringing crypto to the traditional world, and it’s extremely heartening to see such efforts being displayed to push its potential to greater limits. With the launch of Endgame, it sets the precedent for many DAOs across crypto to potentially follow suit as DAOs have been notoriously plagued by bureaucratic paralysis when votes are split.

Additionally, Maker is at the perfect intersection of RWA and ETH Defi - with the ETH ETF as tailwinds, Maker could very well lead the charge for a resurgence in Defi 1.0 assets. Names like Aave and Uniswap come to mind, as some of these “old” protocols have proven to be resilient in times of stress after multiple cycles and others have even achieved product-market fit and built sustainable revenue models

The success of Maker will heavily depend on its ability to rollout Endgame while carefully navigating the growing political uncertainty around crypto assets. However, with growing institutional interest around crypto assets and this year’s launch of the Bitcoin (and potentially Ethereum) ETF, Maker’s future looks brighter than ever.

Maker's Endgame plan represents a bold and ambitious vision for the future of the protocol - as the world heads towards a crypto-centric future, Maker stands at the forefront of the industry, helping to bridge the gap between decentralized assets and a centralized world.